Industrial materials and tools company Kennametal (NYSE: KMT) announced better-than-expected revenue in Q4 CY2025, with sales up 9.8% year on year to $529.5 million. Guidance for next quarter’s revenue was optimistic at $555 million at the midpoint, 2.2% above analysts’ estimates. Its non-GAAP profit of $0.47 per share was 24.3% above analysts’ consensus estimates.

Is now the time to buy Kennametal? Find out by accessing our full research report, it’s free.

Kennametal (KMT) Q4 CY2025 Highlights:

- Revenue: $529.5 million vs analyst estimates of $524.4 million (9.8% year-on-year growth, 1% beat)

- Adjusted EPS: $0.47 vs analyst estimates of $0.38 (24.3% beat)

- The company lifted its revenue guidance for the full year to $2.22 billion at the midpoint from $2.14 billion, a 4% increase

- Management raised its full-year Adjusted EPS guidance to $2.25 at the midpoint, a 50% increase

- Operating Margin: 9.9%, up from 6.6% in the same quarter last year

- Free Cash Flow Margin: 8%, similar to the same quarter last year

- Organic Revenue rose 10% year on year (beat)

- Market Capitalization: $2.72 billion

Company Overview

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE: KMT) is a provider of industrial materials and tools for various sectors.

Revenue Growth

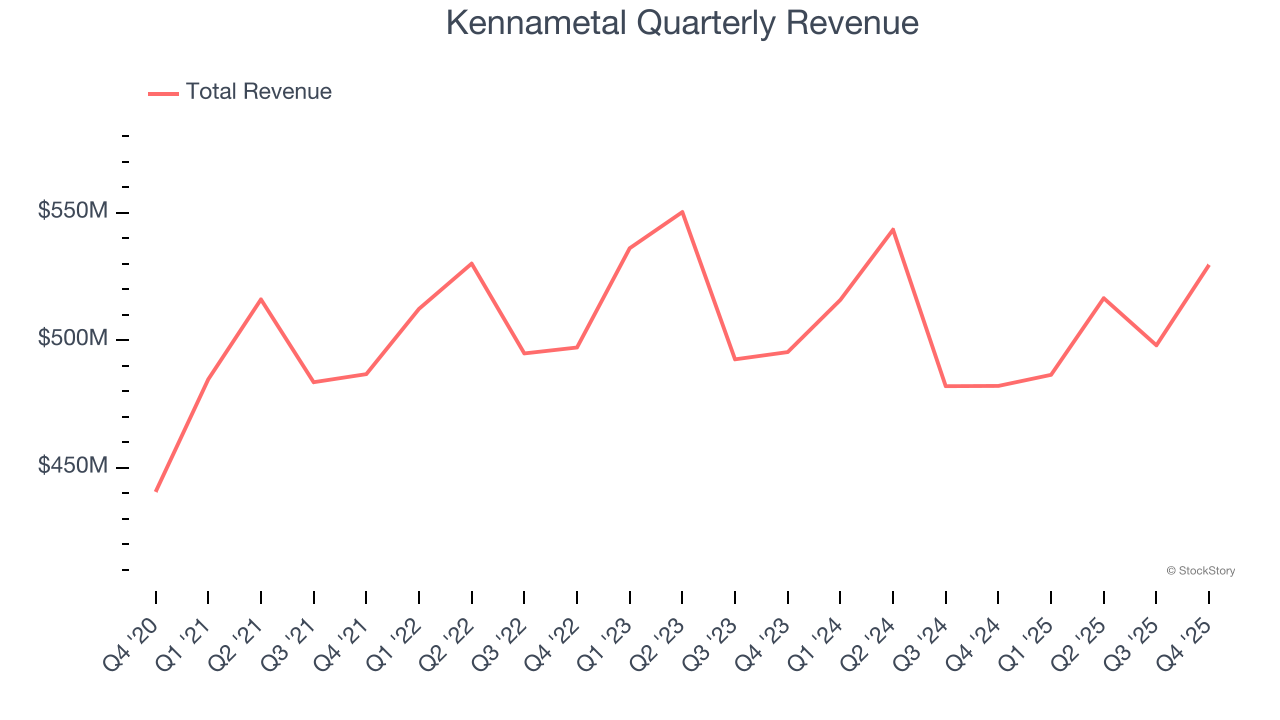

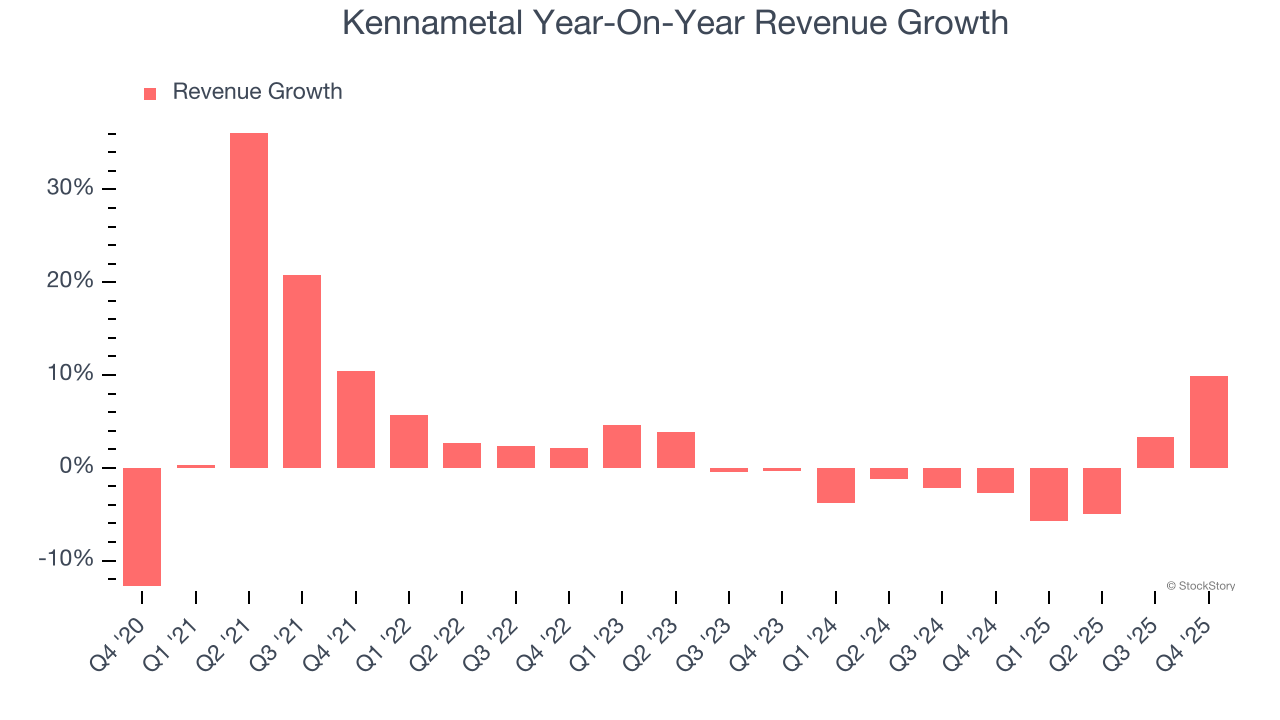

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Kennametal’s 3.6% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Kennametal’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually.

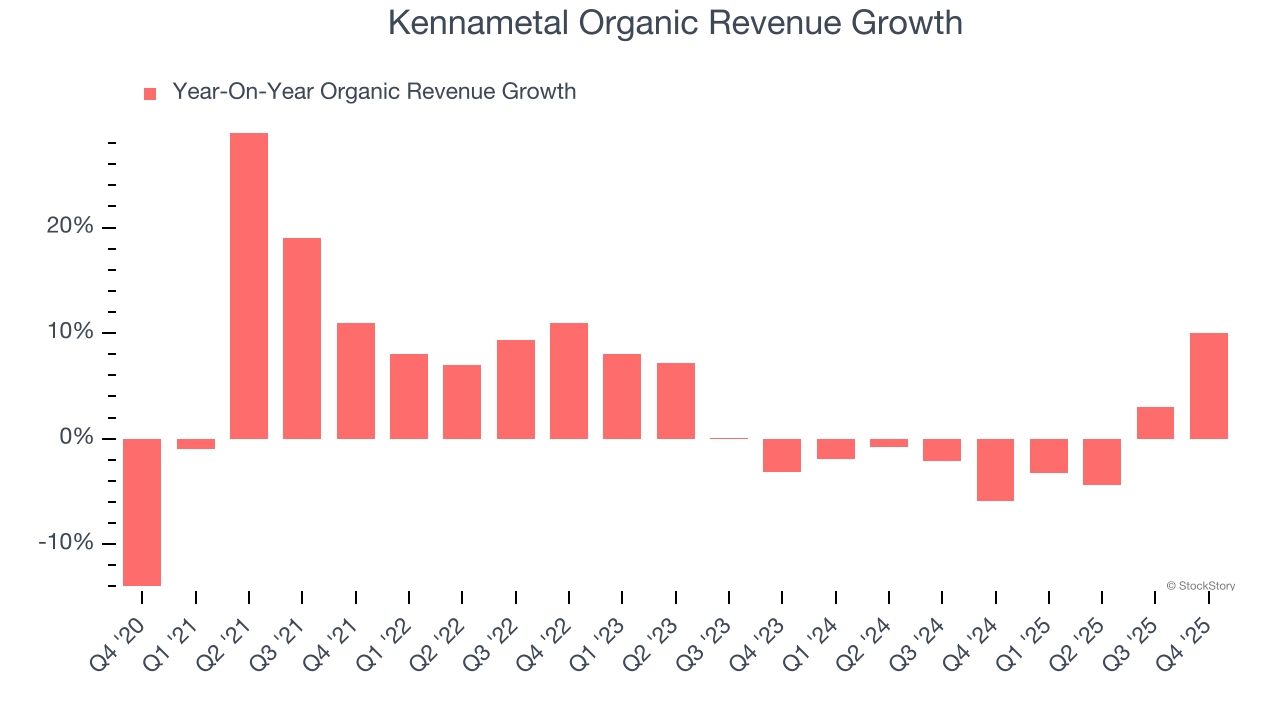

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Kennametal’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Kennametal reported year-on-year revenue growth of 9.8%, and its $529.5 million of revenue exceeded Wall Street’s estimates by 1%. Company management is currently guiding for a 14.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and implies its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

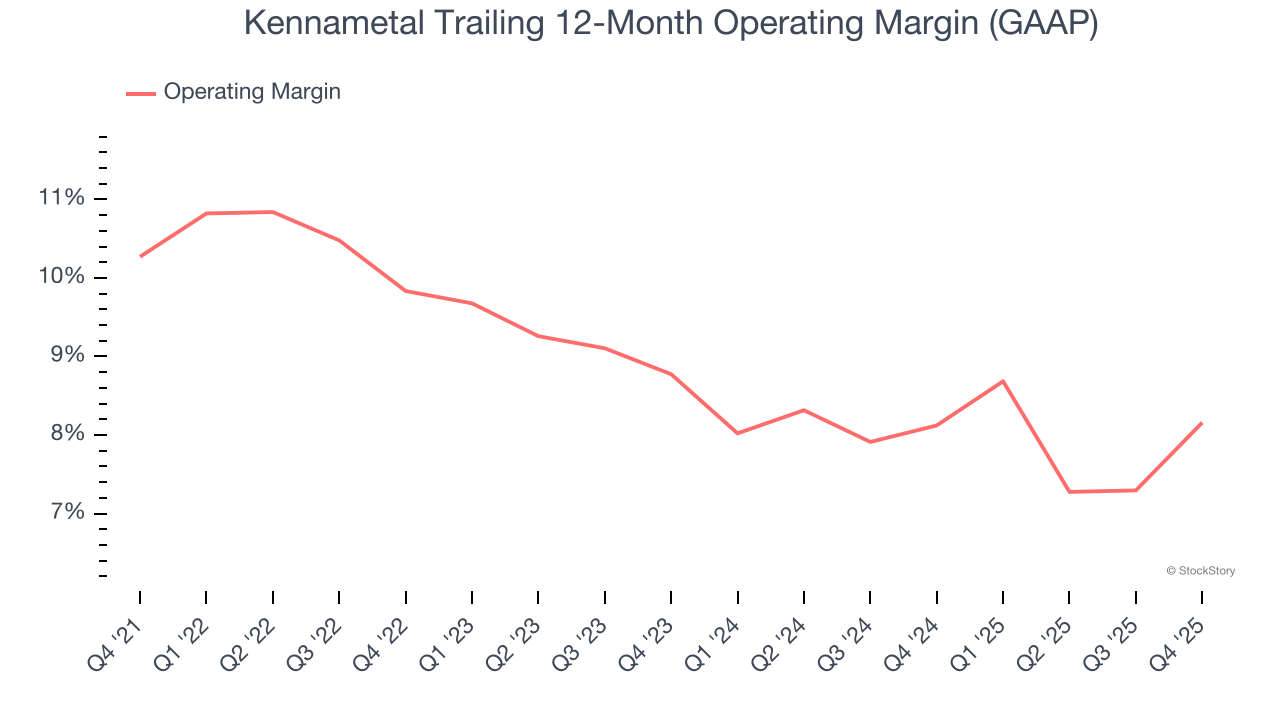

Kennametal has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Kennametal’s operating margin decreased by 2.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Kennametal generated an operating margin profit margin of 9.9%, up 3.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

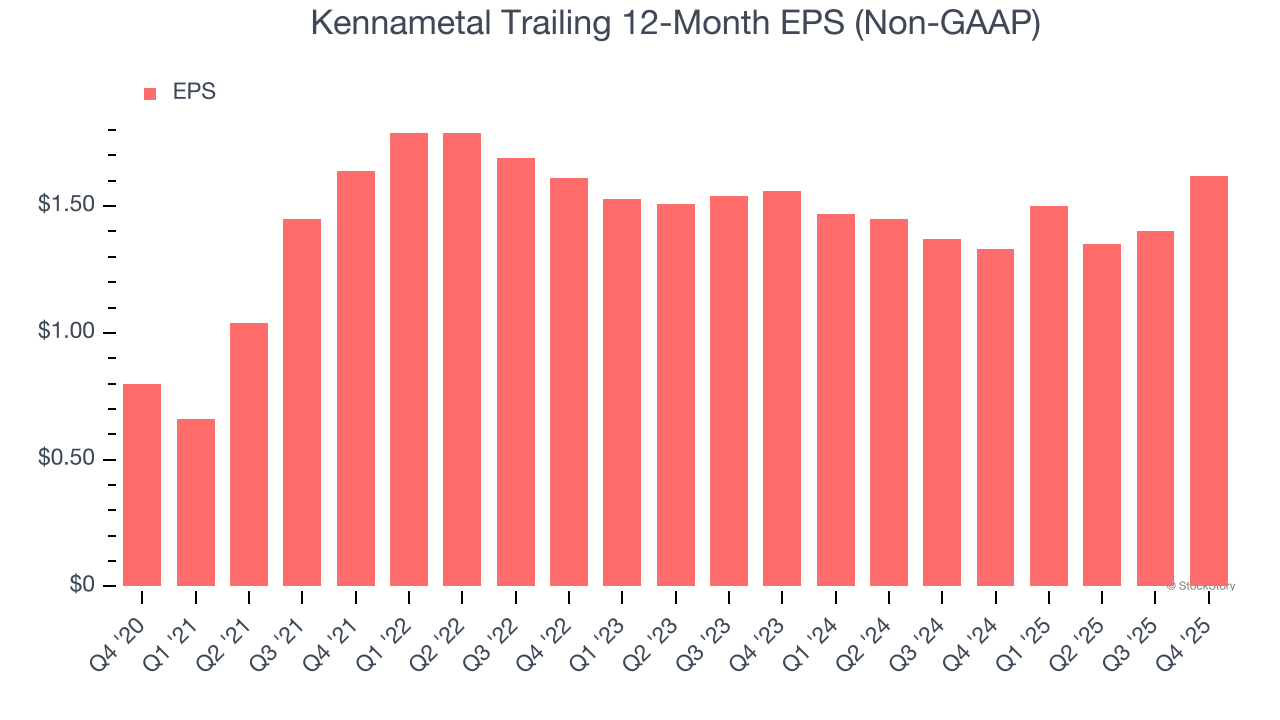

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

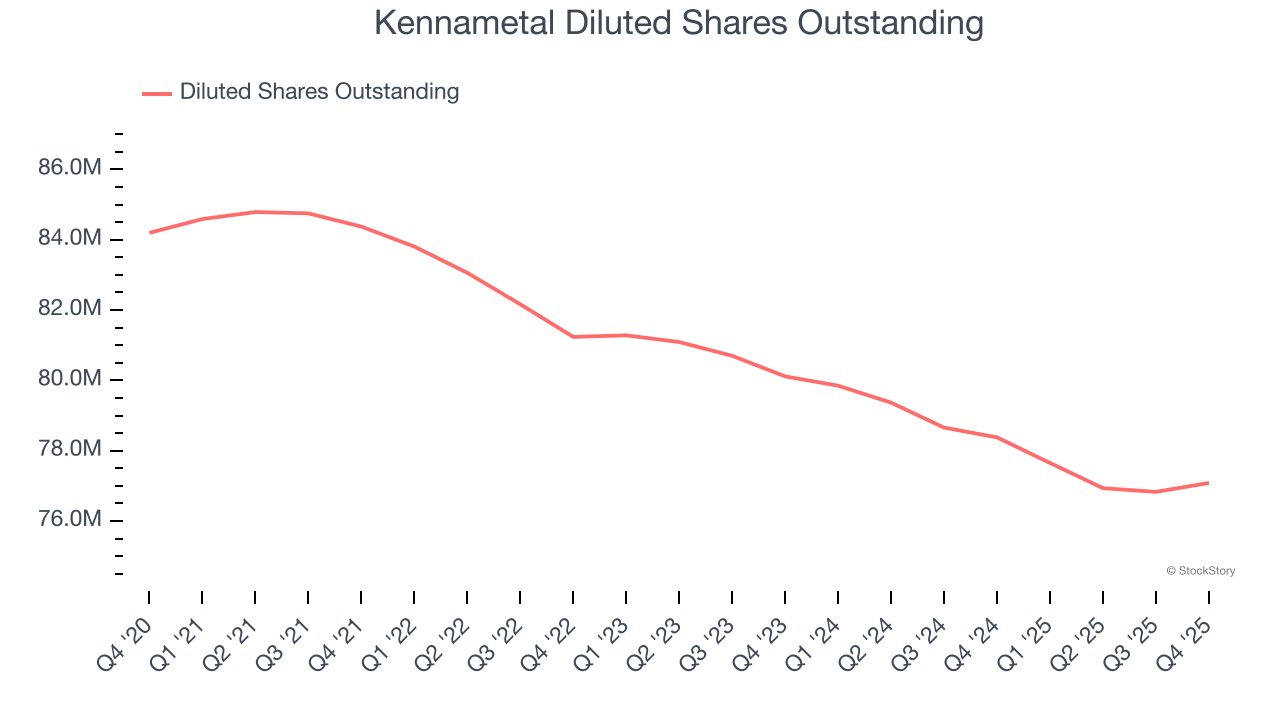

Kennametal’s EPS grew at a spectacular 15.2% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Kennametal’s earnings can give us a better understanding of its performance. A five-year view shows that Kennametal has repurchased its stock, shrinking its share count by 8.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Kennametal, its two-year annual EPS growth of 1.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Kennametal reported adjusted EPS of $0.47, up from $0.25 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Kennametal’s full-year EPS of $1.62 to grow 10.5%.

Key Takeaways from Kennametal’s Q4 Results

We were impressed by Kennametal’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 2.2% to $36.55 immediately following the results.

Indeed, Kennametal had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).