Over the past six months, GoodRx’s stock price fell to $3.94. Shareholders have lost 9.8% of their capital, which is disappointing considering the S&P 500 has climbed by 30.6%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy GoodRx, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think GoodRx Will Underperform?

Even though the stock has become cheaper, we're swiping left on GoodRx for now. Here are three reasons we avoid GDRX and a stock we'd rather own.

1. Weak Customer Growth Points to Soft Demand

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

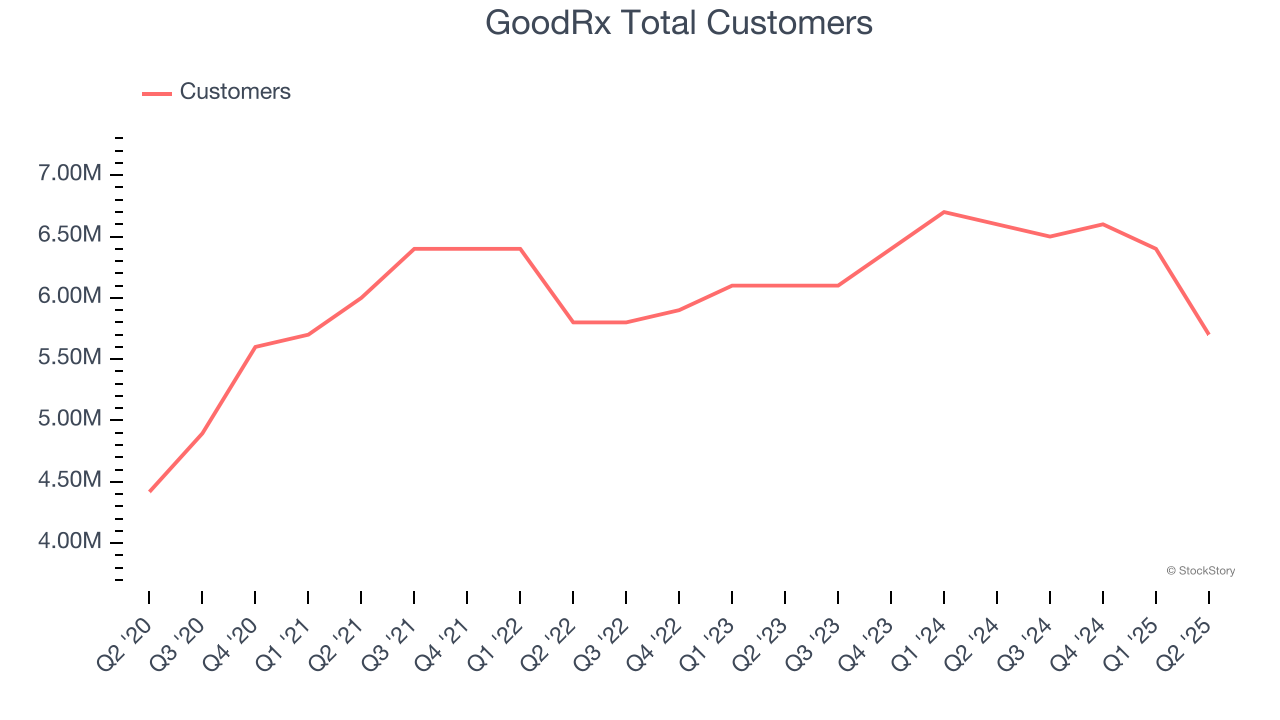

GoodRx’s total customers came in at 5.7 million in the latest quarter, and over the last two years, their count averaged 2.9% year-on-year growth. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in landing new contracts.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $799.9 million in revenue over the past 12 months, GoodRx is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Previous Growth Initiatives Have Lost Money

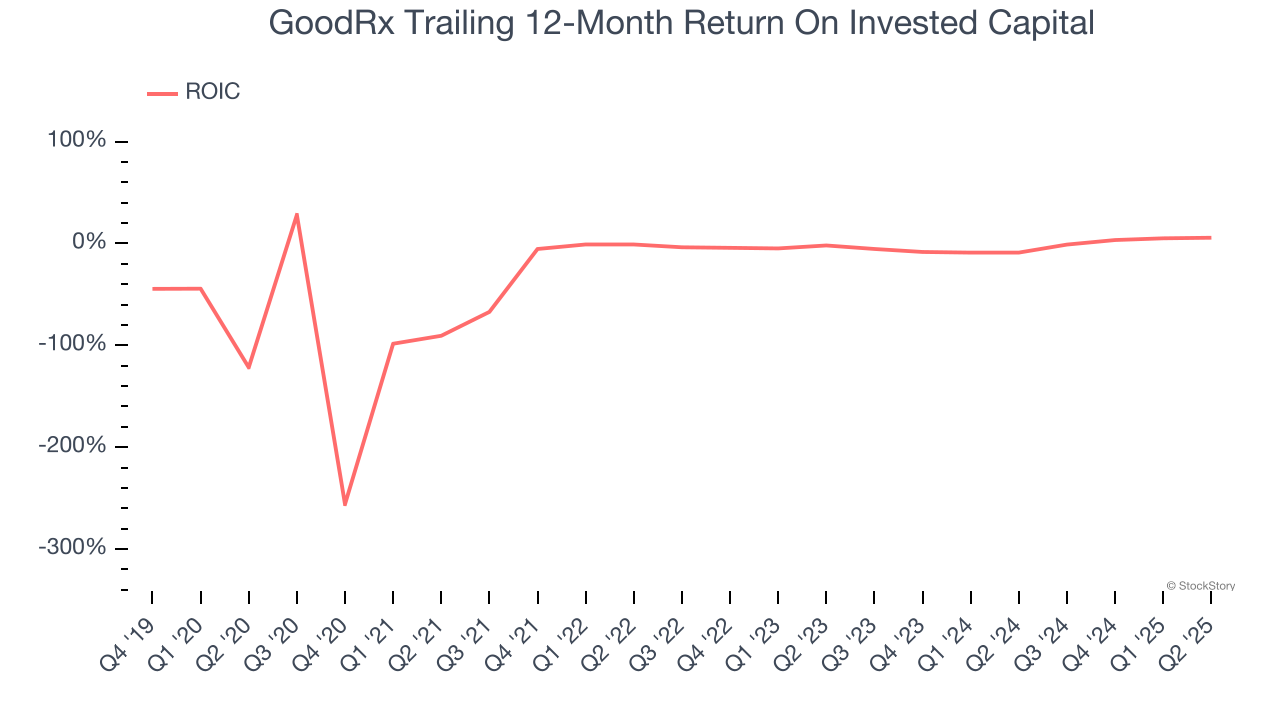

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

GoodRx’s five-year average ROIC was negative 19.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

We see the value of companies making people healthier, but in the case of GoodRx, we’re out. After the recent drawdown, the stock trades at 9.6× forward P/E (or $3.94 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.