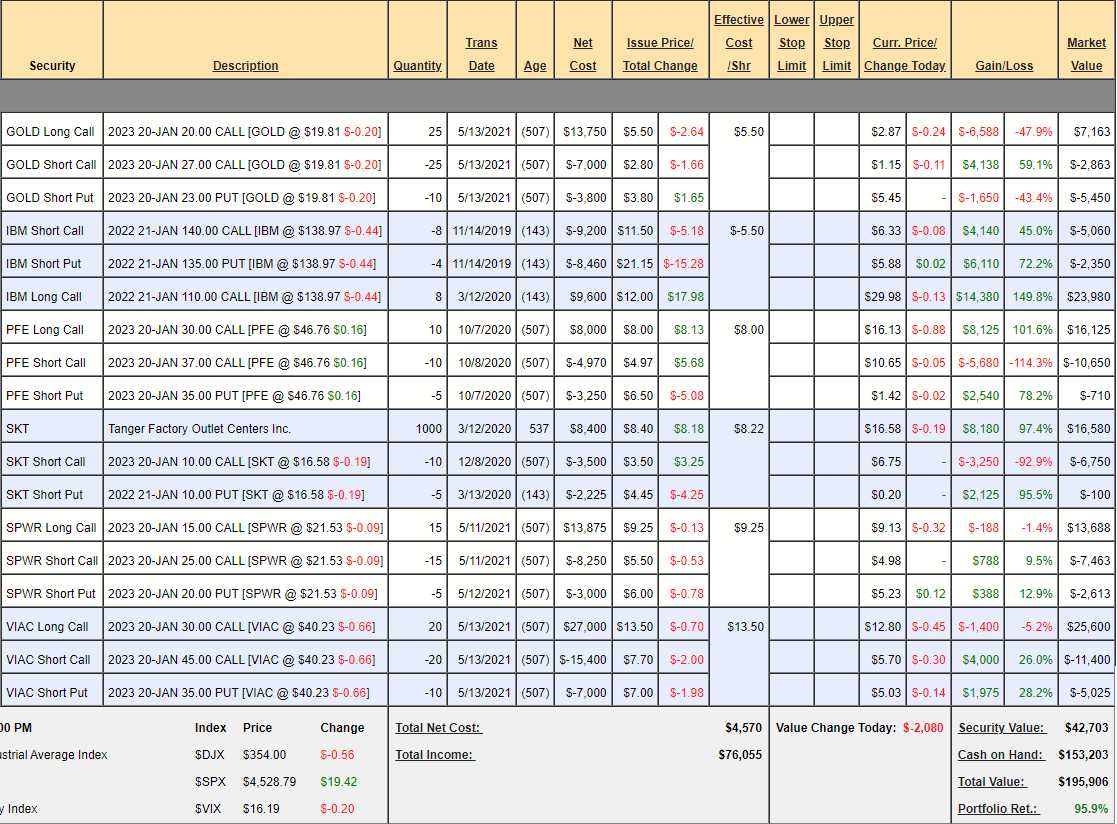

$195,900.

That's up 95.9% in less than two years for our Money Talk Portfolio, the one we we only trade quarterly in our live appearances on BNN's Money Talk but, due to Covid, we pre-tape on Tuesdays so I put up the reviews the day we're taping instead. It's tricky to pick stocks that we aren't allowed to adjust so, needless to say, these are all trades I love but it is time to close our IBM trade – as we expected in our August 18th Review.

As you can see from our last show (May 12th), we were at $187,000 so we've gained $8,000+ since then but we want to stay "Cashy and Cautious" coming into Q3 earnings, which we think is going to indicate a somewhat disappointing Summer as Covid began to re-surge. We are also concerned that the Fed is going to be forced to taper soon and that the Government is not going to be able to keep spending 20% of our GDP on stimulus to maintain a 6.6% growth rate – not as we cross over $30Tn in debt the next quarter.

That is the true cost of our record-high markets – a $3.1Tn (so far) this year). If we pass the infrastructure bill, that's another $1Tn and we'll be over $32Tn by next June. Our entire GDP is "just" $20Tn and 15% of it is debt financing in order to BUY our "growth" – that is why we are being cautious – it's clearly unsustainable but Japan is close to 300% of their GDP in debt yet they keep borrowing – so why shouldn't we?

That is the true cost of our record-high markets – a $3.1Tn (so far) this year). If we pass the infrastructure bill, that's another $1Tn and we'll be over $32Tn by next June. Our entire GDP is "just" $20Tn and 15% of it is debt financing in order to BUY our "growth" – that is why we are being cautious – it's clearly unsustainable but Japan is close to 300% of their GDP in debt yet they keep borrowing – so why shouldn't we?

On the May show, we added trade ideas for Viacom (VIAC) and Barrick Gold (GOLD) and VIAC has been flat, but Barrick got weaker. Despite being flat, we gained on our VIAC position as the volatility died down – a huge advantage we have in the market as premium sellers – time is always on our side on these trades.

On the May show, we added trade ideas for Viacom (VIAC) and Barrick Gold (GOLD) and VIAC has been flat, but Barrick got weaker. Despite being flat, we gained on our VIAC position as the volatility died down – a huge advantage we have in the market as premium sellers – time is always on our side on these trades.

Since we are so much in CASH!!!, we will take advantage and improve our GOLD position and there are still bargains to be had, so we can add a couple of new ones as well:

IN PROGRESS