Over the last six months, Mettler-Toledo shares have sunk to $1,163, producing a disappointing 7.1% loss - worse than the S&P 500’s 1.9% drop. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Mettler-Toledo, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Mettler-Toledo Not Exciting?

Even though the stock has become cheaper, we're swiping left on Mettler-Toledo for now. Here are three reasons why you should be careful with MTD and a stock we'd rather own.

1. Core Business Falling Behind as Demand Plateaus

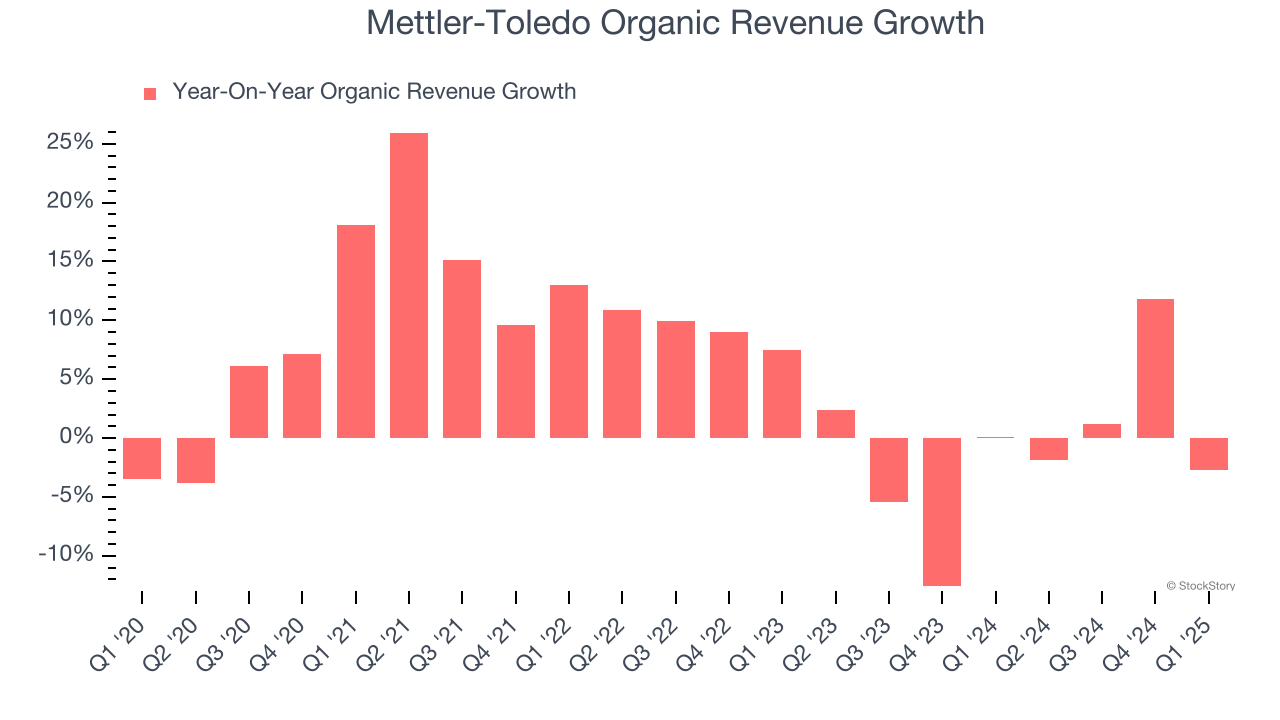

We can better understand Research Tools & Consumables companies by analyzing their organic revenue. This metric gives visibility into Mettler-Toledo’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Mettler-Toledo failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Mettler-Toledo might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Mettler-Toledo’s revenue to rise by 3.4%. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

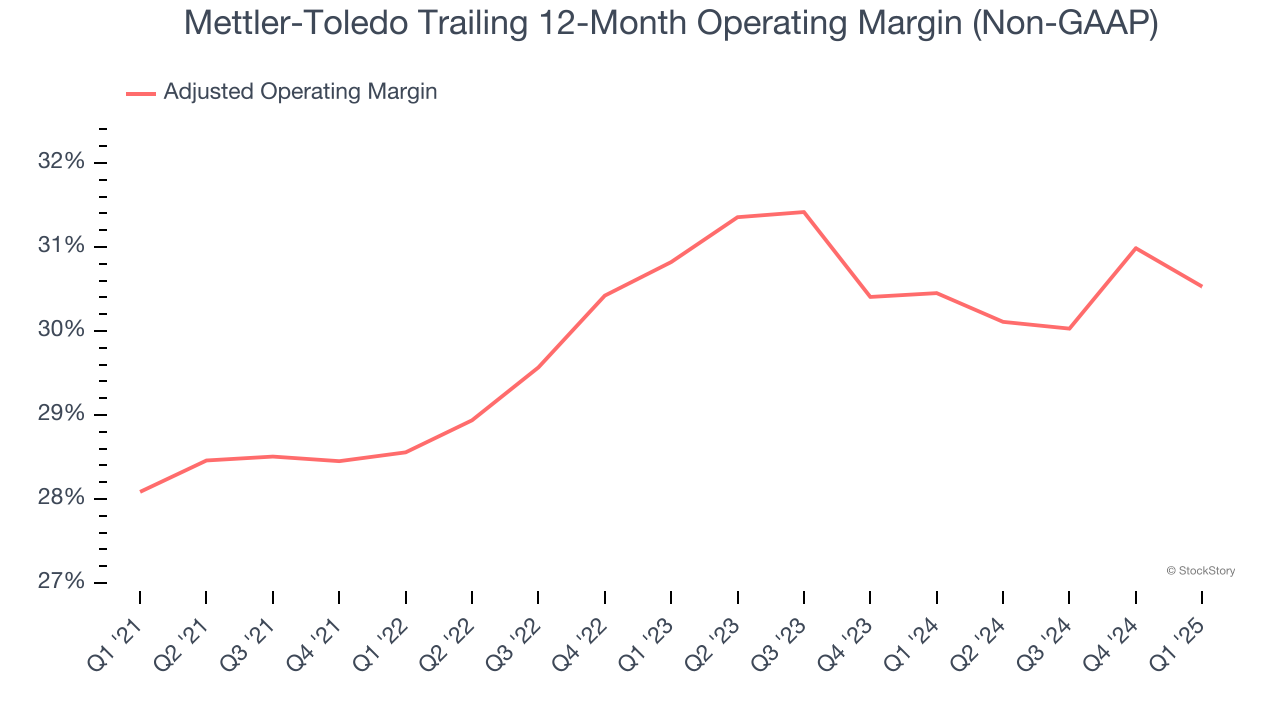

3. Adjusted Operating Margin in Limbo

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Looking at the trend in its profitability, Mettler-Toledo’s adjusted operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 30.5%.

Final Judgment

Mettler-Toledo isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 26.8× forward P/E (or $1,163 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Mettler-Toledo

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.