What a fantastic six months it’s been for Toast. Shares of the company have skyrocketed 43%, hitting $36.40. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is TOST a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does TOST Stock Spark Debate?

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE: TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

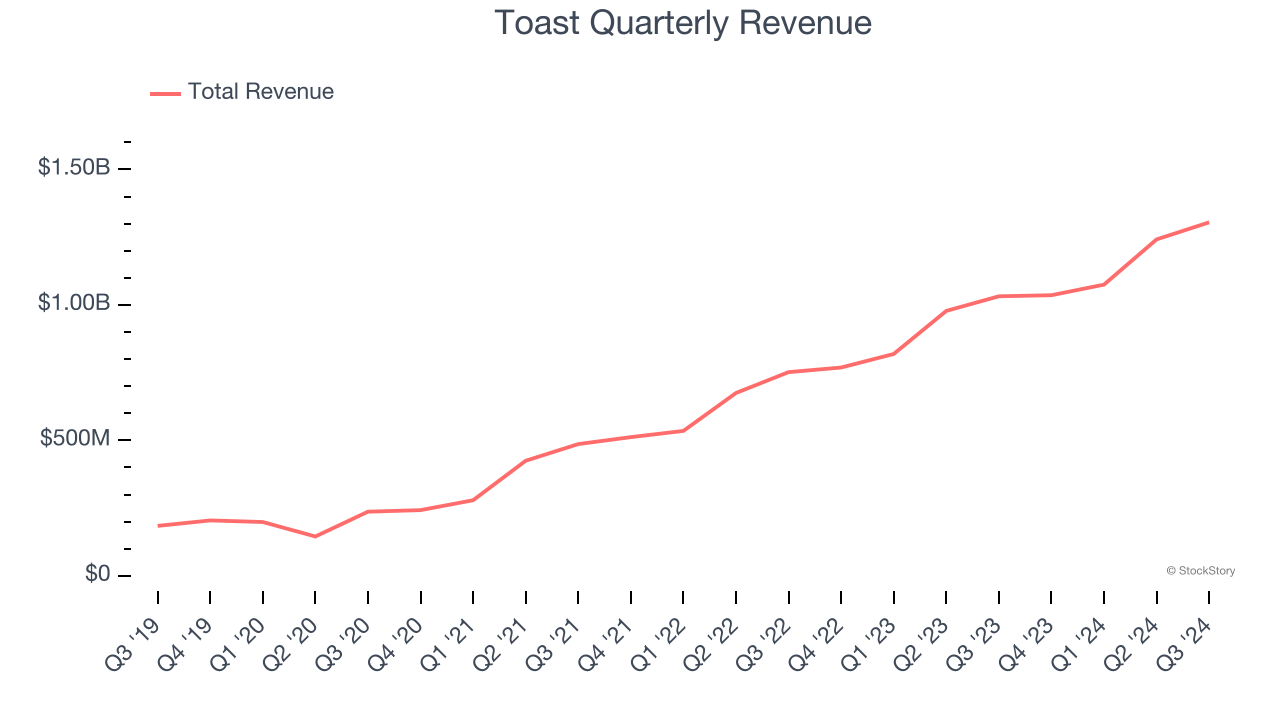

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Toast grew its sales at an incredible 48.1% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

2. ARR Surges as Recurring Revenue Flows In

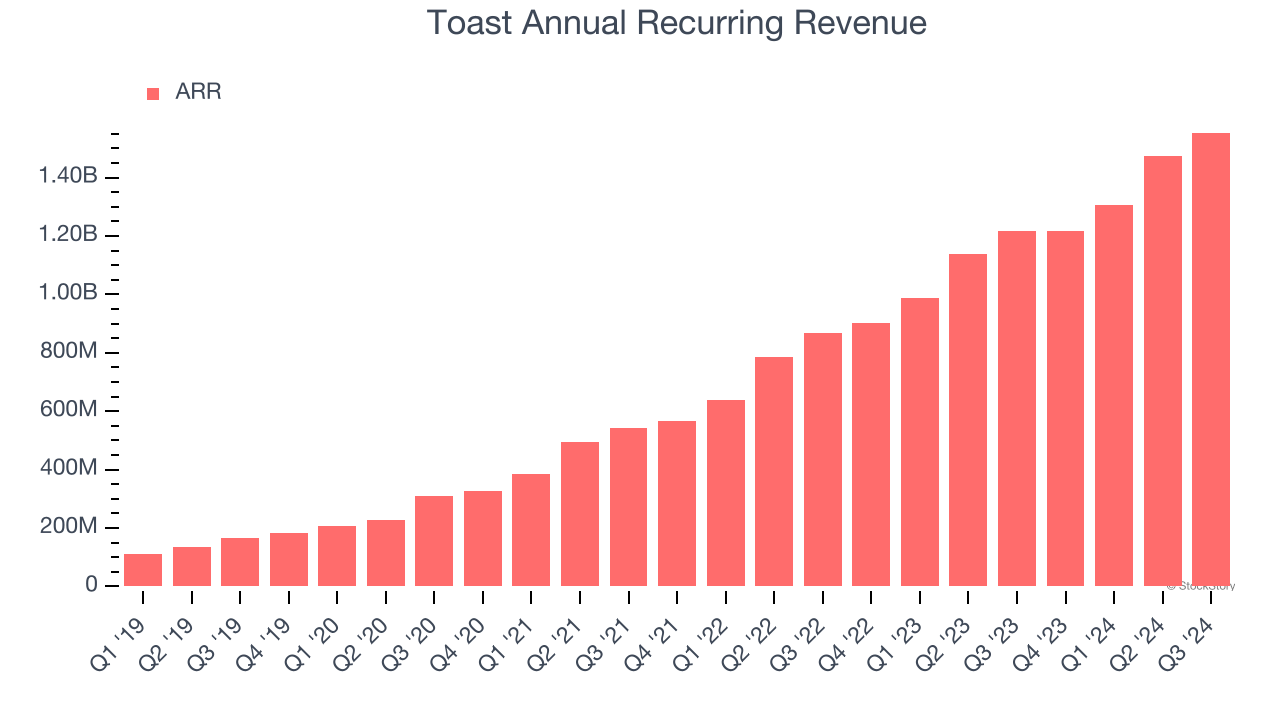

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Toast’s ARR punched in at $1.55 billion in Q3, and over the last four quarters, its year-on-year growth averaged 31%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Toast a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

One Reason to be Careful:

Low Gross Margin Reveals Weak Structural Profitability

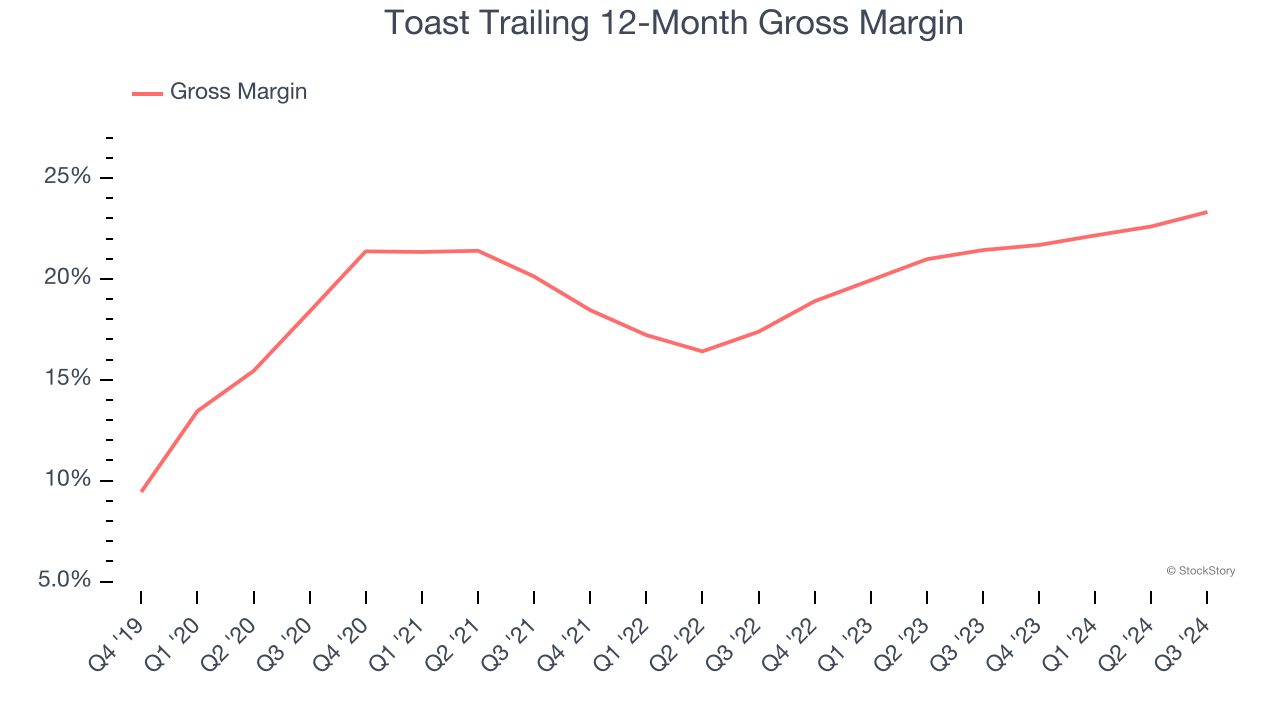

For software companies like Toast, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Toast’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 23.3% gross margin over the last year. Said differently, Toast had to pay a chunky $76.69 to its service providers for every $100 in revenue.

Final Judgment

Toast’s positive characteristics outweigh the negatives, and after the recent rally, the stock trades at 3.8× forward price-to-sales (or $36.40 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Toast

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.