Looking back on design software stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Autodesk (NASDAQ: ADSK) and its peers.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 6 design software stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 3.5% on average since the latest earnings results.

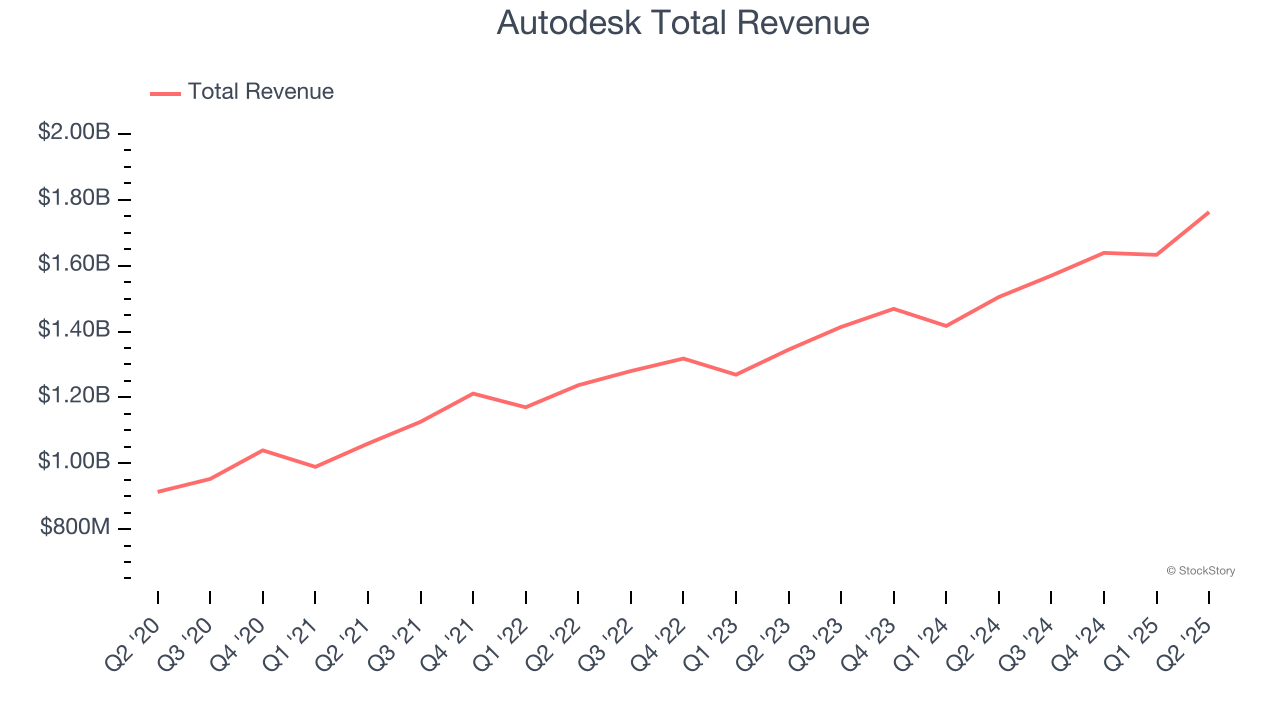

Autodesk (NASDAQ: ADSK)

Starting with AutoCAD in the 1980s and evolving into a comprehensive design ecosystem, Autodesk (NASDAQ: ADSK) provides software solutions for architecture, engineering, construction, manufacturing, and entertainment industries to design, simulate, and visualize projects.

Autodesk reported revenues of $1.76 billion, up 17.1% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

"For more than a decade, Autodesk has been at the forefront of innovation — in BIM, SaaS, generative design, and now in generative AI. We have been building industry-specific foundation models and products capable of understanding and reasoning about 2D and 3D geometry, design and make data, complex structures, and even physical behavior," said Andrew Anagnost, Autodesk president and CEO.

Autodesk delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 9.2% since reporting and currently trades at $315.20.

Is now the time to buy Autodesk? Access our full analysis of the earnings results here, it’s free for active Edge members.

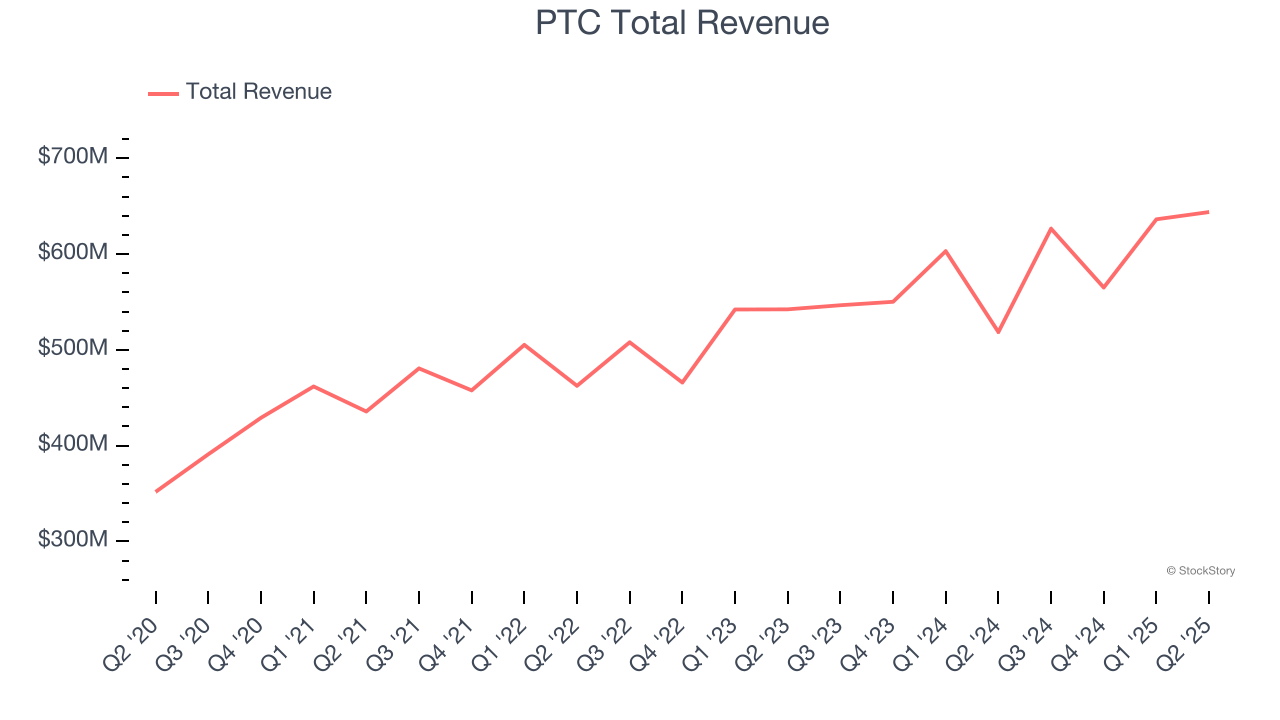

Best Q2: PTC (NASDAQ: PTC)

Originally known as Parametric Technology Corporation until its 2013 rebranding, PTC (NASDAQ: PTC) provides software that helps manufacturers design, develop, and service physical products through digital solutions for CAD, PLM, ALM, and SLM.

PTC reported revenues of $643.9 million, up 24.2% year on year, outperforming analysts’ expectations by 10.4%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

PTC delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $203.18.

Is now the time to buy PTC? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Adobe (NASDAQ: ADBE)

Originally named after Adobe Creek that ran behind co-founder John Warnock's house, Adobe (NASDAQ: ADBE) develops software products used for digital content creation, document management, and marketing solutions across desktop, mobile, and cloud platforms.

Adobe reported revenues of $5.99 billion, up 10.7% year on year, exceeding analysts’ expectations by 1.4%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Adobe delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $348.49.

Read our full analysis of Adobe’s results here.

Cadence Design Systems (NASDAQ: CDNS)

Powering the chips behind everything from smartphones to AI accelerators for over 35 years, Cadence Design Systems (NASDAQ: CDNS) provides essential computational software, hardware, and intellectual property used by engineers to design and verify advanced electronic systems and semiconductors.

Cadence Design Systems reported revenues of $1.28 billion, up 20.2% year on year. This result topped analysts’ expectations by 1.8%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

The stock is up 4.6% since reporting and currently trades at $349.

Read our full, actionable report on Cadence Design Systems here, it’s free for active Edge members.

Procore Technologies (NYSE: PCOR)

With a mission to build software for the people that build the world, Procore Technologies (NYSE: PCOR) provides cloud-based software that enables owners, contractors, and other stakeholders to collaborate and manage construction projects from any device.

Procore Technologies reported revenues of $323.9 million, up 13.9% year on year. This number surpassed analysts’ expectations by 3.9%. It was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ annual recurring revenue estimates.

The company added 195 customers to reach a total of 17,501. The stock is flat since reporting and currently trades at $71.82.

Read our full, actionable report on Procore Technologies here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.