Nvidia (NVDA) shares remain in focus this week after the semiconductor behemoth confirmed it’s spending $20 billion to acquire Groq’s assets and talents.

Founded in 2016, this artificial intelligence (AI) startup based out of Mountain View, California specialize in high-bandwidth, low-latency architectures.

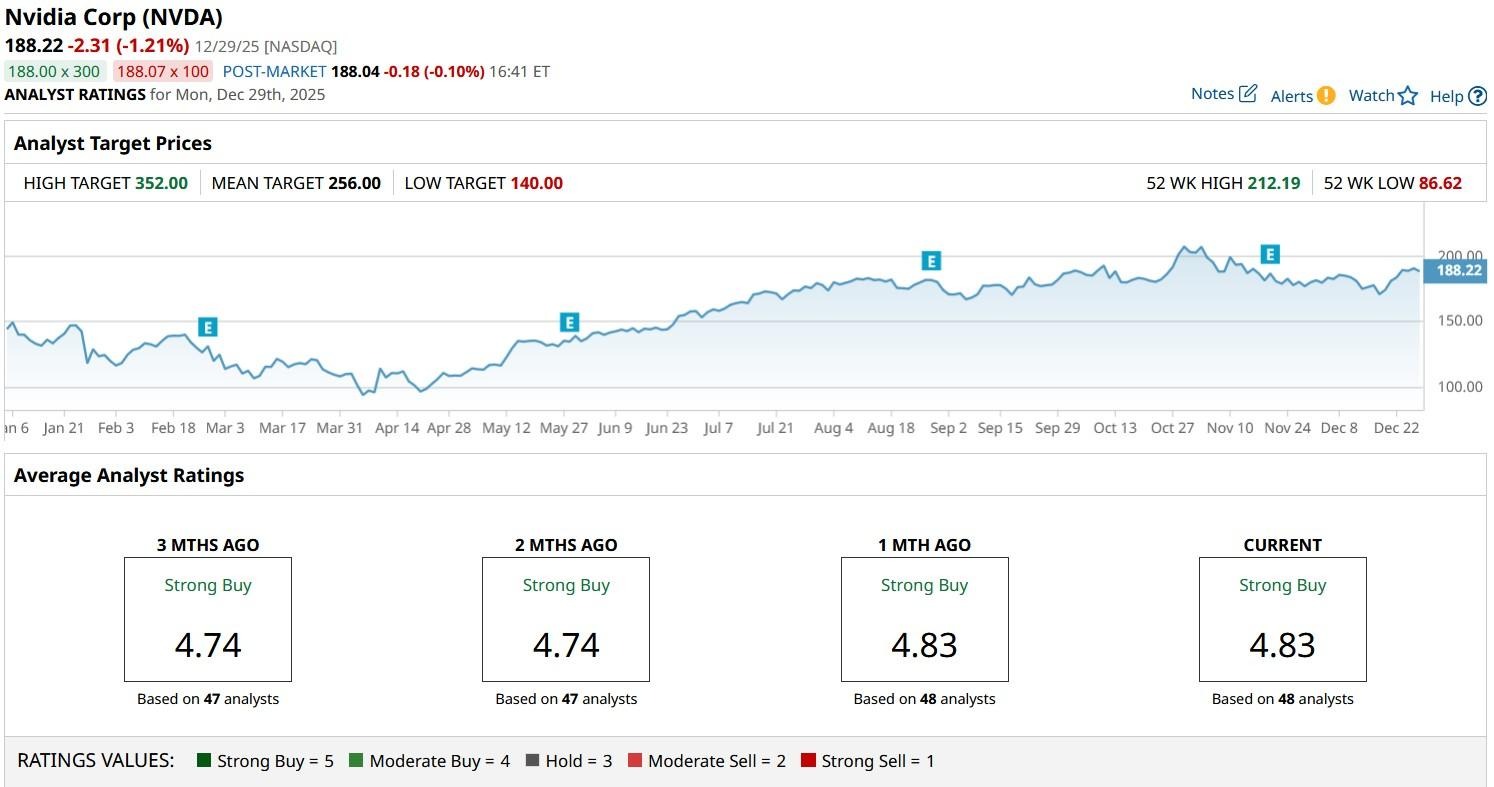

At the time of writing, Nvidia stock is up roughly 120% versus its year-to-date low set in early April.

Mizuho Explains Why Groq Deal Is Bullish for Nvidia Stock

According to Vijay Rakesh – a senior Mizuho analyst – the non-exclusive licensing deal with Groq will prove a meaningful “benefit for NVDA shares in the long run.”

The transaction enables Nvidia to assert its prowess in AI inference, which is expected to make up as much as 80% of workloads over time.

On Monday, Rakesh maintained an “Outperform” rating on the Nasdaq-listed giant. His $245 price target indicates potential for another 32% upside from here.

From a technical perspective, the AI stock is currently trading decisively above its major moving averages (MAs), reinforcing that the bullish momentum will likely sustain in 2026.

Why Groq Deal May Unlock Further Upside in NVDA Shares

What’s also worth mentioning is that the $20 billion price tag on the Groq deal, while huge on the surface, is peanuts compared to Nvidia’s market cap.

This means the associated risk – both executional and to the giant’s balance sheet – is rather small.

For NVDA, it’s more like a “bolt-on” acquisition that strengthens its footprint in AI inference at a minimal financial risk. As Bernstein analyst Stacy Rasgon put it in a recent CNBC interview:

“They can do a $20 billion deal on Christmas Eve with no press release, and nobody bats an eye.”

All in all, acquiring Groq’s assets and talent positions Nvidia shares to widen the gap with rivals, including Advanced Micro Devices (AMD) and Intel (INTC).

What’s the Consensus Rating on Nvidia?

Note that Mizuho isn’t the only Wall Street firm that’s recommending sticking with NVDA stock heading into 2026.

In fact, the consensus rating on Nvidia shares remains at “Strong Buy” with the mean target of $256 indicating potential upside of more than 35% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Nvidia Reportedly Snubs the Intel 18A Process, How Should You Play INTC Stock for 2026?

- These 10 Stocks Are All Up More Than 99% in 2025. 3 of Them Look Likely to Keep Going Higher.

- Is One Asset Screaming that Stocks are Cheap Going into 2026? Can the S&P 500 Reach 10,000 in 2026?

- Worried About a Bust? 3 Old ETFs That Could Have New Appeal in 2026.