Valued at $26.1 billion by market cap, Equifax Inc. (EFX) is a global data, analytics, and technology company that provides information solutions to support credit risk assessment, fraud prevention, and workforce verification. Headquartered in Atlanta, Georgia, Equifax operates in more than 20 countries and serves financial institutions, employers, government agencies, and businesses of all sizes.

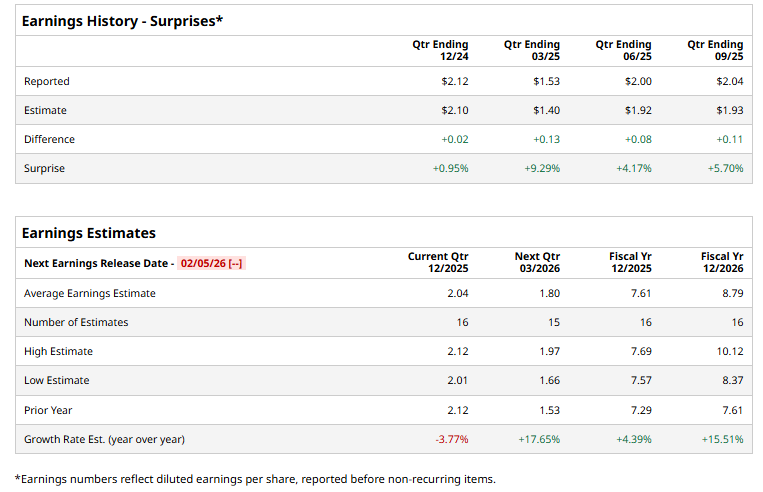

The credit bureau is expected to announce its fiscal fourth-quarter earnings shortly. Ahead of the event, analysts expect EFX to report a profit of $2.04 per share on a diluted basis, down 3.8% from $2.12 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For FY2025, analysts expect EFX to report EPS of $7.61, up 4.4% from $7.29 in fiscal 2024. Its EPS is expected to rise 15.5% year over year to $8.79 in fiscal 2026.

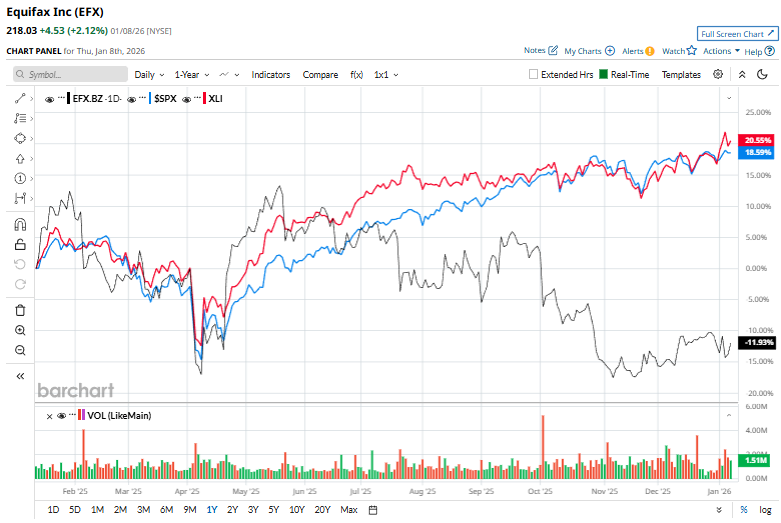

Over the past year, shares of EFX have dropped 12.1%, underperforming the S&P 500 Index’s ($SPX) 17% gains and the Industrial Select Sector SPDR Fund’s (XLI) 20.6% gains over the same time frame.

On Jan. 6, Equifax shares fell more than 3% after FHFA Director Bill Pulte criticized credit bureaus’ pricing practices, stating, “I don’t understand what the credit bureaus are doing with their pricing,” raising concerns over potential regulatory scrutiny. The comments heightened investor worries about Equifax’s pricing power in its U.S. Information Solutions segment, particularly around mortgage-related credit report fees, pressuring the stock amid an already fragile housing market backdrop.

Analysts’ consensus opinion on EFX stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 24 analysts covering the stock, 11 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” and 10 give a “Hold.” EFX’s average analyst price target is $262.38, indicating a potential upside of 20.3% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart