Over the past six months, Nike’s stock price has fallen to $78.24. Shareholders have lost 14.9% of their capital, highly disappointing when considering the S&P 500 has climbed 13%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Nike, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.Even though the stock has become cheaper, we're swiping left on Nike for now. Here are three reasons why you should be careful with NKE and a stock we'd rather own.

Why Do We Think Nike Will Underperform?

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE: NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

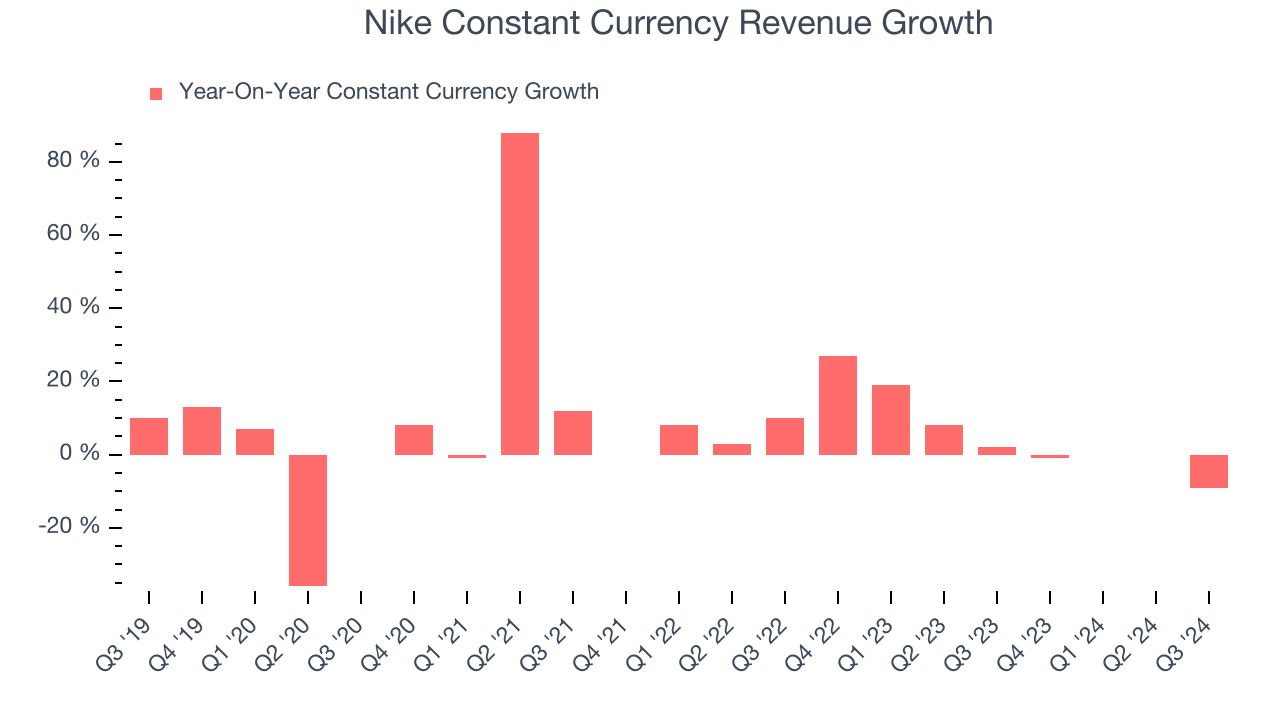

1. Weak Constant Currency Growth Points to Soft Demand

We can better understand Footwear companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Nike’s control and are not indicative of underlying demand.

Over the last two years, Nike’s constant currency revenue averaged 5.8% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Nike’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.4% for the last 12 months will decrease to 8%.

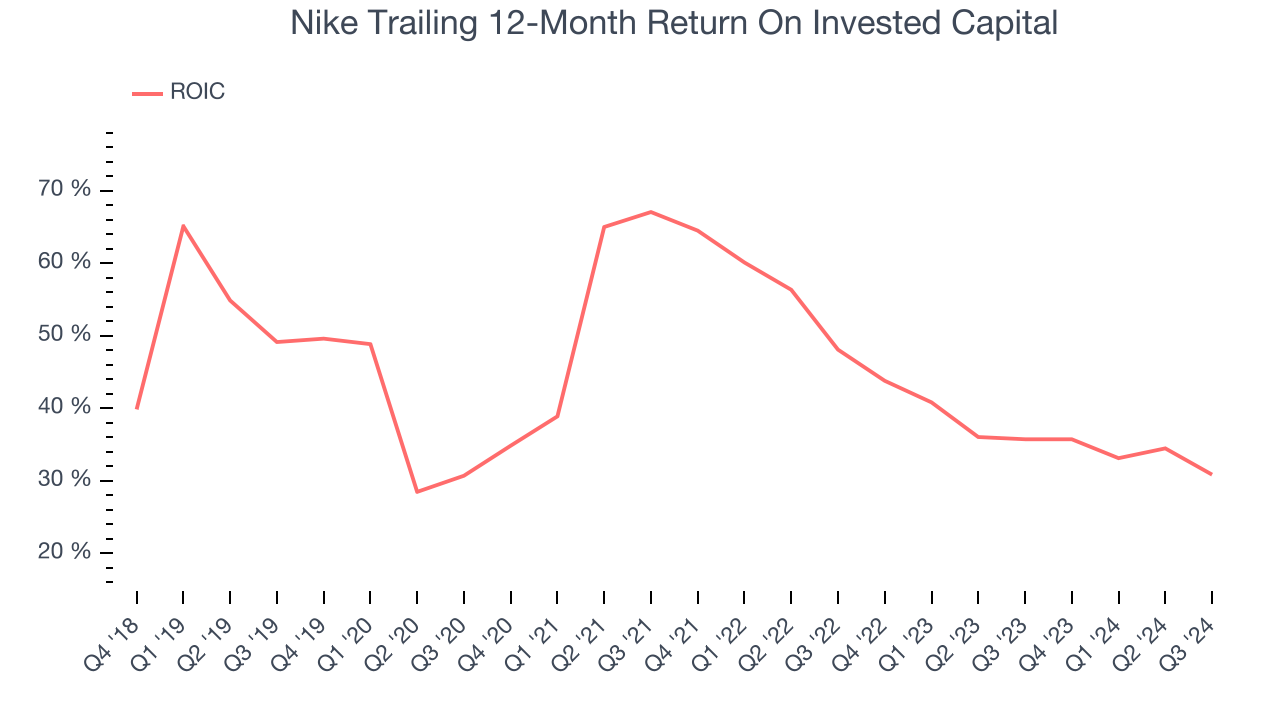

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Nike’s ROIC has decreased significantly over the last few years. We like what management has done in the past but are concerned its ROIC is declining, perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Nike, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 23.9x forward price-to-earnings (or $78.24 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward Chipotle, which surprisingly still has a long runway for growth.

Stocks We Like More Than Nike

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.