Bandwidth’s stock price has taken a beating over the past six months, shedding 29.3% of its value and falling to $14.35 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Bandwidth, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Bandwidth Will Underperform?

Even with the cheaper entry price, we're cautious about Bandwidth. Here are three reasons why we avoid BAND and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

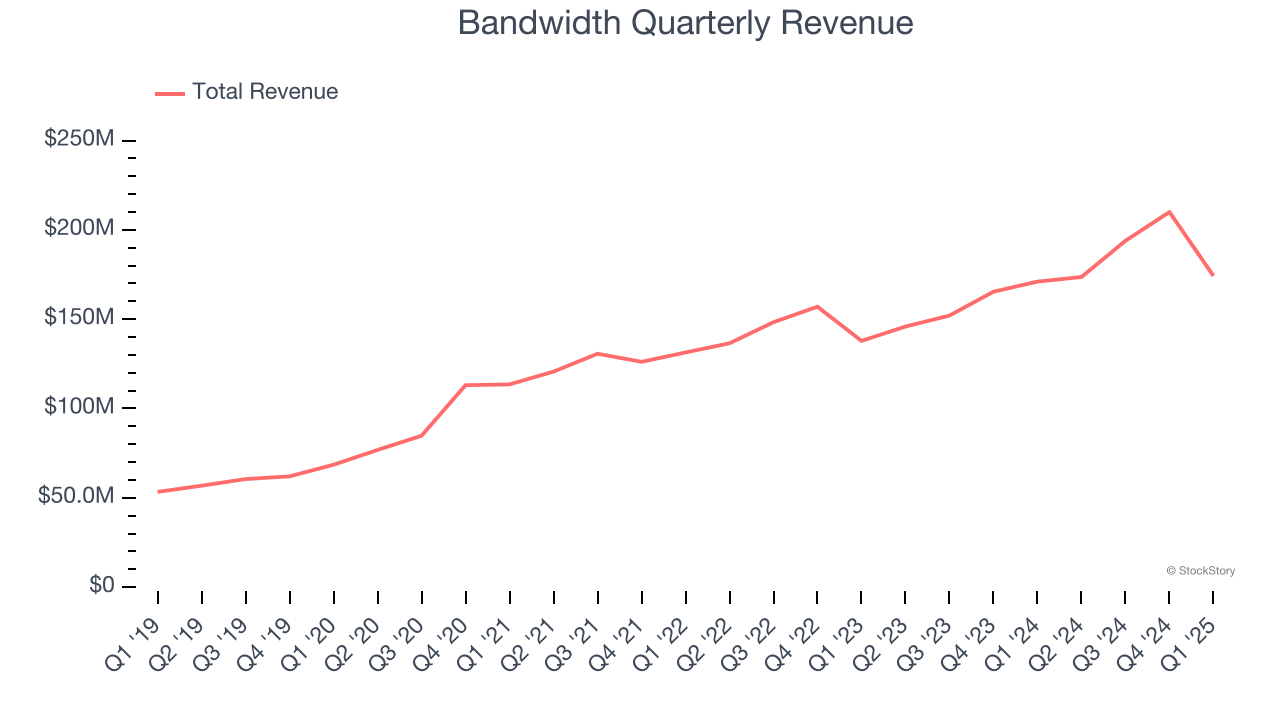

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Bandwidth grew its sales at a 13.9% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Bandwidth’s revenue to rise by 2.8%, a deceleration versus its 13.9% annualized growth for the past three years. This projection is underwhelming and suggests its products and services will face some demand challenges.

3. Low Gross Margin Reveals Weak Structural Profitability

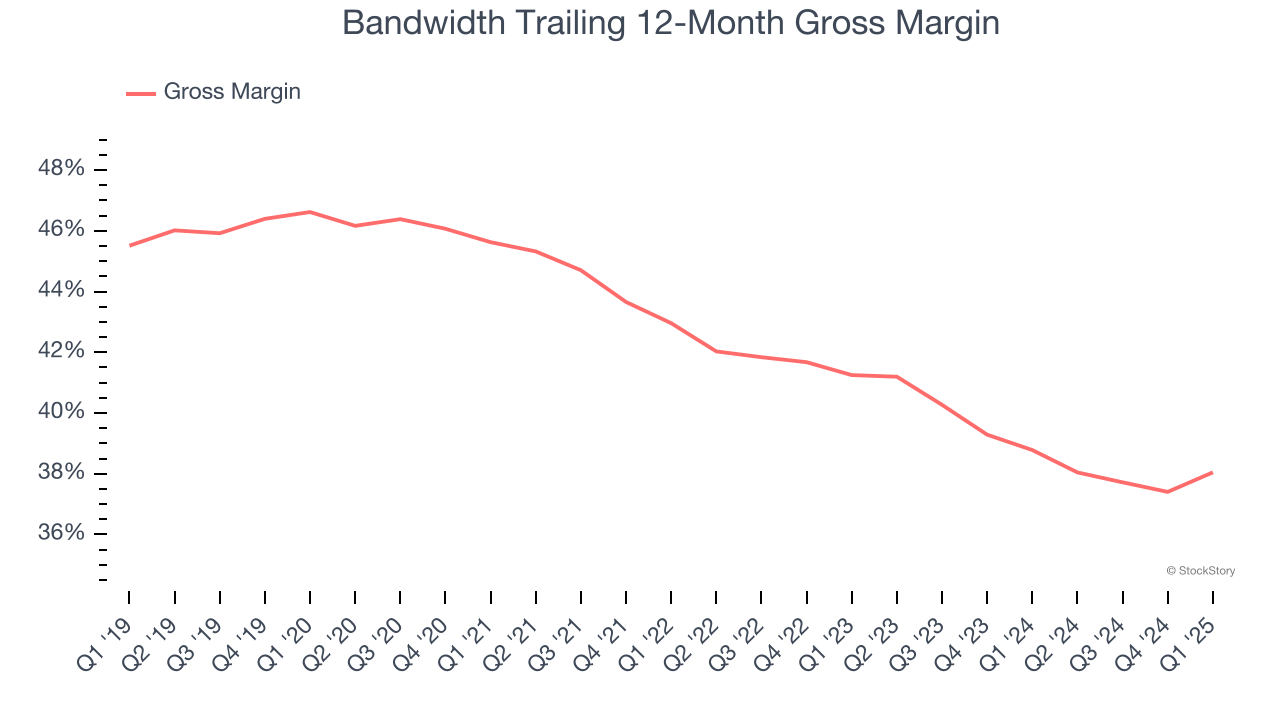

For software companies like Bandwidth, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Bandwidth’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 38% gross margin over the last year. That means Bandwidth paid its providers a lot of money ($61.95 for every $100 in revenue) to run its business.

Final Judgment

We see the value of companies addressing major business pain points, but in the case of Bandwidth, we’re out. After the recent drawdown, the stock trades at 0.5× forward price-to-sales (or $14.35 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than Bandwidth

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.