Gold has moved to the center of the market’s attention this year, with prices climbing to over $4,000 per ounce in October, a 144% jump since 2022, driven by geopolitical tensions and steady demand for a safe haven.

Against that backdrop, big producers like Barrick Mining Corporation (B) have ridden the upswing hard: Barrick’s share price is up over 140% year-to-date (YTD), supported by a solid balance sheet and strong North American assets that give investors confidence in its cash-generation profile.

This kind of performance has not gone unnoticed by Elliott Management, which has taken a stake of at least $700 million in Barrick, putting it straight into the company’s top ten shareholder list and signaling serious interest in how the business is run.

As financing talks and strategy discussions develop, Elliott’s presence raises the prospect of meaningful restructuring, including a possible split between Barrick’s North American operations and assets in higher-risk regions, which could change how the market values the company.

With Elliott’s track record as one of Wall Street’s most aggressive activist investors, fresh off stakes in Anglo American (NGLOY) and past pressure on Kinross (KGC) to ramp up buybacks, the question looms: Does this vote of confidence from a heavyweight investor make Barrick a compelling buy for dividend-seeking investors right now? Let’s find out.

Evaluating Barrick Gold’s Financial Health

Barrick Mining, which used to be called Barrick Gold, is a major producer of gold and copper. It owns mines all over the world and makes money by selling these metals.

In the last year, B stock went up 112%, but the jump since January is even stronger at 143%, showing investors are taking a fresh look at what the company has to offer.

When it comes to value, Barrick trades at a forward price-to-earnings (P/E) ratio of 16.60x. That’s a bit higher than the sector average of 15.54x, which suggests people are willing to pay a little more based on Barrick’s growth and operations.

For those watching dividends, Barrick has made its payout much better. The latest boost raised its base quarterly dividend by 25% to $0.125 per share, and with a performance dividend of $0.05 added on top, investors now get $0.175 per share every quarter. This is higher than the recent regular payout of $0.150, while the annual yield of 1.22% helps Barrick stand out versus other mining companies. The company’s forward payout ratio is just 24.17%, and there’s only one year of increases so far, which means Barrick could keep growing its dividends without slowing other projects.

For the third quarter of 2025, Barrick showed strong results. Gold production hit 829,000 ounces, up 4% from the previous quarter, and copper was steady at 55,000 tonnes. The company’s cash position improved sharply, with operating cash flow at $2.4 billion and free cash flow reaching $1.5 billion, up 82% and 274% over the prior quarter. These gains fed directly into earnings, with net income at $0.76 per share and adjusted income at $0.58 per share.

What Fuels Barrick Gold’s Future Potential?

The Lumwana expansion is a key part of Barrick’s growth plan. The company is investing $2 billion to turn Lumwana into a Tier One copper mine, with the Super Pit Expansion expected to double copper output to 240,000 tons a year, backed by a new processing plant that can handle 50 million tons of ore annually.

At the same time, Barrick is trimming and reshaping its asset base. The planned sale of its interest in the Tongon gold mine and certain exploration permits in Côte d’Ivoire to Atlantic Group for up to $305 million shows how it is shifting capital toward higher-return projects. The deal includes $192 million in upfront cash, which also covers a 23 million shareholder loan repayment within six months of closing, plus up to $113 million in contingent payments linked to the gold price over 2.5 years and resource conversions over five years.

Moreover, Barrick is leaning harder into buybacks. In February 2025, the board approved a program to repurchase up to $1 billion of common shares over 12 months, and the company had fully used that authorization by Sept. 30. With strong performance and cash flow backing it up, the board then added another $500 million to the plan, lifting the potential total to $1.5 billion in repurchases over the same period. The board also intends to revisit what a 2026 program should look like in February, signaling that buybacks are becoming a regular tool in how Barrick returns cash to shareholders, not just a one-time move.

What Analysts Say About Barrick’s Path Ahead

For 2025, management is keeping its full-year outlook unchanged, still guiding for gold production of 3.15 to 3.50 million ounces and indicating that actual output should come in toward the lower end of that range, with Q4 2025 expected to be the strongest quarter. On the earnings front, analysts are looking for a big step up in performance: the average estimate is 0.85 per share for the current quarter (Q4 2025) and 0.71 for next quarter (Q1 2026). Those numbers translate into strong year-over-year (YoY) growth rates of about 84.78% for the current quarter and 102.86% for the next one, which helps explain why a large investor like Elliott is comfortable holding a top-ten position.

The stock calls from individual analysts line up with that view. On Oct. 23, Scotiabank’s Tanya Jakusconek raised her rating on Barrick from “Sector Perform” to “Sector Outperform” and lifted her price target from $27.50 to $43, a 56% increase, pointing to higher gold price forecasts as the main reason for turning more positive.

A few days later, on Oct. 27, RBC Capital analyst Josh Wolfson increased his target from $38 to $40, kept an “Outperform” rating, and focused on Barrick’s strong cash flow generation as the key part of his case.

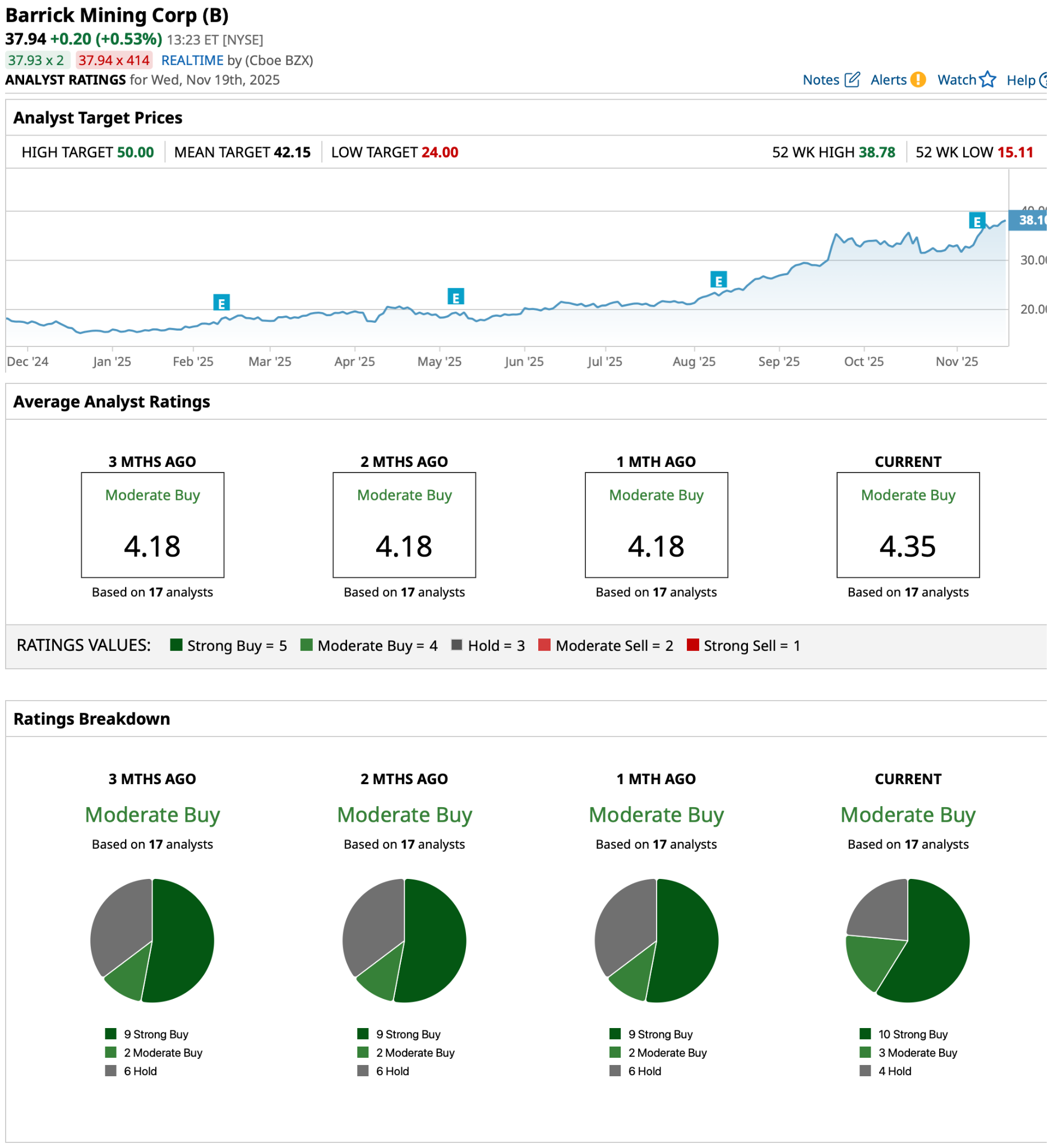

Stepping back, the wider analyst group is in broad agreement: the 17 analysts surveyed assign a consensus “Moderate Buy” rating, and their average target of $42.15 suggests about an 11% upside from the recent share price.

Conclusion

With Elliott Management stepping in as a heavyweight backer, Barrick’s future looks decisively more interesting for yield‑seeking investors, especially considering the miner’s ramped‑up earnings momentum, beefed‑up shareholder returns, and a slew of analyst upgrades. The market’s consensus price target points to solid double‑digit upside from here, and with gold prices and cash flow both charging higher, shares seem more likely to keep grinding upward than lose steam. Short-term volatility aside, this is a name that feels poised for further gains as Barrick’s strategic moves and activist involvement play out.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is GOOGL Stock a Buy, Sell, or Hold as Google Launches Gemini 3?

- Elliott Management Is Betting Big on This Dividend-Paying Gold Stock. Should You Buy Shares Now?

- This Leading Gene-Editing Stock Could Be Going Private. Should You Buy Its Shares First?

- Small-Cap Stocks Are Sounding a Very Scary Alarm. Here’s How to Protect Yourself… and Even Profit.