Waste and recycling services provider Quest Resource (NASDAQ: QRHC) fell short of the market’s revenue expectations in Q3 CY2024 as sales rose 3.3% year on year to $72.77 million. Its GAAP loss of $0.16 per share was also 1,100% below analysts’ consensus estimates.

Is now the time to buy Quest Resource? Find out by accessing our full research report, it’s free.

Quest Resource (QRHC) Q3 CY2024 Highlights:

- Revenue: $72.77 million vs analyst estimates of $77.1 million (5.6% miss)

- EPS: -$0.16 vs analyst estimates of -$0.01 (-$0.15 miss)

- EBITDA: $2.53 million vs analyst estimates of $5.1 million (50.3% miss)

- Gross Margin (GAAP): 16.1%, down from 17.7% in the same quarter last year

- Operating Margin: -1.3%, down from 1.2% in the same quarter last year

- EBITDA Margin: 3.5%, up from 1.8% in the same quarter last year

- Market Capitalization: $166.5 million

“We were very active during the third quarter: securing significant new client wins, onboarding a record number of new clients, and expanding engagements with existing ones. New client onboarding, combined with strong demand from existing clients, added approximately $16 million in revenue during the third quarter. However, growth was partially offset by weaker-than-expected conditions at certain clients in our industrial end markets and isolated client attrition. In addition, during the third quarter, we implemented our vendor management system, which temporarily caused a significantly higher than expected increase in cost of revenue and incremental SG&A in support of the transition,” said S. Ray Hatch, President and Chief Executive Officer of Quest.

Company Overview

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ: QRHC) is a provider of waste and recycling services.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

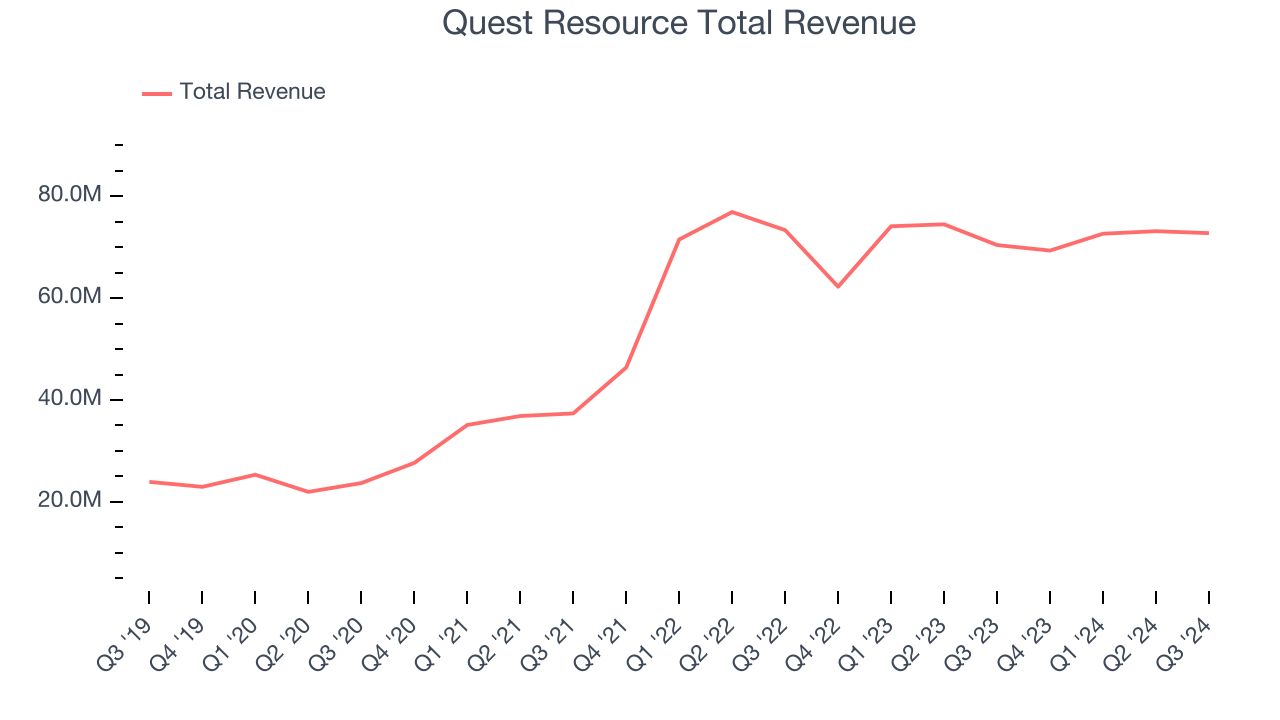

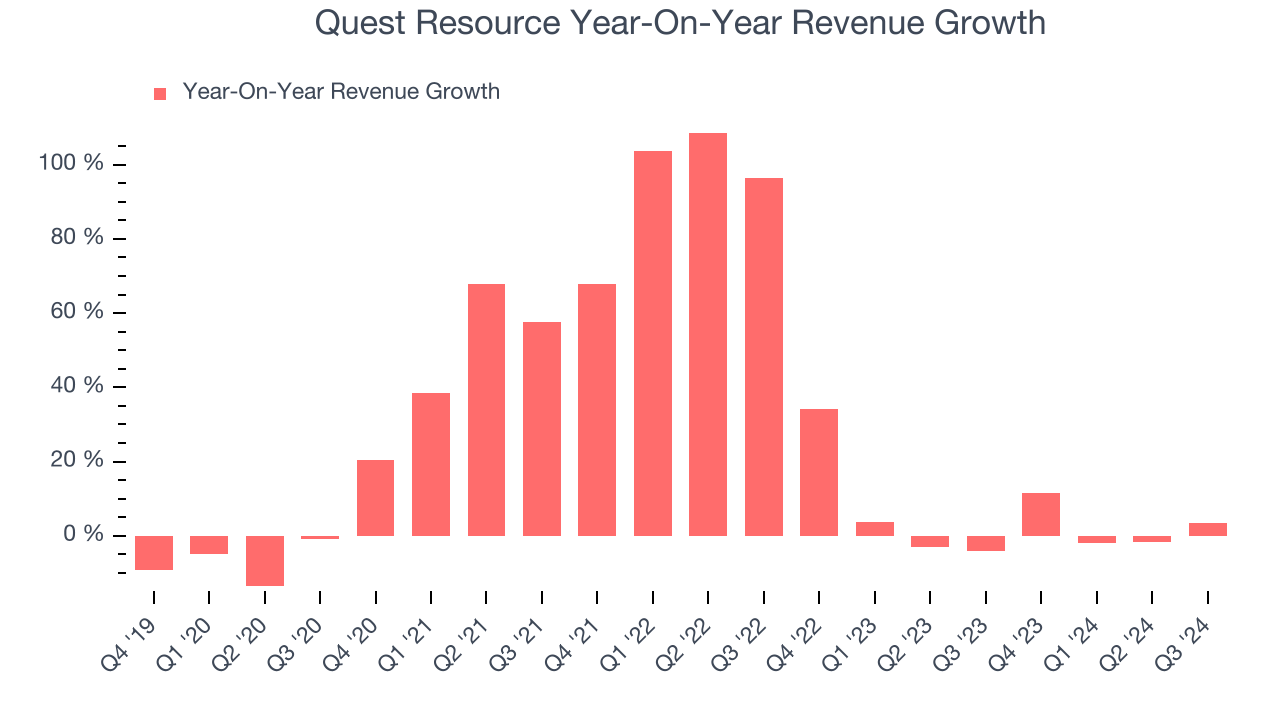

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, Quest Resource grew its sales at an incredible 23.2% compounded annual growth rate. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Quest Resource’s recent history shows its demand slowed significantly as its annualized revenue growth of 3.6% over the last two years is well below its five-year trend.

This quarter, Quest Resource’s revenue grew 3.3% year on year to $72.77 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and illustrates the market thinks its newer products and services will fuel higher growth rates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

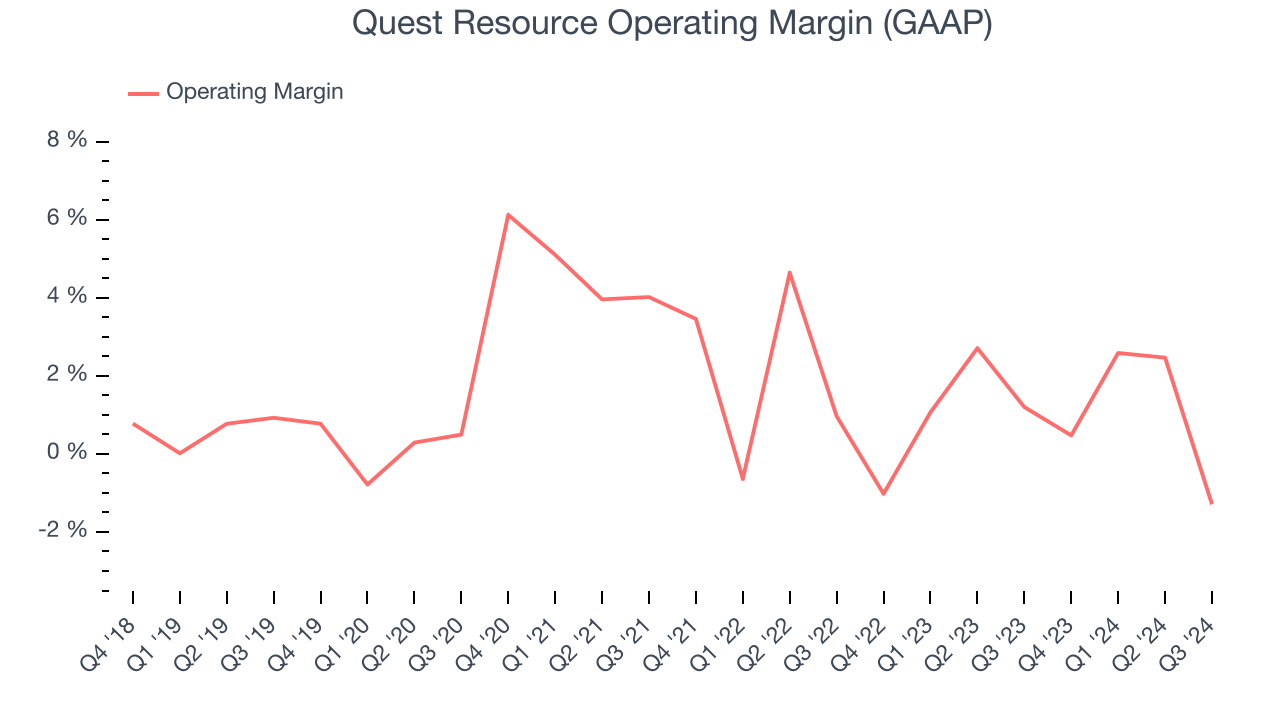

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Quest Resource was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Quest Resource’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

In Q3, Quest Resource generated an operating profit margin of negative 1.3%, down 2.5 percentage points year on year. Since Quest Resource’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

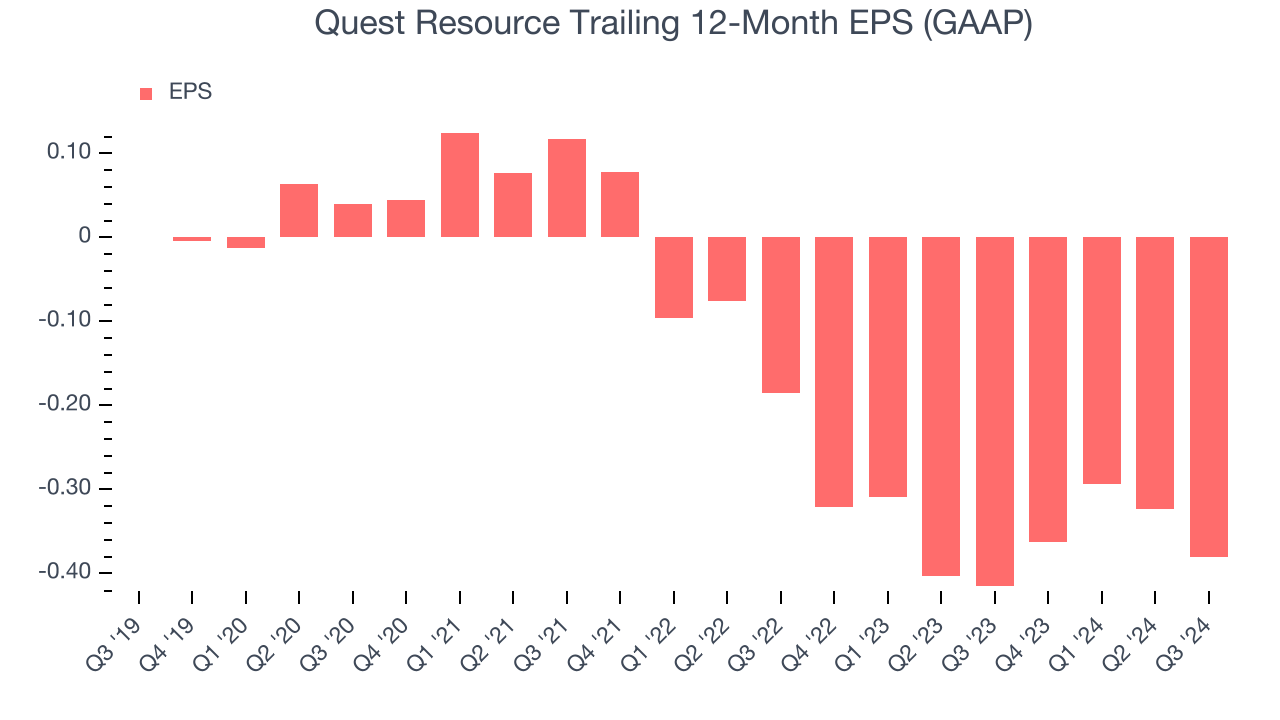

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Quest Resource, its EPS declined by 353% annually over the last five years while its revenue grew by 23.2%. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors affected its ultimate earnings.

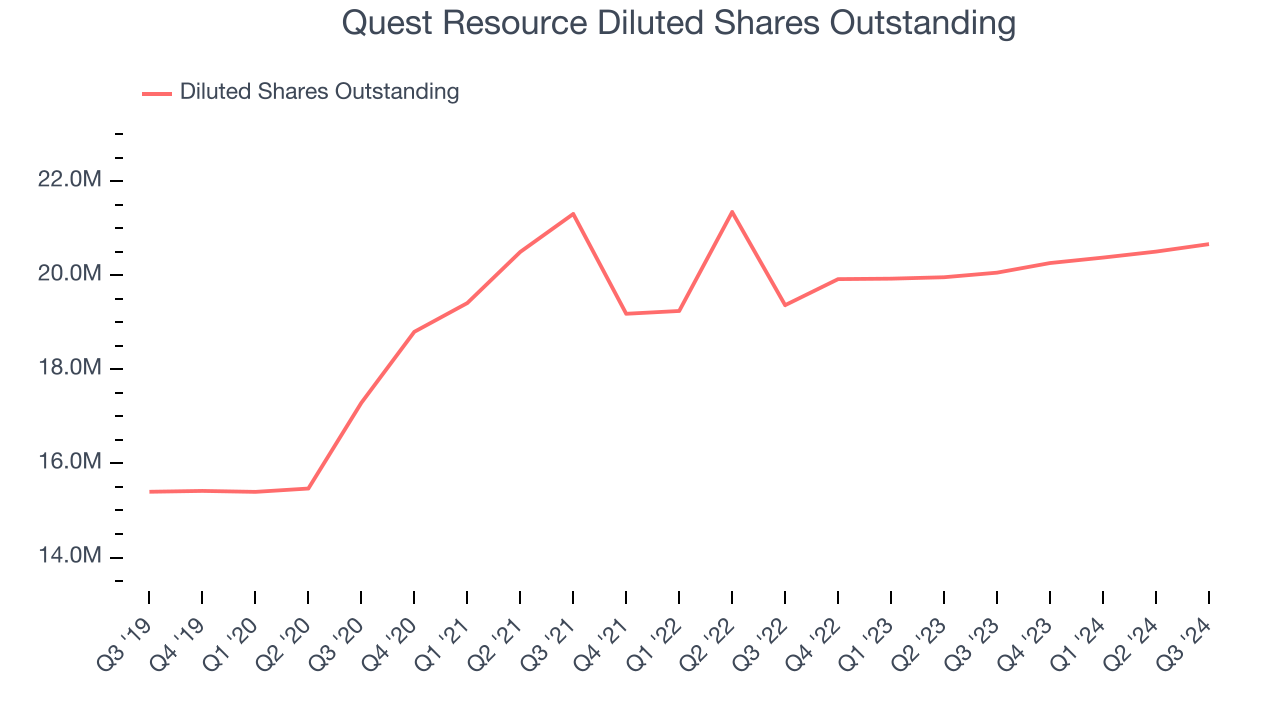

We can take a deeper look into Quest Resource’s earnings to better understand the drivers of its performance. A five-year view shows Quest Resource has diluted its shareholders, growing its share count by 34.2%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Quest Resource, its two-year annual EPS declines of 43.2% show it’s still underperforming. These results were bad no matter how you slice the data.In Q3, Quest Resource reported EPS at negative $0.16, down from negative $0.10 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Quest Resource’s full-year EPS of negative $0.38 will reach break even.

Key Takeaways from Quest Resource’s Q3 Results

We struggled to find many strong positives in these results as its revenue and EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.1% to $7.81 immediately following the results.

The latest quarter from Quest Resource’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.