Coinbase Global Inc. (NASDAQ: COIN) is the largest publicly traded cryptocurrency exchange in the U.S. It is arguably the most trusted and stable exchange due to its regulatory transparency and liquidity. As a member of the financial services sector, Coinbase is considered the crypto exchange of choice for institutional investors and carries with it the largest market cap of the crypto-related stocks, offering over 200 cryptocurrencies. Shares have doubled in the last six months in anticipation of the U.S. Securities and Exchange Commission (SEC) potentially approving spot bitcoin exchange-traded-funds (ETFs).

This has caused stocks of bitcoin miners like Marathon Digital Holdings Inc. (NASDAQ: MARA) and Riot Platforms Inc. (NASDAQ: RIOT) to NASDAQ: MARA">surge into 2024. The SEC decision is widely expected to be released on Jan. 10, 2024. Coinbase would be the key benefactor of approval, but it also has more catalysts in 2024 that could propel shares even higher by another 50%.

Coinbase is the institutional de facto go-to exchange.

The approval of a bitcoin ETF will result in the launch of a number of bitcoin ETFs that will need to buy bitcoin. The largest money management firm in the world, BlackRock Inc. (NYSE: BLK), has committed to launching a Bitcoin ETF upon approval. This in and of itself lends major credibility to bitcoin. Grayscale Investments, Fidelity, Invesco, and Ark Investments also have spot bitcoin ETF proposals on the table.

In August 2023, Greyscale won a court ruling by the District of Columbia Court of Appeals in Washington, D.C., essentially ruling that the SEC was wrong in rejecting its spot bitcoin ETF application. A bitcoin ETF would enable institutions to allocate a portion of risk towards cryptocurrency. It further legitimizes Bitcoin and adds liquidity when the institutions partake.

Bitcoin ETFs would be SIPC-insured like a listed security.

It's the belief that if the SEC approves spot bitcoin ETFs, then they will encourage more investors and institutions to “safely” participate. Crypto assets aren’t protected like stocks covered by SIPC insurance if the broker goes belly up. A bitcoin ETF would allow investors to safely buy and store a form of bitcoin through an ETF and be covered by up to $500,000 in SIPC insurance. It's the belief that holding a spot Bitcoin ETF would be safer than holding Bitcoin in a crypto wallet that could be hacked. Get AI-powered insights on MarketBeat.

Bitcoin can only be purchased on crypto exchanges.

Like purchasing stocks through a brokerage that fills the orders on a stock exchange, bitcoin also has to be acquired through a crypto exchange. As the largest crypto exchange, Coinbase would continue to benefit from the popularity and legitimizing of Bitcoin and cryptos. An SEC approval would provide further regulatory clarity on bitcoin, which could lead to more stabilization, which can incentivize more institutional participation.

The SEC has previously denied approvals on the basis of the potential for manipulation, which would harm investors. The SEC is anticipated to make batch approvals if they approve bitcoin ETFs. Speculation abounds whether the SEC will again deny or approve bitcoin ETFs this time around.

SEC lawsuit

The SEC filed a lawsuit against Coinbase in October 2023 around unregistered securities offerings through staking services and listing crypto assets for trading without proper registration. Coinbase is contesting the lawsuit, claiming that its staking program is not an investment contract and crypto assets are not securities that fall under securities law. The lawsuit is ongoing and could set legal and regulatory precedents for cryptos. Naysayers of bitcoin ETFs argue that the SEC lawsuit.

Improving fundamentals

On Nov. 2, 2023, Coinbase released its Q3 2023 EPS for a loss of 1 cent, a 54-cent beat, versus the consensus analyst estimates for a loss of 55 cents. Revenues rose 14.2% YoY to $674.2 million, beating analyst expectations of $650.94 million. The company expects Q4 2023 subscription and service revenues to be flat compared to Q3 2023. It expects a positive EBITDA for the full year 2023.

Bitcoin halving in April 2024

Every four years, bitcoin is pre-programmed to halve. This means the block reward for Bitcoin miners to validate transactions is cut by 50%. This tends to slow down the rate of new bitcoin entering the market. This further limits new supply, historically causing prices to rise. As a precedent, the last bitcoin halving launched bitcoin from $8,000 to over $60,000. Bitcoin started its halving on Nov. 12, 2012, cutting the reward from 50 bitcoin to 25. On Jul. 9, 2016, bitcoin halved from 25 to 12.5. On May 11, 2020, bitcoin halved from 12.5 to 6.25. The April 2024 halving will cut the reward from 6.25 to 3.125.

Coinbase analyst ratings and price targets are at MarketBeat. Coinbase peers and competitor stocks can be found with the MarketBeat stock screener.

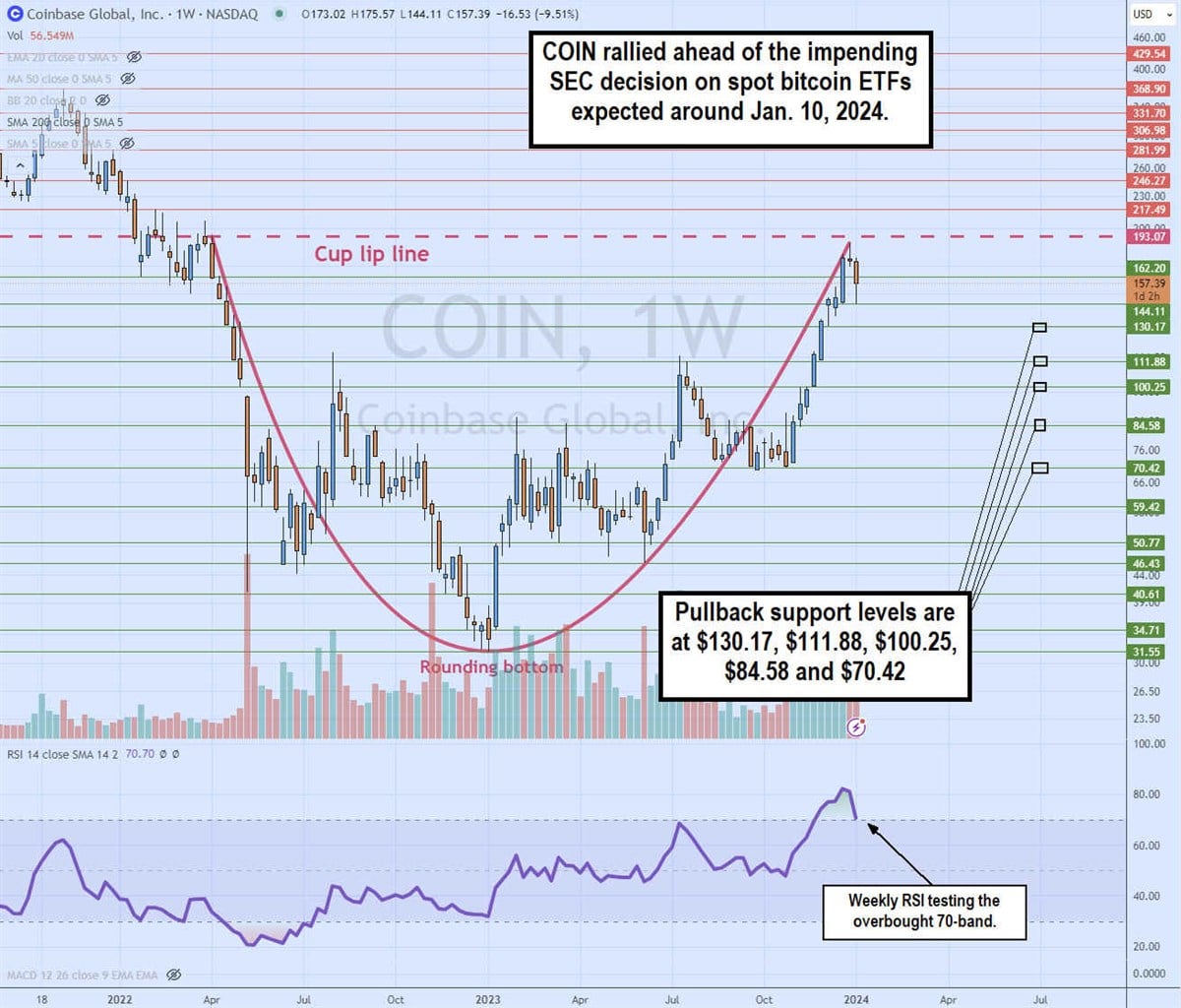

Weekly cup pattern

The weekly candlestick chart on COIN illustrates a cup pattern. The cup lip line formed at $193.07 in April 2022. COIN plunged to a low of $31.55 by January 2023 before staging a rally and forming a rounding bottom. COIN peaked at $114.43 in July 2023 and made a double bottom around $70 on the following pullback afterward.

COIN staged a nine-week rally in 2024 from $72.05 to peak just below the cup lip line at $187.39 during the last week of December 2024 as the Jan. 10, 2024, SEC decision awaits. The weekly relative strength index (RSI) peaked and is testing the overbought 70-band. Pullback support levels are at $130.17, $111.88, $100.25, $84.58 and $70.42.