Lululemon’s 26.7% return over the past six months has outpaced the S&P 500 by 19.4%, and its stock price has climbed to $382.30 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy LULU? Find out in our full research report, it’s free.

Why Is Lululemon a Good Business?

Originally serving yogis and hockey players, Lululemon (NASDAQ: LULU) is a designer, distributor, and retailer of athletic apparel for men and women.

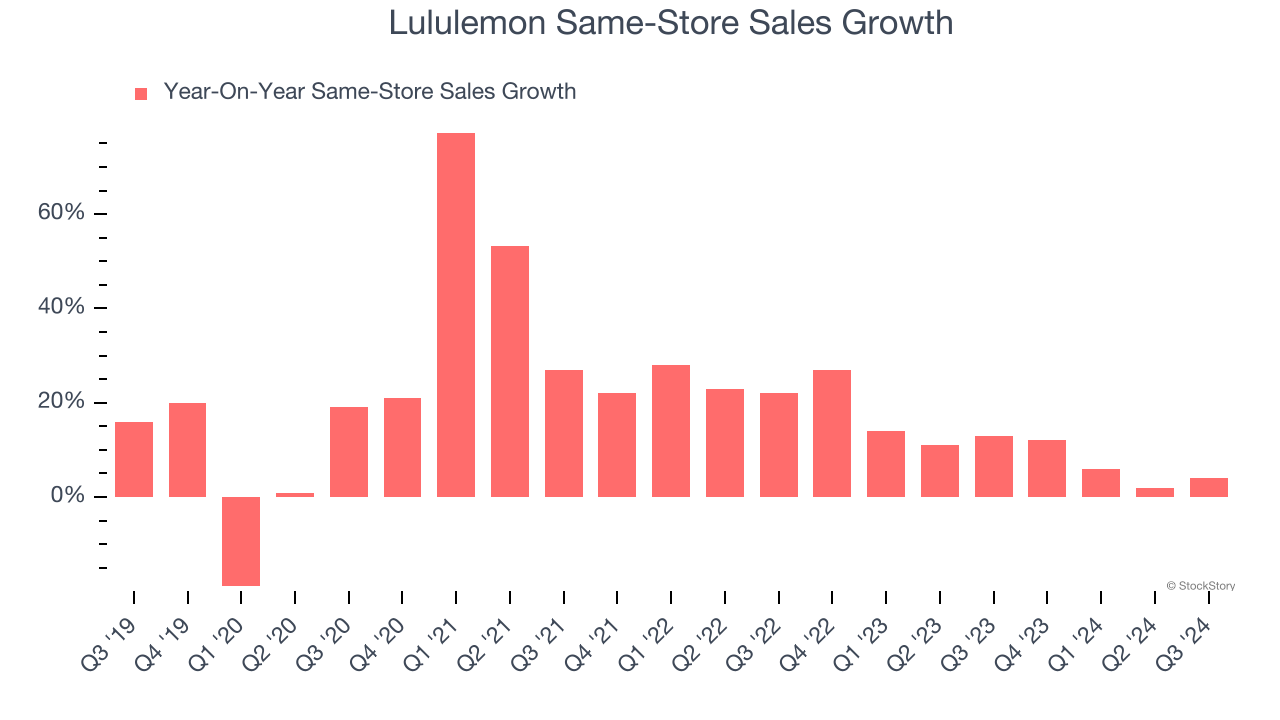

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Lululemon has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 11.1%.

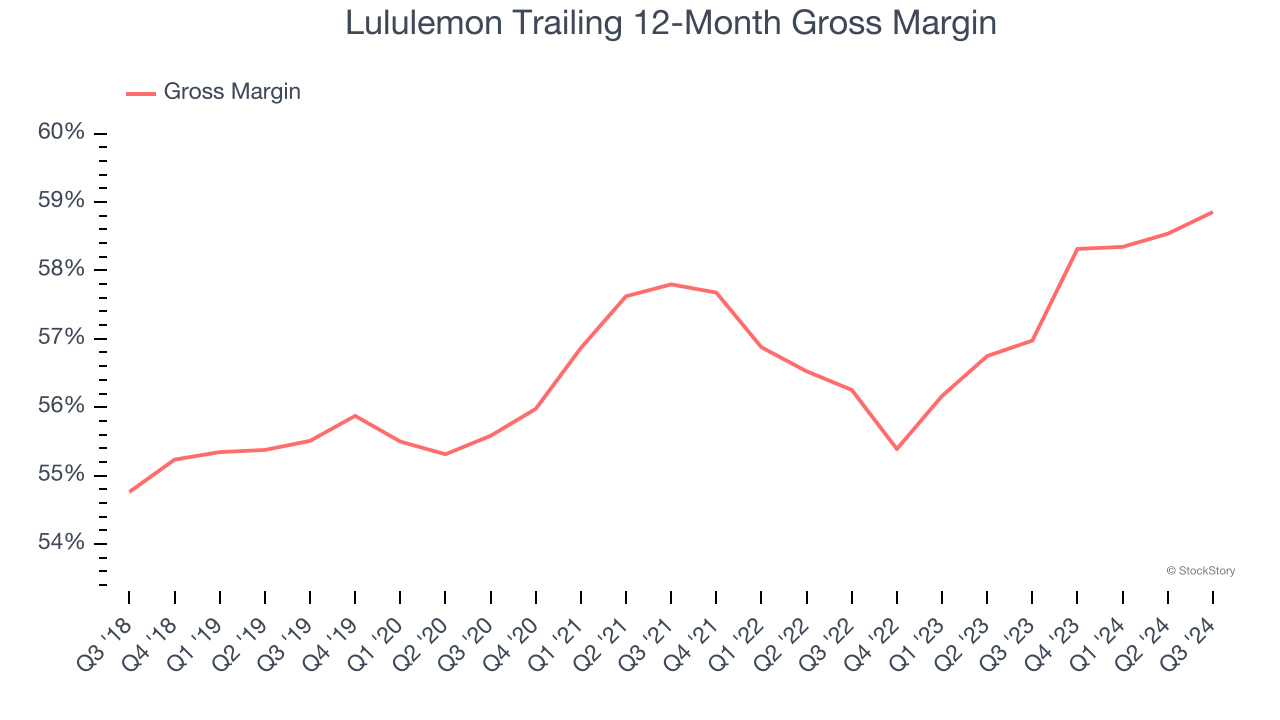

2. Elite Gross Margin Powers Best-In-Class Business Model

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Lululemon has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 58% gross margin over the last two years. That means Lululemon only paid its suppliers $42.04 for every $100 in revenue.

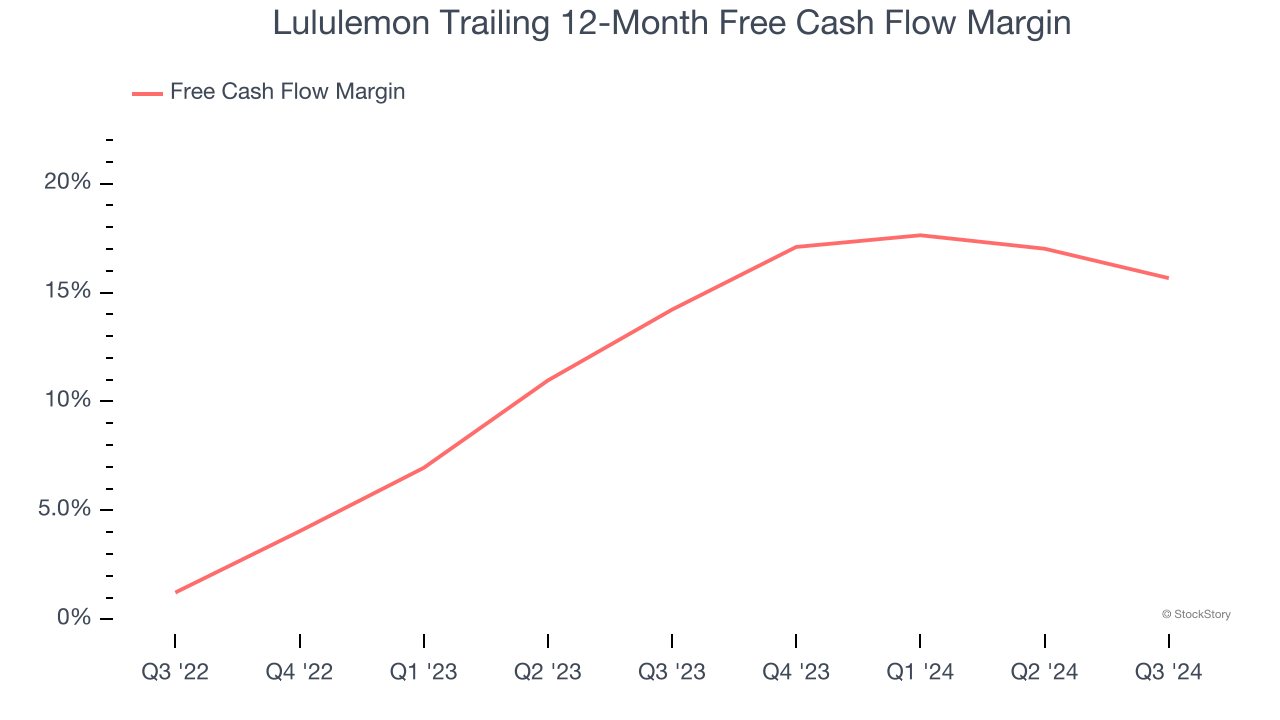

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Lululemon has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 15% over the last two years.

Final Judgment

These are just a few reasons why Lululemon ranks near the top of our list, and with its shares beating the market recently, the stock trades at 26.1× forward price-to-earnings (or $382.30 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Lululemon

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.