Healthcare services company Agilon Health (NYSE: AGL) announced better-than-expected revenue in Q1 CY2025, but sales fell by 4.5% year on year to $1.53 billion. On the other hand, next quarter’s revenue guidance of $1.47 billion was less impressive, coming in 0.5% below analysts’ estimates. Its GAAP loss of $0 per share was in line with analysts’ consensus estimates.

Is now the time to buy agilon health? Find out by accessing our full research report, it’s free.

agilon health (AGL) Q1 CY2025 Highlights:

- Revenue: $1.53 billion vs analyst estimates of $1.51 billion (4.5% year-on-year decline, 1.8% beat)

- EPS (GAAP): $0 vs analyst estimates of -$0.01 (in line)

- Adjusted EBITDA: $20.57 million vs analyst estimates of $17.42 million (1.3% margin, 18.1% beat)

- The company slightly lifted its revenue guidance for the full year to $5.94 billion at the midpoint from $5.93 billion

- EBITDA guidance for the full year is -$75 million at the midpoint, above analyst estimates of -$78.29 million

- Operating Margin: -1.4%, in line with the same quarter last year

- Free Cash Flow was -$35.84 million compared to -$50.92 million in the same quarter last year

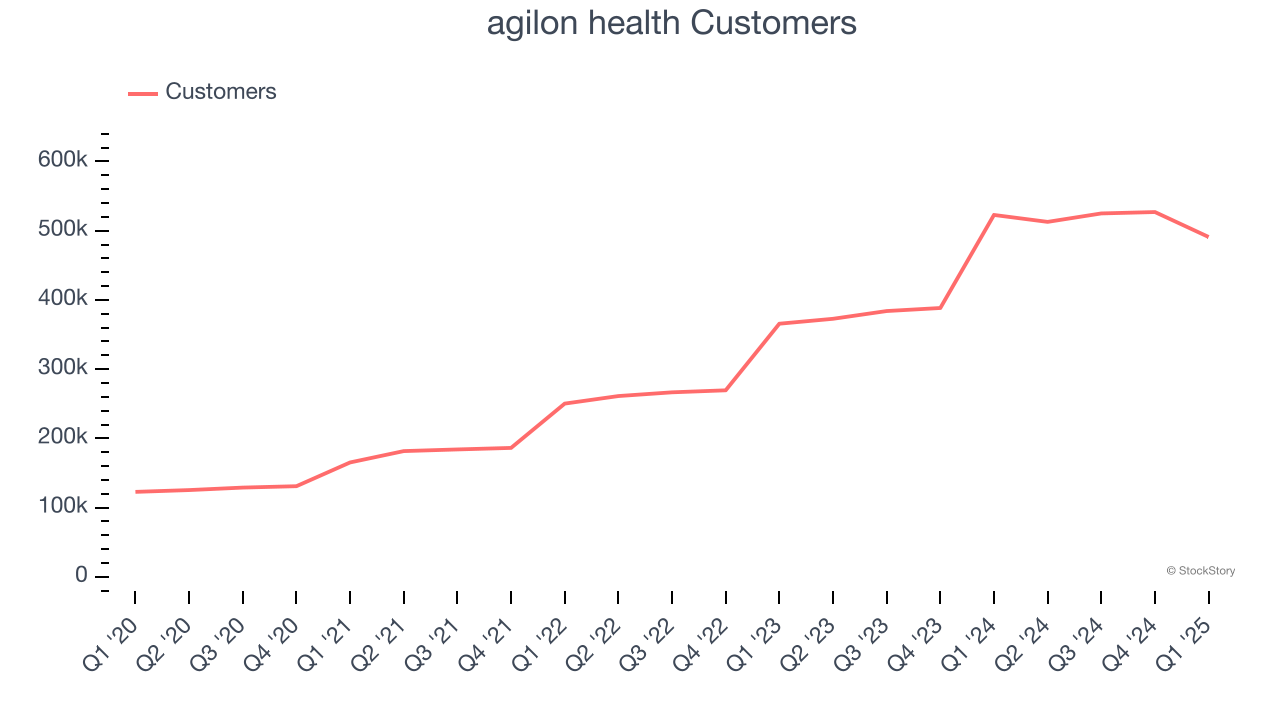

- Customers: 491,000, down from 527,000 in the previous quarter

- Market Capitalization: $1.70 billion

“I’m encouraged by our first quarter results and the progress we are making on key initiatives to drive improved operating performance. With our differentiated Total Care Model, our partnerships remain focused on the entire health of their patients, continuing to deliver significant quality outcomes, and cost-effective care to senior patients,” said Steven Sell, CEO, agilon health.

Company Overview

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE: AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

Sales Growth

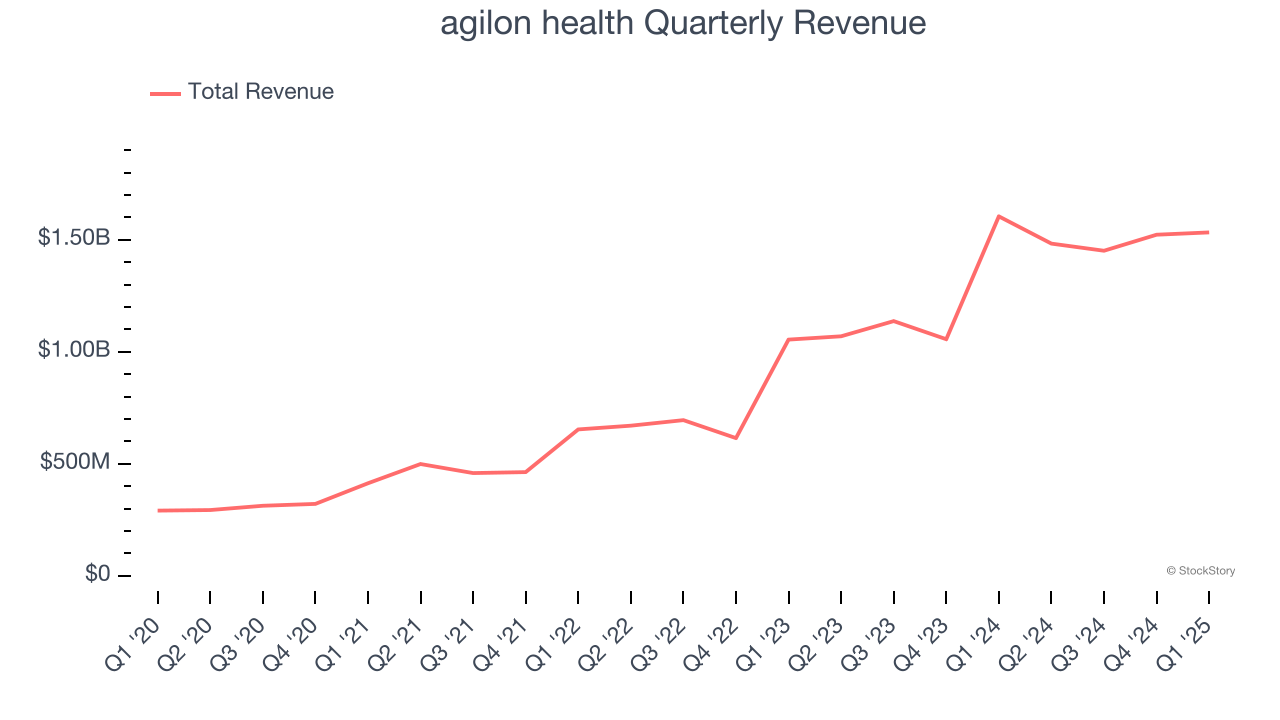

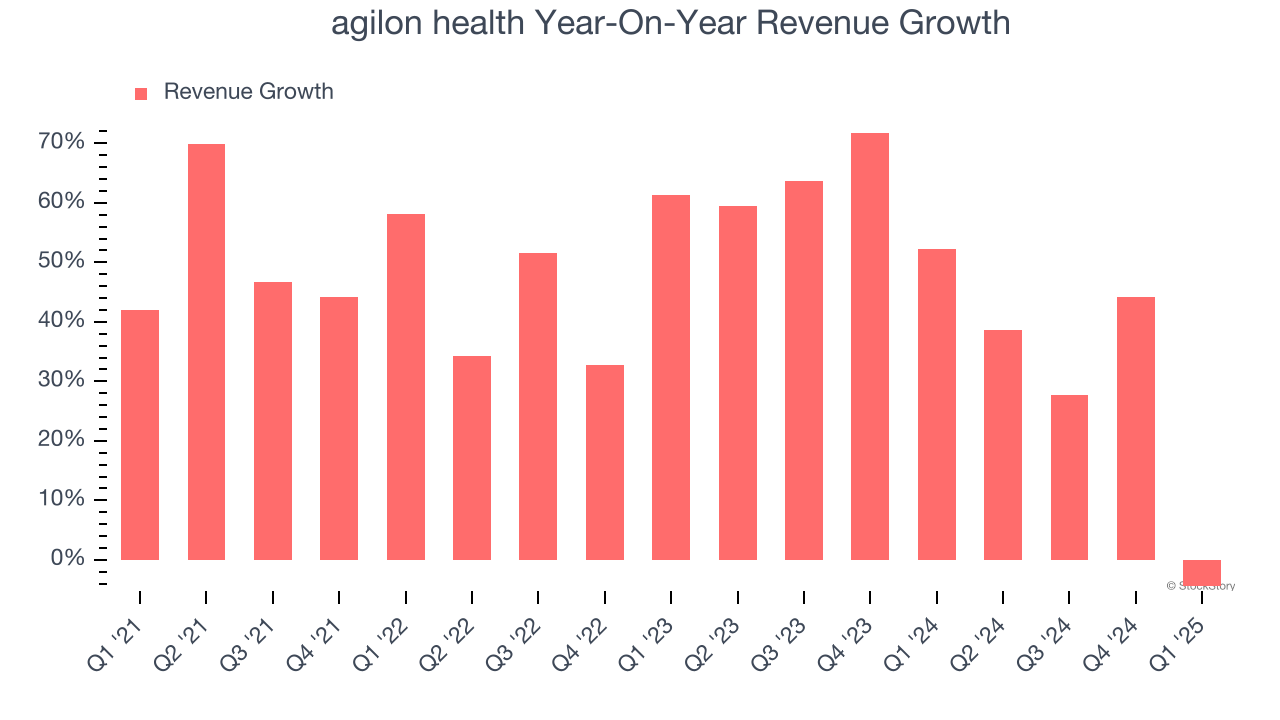

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last four years, agilon health grew its sales at an incredible 45.4% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. agilon health’s annualized revenue growth of 40.5% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 491,000 in the latest quarter. Over the last two years, agilon health’s customer base averaged 34.7% year-on-year growth. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, agilon health’s revenue fell by 4.5% year on year to $1.53 billion but beat Wall Street’s estimates by 1.8%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

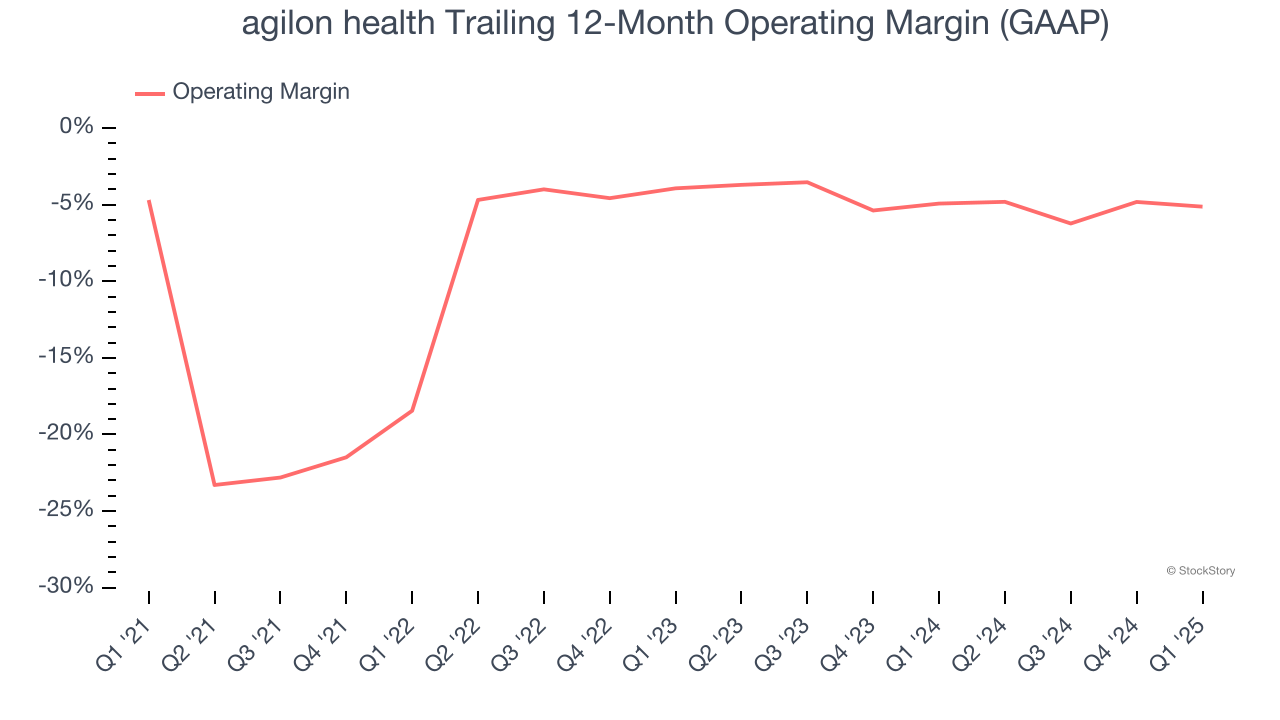

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

agilon health’s high expenses have contributed to an average operating margin of negative 6.4% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

Analyzing the trend in its profitability, agilon health’s operating margin of negative 5.1% for the trailing 12 months may be around the same as five years ago, but it has decreased by 1.2 percentage points over the last two years. Still, we’re optimistic that agilon health can correct course and expand its profitability on a longer-term horizon due to its business quality.

In Q1, agilon health generated a negative 1.4% operating margin.

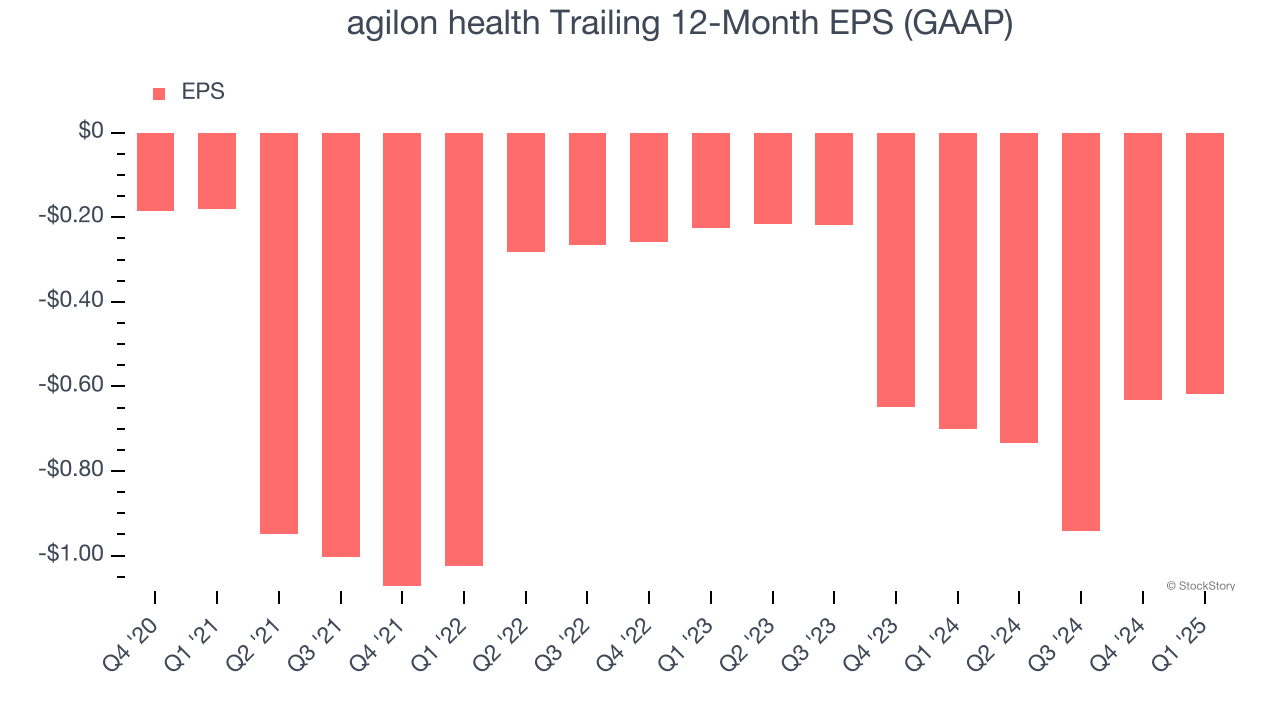

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

agilon health’s earnings losses deepened over the last four years as its EPS dropped 35.9% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q1, agilon health reported EPS at $0, up from negative $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast agilon health’s full-year EPS of negative $0.62 will reach break even.

Key Takeaways from agilon health’s Q1 Results

We were impressed by how agilon health beat analysts’ revenue and EBITDA expectations this quarter. We were also glad its full-year revenue and EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its new customer additions fell short. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $4.45 immediately following the results.

Is agilon health an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.