Pre-tax NPV of C$314M with 28.3% IRR at US$916/t Cg; after-tax NPV of 186M with 21.5% IRR

Lomiko Metals Inc. (Lomiko) ((TSX-V: LMR, OTC: LMRMF, FSE: DH8C)) ("Lomiko Metals Inc or “Lomiko" or the "Corporation") is pleased to announce positive results from the Preliminary Economic Assessment (“PEA”) on its 100 percent-owned La Loutre Project in south-eastern Quebec. The PEA was completed by Ausenco Engineering Canada Inc. (“Ausenco”) in accordance with National Instrument 43-101 (“NI 43-101”). Lomiko now aims to initiate a Preliminary Feasibility Study (PFS) to advance its La Loutre Project towards production as part of a staged development strategy while continuing its aggressive drilling programs to maximize value creation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210729006155/en/

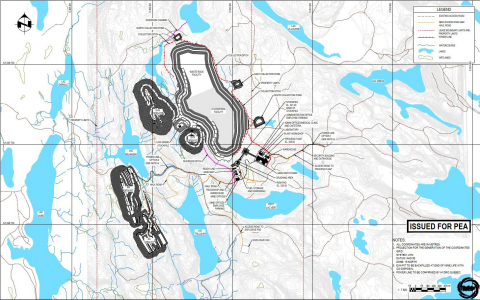

Figure 1: Site Plan (Photo: Business Wire)

Highlights of the PEA (all figures are stated in Canadian dollars unless otherwise stated):

- Long-term Weighted-Average1 Graphite Price US$916/t Cg conc. (graphitic carbon concentrate)

- Exchange rate: C$1.00 = US$0.75

- Pre-tax NPV (8%) of C$313.6M

- After-tax NPV (8%) of C$185.6M

- Pre-tax IRR of 28.3%

- After-tax IRR of 21.5%

- Pre-tax payback period of 3.3 years

- After-tax payback period 4.2 years

- Initial capital of (“CAPEX”) of C$236.1M including mine pre-production, processing, infrastructure (roads, power line construction, co-disposal tailings facility, ancillary buildings, and water management)

- Life of mine processing period (“LOM”) of 14.7 years

- Average LOM strip ratio (Waste:Mineralization) of 4.04:1

- LOM plant production of 21,874 Kilotons (kt=1,000 metric tonnes) of mill feed yielding 1,436 kt of graphite concentrate grading 95.0% Cg.

- Average annual graphite concentrate production of 108 kt for the first eight years; LOM average annual production of 97.4 kt.

- Average graphite mill head grade of 7.44% Cg for the first eight years; LOM average graphite mill head grade of 6.67% Cg.

- Average LOM recovery of 93.5% Cg.

- Measured + Indicated resource at the base case cut-off grade of 1.5% Cg of 23,165 kt at a 4.51% Cg grade for 1.04 Mt of graphite.

- Inferred resource at the base case cut-off grade of 1.5% Cg of 46,821 kt at a 4.01% Cg grade for 1.9Mt of graphite.

- Cash Cost of US$386 per tonne of graphite concentrate

- All-in Sustaining Cost (“AISC”) of US$406 per tonne of graphite concentrate

The Lomiko team is pleased to present the results of a PEA on its La Loutre Project, clearly demonstrating its potential for the Corporation to become a major North American graphite producer, with a positive after-tax Internal Rate of Return (“IRR”) of 21.5% and after-tax Net Present Value (“NPV”) of C$186M. The PEA supports an open pit project with production spanning 14.7 years with robust economics at a US$916/tonne Cg sale price, with very attractive cash costs and AISC, low CAPEX and low capital intensity. The first eight years will target production averaging 108 kt/a payable graphite concentrate peaking at 112 kt/a in year 4.

“La Loutre has shown it has the potential to become a highly profitable graphite mine in one of the most prolific producing regions in Canada. The La Loutre PEA was produced by the Ausenco team, one of the most experienced and reputable engineering firms working on mining projects in Canada. With further drill programs, we will continue to add to and upgrade resources as we seek to move the project forward towards production,” said A Paul Gill, President, CEO and director, Lomiko.

The La Loutre Project PEA indicates the property has the geological potential to extend the mine life beyond the initial 14.7 years presented in the PEA as well as the opportunity to expand the scale of production by increasing the mineral resource through ongoing exploration and drilling. The Company’s goal is for La Loutre to be a cornerstone mine for its future growth in a mining friendly jurisdiction. With a strong treasury to support their next steps, the Company plans to commence a Preliminary Feasibility Study (PFS) and Environmental Impact Studies while continuing to explore the geological potential of its La Loutre property.

“The development of Canada-USA and Canada-EU critical minerals collaboration agreements gives access for graphite products in these markets. There is a focus on projects with environmental, social and governance (ESG) acceptability which Lomiko has also adopted. The strict criteria for the report should result in competitively-priced graphite for customers in the North America and European markets. These recent agreements between Canada and the USA and Canada and Europe have identified graphite as a critical element that will be part of a new supply chain. Lomiko is ready to maximize La Loutre’s value by advancing the studies to further refine and de-risk the project,” added Gill.

Lomiko looks forward to working with its partners in the MRC of Papineau region including the Lac-des-Plages and the Duhamel municipalities, as well as the surrounding First Nations communities. We will also continue to work closely with the Quebec and Federal governments to advance the La Loutre Project.

Overview

Ausenco was appointed as lead PEA consultant on February 22, 2021, in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). Ausenco is the lead consultant responsible for the overall development of the PEA, including the processing, major infrastructure, hydrogeology, hydrology, environmental, co-disposal of mine waste rock and mill tailings, mining and economic assessment. Ausenco’s specialist ESG group Hemmera Envirochem Inc., provided environmental support and Moose Mountain Technical Services was responsible for the resource estimate and mine design. Metpro Management Inc. (Metpro) was responsible for metallurgy.

The La Loutre Project is located in the Nominingue-Chénéville Deformation Zone in Quebec. The Property consists of one large contiguous block of 42 mineral claims totaling 2,508.97 hectares (25.09 km2) and is located approximately 117 km northwest of Montréal in southern Québec, 230 km southwest of the Nouveau Monde Matawinie Project and 100 km southeast of the Imerys Graphite & Carbon Lac-des-îles mine.

Financial Analysis

The economic analysis was performed assuming an 8% discount rate. This analysis shows a projected pre-tax NPV 8% of $313.6M, internal rate of return IRR is 28.3% and payback period of 3.3 years. On an after-tax basis, an NPV 8% of $186M, IRR of 21.5% and payback period of 4.2 years is expected. A summary of the project economics is listed in (Table 1).

The size distribution as noted in Table 1 was derived from the lock cycle testing (LCT) on the Master composite by SGS Canada Inc. Benchmark Mineral Intelligence (Benchmark) provided pricing information based on Mesh Size only. The prices were derived based on Benchmark forecasted graphite prices and is noted in Table 1.

Table 1: Graphite Price Forecast

Mesh Size |

Average 10-year Price ($US/tonne) |

% Distribution |

Weighted Average Price ($US/t) |

+50 |

1,211 |

10.8 |

130.79 |

+80 |

987 |

21.6 |

213.19 |

+100 |

893 |

10.8 |

96.44 |

-100 |

837 |

56.8 |

475.42 |

Average: |

|

100 |

915.84 |

Description of Economic Valuation

Table 2: Summary of Project Economics

General |

LOM Total / Avg. |

Graphite Price (US$/tonne) |

$915.84 |

Exchange Rate ($US:$C) |

0.75 |

Mine Life (years) |

14.7 |

Total Waste Tonnes Mined (kt) (including pre-stripping) |

88,396 |

Total Mill Feed Tonnes (kt) |

21,874 |

LOM Operating Strip Ratio (W:O) |

4.04 |

Production |

LOM Total / Avg. |

Mill Head Grade (% Cg) |

6.67 |

Mill Recovery Rate (%) |

93.5% |

Concentrate Grade (% Cg) |

95.0% |

Total Graphite Concentrate Recovered (kt) |

1,436 |

Total LOM Average Annual Concentrate Production (kt) |

97.4 |

Operating Costs |

LOM Total / Avg. |

Mining Cost (C$ /t Milled) |

$16.20 |

Processing Cost (CAD$/t Milled) |

$11.85 |

G&A Cost (C$/t Milled) |

$2.37 |

Total Operating Costs (C$/t Milled) |

$30.43 |

Transport Cost (C$/t Cg conc.) |

$37.42 |

Royalty NSR * |

1.0 % |

Cash Costs (US$/t Cg conc.) ** |

$386 |

AISC (US$/t Cg conc.) *** |

$406 |

Capital Costs |

LOM Total / Avg. |

Initial Capital (C$M) |

$236.1 |

Sustaining Capital (C$M) |

$37.7 |

Closure Costs (C$M) |

$5.6 |

Salvage Costs (C$M) |

$4.0 |

Financials - Pre Tax |

LOM Total / Avg. |

NPV (8%) (C$M) |

$313.6 |

IRR (%) |

28.3% |

Payback (years) |

3.3 |

Financials - Post Tax |

LOM Total / Avg. |

NPV (8%) (C$M) |

$185.6 |

IRR (%) |

21.5% |

Payback (years) |

4.2 |

* La Loutre property is subject to a 1.5% NSR of which the company is buying back at 0.5% NSR for $0.5M.

** Cash costs consist of mining costs, processing costs, mine-level G&A, transportation costs and royalties.

*** AISC includes cash costs plus sustaining capital, closure cost and salvage value.

Sensitivity

A sensitivity analysis was conducted on the base case pre-tax and after-tax NPV and IRR of the project, using the following variables: metal price, total capex (initial + sustaining), total operating costs and exchange rate. The tables below provide a summary of the sensitivity analysis.

Table 3: Post-Tax NPV (8%) Sensitivity

Graphite

|

Post-Tax

|

Initial CAPEX |

OPEX |

FX

|

|||

|

Base

|

(-20%) |

(+20%) |

(-20%) |

(+20%) |

(-20%) |

(+20%) |

$750 |

$76 |

$115 |

$37 |

$123 |

$28 |

($32) |

$176 |

$850 |

$143 |

$180 |

$104 |

$188 |

$96 |

$28 |

$251 |

$916 |

$186 |

$222 |

$148 |

$230 |

$140 |

$65 |

$301 |

$1,150 |

$332 |

$364 |

$297 |

$371 |

$289 |

$188 |

$461 |

$1,300 |

$419 |

$445 |

$388 |

$449 |

$382 |

$264 |

$547 |

Table 4: Post-Tax IRR Sensitivity

Graphite

|

IRR |

Initial CAPEX |

OPEX |

FX

|

|||

|

Base

|

(-20%) |

(+20%) |

(-20%) |

(+20%) |

(-20%) |

(+20%) |

$750 |

13.8% |

18.6% |

10.4% |

17.1% |

10.2% |

5.4% |

20.8% |

$850 |

18.6% |

24.1% |

14.6% |

21.6% |

15.3% |

10.2% |

25.8% |

$916 |

21.5% |

27.5% |

17.2% |

24.4% |

18.4% |

13.0% |

29.0% |

$1,150 |

31.0% |

38.8% |

25.6% |

33.5% |

28.3% |

21.6% |

39.5% |

$1,300 |

36.7% |

45.4% |

30.5% |

38.8% |

34.2% |

26.6% |

45.2% |

Mineral Resource

The mineral resource is estimated from a drill hole database containing 117 drill holes consisting of 15,160 metres of drilling and 8,850 assay intervals.

The total Mineral Resource Estimate (MRE) is summarized in Table 5, with the base case cut-off of 1.5% Graphite highlighted. A Lerchs-Grossman resource pit has been constructed using the 150% pit case based on the prices, offsite costs, metallurgical recovery and graphite prices used for the economic analysis thus confining the resource to a “reasonable prospects of eventual economic extraction” pit shape. The cut-off grade is based on a processing cost of CDN$11.85/tonne, and General and Administrative Costs of CDN$2.37/tonne and a C$1.00 = US$0.75 as summarized in the notes below. A cut-off grade of 1.5% Cg has been used for the base case of the resource estimate, which more than covers the Process and G&A costs.

These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 5: Mineral Resource Estimate (effective date May 14, 2021)

Class |

Cut-off

|

EV Deposit |

Battery Deposit |

Total |

||||

ROM |

In Situ

|

ROM |

In Situ

|

ROM |

In Situ

|

Graphite

|

||

Tonnage

|

Graphite

|

Tonnage

|

Graphite

|

Tonnage

|

Graphite

|

|||

Indicated |

1 |

8,321 |

6.38 |

15,889 |

3.32 |

24,210 |

4.37 |

1,057.9 |

1.5 |

8,158 |

6.48 |

15,007 |

3.44 |

23,165 |

4.51 |

1,044.3 |

|

2 |

7,792 |

6.70 |

12,622 |

3.75 |

20,414 |

4.88 |

995.5 |

|

3 |

6,768 |

7.33 |

4,529 |

6.16 |

11,297 |

6.86 |

774.6 |

|

5 |

4,443 |

9.17 |

2,394 |

8.27 |

6,837 |

8.85 |

605.4 |

|

Inferred |

1 |

13,114 |

5.71 |

38,273 |

3.10 |

51,387 |

3.77 |

1,936.4 |

1.5 |

12,829 |

5.81 |

33,992 |

3.33 |

46,821 |

4.01 |

1,877.9 |

|

2 |

12,273 |

5.99 |

27,775 |

3.69 |

40,048 |

4.39 |

1,759.5 |

|

3 |

9,645 |

6.92 |

10,311 |

5.92 |

19,956 |

6.40 |

1,277.6 |

|

5 |

5,833 |

8.99 |

5,687 |

7.58 |

11,520 |

8.29 |

955.2 |

|

Notes to Table 5:

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines.

- Mineral Resources are reported inclusive of Mineral Reserves.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resource has been confined by a “reasonable prospects of eventual economic extraction” pit using the following assumptions: Exchange Rate C$1.00 = US$0.75; Weighted average price of graphite of US$ 916/tonne; 100% payable; Offsite costs including transportation and insurance of CDN$37.42/tonne; a 1.5% NSR royalty; Metallurgical recoveries of 95%.

- Pit slope angles are 45º below overburden, 20o in overburden.

- The specific gravity of the deposit is 2.86 in unmineralized and low-grade zones and 2.78 in high-grade zones (within solids above a 4% Graphite grade).

- Numbers may not add due to rounding.

The following factors, among others, could affect the Mineral Resource estimate: commodity price and exchange rate assumptions; pit slope angles; assumptions used in generating the Lerchs–Grossmann (LG) pit shell, including metal recoveries, and mining and process cost assumptions. The QP is not aware of any environmental, permitting, legal, title, taxation, socioeconomic, marketing, political, or other relevant factors that could materially affect the Mineral Resource Estimate.

Mining

The mine plan includes 21.9 Mt of mill feed and 88.4 Mt of waste over the 14.7-year project life. Mine planning is based on conventional open pit methods suited for the project location and local site requirements. Owner-operated and managed open pit operations are anticipated to begin prior to mill start up, running for 14.7 years to pit exhaustion, with feed from the low-grade stockpile supplementing plant feed over the last two years.

The subset of Mineral Resources contained within the designed open pits, summarized in Table 6 with a 2.5% Cg cut-off, forms the basis of the mine plan and production schedule.

Table 6: PEA Mine Plan Production Summary

Mine Plan Production Description |

Mine Plan Production Summary Values |

PEA Mill Feed |

21,874 kt |

Average Graphite Mill Head Grade |

6.67% Cg |

Waste Overburden and Rock |

88,396 kt |

LOM Strip Ratio (W:O) |

4.04 |

Mill Feed Graphite Grade (Years 1-8) |

7.44 % Cg |

Strip Ratio (Year 1-8) |

4.4 |

Notes:

- The PEA Mine Plan and Mill Feed estimates are a subset of the May 14, 2021, Mineral Resource estimates and are based on open pit mine engineering and technical information developed at a Scoping level for the La Loutre deposits.

- The Mineral Resources provided in this table were estimated using current Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Reserves, Definitions and Guidelines

- Mineral resources that are not mineral reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert Inferred and Indicated Mineral Resources to Measured Mineral Resources. There is no certainty that any part of a mineral resource will ever be converted into reserves

- Waste:mineralization contact edge dilution of 0.5m at contact block grades is applied to the in situ Mineral Resources. Partial blocks are diluted to whole blocks grades prior to applying cut-off grade. Mining Recovery of 100% of diluted tonnages is assumed.

- Mineral Resources are stated at a cut-off grade of 2.5 % C(g). Estimates have been rounded and may result in summation differences.

The economic pit limits are determined using Minesight™ Pseudoflow algorithm. La Loutre deposit comprises the Battery (B) zone and the Electric Vehicle (EV) zone. The B zone is planned as two pits, and the EV zone is split into two pits EV North (EVN) and EV South (EVS) with the EVN pit split into two phases. Pit designs are based on 45 degree overall configured on 6 metre bench heights, with 7.8-metre-wide berms placed every two benches with 70 degree face angles. The pit delineated resource for mine scheduling are listed in Table 7 below:

Table 7: PEA Mine Plan Pit Sequencing

Pit |

ROM Tonnage (kt) |

Insitu Grade (%) |

Diluted Grade (%) |

Waste (Mt) |

EVN1 |

6,267 |

7.90 |

7.65 |

20.5 |

EVN2 |

4,596 |

7.41 |

7.22 |

20.3 |

EVS |

3,058 |

5.81 |

5.77 |

5.6 |

GRN |

3,598 |

6.93 |

6.36 |

27.3 |

GRS |

4,355 |

5.74 |

5.56 |

15.4 |

Total |

21,874 |

6.90 |

6.67 |

89.1 |

Mine development is within the EVN pit for the first four years with development of the BN and BS zones beginning in Year 5. The EVN pit is mined out in Year 8 with backfill from the EVS, BN and BS pits beginning in Year 9 and final reclamation of the waste and co-disposal site.

The mill will be fed with material from the pits at an average rate of 1.5 Mtpa (4.1ktpd). Cut-off grade optimization is employed during the first 8 years, in a low-grade stockpile adjacent to the EVS pit entrances and is planned for reclamation to the mill in the last two years of the mine life. Overburden will be placed in a stockpile directly north of the EVS pit. A single waste rock and co-disposal site is located adjacent to the EV pits and will be reclaimed during the LOM. The majority of the Battery pit waste will be backfilled into the EVN pit as a co-disposal site.

Mining operations will be based on 365 operating days per year with two 12-hour shifts per day.

The mining fleet is based on diesel-powered drills with 140mm bit size for production drilling and grade control drilling, 4.5 m3 bucket size diesel hydraulic excavators and 7 m3 bucket sized wheel loaders for production loading, and 60 t payload rigid-frame haul trucks production hauling, plus ancillary and service equipment to support the mining operations. In-pit dewatering systems will be established for each pit. All surface water and precipitation in the pits will be handled by submersible pumps.

Maintenance on mine equipment will be performed in the field with major repairs to mobile equipment in the shops located near the plant facilities.

Milling and Processing

The La Loutre Process Plant employs standard flotation technology to produce a graphite concentrate. The plant includes crushing, grinding, classification, flotation, tailings thickening and filtration, graphite concentrate filtration, drying and screening and separation into the product sizes. Graphite concentrate is loaded into 1 tonne bags for shipment and sale.

The plant is expected to treat 1.5 Mt of feed per year at an average throughput of 4,100 t/d. The mill design availability is 8,147 hours per year or 93%, with an operating throughput of 184 t/h.

The plant has been designed to realize an average recovery of 93.5% of the graphite at a concentrate grade of 95% Cg over the life of the project based on metallurgical test work completed by SGS Lakefield in 2021. Graphite product split is estimated to be 32% plus 80 mesh (177 microns) and 68% less than 80 mesh (177 microns).

Mill tailings storage capacity has been identified to safely accommodate the life of mine production as described in this PEA. Mill tailings produced will be comingled or co-disposed with 50% of the mine waste rock in the central and southern portion and the balance of the waste rock will be stored predominantly in the northern section until after Year 9 of the operation in a co-disposal facility constructed northwest of the process plant.

The Co-Disposal Storage Facility perimeter containment berms will be constructed with waste rock from open pit mine development and will utilize downstream construction method to ensure safe tailings storage over the long-term. Run-off water and seepage from the Co-Disposal Storage Facility will be collected in an adjacent Water Management Ponds. Tailings production after Year 9 will be placed in the mined out EVN pit.

Capital and Operating Costs

The total pre-production capital cost for the La Loutre Project is estimated to be $236.1M including allowances for indirect costs and contingency of $41.4M and $36.1M respectively. Sustaining capital costs are estimated at $37.7M as shown in Table 8. Operating costs are estimated at $30.43 per tonne milled as per Table 9.

Table 8: Total Capital Costs

Cost Area Description |

Initial Capital

|

Sustaining Capital

|

Cost Area Description

|

Mining |

$29.4 |

$24.1 |

$53.5 |

Processing |

$79.1 |

- |

$79.1 |

Infrastructure (and Co-Disposal) |

$28.9 |

$13.7 |

$42.5 |

Off-site Infrastructure |

$6.8 |

|

$6.80 |

Indirect Costs |

$41.4 |

- |

$41.4 |

Owner's Project Costs |

$14.4 |

- |

$14.4 |

Contingency |

$36.1 |

- |

$36.1 |

Closure Cost |

- |

- |

$5.60 |

Total |

$236.1 |

$37.7 |

$279.5 |

Table 9: Total Operating Costs

Cost Area |

LOM

|

Annual Avg.

|

Avg. LOM

|

Avg. LOM

|

OPEX (%) |

Total Mine Operating Costs

|

$354.5 |

$24.0 |

$16.20 |

$185.61 |

53% |

Total Mill Processing Including

|

$259.2 |

$17.6 |

$11.85 |

$135.74 |

39% |

Total G&A Costs |

$51.8 |

$3.5 |

$2.37 |

$27.15 |

8 % |

Total |

$665.5 |

$45.1 |

$30.43 |

$348.50 |

100% |

Graphite Production

Projected graphite concentrate production averages 97.4 kt/a per year over the 14.7 year LOM, peaking at 112kt in year 4.

Next Steps

The results of the PEA indicate that the proposed Project has technical and financial merit using the base case assumptions. It has also identified additional field work, metallurgical test work, trade-off studies and analysis required to support more advanced mining studies. The QPs consider the PEA results sufficiently reliable and recommend that the La Loutre Project be advanced to the next stage of development through the initiation of a PFS and working towards completion of an Environmental Impact Study for the Project while continuing to explore the geological potential of the La Loutre property.

PEA Details

The independent PEA was prepared by Ausenco and MMTS. These firms provided mineral resource estimates, design parameter and cost estimates for mine operations, process facilities, major equipment selection, waste and tailings storage, reclamation, permitting, and operating and capital expenditures. Table 10 summarizes the contributors and their area of responsibility.

Table 10: Consulting Firm and Area of Responsibility

Consulting Firm |

Area of Responsibility |

Ausenco Engineering

|

|

Hemmera Envirochem Inc.

|

|

Metpro Management Inc. |

|

Moose Mountain Technical

|

|

Qualified Person

All technical information, not pertaining to the PEA, in this news release has been reviewed and approved by Mike Petrina, P.Eng., who is a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

The PEA has been prepared by Ausenco. The contributors to the report are Qualified Persons (“QP”) under National Instrument 43-101 and are independent of Lomiko for the purposes of the NI 43-101. The technical content of the PEA and this press release has been reviewed and approved by:

Tommaso Roberto Raponi, P.Eng (PEO), Process and Infrastructure

Mohammed (Ali) A. Hooshiar Fard, P.Eng (EGBC), Tailings and Water Management

Greg Trout, P.Eng (APEGA), Mining

Sue Bird, P.Eng (EGBC), Resource Estimate

Scott Weston, P.Geo (EGBC), Environment

Oliver Peters, P.Eng (PEO), Metallurgical Testwork

Non-IFRS Financial Measures

The Company has included certain non-IFRS financial measures in this news release, such as Initial Capital Cost, Cash Operating Costs, Total Cash Cost, All-In Sustaining Cost, Expansion Capital and Capital Intensity, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Non-IFRS financial measures used in this news release and common to the graphite mining industry are defined below.

Total Cash Costs and Total Cash Costs per graphite concentrate tonnes

Total Cash Costs are reflective of the cost of production. Total Cash Costs reported in the PEA include mining costs, processing & water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total Cash Costs per graphite concentrate tonnes is calculated as Total Cash Costs divided by graphite concentrate tonnes.

All-in Sustaining Costs (“AISC”) and AISC per graphite concentrate tonnes

AISC is reflective of all of the expenditures that are required to produce a tonne of graphite concentrate from operations. AISC reported in the PEA includes total cash costs, sustaining capital, closure costs and salvage, but excludes corporate general and administrative costs. AISC per tonne of graphite concentrate is calculated as AISC divided by graphite concentrate tonnes.

About Lomiko Metals Inc.

Lomiko Metals holds a 100% interest in its La Loutre graphite development in southern Quebec. Located 117 kilometres northwest of Montreal, the property consists of 1 large, continuous block with 42 minerals claims totalling 2,509 hectares (25.1km2). Lomiko also optioned The Bourier project consisting of 203 claims, for a total ground position of 10,252.20 hectares (102.52 km2) in Canada’s lithium triangle near the James Bay region of Quebec that has lithium deposits and mineralization trends.

For more information on Lomiko Metals, review the website at www.lomiko.com, contact A. Paul Gill at 604-729-5312 or email: info@lomiko.com.

About Ausenco

Ausenco is a global company redefining what’s possible. Ausenco’s team is based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining deep technical expertise with a 30-year track record, Ausenco delivers innovative, value-add consulting studies, project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas and industrial sectors.

Ausenco’s experience in mining projects ranges from conceptual, pre-feasibility and feasibility studies for new project developments to project execution with EPCM and EPC delivery.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be "forward-looking information". Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation's business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID-19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

On Behalf of the Board,

“A. Paul Gill”

Chief Executive Officer

__________________________

1 The long-term weighted-average graphite price is determined by weighting the percentage of production of flake sizes of graphite against the respective flake size prices.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210729006155/en/

Contacts

A. Paul Gill

604-729-5312

info@lomiko.com