Bitcoin (BTCUSD) was originally marketed as a non-correlated digital asset and a hedge against fiat debasement. However, market behavior now contradicts that thesis.

Price action in the benchmark digital asset increasingly aligns with risk-on, growth-oriented assets, and not defensive hedges. Correlation analysis shows Bitcoin trading less like digital gold and more like a high-beta software equity.

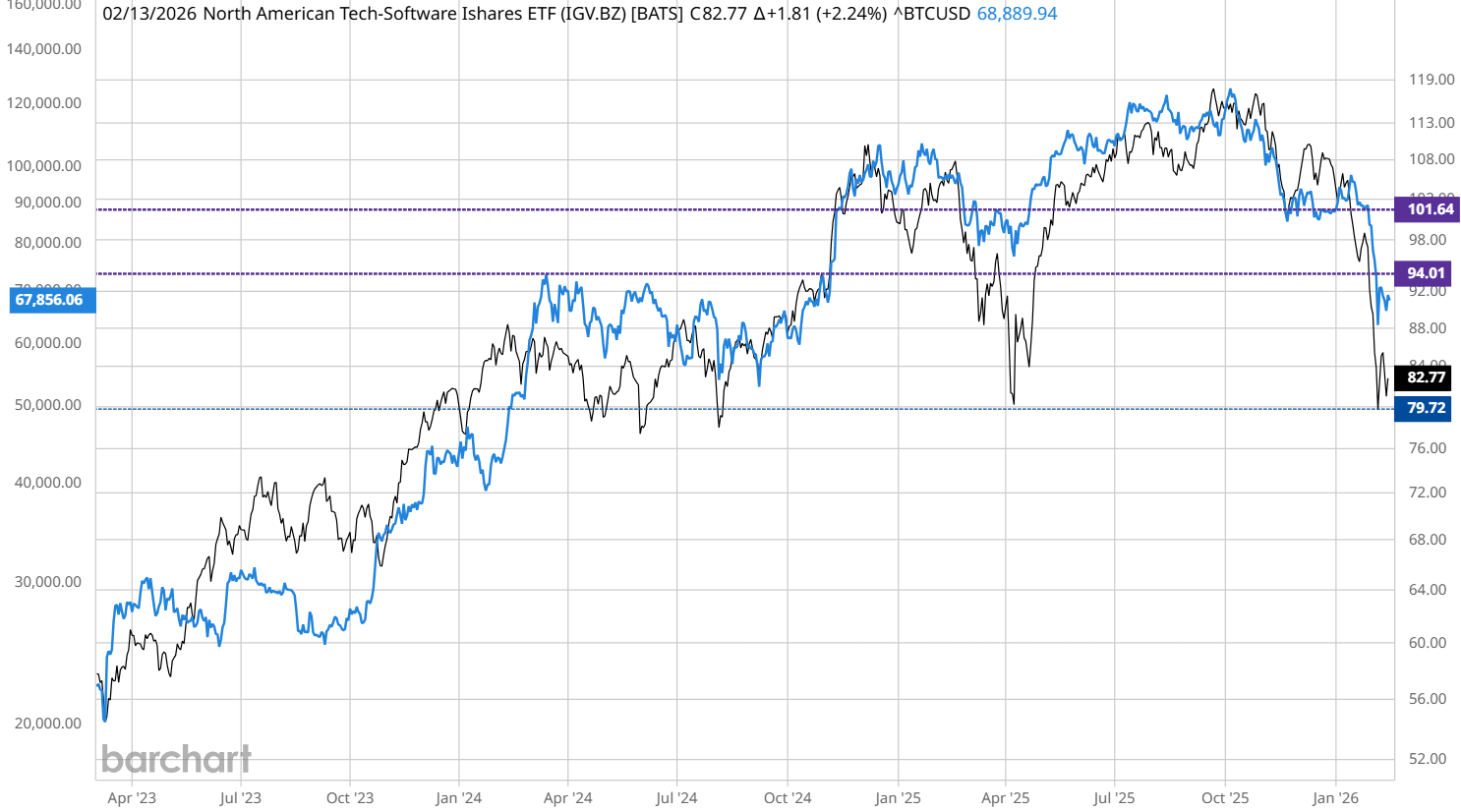

Correlation Evidence: Bitcoin and IGV

The strong correlation between Bitcoin and the iShares Expanded Tech-Software ETF (IGV) suggests Bitcoin is being priced as part of the software growth complex.

IGV represents high-duration, innovation-driven software-as-a-service (SaaS) businesses—precisely the segment most sensitive to liquidity, interest rates, and risk appetite.

Bitcoin’s drawdowns increasingly mirror software sector selloffs rather than macro hedging behavior.

Bitcoin as a Leveraged Risk Asset

Bitcoin’s volatility and 24/7 liquidity make it an ideal collateral asset in leveraged portfolios. Investors searching for alpha in software and AI-related equities may also hold Bitcoin, using it to finance margin or derivatives exposure elsewhere.

But when risk appetite contracts, Bitcoin becomes a source of liquidity, not a destination.

Deleveraging and Margin Dynamics

What market participants label “deleveraging” is often the mechanical process of margin calls and forced liquidation.

If Bitcoin is pledged as collateral, declines in software equities can trigger forced selling of Bitcoin—even without crypto-specific news.

This creates a negative feedback loop in which weaknesses in SaaS stocks spill directly into crypto markets.

AI Narrative Spillover

The artificial intelligence (AI) boom lifted both SaaS equities and Bitcoin through speculative capital flows.

As earnings realities challenge AI valuations, pressure spreads not only to equities, but also to collateral assets backing those trades.

Bitcoin becomes indirectly exposed to the AI earnings cycle, despite having no direct cash flows.

Additional Downward Pressure Factors

- Rising electricity costs compress Bitcoin miner margins, increasing supply pressure.

- Reduced global liquidity and tighter financial conditions limit speculative capital.

- Regulatory uncertainty continues to cap institutional risk-taking.

- Software earnings cycles and guidance resets reinforce the risk-off environment.

Historical Tech Cycles and Time Analysis

Understanding the correlation requires historical context.

Research on technology bear markets shows average downturns lasting approximately 14 months, and Bitcoin’s current drawdown began in October of last year.

If Bitcoin continues to behave like a software stock, historical precedent suggests that downward pressure may persist through year-end rather than resolve quickly.

Conclusion: Bitcoin’s Evolving Market Identity

Bitcoin is no longer trading as a hedge or digital gold — it is trading as a leveraged expression of growth, liquidity, and risk appetite.

The digital asset’s correlation with IGV supports the conclusion that Bitcoin has been integrated into the broader tech ecosystem.

For investors, this reframing is critical: Bitcoin risk may be less about crypto fundamentals and more about software cycles, leverage, and liquidity regimes.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart