Vernon Hills, Illinois-based CDW Corporation (CDW) offers information technology solutions and services to businesses, government agencies, healthcare institutions, and educational organizations. Valued at a market cap of $17.3 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

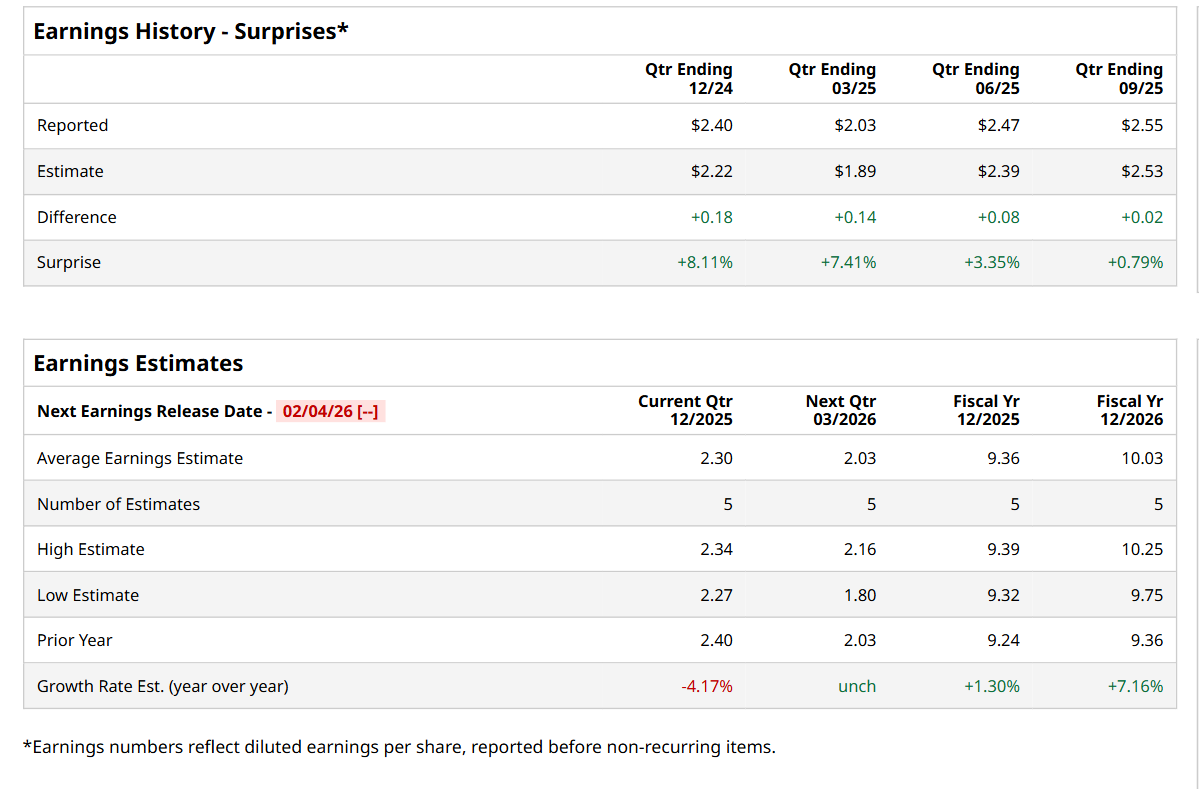

Before this event, analysts expect this tech company to report a profit of $2.30 per share, down 4.2% from $2.40 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its EPS of $2.55 exceeded the consensus estimates by a slight margin.

For the current fiscal year, ending in December, analysts expect CDW to report a profit of $9.36 per share, up 1.3% from $9.24 per share in fiscal 2024. Its EPS is expected to further grow 7.2% year-over-year to $10.03 in fiscal 2026.

Shares of CDW have declined 26.6% over the past 52 weeks, notably underperforming both the S&P 500 Index's ($SPX) 17.5% return and the State Street Technology Select Sector SPDR ETF’s (XLK) 24.8% uptick over the same time period.

On Nov. 4, shares of CDW plunged 8.5% despite posting better-than-expected Q3 results. Both its adjusted EPS of $2.71 and revenue of $5.7 billion handily topped the consensus estimates; however, a 12.9% rise in selling and administrative expenses and a decrease in data storage and server customer demand might have weighed on investor sentiment.

Wall Street analysts are moderately optimistic about CDW’s stock, with an overall "Moderate Buy" rating. Among 12 analysts covering the stock, six recommend "Strong Buy," one indicates a "Moderate Buy,” and five suggest "Hold.” The mean price target for CDW is $180.60, indicating a 35.6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia CEO Jensen Huang Warns Investors That the AI Market Is Bigger Than They Realize With Over ‘One and a Half Million AI Models in the World’

- Novo Nordisk Is Getting a Major Boost from Amazon for Its New Wegovy Pill. Does That Make NVO Stock a Buy Here?

- A $200 Billion Reason to Buy Opendoor Stock Today

- Oklo Declares a ‘Major Step in Moving Advanced Nuclear Forward’ Following Meta Deal. Should You Buy OKLO Stock Today?