Adam Coffey, an established expert on private equity in the United States, is interviewed on a podcast about considering private equity as a participant in the sale of a business. Adam discusses mistakes that are made and how to avoid them.

Financial professionals understand the importance of setting clients up for success in their finances. However, even the savviest business owners can make mistakes when it comes to managing their money after selling their business.

To ensure that clients avoid these common pitfalls, here are some key actions they should take after the sale of their business:

- Create a Financial Plan

After receiving a large sum of money from selling their business, owners may feel overwhelmed and unsure of what to do with it. This is where financial expertise comes in – encourage clients to create a financial plan that aligns with their goals and priorities. This will help them make smart decisions with their newfound wealth and avoid impulsive or unnecessary spending.

- Diversify Their Investments

Many business owners put all their eggs in one basket – their business. However, after selling it, they need to diversify their investments to reduce risk and ensure long-term financial stability. As their financial advisor, recommend a mix of stocks, bonds, real estate, and other assets that align with their risk tolerance and financial goals.

- Pay off Debts

One mistake some owners make after selling their business is not paying off debts, such as loans or credit card balances. This can be a costly error, as high-interest debt can quickly eat into their newfound wealth. Encourage clients to prioritize paying off any outstanding debts to set themselves up for a stronger financial future.

- Consider Tax Implications

The sale of a business can have significant tax implications, and it’s important that clients are aware of these when making financial decisions. For example, they may be subject to capital gains taxes or have opportunities for tax deductions. As their advisor, guide them through the tax implications and help them make informed decisions.

- Save for Retirement

After selling their business, some owners may feel confident about their financial future and neglect saving for retirement. However, they must continue to save for retirement to maintain their standard of living and ensure financial security in the long run. Encourage clients to consider tax-advantaged retirement accounts and other investment options.

By following these recommendations, clients can avoid common financial mistakes after selling their businesses and make the most of their newfound wealth. As financial professionals, it’s their job to guide them through this transition and help them achieve their financial goals. So be confident, authoritative, and persuasive in educating them on these important actions to take for a successful future.

Michael Ross said: “This is important because there are hundreds of business exits in the United States every week, and too many business sellers ignore their finances trying to get the transaction done.”

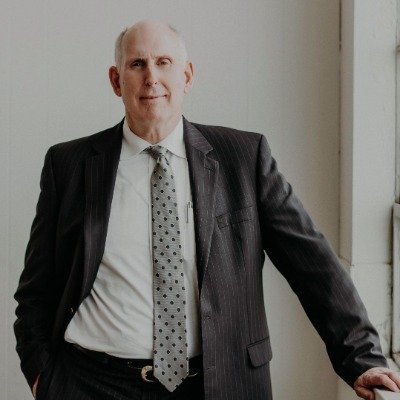

About Michael Ross

Michael Ross, is 30+ year veteran as a financial advisor. After 30 years with Morgan Stanley, he is now an independent financial advisor who excels in helping business owners exit their businesses and move to the next phase of their lives.

Advisory services are offered through Integrated Advisors Network LLC, a registered investment advisor.

Learn more: www.mylatticewealth.com

Media Contact

Company Name: Marketing Huddle, LLC

Contact Person: Mike Saunders, MBA

Email: Send Email

Phone: 7202323112

Country: United States

Website: https://www.AuthorityPositioningCoach.com