The old saying, “I’m from the government, I’m here to help,” is always intended as a punchline, but a Medicare rule changes sure did help shares of Shockwave Medical Inc. (NASDAQ: SWAV).

Shares got a 10.64% jolt on April 11, as the Centers for Medicare and Medicaid Services proposed changes to reimbursements for a coronary procedure that’s conducted using Shockwave gear. Trading volume was 156% heavier than normal, as investors cheered the growth potential as a result of the rule change.

The news broke via a Bank of America research note as analysts there boosted Shockwave’s price target to $275 from $235. You can see that increase on MarketBeat’s analyst data page for the stock. Needham & Co. also boosted its price target for Shockwave to $283 from $240.

Shockwave had other news that could drive revenue. On April 11, it announced that it completed its acquisition of Neovasc, which develops technology to treat severely calcified cardiovascular disease that traditional therapies can’t control.

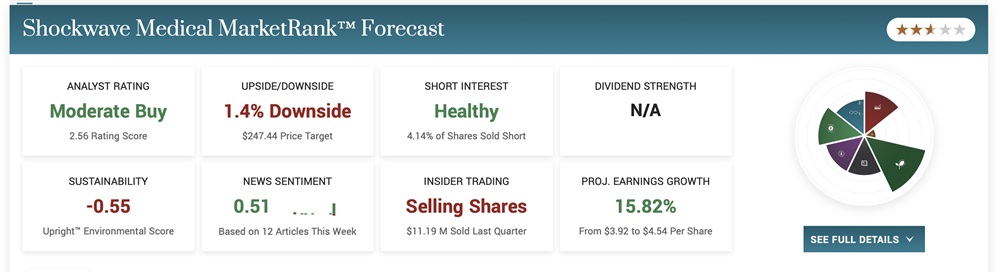

Analysts have a “moderate-buy” rating on Shockwave. The stock’s chart shows a base that began in November. The stock appears to be etching the right side of that pattern now, having advanced 37.67% in the past month and 25.80% in the past three months.

Other medical device and product makers are among stocks that are either forming bullish consolidations or simply continuing to post strong price gains. That’s often a harbinger of more gains ahead, even if the stock pulls into consolidation before a fresh rally.

GE HealthCare

A good example of a stock that’s been on a tear is GE HealthCare Technologies Inc. (NASDAQ: GEHC). As you can guess from its name, the company is a spinoff of General Electric Co.’s (NYSE: GE) healthcare unit. The company, which specializes in medical technologies, digital infrastructure, and services to support healthcare providers in diagnosing and treating patients, began trading in December.

GE spun off the unit to unlock shareholder value that had been pent up while the healthcare unit was part of the larger conglomerate. So far, that strategy has worked, as GE HealthCare shares are up 38.04% year-to-date.

Is it possible the stock is overvalued at this point? Sure. It’s got a price-to-book ratio of 2.20, which could indicate it’s trading at a premium relative to its book value.

On the other hand, its price-to-earnings ratio is 17, which is not ridiculously high by growth stock standards.

Analysts expect net income to drop by 20% this year, to $3.70 per share, with growth returning in 2024 as earnings rise to $4.25 a share.

GE HealthCare’s chart shows a pullback from an April 3 high of $82.62. The stock is holding well above its 50-day average and has been trending along its 10-day line. It’s currently in buy range, below that April 3 high. However, after such a strong rally, it wouldn’t be surprising to see the stock form a true base of about 10% or more below its prior high.

3 More Top Medical Performers

Other medical device and product makers boasting strong chart action include Intuitive Surgical Inc. (NASDAQ: ISRG), Align Technology (NASDAQ: ALGN), and Zimmer Biomet Holdings Inc. (NYSE: ZBH).

Intuitive Surgical has been forming a cup pattern since mid-December, with a buy point north of $285.09. The company, which pioneered robotic surgeries more than two decades ago, reports its first quarter on April 18. With the earnings report being so close, it’s generally best to avoid a buy, as anything construed as disappointing, even a comment in the conference call, could send the stock lower. Even if the stock jumps higher on surprise good news, that can be a buy signal, as it typically indicates more gains will follow in the coming days, weeks or months.

Align Technology, maker of the Invisalign system for tooth straightening, has been forming a consolidation since early February. Watch for the stock to clear a buy point above $368.87. Analysts have a “moderate buy” rating on the stock, with a price target of $358.78, a 5.53% upside. The company’s first-quarter report on April 26, may be a catalyst for a price move in either direction.

Zimmer Biomet cleared a $132.28 buy point on April 12, zooming 1.63% in heavy turnover. The stock got an upgrade from Evercore ISI analyst Vijay Kumar, who boosted the stock to outperform from in-line. He also raised the price target to $148 from $135. The consensus rating for the stock is “hold.”