The New York Times’s 22.8% return over the past six months has outpaced the S&P 500 by 13%, and its stock price has climbed to $69.40 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in The New York Times, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think The New York Times Will Underperform?

We’re happy investors have made money, but we're swiping left on The New York Times for now. Here are three reasons there are better opportunities than NYT and a stock we'd rather own.

1. Weak Growth in Subscribers Points to Soft Demand

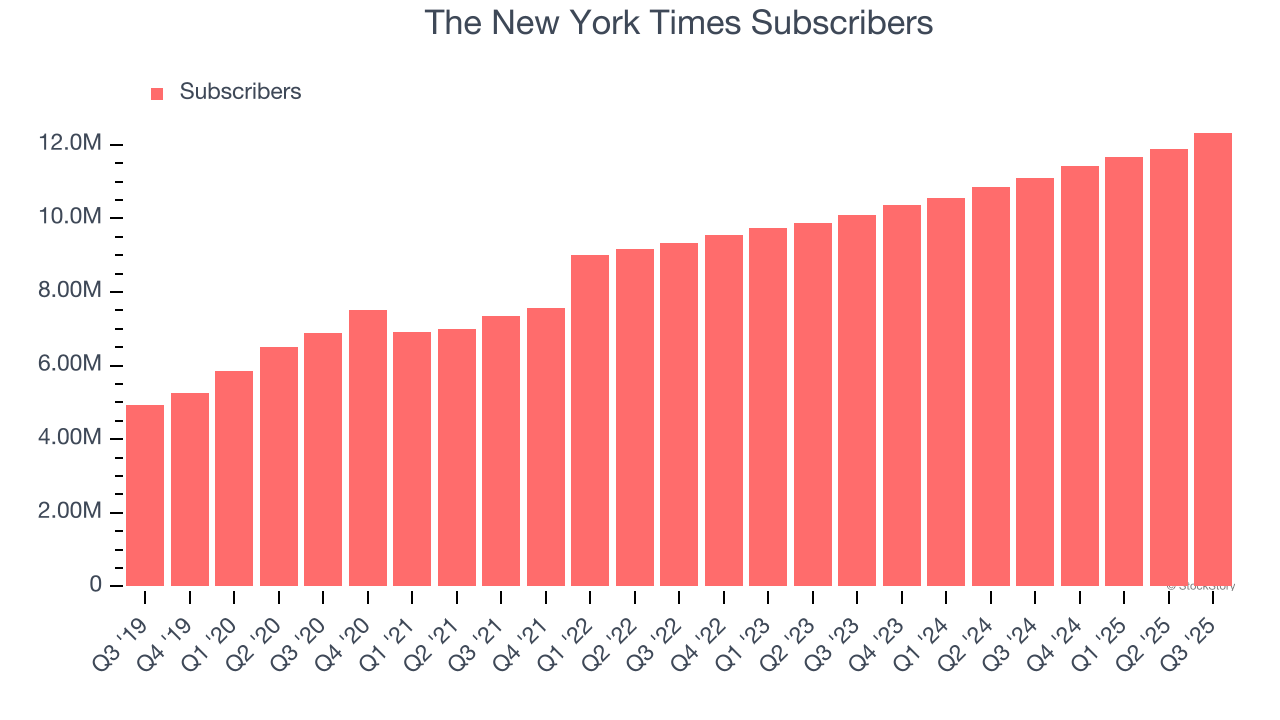

Revenue growth can be broken down into changes in price and volume (for companies like The New York Times, our preferred volume metric is subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

The New York Times’s subscribers came in at 12.33 million in the latest quarter, and over the last two years, averaged 9.8% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Weak Operating Margin Could Cause Trouble

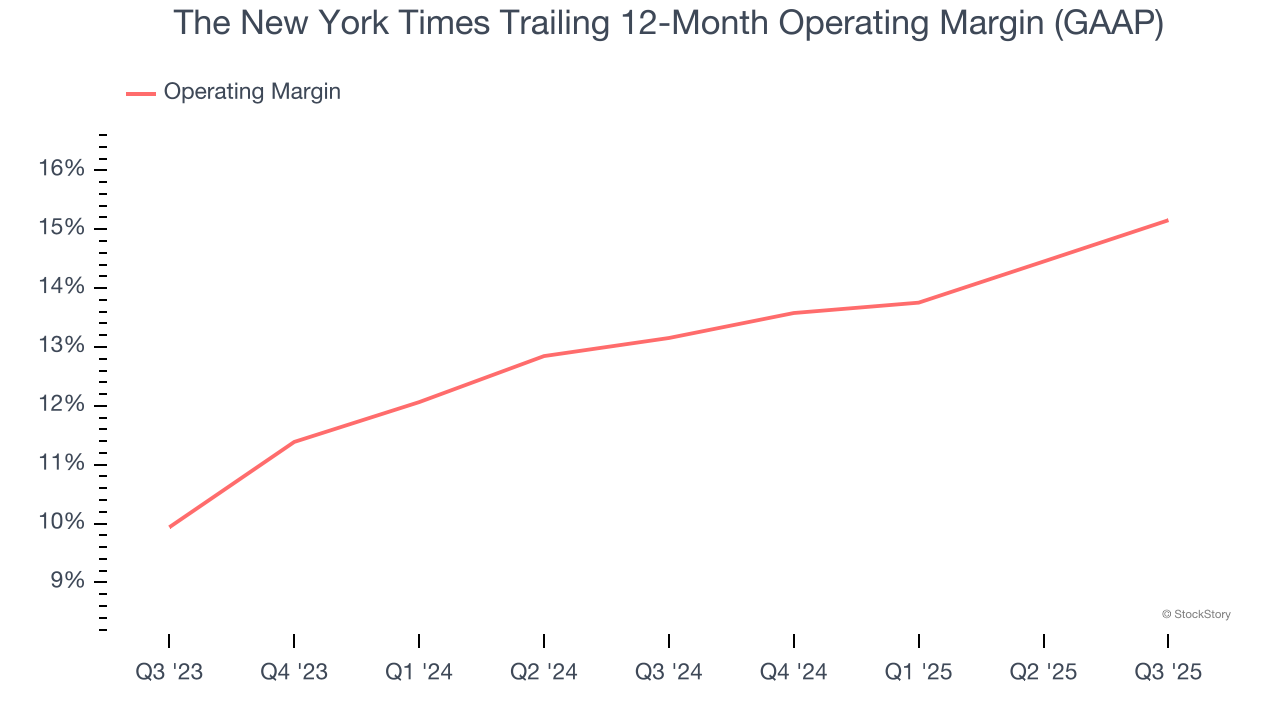

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

The New York Times’s operating margin has risen over the last 12 months and averaged 14.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

3. New Investments Fail to Bear Fruit as ROIC Declines

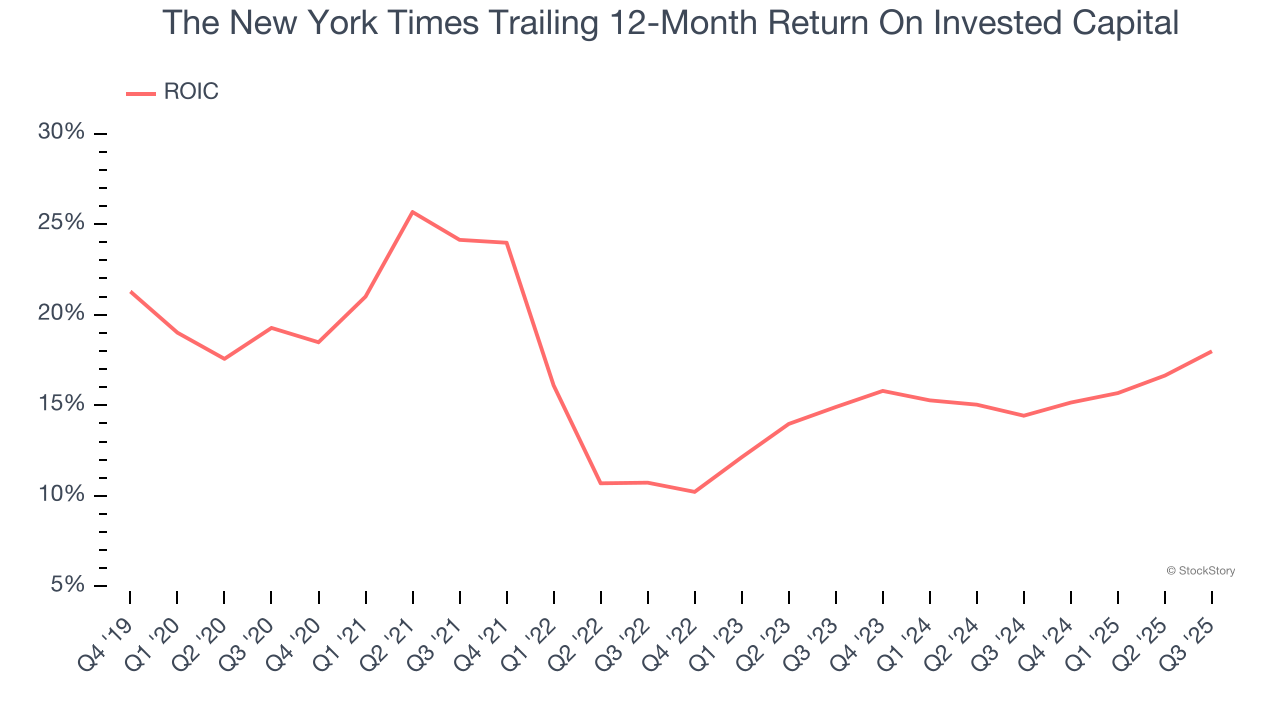

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, The New York Times’s ROIC averaged 1.2 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

The New York Times doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 26.6× forward P/E (or $69.40 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than The New York Times

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.