Valued at a market cap of $45.8 billion, Corteva, Inc. (CTVA) is a global agricultural science company based in Indianapolis, Indiana. It focuses on delivering innovative crop protection solutions, and data-driven agricultural insights that help farmers farm more sustainably. The company is scheduled to announce its fiscal Q4 earnings for 2025 after the market closes on Tuesday, Feb. 3.

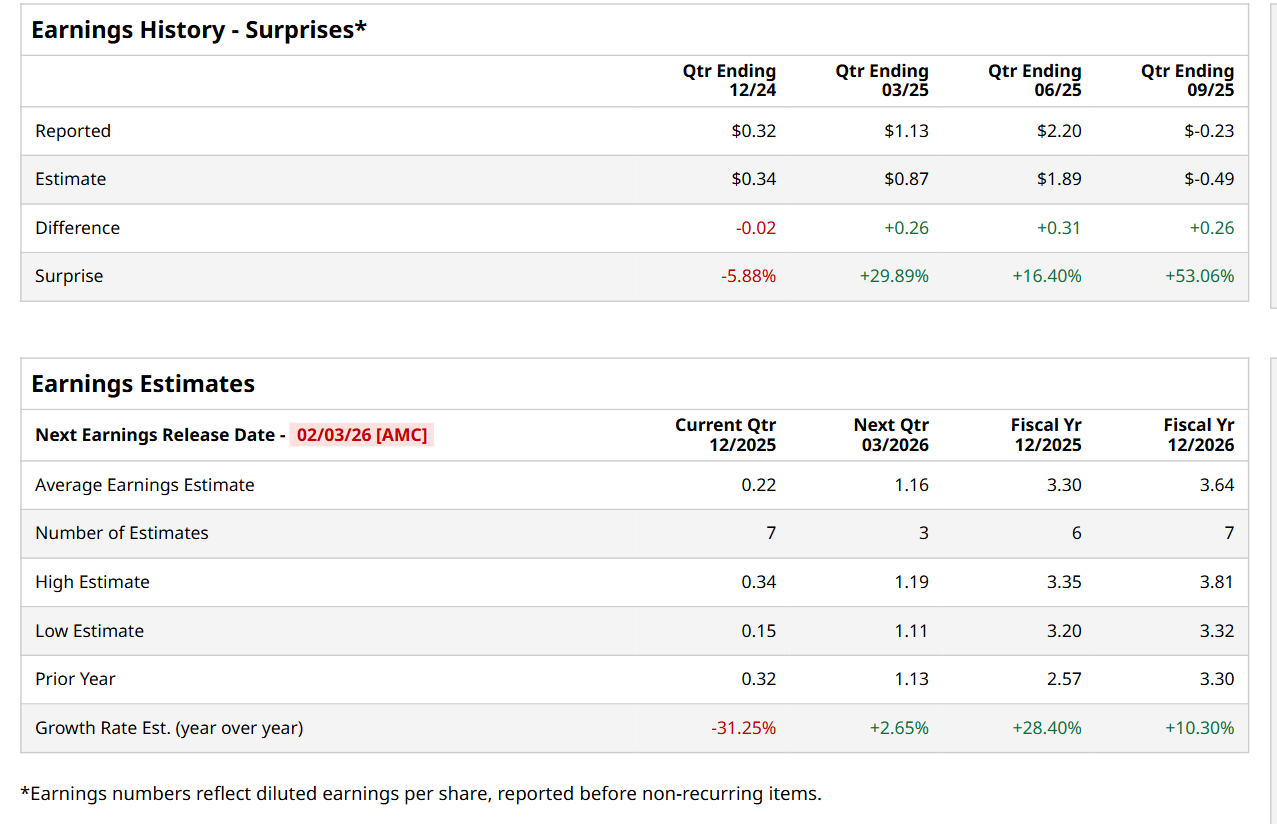

Ahead of this event, analysts expect this agriculture giant to report a profit of $0.22 per share, down 31.3% from $0.32 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its loss of $0.23 per share in the previous quarter exceeded the forecasted figure by a notable margin of 53.1%.

For the current fiscal year, ending in December, analysts expect Corteva to report a profit of $3.30 per share, up 28.4% from $2.57 per share in fiscal 2024. Furthermore, its EPS is expected to grow 10.3% year-over-year to $3.64 in fiscal 2026.

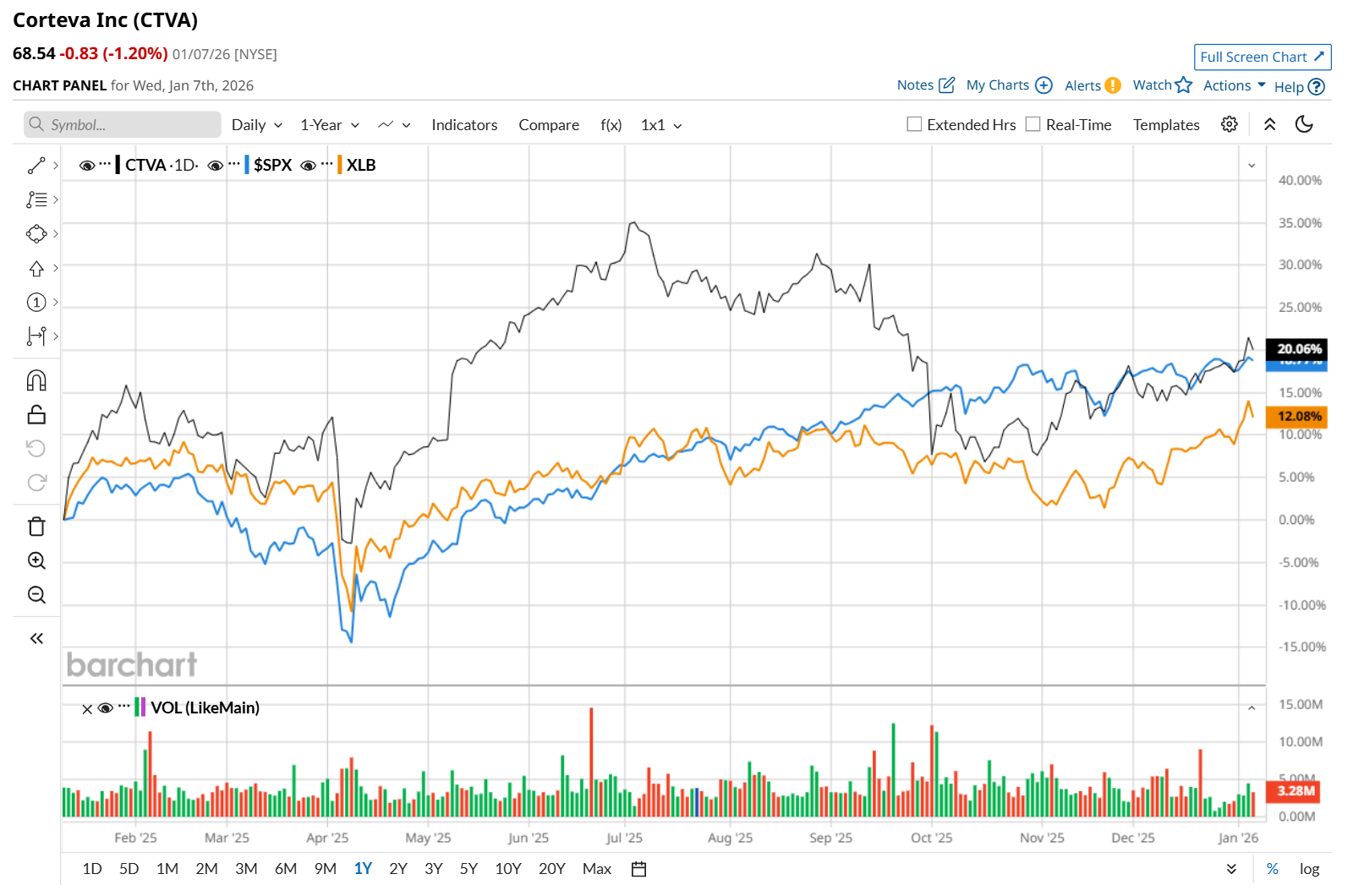

CTVA has surged 20.2% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 17.1% return and the State Street Materials Select Sector SPDR ETF’s (XLB) 11.5% uptick over the same time period.

On Nov. 4, Corteva reported impressive Q3 earnings results, sending its shares up 1.9% in the following trading session. Due to notable growth in three of its four key regions, the company reported a 12.6% year-over-year increase in net sales to $2.6 billion, exceeding analyst expectations by 5.2%. Meanwhile, its operating loss of $0.23 per share also came in well ahead of Wall Street expectations of a loss of $0.49 per share. Furthermore, noting its strong year-to-date performance, improved cost controls, and momentum in its growth initiatives, CTVA raised its fiscal 2025 outlook, now expecting net sales in the range of $17.7 billion to $17.9 billion and operating EPS between $3.25 and $3.35 per share.

Wall Street analysts are moderately optimistic about CTVA’s stock, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, 14 recommend "Strong Buy," two indicate “Moderate Buy,” and six suggest "Hold.” The mean price target for CTVA is $78.20, indicating a 14.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Dip in First Solar Stock?

- This AI Data Center Power Stock is About to Break Out. Spot the Trade as It Unfolds With This Chart Signal.

- This Covered-Call Google ETF Yields 41%. These 2 Option Trades Are Even Better.

- Here’s How You Can Intercept IONQ Stock’s Play-Action Pass for a 127% Payout