Brand Engagement Network (BNAI) shares more than doubled on Dec. 29 after the conversational artificial intelligence (AI) solutions firm secured a sizable contract from a leading ads agency.

In its press release, BNAI confirmed that it will develop a custom AI engagement solution for one of the agency’s clients, which is a top-10 pharmaceutical firm.

Despite the cosmic run, Brand Engagement Network stock remains down some 75% year-to-date.

Is It Too Late to Invest in BNAI Stock?

BNAI shares soared on the contract announcement primarily because it represents meaningful near-term revenue for the micro-cap company.

Its management expects the contract to drive $250,000 in development revenue in the final quarter of this year, with monthly recurring license fees anticipated to being in 2026.

More broadly, the agreement demonstrates Brand Engagement Network’s ability to penetrate high-barrier, regulated industries where artificial intelligence compliance and data integrity are paramount concerns.

In short, the strategic entry into the pharma space represents significant commercial validation for the company’s technology platform, making its stock much more attractive for the coming year.

What Else Makes BNAI Shares Worth Investing?

Investors should note that Brand Engagement Network – even after an explosive rally this week – remains a penny stock, which often means extreme volatility and increased risk of ownership.

On the flip side, however, BNAI’s technicals suggest continued momentum ahead. The recent rally has pushed it past its 61.8% Fibonacci retracement level, potentially clearing the path to $10.

Additionally, the stock’s 9-day relative strength index (RSI) currently sits at 49, reinforcing that it could rally further without reaching overbought conditions.

BNAI stock is worth owning also because the firm’s broader AI healthcare strategy extends beyond a single contract, to an exclusive Latin American licensing partnership and the planned launch of Skye Salud in Mexico.

What’s the Consensus Rating on Brands Engagement Network?

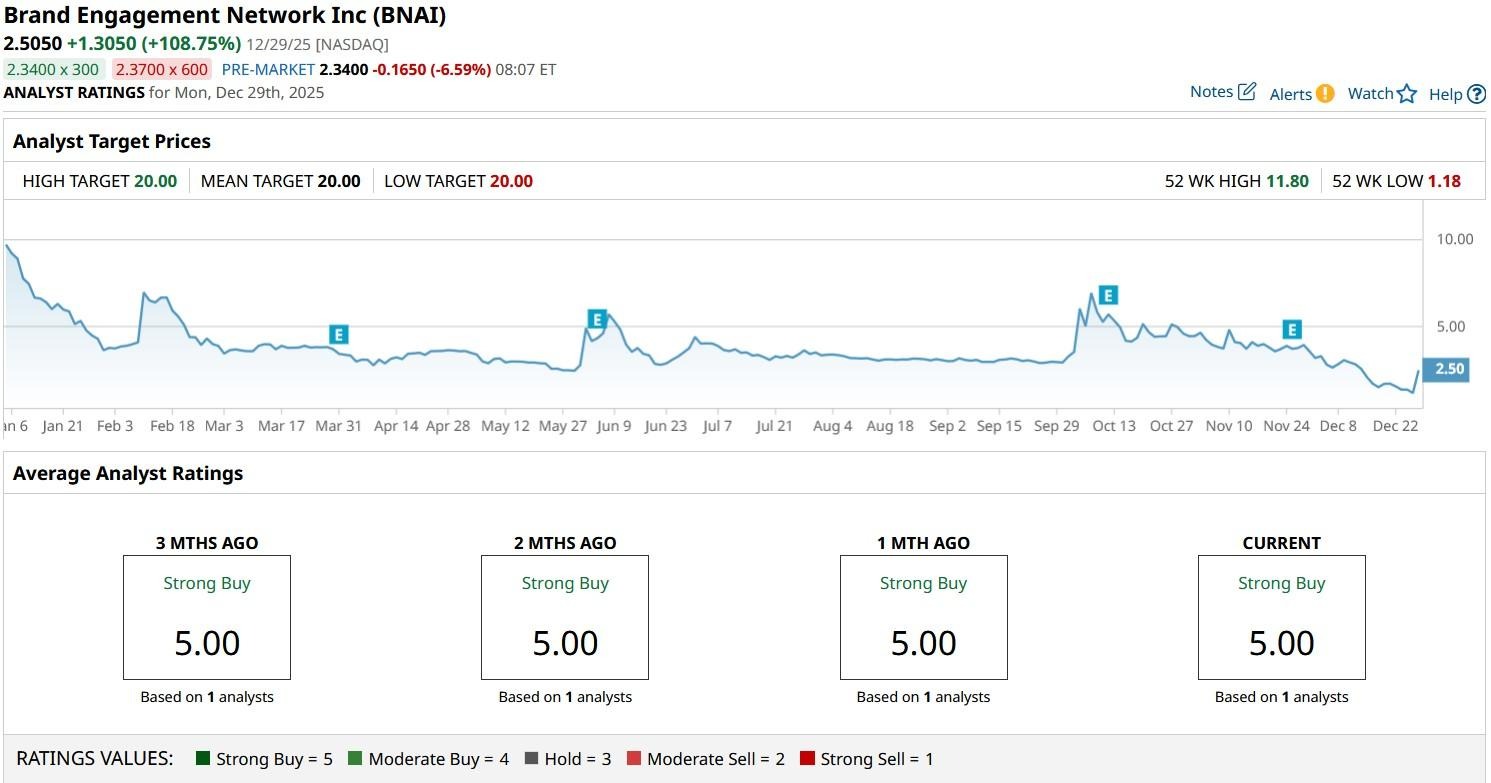

Brands Engagement Network Inc doesn’t currently receive coverage from a large number of Wall Street analysts.

However, the only one who covers BNAI shares rates them at “Strong Buy” with a price target of $20, indicating potential for a 7x rally from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Nvidia Reportedly Snubs the Intel 18A Process, How Should You Play INTC Stock for 2026?

- These 10 Stocks Are All Up More Than 99% in 2025. 3 of Them Look Likely to Keep Going Higher.

- Is One Asset Screaming that Stocks are Cheap Going into 2026? Can the S&P 500 Reach 10,000 in 2026?

- Worried About a Bust? 3 Old ETFs That Could Have New Appeal in 2026.