Since January 2025, Sprinklr has been in a holding pattern, posting a small return of 3.1% while floating around $8.90.

Is now the time to buy Sprinklr, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Sprinklr Will Underperform?

We're swiping left on Sprinklr for now. Here are three reasons why you should be careful with CXM and a stock we'd rather own.

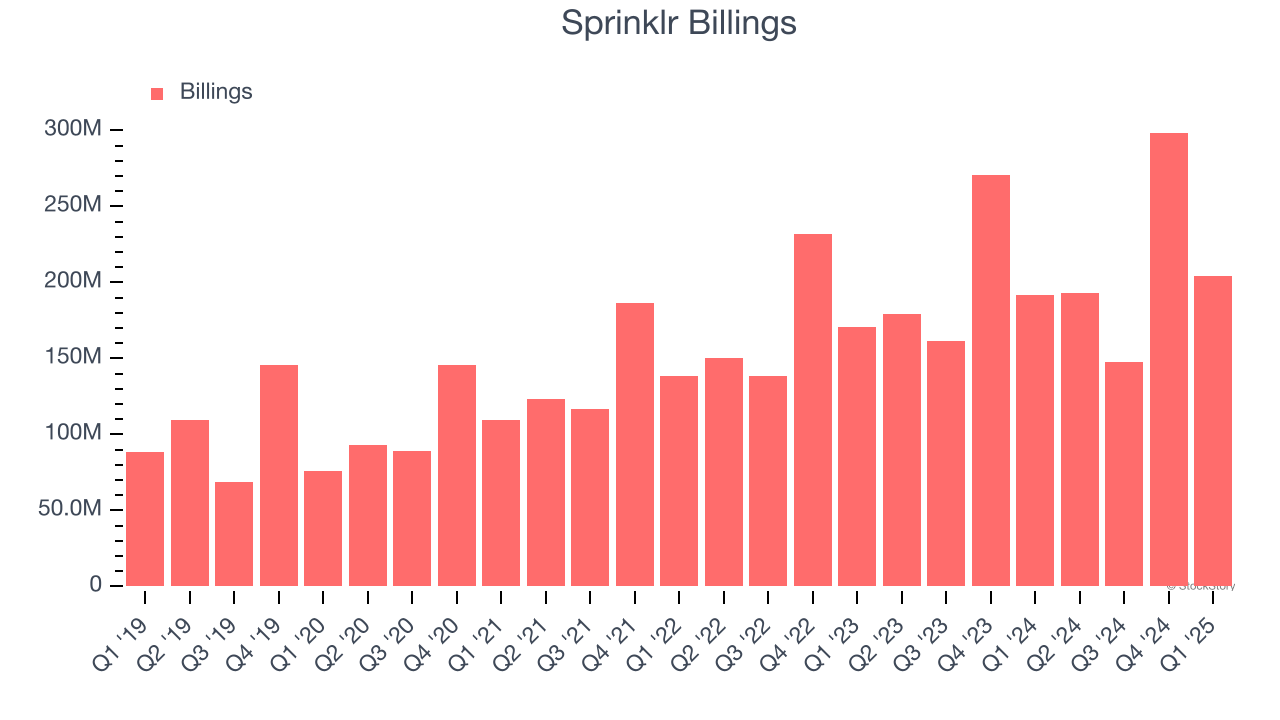

1. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Sprinklr’s billings came in at $204.3 million in Q1, and over the last four quarters, its year-on-year growth averaged 4%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Sprinklr’s revenue to rise by 3.4%, a deceleration versus This projection is underwhelming and indicates its products and services will see some demand headwinds.

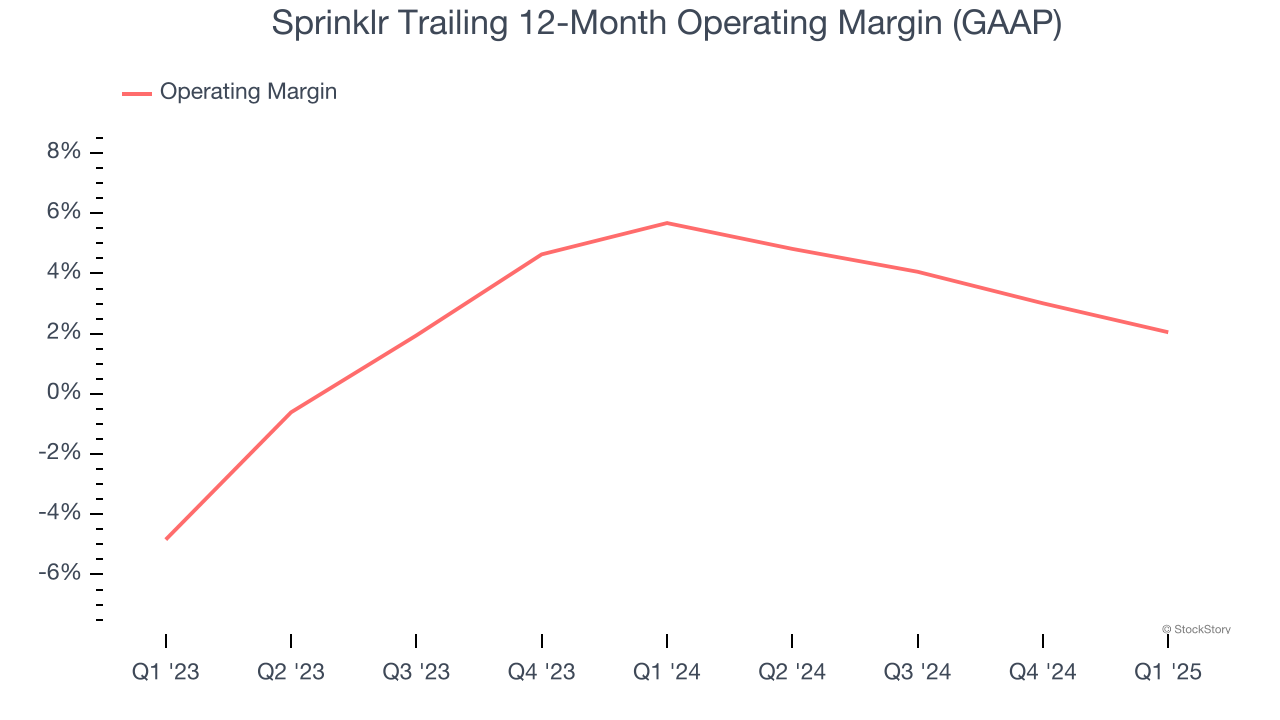

3. Shrinking Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Sprinklr’s operating margin decreased by 3.6 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 2%.

Final Judgment

Sprinklr falls short of our quality standards. That said, the stock currently trades at 2.8× forward price-to-sales (or $8.90 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Sprinklr

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.