Since January 2025, WESCO has been in a holding pattern, posting a small return of 2.1% while floating around $203.35.

Is there a buying opportunity in WESCO, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is WESCO Not Exciting?

We don't have much confidence in WESCO. Here are three reasons why you should be careful with WCC and a stock we'd rather own.

1. Core Business Falling Behind as Demand Plateaus

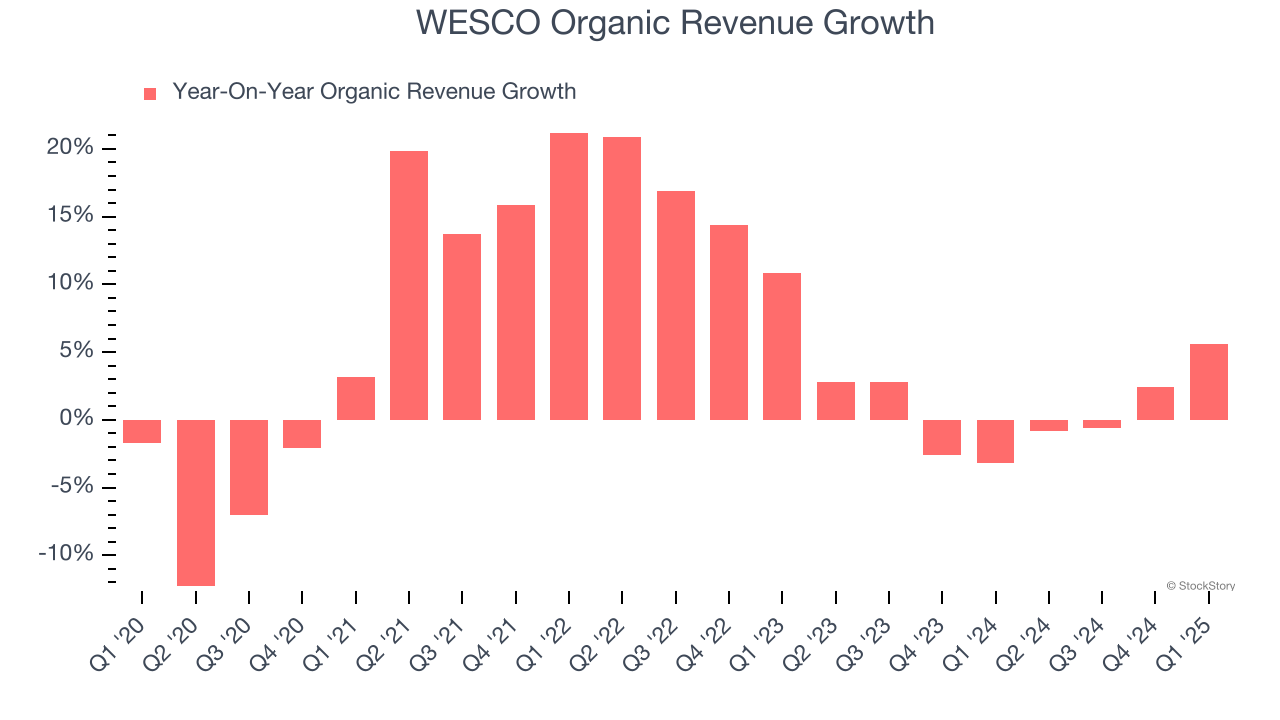

We can better understand Maintenance and Repair Distributors companies by analyzing their organic revenue. This metric gives visibility into WESCO’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, WESCO failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests WESCO might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Took a Dip Over the Last Two Years

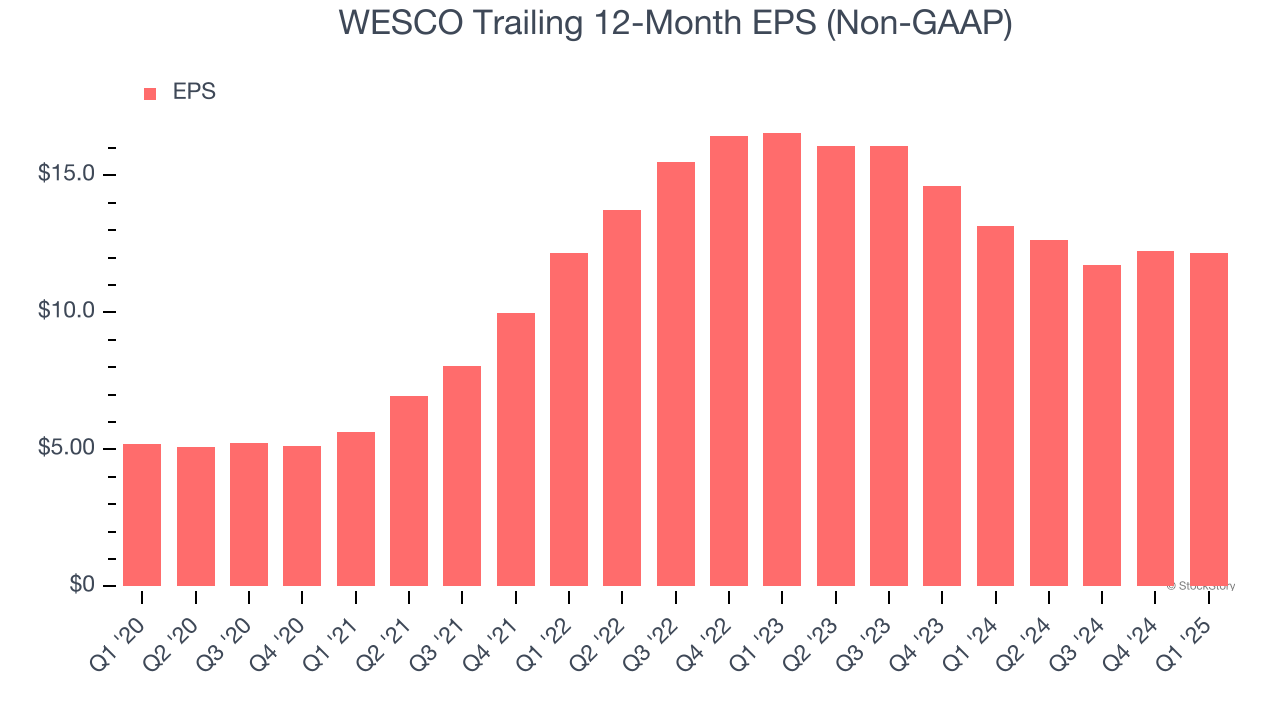

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for WESCO, its EPS declined by 14.3% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

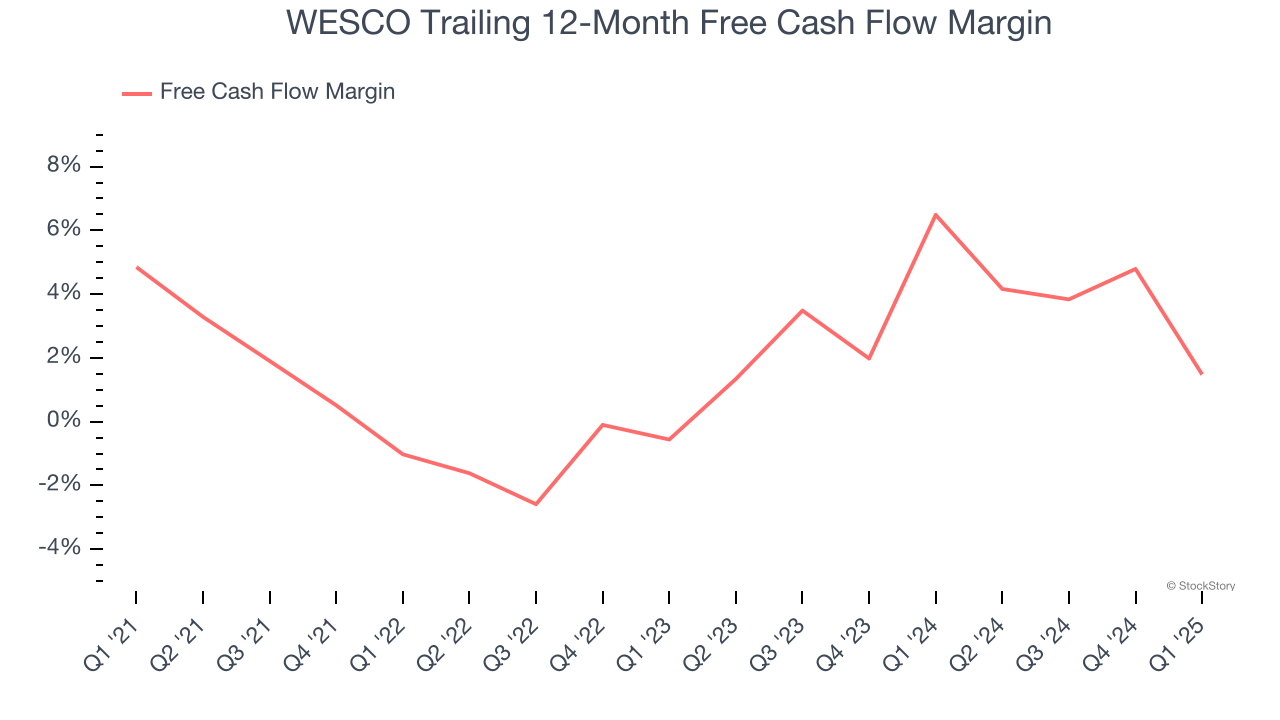

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

WESCO has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.2%, lousy for an industrials business.

Final Judgment

WESCO’s business quality ultimately falls short of our standards. That said, the stock currently trades at 14.3× forward P/E (or $203.35 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.