Let’s dig into the relative performance of Kforce (NYSE: KFRC) and its peers as we unravel the now-completed Q3 professional staffing & hr solutions earnings season.

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

The 8 professional staffing & hr solutions stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was 1.1% below.

While some professional staffing & hr solutions stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4% since the latest earnings results.

Best Q3: Kforce (NYSE: KFRC)

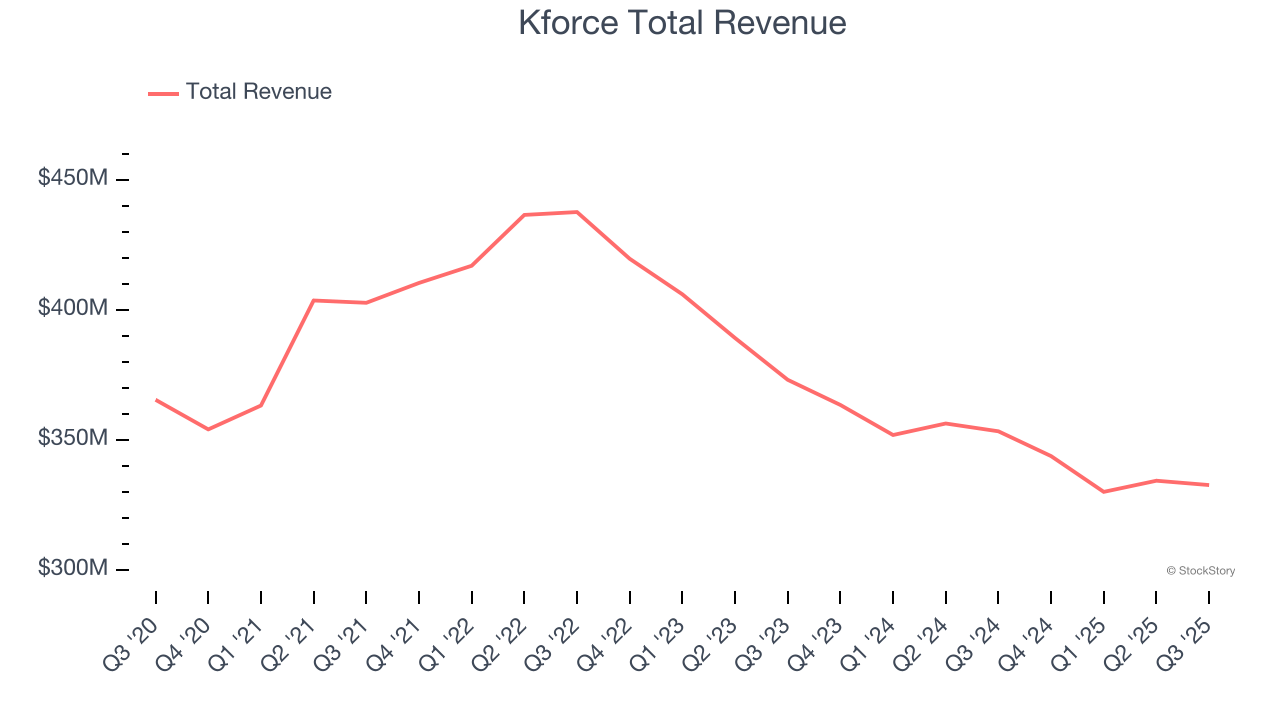

With nearly 60 years of matching skilled professionals with the right opportunities, Kforce (NYSE: KFRC) is a professional staffing company that specializes in placing technology and finance experts with businesses on both temporary and permanent bases.

Kforce reported revenues of $332.6 million, down 5.9% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was an exceptional quarter for the company with revenue guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

Joseph J. Liberatore, President and Chief Executive Officer, said, "We are pleased with our performance in the third quarter where we exceeded both top and bottom line expectations led by better-than-expected results in both our Technology and FA businesses. We are particularly encouraged that, following the early third quarter lows, consultants on assignment in our Technology segment improved throughout the third quarter. Our team has also done a nice job stabilizing and now meaningfully growing our FA business sequentially. The momentum has largely been carried into the fourth quarter, which puts us in a position to expect to deliver sequential billing day growth in both our Technology and FA businesses in the fourth quarter. "

Interestingly, the stock is up 36.5% since reporting and currently trades at $33.51.

Is now the time to buy Kforce? Access our full analysis of the earnings results here, it’s free.

First Advantage (NASDAQ: FA)

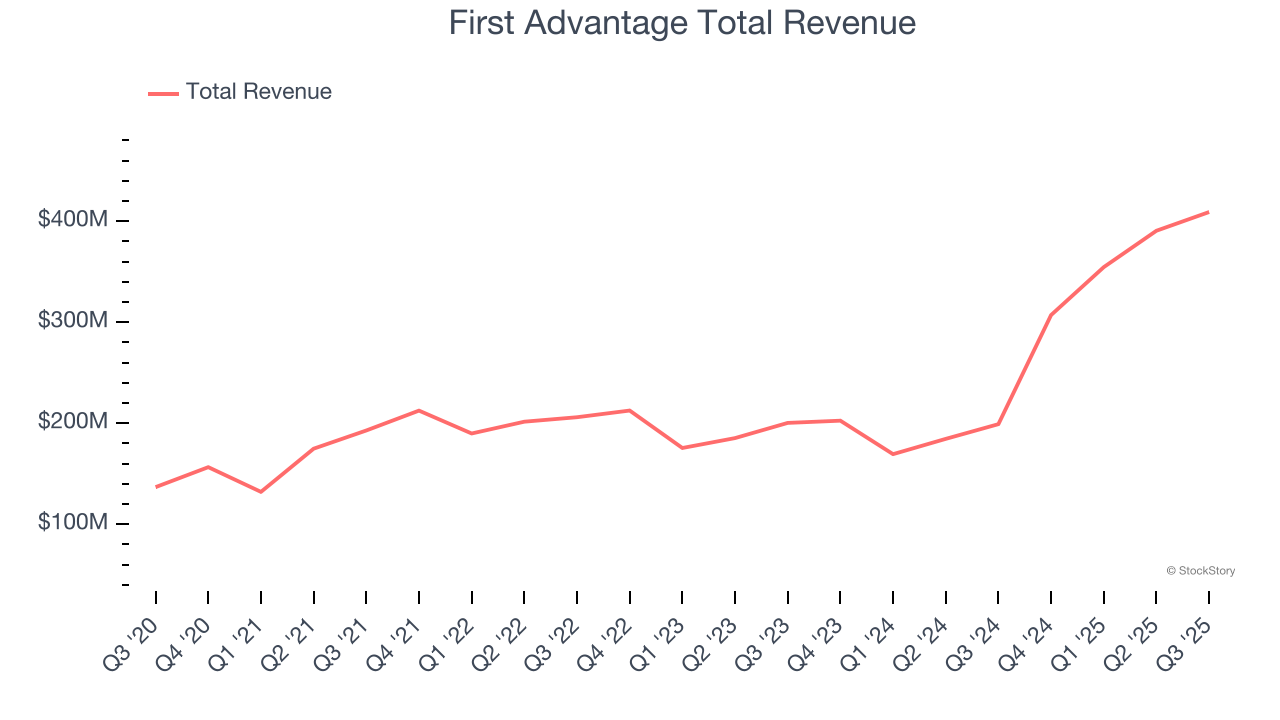

Processing approximately 100 million background checks annually across more than 200 countries and territories, First Advantage (NASDAQ: FA) provides employment background screening, identity verification, and compliance solutions to help companies manage hiring risks.

First Advantage reported revenues of $409.2 million, up 105% year on year, outperforming analysts’ expectations by 1.6%. The business had a strong quarter with a solid beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

First Advantage scored the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 9.6% since reporting. It currently trades at $14.17.

Is now the time to buy First Advantage? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Insperity (NYSE: NSP)

Pioneering the professional employer organization (PEO) industry it helped establish, Insperity (NYSE: NSP) provides human resources outsourcing services to small and medium-sized businesses, handling payroll, benefits, compliance, and HR administration.

Insperity reported revenues of $1.62 billion, up 4% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

The stock is flat since the results and currently trades at $45.36.

Read our full analysis of Insperity’s results here.

ManpowerGroup (NYSE: MAN)

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE: MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

ManpowerGroup reported revenues of $4.63 billion, up 2.3% year on year. This print topped analysts’ expectations by 0.7%. Taking a step back, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EPS guidance for next quarter estimates but a significant miss of analysts’ EPS estimates.

The stock is down 23% since reporting and currently trades at $29.28.

Read our full, actionable report on ManpowerGroup here, it’s free.

Robert Half (NYSE: RHI)

With roots dating back to 1948 as the first specialized recruiting firm for accounting and finance professionals, Robert Half (NYSE: RHI) provides specialized talent solutions and business consulting services, connecting skilled professionals with companies across various fields.

Robert Half reported revenues of $1.35 billion, down 7.5% year on year. This result met analysts’ expectations. More broadly, it was a mixed quarter as it also logged EPS in line with analysts’ estimates but revenue in line with analysts’ estimates.

Robert Half had the slowest revenue growth among its peers. The stock is down 8% since reporting and currently trades at $27.26.

Read our full, actionable report on Robert Half here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.