Strategic consolidation of large-scale core Haynesville assets;

Creates the largest dual-basin natural gas producer

Southwestern Energy Company (NYSE: SWN) (the “Company” or “Southwestern”) today announced that it has entered into a definitive agreement with the third largest private Haynesville producer – GEP Haynesville, LLC (“GEP”) under which it will acquire GEP for approximately $1.85 billion. The transaction is expected to close by year-end 2021, subject to customary closing conditions. Transaction highlights include:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211104005628/en/

(Graphic: Business Wire)

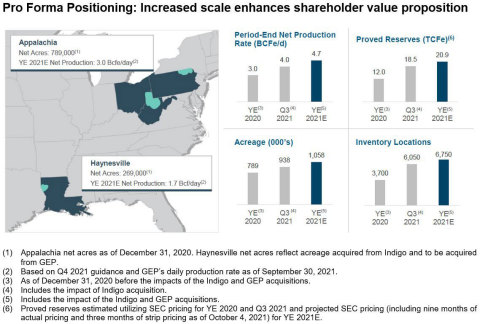

- Builds further scale in the Haynesville with approximately 700 MMcf per day of production; total Company production of approximately 4.7 Bcfe per day pro forma;

- Expands exposure to the LNG corridor and growing demand centers along the Gulf Coast;

- Further deepens economic inventory with 700 locations across stacked-pay Haynesville and Middle Bossier;

- Adds 2.2 Tcfe of estimated year-end 2021 proved reserves at projected SEC pricing1; expected year-end 2021 total proved reserves approximately 20.9 Tcfe;

- Attractive valuation; implied transaction multiple of 2.9x estimated 2022 EBITDA;

-

Expected to be immediately accretive to margins, returns and key per-share metrics;

-

Estimated 2022 free cash flow per share and cash flow per share expected to improve by ~15% each

-

-

Complementary assets expected to provide $25 million of immediate annual synergies;

- Projected pro forma free cash flow approximately $2.3 billion in 2022 – 2023;

- Disciplined financing minimizes equity dilution while preserving financial strength;

- Maintains pathway to achieving sustainable leverage target range of 1.0x to 1.5x by year-end 2022; and

- Execution of strategic hedging plan in current price environment.

“This strategic move positions Southwestern as the largest producer in the Haynesville and enhances our leading presence in the top two premier natural gas basins in the US. The Company’s increased scale from both a reserves and production perspective is expected to deliver higher margins, enhanced economic returns and improved per-share cash flow metrics. The transaction adds significant high-return locations to our development inventory while expanding access to premium Gulf Coast markets,” said Bill Way, Southwestern Energy President and Chief Executive Officer.

Way continued, “This transaction reflects the Company’s strict adherence to our rigorous acquisition framework and will build on our leading execution in the integration and development of large scale assets. The financing and hedging strategy for the deal aligns with our commitment to financial strength and disciplined enterprise risk management. Combined with our other strategic actions, this transaction further expands the sustainable value being generated for our shareholders.”

Transaction and Timing

The total consideration of $1.85 billion will be comprised of $1.325 billion in cash and approximately $525 million in Southwestern common shares.

The stock consideration consists of approximately 99 million shares of Southwestern Energy common stock, calculated utilizing the 30-day volume-weighted average price of $5.285 as of November 2, 2021.

The Company expects to finance the $1.325 billion cash consideration in a manner that affords near-term and efficient debt reduction, extends its maturity runway and lowers its cost of debt.

The acquisition valuation compares favorably to other recent natural gas transactions, with the $1.85 billion purchase price representing 2.9x estimated 2022 EBITDA using a $4 per Mcf NYMEX Henry Hub price, which is below today’s strip prices.

The transaction was unanimously approved by each of Southwestern Energy’s and GEP Haynesville’s boards of directors. It is expected to close by year-end 2021, subject to regulatory approvals and customary closing conditions.

Outlook

Once the transaction is closed, the Company will produce approximately 4.7 Bcfe per day. Within Southwestern’s balanced portfolio, approximately 65% of its daily natural gas production will be marketed to growing demand centers along the Gulf Coast, positioning the Company to efficiently capture natural gas price improvement and expand margins.

As of September 30, 2021, the Company had total debt of $4.2 billion. After the financing of the $1.325 billion cash consideration for this transaction, the Company anticipates its year-end 2021 debt balance to be approximately $5.4 billion with a leverage ratio of approximately 2.0x.

Southwestern expects to continue utilizing free cash flow to reduce debt to maintain a sustainable target leverage range of 1.0x to 1.5x. Consistent with this target leverage range, the Company is targeting total debt of $3 billion to $3.5 billion. The Company believes this target range of leverage and total debt balances cost of capital efficiency with the preservation of the Company’s financial strength through commodity price cycles. As it approaches its total debt target, the Company intends to initiate a program to return capital to shareholders.

The Company will protect its financial strength by executing a comprehensive hedge plan designed to safeguard cash flow for debt reduction, consistent with the Company’s established enterprise risk management policy. GEP has existing 2022 hedge positions for approximately 35% of its expected 2022 production at an average price of $2.89 per Mcf. GEP does not have existing hedge positions beyond 2022, providing an opportunity to protect returns and cash flow well above valuation prices.

The Company will release formal 2022 guidance at the beginning of next year. In 2022, Southwestern Energy expects to continue with maintenance capital investment, averaging approximately 4.7 Bcfe per day of production. At $4 per Mcf NYMEX Henry Hub and $67 per barrel WTI, the Company expects to generate approximately $1 billion of free cash flow.

Upon closing, Southwestern expects to realize at least $25 million in annual synergies, driven by G&A and other operational savings. The Company expects further value enhancing opportunities through operating economies, marketing synergies, contract optimization, and reduced cost of capital given its improved financial and business risk profile.

Advisors

Goldman Sachs & Co. LLC served as the exclusive strategic advisor to Southwestern. JP Morgan, Bank of America, Citigroup, RBC and Wells Fargo served as financing advisors and provided $1.325 billion committed financing in connection with the transaction. Intrepid Partners, LLC also provided a fairness opinion to Southwestern. Credit Suisse Securities (USA) LLC served as the exclusive strategic and financial advisor to GEP. Skadden, Arps, Slate, Meagher & Flom LLP served as legal advisor to Southwestern, and Kirkland & Ellis LLP served as legal advisor to GEP.

Conference Call

Southwestern Energy will host a conference call on Thursday, November 4, 2021 at 10:00 a.m. Central to discuss this transaction and its third quarter 2021 results. To participate, dial US toll-free 877-883-0383, or international 412-902-6506 and enter access code 7695937. A live webcast will be available at ir.swn.com.

About Southwestern Energy

Southwestern Energy Company (NYSE: SWN) is a leading U.S. producer of natural gas and natural gas liquids focused on responsibly developing large-scale energy assets in the nation’s most prolific shale gas basins. SWN’s returns-driven strategy strives to create sustainable value for its stakeholders by leveraging its scale, financial strength and operational execution. For additional information, please visit www.swn.com and www.swn.com/responsibility.

About GEP Haynesville

GEP Haynesville, LLC, a joint venture formed by the principals of GeoSouthern Haynesville, LP and a private equity firm, and based in the Woodlands, Texas, is a leading energy company focused on the development of natural gas properties in the stacked Haynesville and Middle Bossier shale plays in North Louisiana.

Forward-Looking Statements

Certain statements and information herein may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended. The words “believe,” “expect,” “anticipate,” “plan,” "predict," “intend,” "seek," “foresee,” “should,” “would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “likely,” “guidance,” “goal,” “model,” “target,” “budget” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. Statements may be forward looking even in the absence of these particular words. Examples of forward-looking statements include, but are not limited to, statements regarding the proposed acquisition of GEP Haynesville, LLC (the “Proposed Transaction”), expected synergies and other benefits from and costs in connection with the Proposed Transaction, estimated financial metrics giving effect to the Proposed Transaction, including the estimate of additional year-end 2021 reserves and related pricing assumptions, our financial position, business strategy, production, reserve growth and other plans and objectives for our future operations, and generation of free cash flow. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward-looking statements contained in this document are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate. For a more detailed description of the risks and uncertainties involved, see “Risk Factors” in our most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings. We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained herein are not guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to: the timing and extent of changes in market conditions and prices for natural gas, oil and natural gas liquids (“NGLs”), including regional basis differentials and the impact of reduced demand for our production and products in which our production is a component due to governmental and societal actions taken in response to COVID-19 or other public health crises and any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to maintain the functioning of national or global economies and markets; differences between the prices used to estimate additional year-end 2021 reserves, as compared to actual pricing we will use to calculate reserves, which differences could result in a different reserve figure as compared to the estimate; our ability to fund our planned capital investments; a change in our credit rating, an increase in interest rates and any adverse impacts from the discontinuation of the London Interbank Offered Rate; the extent to which lower commodity prices impact our ability to service or refinance our existing debt; the impact of volatility in the financial markets or other global economic factors; difficulties in appropriately allocating capital and resources among our strategic opportunities; the timing and extent of our success in discovering, developing, producing and estimating reserves; our ability to maintain leases that may expire if production is not established or profitably maintained; our ability to realize the expected benefits from recent acquisitions or the Proposed Transaction; costs in connection with the Proposed Transaction; the consummation of or failure to consummate the Proposed Transaction and the timing thereof; integration of operations and results subsequent to the Proposed Transaction; our ability to transport our production to the most favorable markets or at all; the impact of government regulation, including changes in law, the ability to obtain and maintain permits, any increase in severance or similar taxes, and legislation or regulation relating to hydraulic fracturing, climate and over-the-counter derivatives; the impact of the adverse outcome of any material litigation against us or judicial decisions that affect us or our industry generally; the effects of weather; increased competition; the financial impact of accounting regulations and critical accounting policies; the comparative cost of alternative fuels; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors listed in the reports we have filed and may file with the SEC that are incorporated by reference herein. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement.

Use of Non-GAAP Information

This news release contains non-GAAP financial measures, such as net cash flow, free cash flow, net debt and adjusted EBITDA, including certain key statistics and estimates. We report our financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide users of this financial information additional meaningful comparisons between current results and the results of our peers and of prior periods. Please see the Appendix for definitions of the non-GAAP financial measures that are based on reconcilable historical information.

Use of Projections

The financial, operational, industry and market projections, estimates and targets in this news release are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond SWN's and GEP’s control. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial, operational, industry and market projections, estimates and targets, including assumptions, risks and uncertainties described in "Forward-looking Statements" above.

Explanation of Non-GAAP Financial Measures

EBITDA is defined as net income (loss) plus interest, income tax expense (benefit), depreciation, depletion and amortization, expenses associated with the restructuring charges, impairments, legal settlements and gains (losses) on unsettled derivatives less gains (losses) on sale of assets and gains on early extinguishment of debt over the prior 12-month period. Net cash flow is defined as cash flow from operating activities before changes in operating assets and liabilities. Free cash flow is defined as net cash flow less accrual-based capital expenditures and estimate free cash flow for future periods is based on strip pricing as of September 22, 2021. Southwestern has included information concerning Net debt / EBITDA because it is used by certain investors as a measure of the ability of a company to service or incur indebtedness and because it is a financial measure commonly used in the energy industry. Net debt / EBITDA should not be considered in isolation or as a substitute for net income, net cash provided by operating activities or other income or cash flow data prepared in accordance with generally accepted accounting principles or as a measure of the Company's profitability or liquidity. Net debt / EBITDA, as defined above, may not be comparable to similarly titled measures of other companies. These adjusted amounts are not a measure of financial performance under GAAP.

The Company does not provide a reconciliation to estimated Free Cash Flow because the Company does not provide the GAAP financial measures of net income or loss or net cash provided by operating activities on a forward-looking basis because it is unable to predict, without unreasonable effort, certain components thereof including, but not limited to capital expenditures, production and realized prices for production. These items are inherently uncertain and depend on various factors, many of which are beyond the Company’s control. As such, any associated estimate and its impact on GAAP performance and cash flow measures could vary materially based on a variety of acceptable management assumptions.

1 Estimated year-end 2021 proved reserves utilizing nine months of historical prices and three months of strip prices as of October 4, 2021.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211104005628/en/

Contacts

Brittany Raiford

Director, Investor Relations

(832) 796-7906

brittany_raiford@swn.com