Over the past six months, La-Z-Boy’s shares (currently trading at $38.26) have posted a disappointing 16% loss, well below the S&P 500’s 3.1% gain. This might have investors contemplating their next move.

Is now the time to buy La-Z-Boy, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think La-Z-Boy Will Underperform?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why LZB doesn't excite us and a stock we'd rather own.

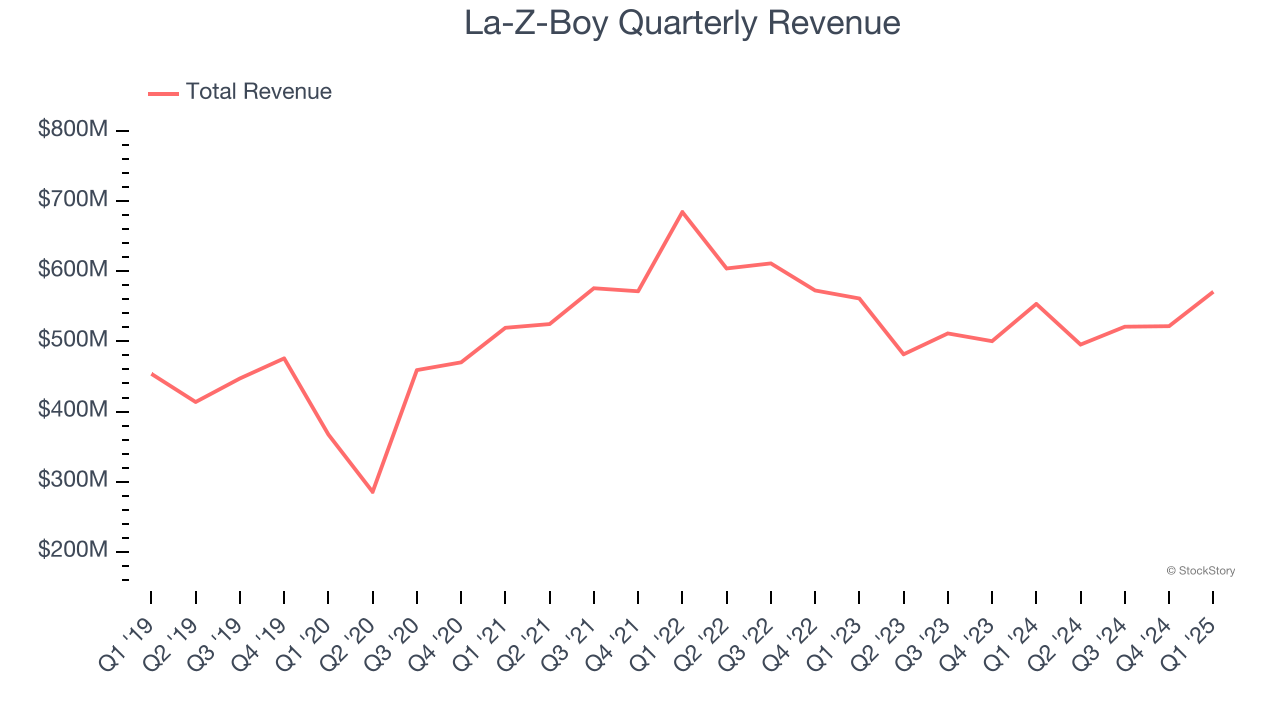

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, La-Z-Boy’s 4.4% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect La-Z-Boy’s revenue to rise by 1.9%. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

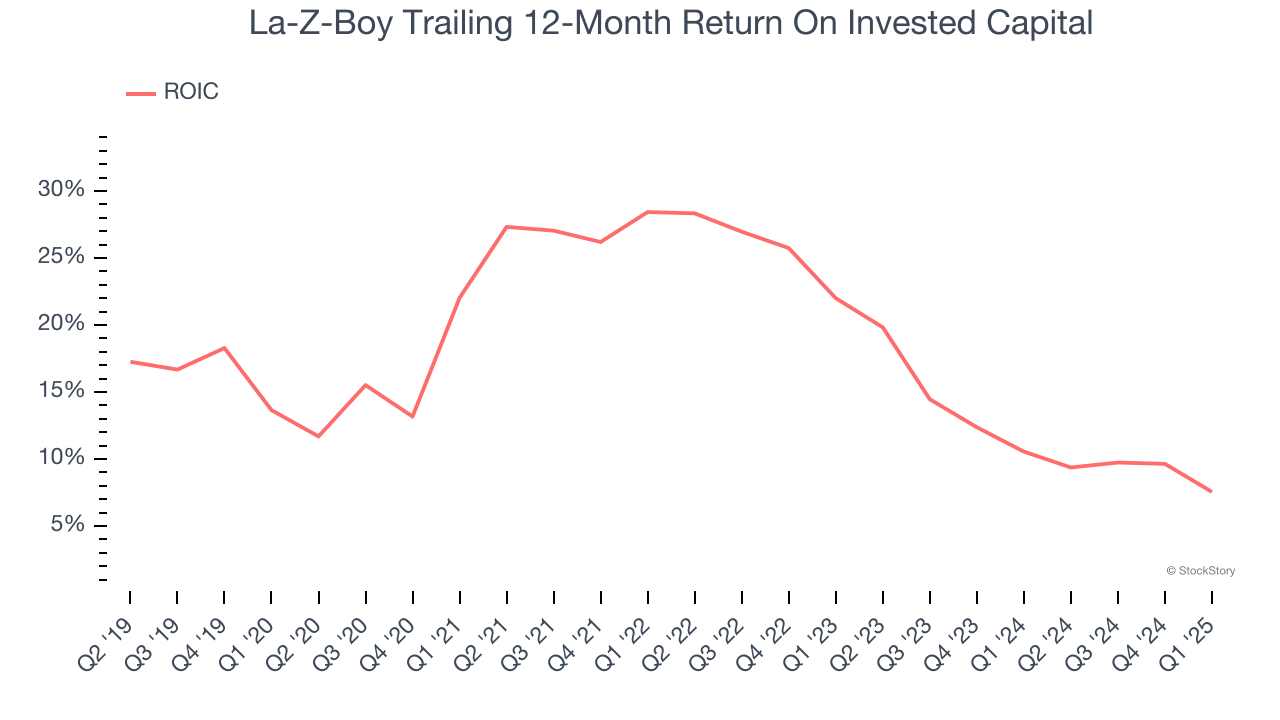

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, La-Z-Boy’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of La-Z-Boy, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 11.6× forward P/E (or $38.26 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than La-Z-Boy

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.