Wrapping up Q1 earnings, we look at the numbers and key takeaways for the life insurance stocks, including Horace Mann Educators (NYSE: HMN) and its peers.

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

The 15 life insurance stocks we track reported a softer Q1. As a group, revenues missed analysts’ consensus estimates by 3.1%.

While some life insurance stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.1% since the latest earnings results.

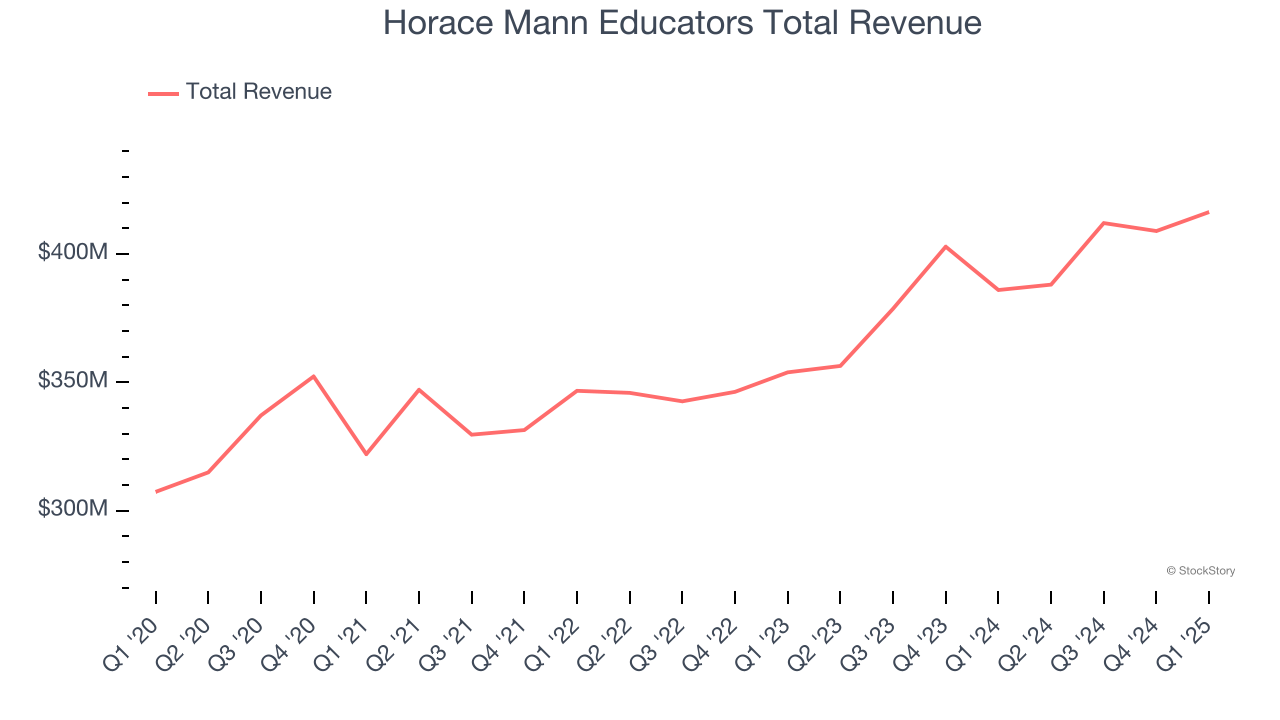

Horace Mann Educators (NYSE: HMN)

Founded in 1945 and named after the 19th-century education reformer known as the "father of American public education," Horace Mann Educators (NYSE: HMN) is an insurance company that specializes in providing auto, property, life, and retirement products tailored for educators and other public service employees.

Horace Mann Educators reported revenues of $416.4 million, up 7.9% year on year. This print fell short of analysts’ expectations by 1.9%. Overall, it was a slower quarter for the company with a significant miss of analysts’ book value per share estimates.

“First-quarter results reflect the earnings power of our business, particularly in the Property & Casualty line. The reported combined ratio of 89.4% reflects the profitability restoration work we completed in 2024 as well as lower property loss costs and favorable prior years’ reserve development,” said Horace Mann President & CEO Marita Zuraitis.

Unsurprisingly, the stock is down 4.9% since reporting and currently trades at $41.37.

Read our full report on Horace Mann Educators here, it’s free.

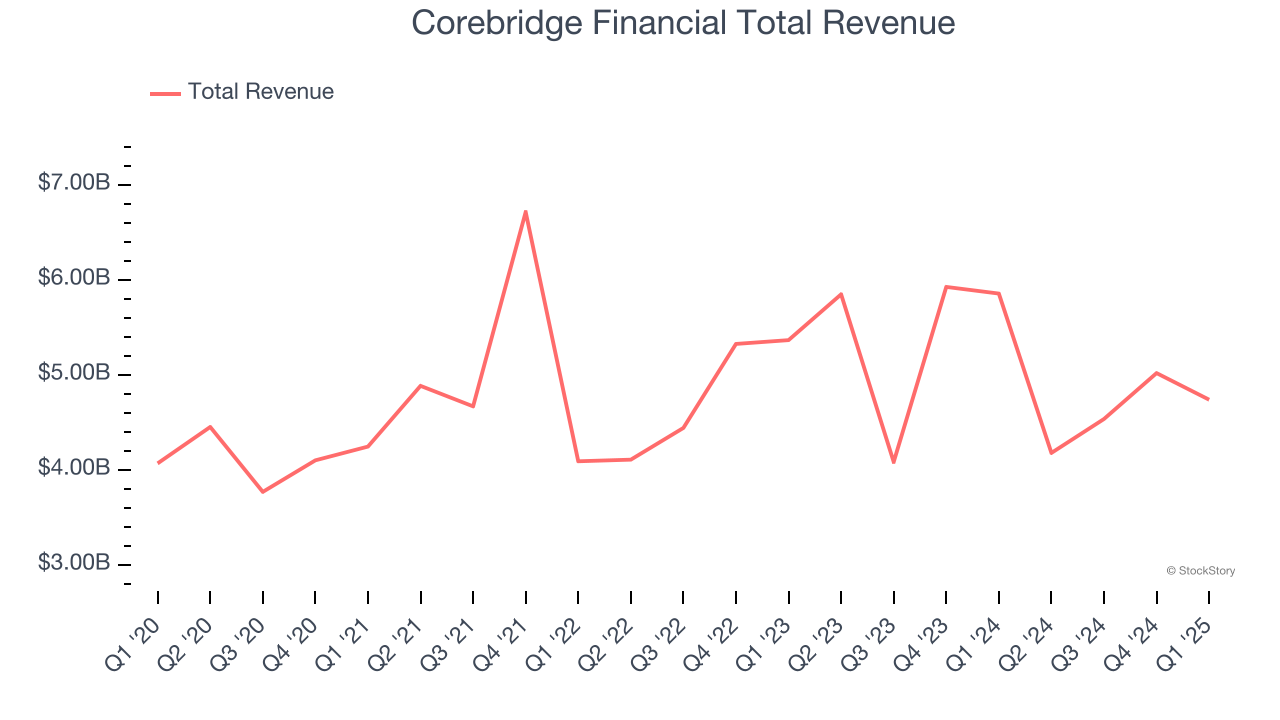

Best Q1: Corebridge Financial (NYSE: CRBG)

Spun off from insurance giant AIG in 2022 to focus on the growing retirement market, Corebridge Financial (NYSE: CRBG) provides retirement solutions, annuities, life insurance, and institutional risk management products in the United States.

Corebridge Financial reported revenues of $4.74 billion, down 19.1% year on year, outperforming analysts’ expectations by 7.9%. The business had a satisfactory quarter.

Corebridge Financial delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 7% since reporting. It currently trades at $35.26.

Is now the time to buy Corebridge Financial? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Equitable Holdings (NYSE: EQH)

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE: EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Equitable Holdings reported revenues of $3.78 billion, up 4% year on year, falling short of analysts’ expectations by 5.7%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.3% since the results and currently trades at $52.93.

Read our full analysis of Equitable Holdings’s results here.

F&G Annuities & Life (NYSE: FG)

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life (NYSE: FG) provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

F&G Annuities & Life reported revenues of $930 million, down 40.7% year on year. This result came in 36.9% below analysts' expectations. It was a disappointing quarter as it also produced a significant miss of analysts’ net premiums earned estimates and a significant miss of analysts’ EPS estimates.

F&G Annuities & Life had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 13.5% since reporting and currently trades at $31.04.

Read our full, actionable report on F&G Annuities & Life here, it’s free.

Primerica (NYSE: PRI)

With a sales force of over 140,000 licensed representatives operating on an independent contractor model, Primerica (NYSE: PRI) provides term life insurance, investment products, and other financial services to middle-income households in the United States and Canada.

Primerica reported revenues of $803.6 million, up 9.4% year on year. This number topped analysts’ expectations by 2.1%. More broadly, it was a mixed quarter as it also logged net premiums earned in line with analysts’ estimates but a slight miss of analysts’ book value per share estimates.

The stock is flat since reporting and currently trades at $267.39.

Read our full, actionable report on Primerica here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.