Novo Nordisk (NVO) stock extended gains on Friday after the pharmaceutical giant announced a partnership with Amazon Pharmacy for its FDA-approved oral weight-loss pill.

According to its press release, Amazon Pharmacy will offer access to oral Wegovy at competitive price points starting at $25 for insured patients and $149 for uninsured customers.

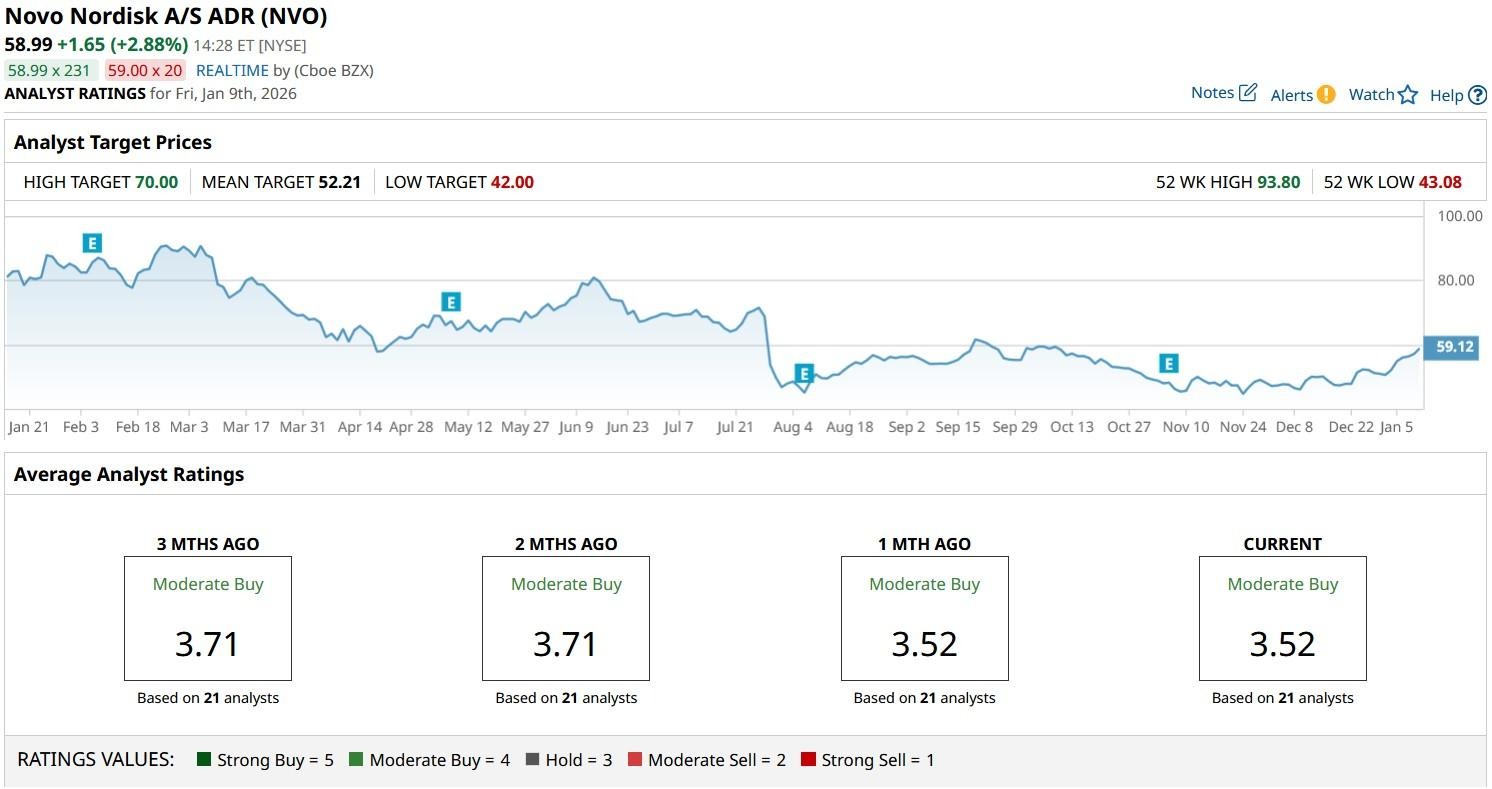

While Novo Nordisk stock did inch higher on Jan. 9, it remains down roughly 35% versus its 52-week high.

Why Amazon Pharmacy Deal Matters for Novo Nordisk Stock

Investors cheered NVO stock today mostly because the Amazon Pharmacy development removes accessibility obstacles that previously limited market penetration.

This massive distribution channel, spanning over 70,000 U.S. pharmacies and established telehealth networks like Weight Watchers, LifeMD, and Ro, positions Novo Nordisk to capture market share

The timing is particularly significant given it currently has a crucial window to grow its presence in the obesity market before rival oral formulations hit the shelves.

Note that oral formulation addresses needle-aversion barriers while offering patients a once-daily convenience option for chronic weight management.

NVO Shares Are Trading at a Discount Currently

From a valuation perspective as well, Novo Nordisk shares are worth owning in 2026.

At the time of writing, the pharma stock is going for a forward price-earnings (P/E) multiple of about 17x only, a material discount to both its historical valuations and its U.S. competitor Eli Lilly (LLY).

Moreover, analysts believe the oral Wegovy launch could drive material margin expansion, with the company maintaining robust EBITDA margins exceeding 47% despite pricing pressures.

The broader obesity treatment market also offers substantial growth potential, with oral GLP-1 formulations projected to add about 2.2% to total market share by 2030 as production costs decline and addressable patient population expands.

NVO is currently challenging a major resistance coinciding with its 200-day moving average (MA) at the $59 level. A decisive break above this price could accelerate bullish momentum in the weeks ahead.

Wall Street Sees Further Upside in Novo Nordisk

What’s also worth mentioning is that Wall Street remains bullish on NVO shares.

The consensus rating on Novo Nordisk stock currently sits at “Moderate Buy” with price targets going as high as $70, indicating potential upside of another 18% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia CEO Jensen Huang Warns Investors That the AI Market Is Bigger Than They Realize With Over ‘One and a Half Million AI Models in the World’

- Novo Nordisk Is Getting a Major Boost from Amazon for Its New Wegovy Pill. Does That Make NVO Stock a Buy Here?

- A $200 Billion Reason to Buy Opendoor Stock Today

- Oklo Declares a ‘Major Step in Moving Advanced Nuclear Forward’ Following Meta Deal. Should You Buy OKLO Stock Today?