Commercial end-users can potentially treat their water without major capital expense

OriginClear Inc. (OTC Pink: OCLN), a leading corporation in the self-reliant water revolution that develops outsourced pay-per-gallon programs, has announced that it has received first investor funds into its Water On Demand #1 subsidiary. The Company plans to allocate these and future Water On Demand™ investments to purchase water equipment that customers pay for as a service. Ken Berenger, VP of Business Development, outlined the program recently in a Money Show presentation: https://youtu.be/3XPN12zIez8.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211110005958/en/

With severe drought conditions, widening water shortages, increasing water losses due to failing infrastructure and repeated water-rights violations the demand for action to remedy water related situations has dramatically escalated. What's the solution? OriginClear's Water on Demand program and pay-per-gallon water treatment solutions. (Graphic: Business Wire)

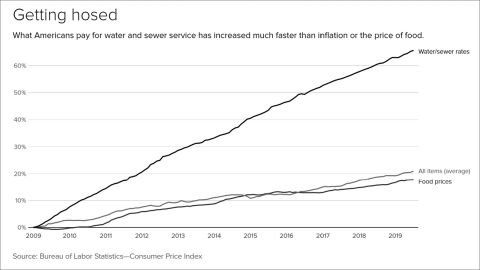

The Company also began talks for a commercial pilot program using such a pay-as-you-go water treatment contract, known in the water industry as Design-Build-Own-Operate (DBOO). Such contracts are typically indexed to local water rates, with the potential of an inflation-friendly investment over the long term.

“After months of planning, I’m delighted to be implementing water as a managed service to replace capital expense,” said Tom Marchesello, OriginClear Chief Operating Officer. “Unlike the plain Design & Build model, where the revenue just occurs once, the full DBOO model can bring decades of lifecycle revenue.”

“October 29, 2021 is a red-letter day for us”, said Riggs Eckelberry, OriginClear CEO. “On that day, we received the first six-figure investment in Water On Demand™, and we began talks for a commercial pilot to implement water treatment as a managed service.”

Accredited and non-US investors should contact OriginClear at invest@originclear.com, or book a call at www.oc.gold/ken.

Water On Demand customers avoid the burden of capital expense, and outsourced maintenance helps users such as breweries and mobile home parks eliminate the expense and expertise of running a water system of their own. These privately metered programs are common in the water industry, but have been applied, until now, to much larger systems, such as desalination plants at the scale of entire islands.

With its prefabricated, modular systems, OriginClear believes it can serve local industry, a fast-growing user base as our national water infrastructure continues to deteriorate (a 2016 survey by the U.S. Environmental Protection Agency (EPA) showed that $271 billion is needed to maintain and improve the nation's wastewater infrastructure: https://archive.epa.gov/epa/newsreleases/epa-survey-shows-271-billion-needed-nations-wastewater-infrastructure.html.) Local action may help alleviate much of this gap.

The securities referred to in this announcement may be sold only to accredited investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds. These securities are being offered in reliance on an exemption from the registration requirements of the Securities Act and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. The Securities and Exchange Commission has not passed on the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume that they will be able to resell their securities. Investing in securities involves risk, and investors should be able to bear the loss of their investment.

About OriginClear Inc.

OriginClear leads the self-reliant water revolution, democratizing water investment by developing a marketplace to connect investors with water projects; and commercializing modular, prefabricated, filter-free advanced systems for faster sanitation worldwide. With America’s broken infrastructure and 100 billion dollars of government spending to fix the nation’s 150,000-plus water systems, OriginClear is helping them “cut the cord”, by developing outsourced pay-per-gallon programs and a future digital currency to streamline payments. Our line of Modular Water products and systems is key to the self-reliant water treatment revolution as they create “instant infrastructure” – fully engineered, prefabricated and prepackaged systems that use durable, sophisticated materials. To learn more about OriginClear®, please visit our website at www.originclear.com.

For more information, visit the company’s website: www.OriginClear.com

Follow us on Twitter

Follow us on LinkedIn

Like us on Facebook

Subscribe to us on YouTube

Signup for our Newsletter

OriginClear Safe Harbor Statement:

Matters discussed in this release contain forward-looking statements. When used in this release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein.

These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with our history of losses and our need to raise additional financing, the acceptance of our products and technology in the marketplace, our ability to demonstrate the commercial viability of our products and technology and our need to increase the size of our organization, and if or when the Company will receive and/or fulfill its obligations under any purchaser orders. Further information on the Company's risk factors is contained in the Company's quarterly and annual reports as filed with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason except as may be required under applicable laws.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211110005958/en/

Contacts

Media Contact

The Pontes Group

Lais Pontes Greene (954) 960-6083

lais@thepontesgroup.com

www.thepontesgroup.com

Investor Relations and Press Contact:

Devin Angus

Toll-free: 877-999-OOIL (6645) Ext. 3

International: +1-323-939-6645 Ext. 3

Fax: 323-315-2301

ir@OriginClear.com

www.OriginClear.com