With the Federal Reserve shifting into rate-cut mode, income-seeking investors should look beyond bonds. As yields on fixed-income securities taper off, dividend-paying stocks, especially those with reliable payouts and high yields, look attractive.

With that in mind, I turned to Barchart’s stock screener to hunt for the most compelling opportunities. The goal was simple: find dividend stocks yielding at least 7% and backed by bullish analyst sentiment. CTO Realty Growth (CTO) and Energy Transfer (ET) stood out for their solid payout history and high yield.

Both companies offer dividend yields well above the 7% mark and maintain a consistent track record of returning cash to shareholders. Moreover, Wall Street analysts love these stocks, maintaining “Strong Buy” consensus ratings. This shows that analysts believe these companies are financially solid, will continue to grow earnings, and will keep rewarding their investors with reliable dividends.

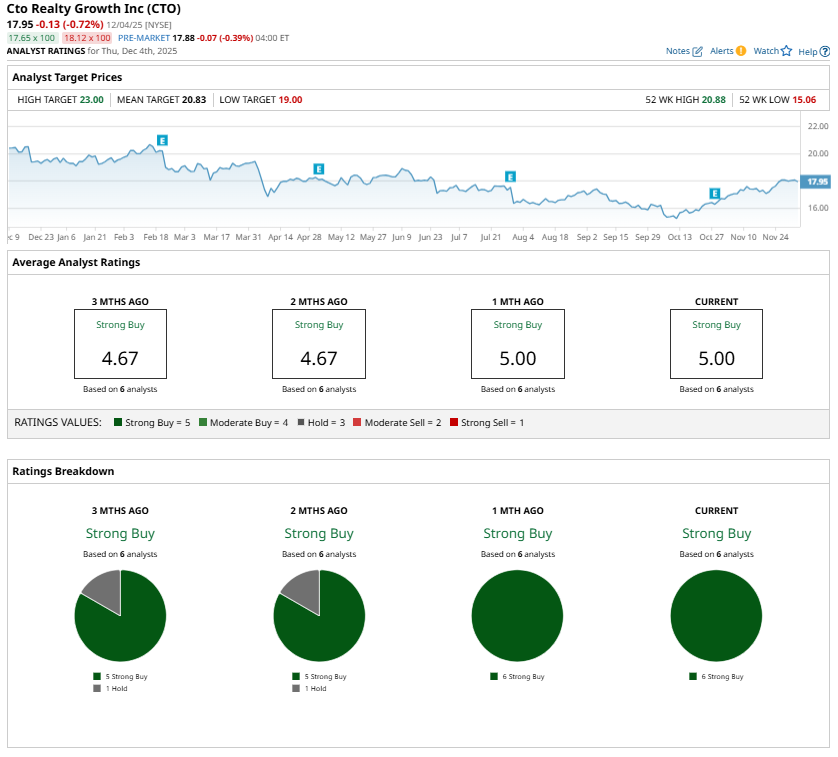

High-Yield Dividend Stock #1: CTO Realty Growth (CTO)

CTO Realty Growth is a real estate investment trust (REIT) focused on high-quality retail properties in fast-growing U.S. markets. Its portfolio centers on multi-tenant shopping centers anchored by essential businesses. These tenants help ensure steady foot traffic and provide a more resilient earnings base.

CTO also holds a stake in Alpine Income Property Trust (PINE), another publicly traded REIT, providing an additional revenue stream.

The company’s leasing momentum has been strong. Through Sept. 30, CTO secured 482,000 square feet of total leasing activity for the year, including 424,000 square feet of comparable leases with an impressive 21.7% rent spread. During the third quarter, the firm secured new and renewal leases totaling 143,000 square feet, with an average base rent of $23 per square foot. After quarter-end, it further strengthened its footprint by signing a major lease at Shops at Legacy in Dallas, a premier mixed-use destination.

CTO is also backfilling large anchor spaces. Six of ten previously vacant anchors are now leased, with ongoing negotiations for the remaining four. These new anchor tenants are expected to increase both rental income and customer traffic. The company maintains a strong signed-not-open pipeline valued at $5.5 million, positioning it well for future earnings growth. At the end of the third quarter, CTO’s portfolio was 94.2% leased and 90.6% occupied.

With a focus on high-growth markets, a strong tenant base, solid leasing activity, and efforts to reduce leverage, CTO appears well-prepared to enhance shareholder value. The REIT has paid dividends continuously since 1976 and is well-positioned to sustain those payouts. Analysts currently maintain a “Strong Buy” consensus rating, and the stock offers a compelling forward yield of 8%.

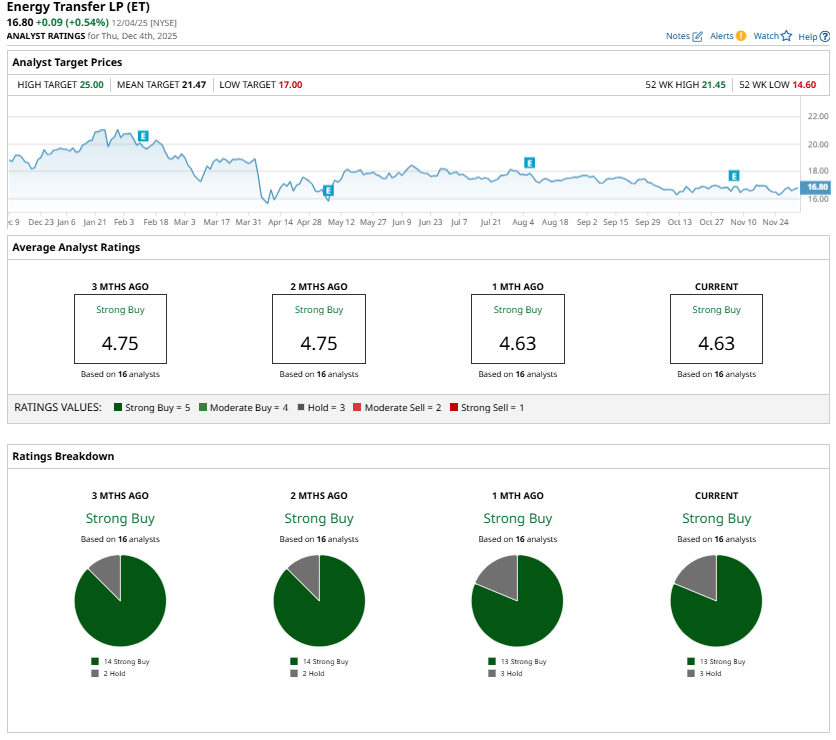

High-Yield Dividend Stock #2: Energy Transfer (ET)

Energy Transfer operates extensive intrastate natural gas pipeline systems in the U.S. Its network connects major production regions with utilities, industrial consumers, power plants, and other pipelines, ensuring strong asset utilization and consistent cash generation.

The company’s diversified revenue model and reliance on long-term, fee-based contracts add stability to its operations and shield it from commodity price volatility.

Thanks to its high-quality earnings base, Energy Transfer has consistently raised its dividend for years. It recently raised its quarterly dividend to $0.3325 per share, or $1.33 annually, yielding about 7.9%.

Energy Transfer’s future payouts are likely to be supported by its multibillion-dollar project backlog, which is expected to deliver mid-teen returns as new infrastructure comes online under secure, long-term agreements. At the same time, the company is benefiting from a surge in U.S. natural gas demand driven by data centers.

Recently, it signed agreements to supply natural gas to a major hyperscaler in Texas and three Oracle (ORCL) data centers. In addition, a decade-long exclusivity arrangement with Fermi America and contracts with several data center and power plant customers highlight the strong and rising pull from companies that require dependable natural gas capacity.

Further boosting future cash flow visibility, Energy Transfer has signed a 20-year transportation agreement with Entergy Louisiana, beginning in 2028. Over the past year alone, it has contracted more than 6 billion cubic feet per day of pipeline capacity with an average contract life of more than 18 years, representing over $25 billion in future revenue.

With steady demand, a strong project pipeline, and an attractive yield, Energy Transfer is a compelling income stock. Analysts have a “Strong Buy” consensus rating on ET stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unlock Over 7% Income: Analysts Love These 2 High-Yield Dividend Stocks

- Nearly 45% of Its Float Is Being Sold Short. Should You Bet on iRobot Stock Here?

- Eric Jackson Could Make Nextdoor the Next Big Meme Stock. Should You Chase the Rally Here?

- GE Vernova Showing No Signs of Slowing, Will GEV Stock Hit $1,000?