As the inflation rate in the most significant economic power in the world pushes on, the United States FED has been backed against a wall and forced to raise its interest rate benchmark to combat the heating price indicator. This reaction and the current environment have started to place some caution in the minds of the American consumer, as the widely followed consumer confidence index has remained at compressed levels not seen since the aftermath of the great recession all the way back in 2008.

While there may not be outstanding bearish signs across the economy, and most retail stocks continue to report expanding top and bottom lines, ultimately, consumer psychology catches up to wallets and kicks in the effects that this confidence indicator surely - and historically - brings upon the consumer sector. For those investors who prefer to ride the easy waves of the consumer-dependent stocks and find themselves on the fence trying to figure out a directional wind for U.S. equities so that investors can build proper portfolios around a consumer recovery, there is a cat just south of the continent that is proving easier to skin.

Brazilian Economic Comeback

Markets in general, and investors (both international and local), are still somewhat scrambling to find footing in Brazilian equities following the recent presidential election from which Lula gained his second term in office and what this may mean for the economy and investing landscape moving forward. There can be signs of recent settling by market participants when looking at the iShares MSCI Brazil ETF (NYSE: EWZ) and the significant compression in volatility from the first half of 2022 (a period when a lot of presidential speculation was present) compared to the second half of the year, and for that matter, 2023 thus far.

Typically lower levels of volatility translate to higher confidence levels across participants in the given instrument; thus, lowering volatility in this ETF can imply reduced uncertainty across investors and traders looking to gain or reduce exposure in the Latin American nation. This new calm can be attributed to a bottoming Brazilian capacity utilization index, showcasing a higher reading in January 2023 for the first time since its initiated decline in March 2021. A capacity utilization slowdown can be the product of slowing demand and - or - increasing inventories across all industries (in Brazil's case, the drying demand for products caused this decline).

The recent rise in the capacity utilization rate can signal a waking consumer sector. As inflation in the country heads to a three-year low, there can be an increased incentive for businesses and even the government itself to stimulate spending from everyday consumers. If only there were readily available liquidity and financing sources for the middle-class Brazilian consumer to partake in the country's expected 1.2% GDP growth.

Fintech Catered for Expansion

In Brazil, the largest age group in the population (both male and female) is in the 20-24 years old range. While the country sports a historically low (though recently rising) 8.6% unemployment rate, this age group carries an unemployment rate more in tune with 30%.

Nu Holdings (NYSE: NU) is catering directly to this demographic, understanding the need to financially educate the younger generation while allowing them access to spending and investing power. As a result, the company's business model has attracted 61 million active users as of the fourth quarter of 2022, a growing base that requires less than 4% of generated revenues to be allocated toward marketing campaigns, as most of the growth is coming from word of mouth and unpaid referrals (people seemingly love the service that much).

User growth has delivered a massive increase in sales over the past four years. Figures for 2020, 2021, and 2022 surprised investors with 20.4%, 130.4%, and 73.2% revenue growth, respectively. These figures would be alright for any young technology company going through its so-called "growth stage." However, the fact that NU is a financial services company, in essence, makes these growth rates all the more impressive.

The company carries 67% of its assets in a portfolio of credit cards outstanding and the remaining 33% in personal loans, all of which are aggressively retracting from recent pandemic-induced delinquency rate rises, leaving NU with an open field ahead to drive additional interest income from a recovering portfolio.

Institutional Approval, Upside Potential

Warren Buffett is a known value investor who strictly sticks to boring, easy-to-understand businesses. Still, in the case of NU, it seems that the oracle of Omaha himself sees the massive tailwinds that the Brazilian consumer - along with a further expanding middle-class - can deliver to the future growth expectations in the business. Buffett's Berkshire Hathaway (NYSE: BRK.B) reportedly owns 107.1 million shares of the company, which would translate to a nearly 3% ownership of the business. He must expect quite an upside for being content with such a small position.

From the looks of it, revenues are poised to grow from active user growth and by a normalizing loan-to-deposit ratio in the company. NU currently carries a 25% LDR ratio, whereas a figure closer to 70% would be considered typical in the industry. An implied rise in this ratio could translate to more outstanding loans, whether personal loans or lines of credit; what matters to investors is the subsequent wave of interest income that can inevitably come from such an event.

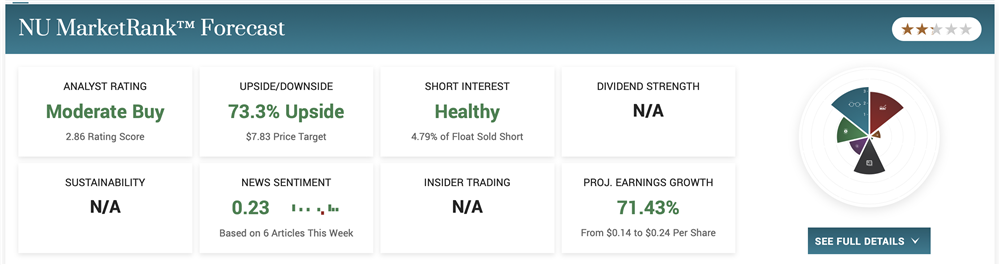

Analysts do seem to agree with Mr. Buffett and Mr. Lula in there being outsized potential for upside in both Brazil and NU, as showcased by the 73% consensus upside target placed by analysts currently.