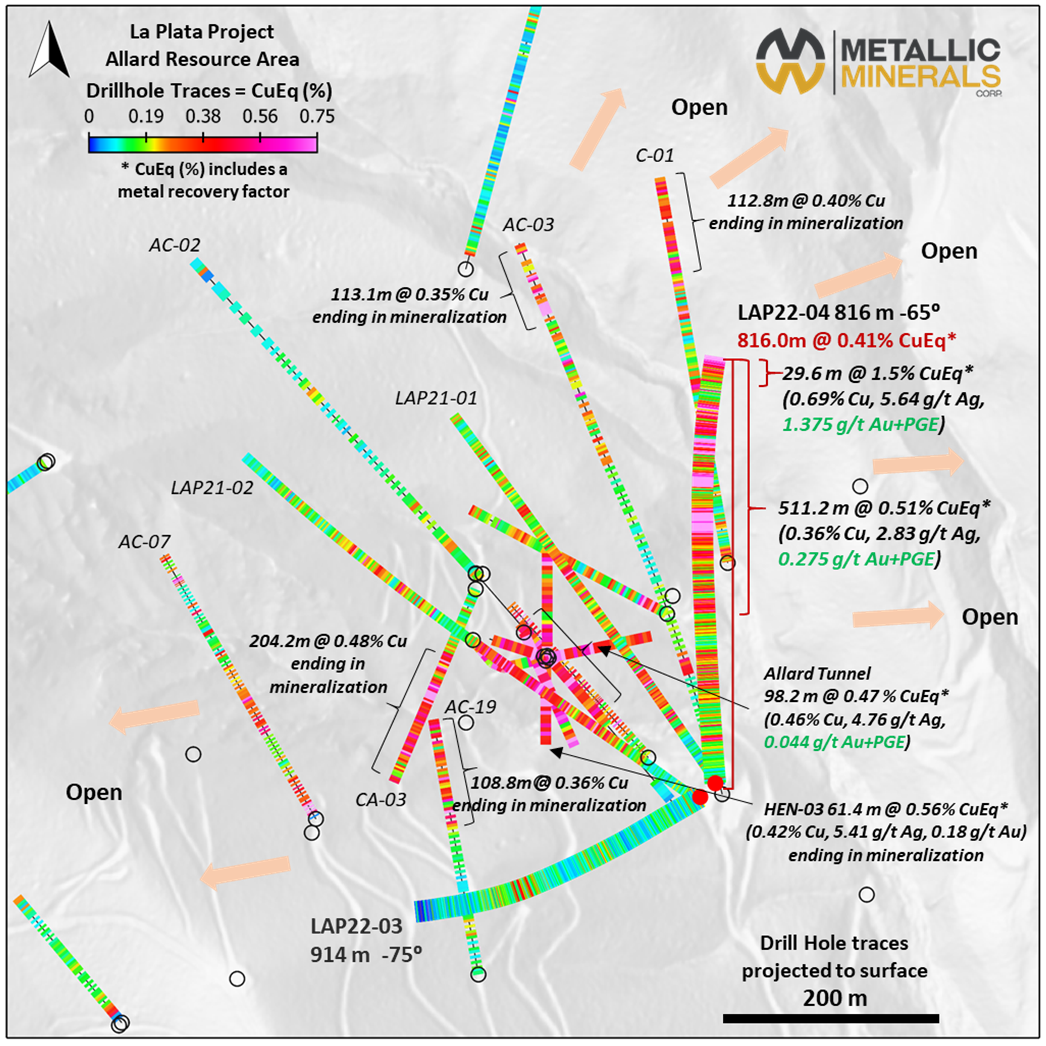

VANCOUVER, BC / ACCESSWIRE / February 28, 2023 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) ("Metallic Minerals" or the "Company") is pleased to announce final results from its 2022 exploration program at the La Plata copper-silver-gold-platinum group element ("Cu-Ag-Au-PGE") project in southwestern Colorado. Two holes totaling 1,730 meters ("m") were drilled to test lateral extensions of the existing 985-million-pound copper equivalent NI 43-101 mineral resource1. Hole LAP22-04, drilled to the north of the resource area, intercepted the longest and highest-grade interval ever encountered at La Plata at 816 m of 0.41% Recovered Copper Equivalent ("CuEq") (see Table 1 footnote). This is one of the top intersections for any North American copper project in the past several years. Significant high-grade gold-platinum-palladium ("Au+PGE") mineralization associated with copper and silver represents the discovery of a new style of mineralization in the resource area that has not been previously recognized or explored for.

The porphyry style mineralization in LAP22-04 strengthens through the hole, transitioning from chalcopyrite dominated at surface to bornite-rich at depth. The hole ended in mineralization with the final 5.2 m of copper plus precious metals rich mineralization grading 5.39% CuEq (2.44% Cu, 18.7 grams per tonne ("g/t") Ag and 5.0 g/t Au+PGE (see Figure 1) but did not reach full target depth due to mechanical issues. The last sample in the hole, representing the deepest material, graded 5.42% Cu, with 47.0 g/t Ag and 11.0 g/t Au+PGE for a total of 11.54% CuEq. Mineralization remains completely open to expansion of the current resource area and outward from drill hole LAP22-04 (see Figure 2). Both drill holes intercepted continuous porphyry style mineralization starting from surface and ending in mineralization at 914 and 816 meters depth, respectively. Hole LAP22-03 shows that the shallow porphyry style mineralization is weakening to the south and west of the resource but still open at depth (see Figure 3).

Drilling Highlights

- Drill hole LAP22-04 intersected 816 m of 0.41% CuEq (0.30% Cu, 2.47 g/t Ag, 0.186 g/t Au+PGE) from surface, with multiple higher-grade intercepts (See Table 1).

- The interval starting at 304.8 m returned 511.2 m at 0.51% CuEq (0.36% Cu, 2.83 g/t Ag, 0.275 g/t Au+PGE).

- Higher-grade zones include 0.90% CuEq over 55.8 m (0.70% Cu, 5.44 g/t Ag, 0.369 g/t Au+PGE and 1.5% CuEq over 29.57 m (0.69% Cu, 5.64 g/t Ag, 1.268 g/t Au+PGE).

- The drill hole bottomed in 5.39% CuEq over 5.2 m (2.44% Cu, 18.7 g/t Ag, 5.0 g/t Au+PGE).

- The precious metals component of LAP22-04 (silver, gold, platinum and palladium) adds 50% in value above the copper only values. The inclusion of Au+PGE values that were not previously analyzed for in historical drilling represents a significant future upside value opportunity for the project.

- The 2022 drilling will be incorporated into an updated NI 43-101 mineral resource estimate for the La Plata project, which is expected to expand significantly based on these results.

The Company will host a live webcast on March 2, 2023, at 10am PT | 1pm ET to discuss the La Plata project, along with a general overview and update on the Company. To register, click here.

Scott Petsel, President of Metallic Minerals, stated, "We have had no doubt about the strength of the mineralized system in the La Plata district, based on its 10 km2 alteration footprint and high-grade past production from the surrounding epithermal silver and gold deposits. Our work since 2020 has rapidly demonstrated the significance of the porphyry system, with the definition of our inaugural copper-silver resource in early 2022. Now, with a major new high-grade discovery from step out drilling in hole LAP22-04, we are uncovering how richly mineralized that porphyry system is. The intensity of alteration and mineralization in this drilling indicates we are vectoring to a higher-grade portion of the La Plata porphyry system with overlapping mineralization styles and a transition to high-grade bornite-rich copper mineralization with associated high precious metals values."

"While it is not uncommon to have elevated platinum group metals in alkalic porphyry systems associated with copper, silver and gold, the level of enrichment at La Plata, with wide intervals of greater than 0.8% copper and up to multi-gram gold, platinum and palladium values, is truly exceptional. The occurrence of other anomalous critical minerals, including tellurium and rare earth elements ("REE"s), is also an intriguing value-adding opportunity. Other major alkalic magmatic systems in the region include Rio Tinto's Bingham Canyon and Newmont's Cripple Creek mines, which also include enrichment in tellurium, PGEs and other critical minerals."

2023 Prospectors and Developers Convention (PDAC) - Booth, Presentation & YMA Core Shack

Metallic Minerals will be attending PDAC 2023 and attendees are invited to visit the Company at Investors Exchange Booth #3024. Additionally, President Scott Petsel will be providing a corporate presentation at a Forum for Investors during the 2023 Prospectors and Developers convention in Toronto Monday March 6th in the silver-focused session, Room 803, between 10:00 am and 12:00 pm at the Metro Toronto Convention Center. For more information, visit here.

The Company will also be participating in the inaugural Yukon Mining Alliance Invest Yukon Core Shack to be held in the Investors Exchange exhibit hall in Booth #3314, adjacent to the main PDAC Core Shack. Our technical team will be on hand to display core from La Plata (including Hole LAP22-04) and our Keno Silver project.

Table 1. La Plata Project 2022 Drill Results

Drill Hole |

From (M) |

To (M) |

Length (M) |

CuEq1 (%) |

Cu (%) |

Ag (g/t) |

Au (g/t) |

Pt (g/t) |

Pd (g/t) |

Au+PGE (g/t) |

| LAP22-04 | 0.00 |

815.95 |

815.95 |

0.41 |

0.30 |

2.47 |

0.038 |

0.055 |

0.093 |

0.186 |

141.73 |

239.27 |

97.54 |

0.31 |

0.29 |

2.51 |

0.029 |

0.004 |

0.015 |

0.048 |

|

304.80 |

815.95 |

511.15 |

0.51 |

0.36 |

2.83 |

0.044 |

0.057 |

0.100 |

0.275 |

|

including |

449.58 |

505.36 |

55.78 |

0.90 |

0.70 |

5.54 |

0.056 |

0.114 |

0.199 |

0.369 |

including |

547.12 |

576.07 |

28.95 |

0.83 |

0.62 |

4.84 |

0.052 |

0.158 |

0.191 |

0.401 |

including |

612.65 |

644.65 |

32.00 |

0.85 |

0.60 |

4.60 |

0.129 |

0.123 |

0.196 |

0.448 |

including |

786.38 |

815.95 |

29.57 |

1.50 |

0.69 |

5.64 |

0.160 |

0.455 |

0.753 |

1.368 |

including |

806.2 |

815.95 |

9.75 |

3.53 |

1.59 |

12.46 |

0.338 |

1.064 |

1.833 |

3.235 |

including |

810.77 |

815.95 |

5.18 |

5.39 |

2.44 |

18.70 |

0.467 |

1.755 |

2.778 |

5.000 |

ending in |

815.34 |

815.95 |

0.61 |

11.54 |

5.42 |

47.00 |

0.622 |

5.016 |

5.393 |

11.031 |

| LAP22-03 | 0.00 |

913.79 |

913.79 |

0.12 |

0.11 |

1.11 |

0.017 |

0.001 |

0.006 |

0.024 |

518.46 |

594.67 |

76.21 |

0.24 |

0.22 |

1.83 |

0.034 |

0.002 |

0.006 |

0.042 |

Notes to reported values:

- Recovered Copper Equivalent (CuEq) in Table 1 is determined as follows: CuEq% = [Cu% x recovery] + [Ag g/t x recovery / 31.103 x Ag price / Cu price / 2,204 x 100] + [Au g/t x recovery / 31.103 x Au price / Cu price / 2,204 x 100] + [Pt g/t x recovery / 31.103 x Pt price / Cu price / 2,204 x 100] + [Pd g/t x recovery / 31.103 x Pd price / Cu price / 2,204 x 100]

- Copper equivalent is presented for comparative purposes using conservative long-term metal prices (all USD): $3.75/lb copper, $22/oz silver (Ag), $1,800/oz gold, $1,000/Oz platinum (Pt), $2,200/oz Palladium (Pd).

- In the above calculations: 31.103 = grams per troy ounce, 2,204 = pounds per metric tonne, and 100 converts from g/t to %.

- The following recoveries have been assumed for purposes of the above equivalent calculations: 90% for Cu and all other listed metals, based on recoveries at similar operations.

- Intervals are reported as measured drill intersect lengths and may not represent true width.

Figure 1 - Drill core photo showing porphyry style mineralization in LAP22-04 from 806.2 to 815.95 m (9.75 m) grading 3.53% CuEq, 1.59% Cu, 12.46 g/t Ag, 0.338 g/t Au, 1.064 g/t Pt, 1.833 g/t Pd (3.235 g/t Au+PGE).

Figure 2 - La Plata 3D Long Section looking northwest, with significant drill intervals and mineralized grade shells Including, Hole LAP22-04. Shows nearly 1.5 kilometers of vertical mineralization open at depth and along trend to the north and east and to the west. Note 0.25% CuEq cut-off grade shell and higher-grade 0.4% CuEq shell.

Figure 3 - Plan map of the Allard Resource Area showing surface projections of the drill hole traces with CuEq% or Cu% in historic holes without precious metals assays.

La Plata Property Overview

Metallic Minerals' La Plata project covers 44 square kilometers 20 km northwest of Mancos, Colorado, within the historic La Plata mining district, that is in the southwest portion of the prolific Colorado Mineral Belt. Copper mineralization with associated silver, gold, platinum and palladium is hosted by a large-scale, Late Mesozoic age, alkalic porphyry system with related silver, gold, telluride epithermal vein, breccia and replacement deposits hosted in adjacent sedimentary rocks.

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from mineralized deposits at over 90 individual mines and prospects2. From the 1950s to 1970s, major miners including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge) explored the district focusing on the significant potential for bulk-tonnage disseminated and stockwork hosted mineralization3. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the current underlying vendors during the lows of the last metal price cycle.

A total of 58 drill holes totaling 16,930 m have been drilled on the property from the 1950s to present, this drilling has demonstrated the presence of a large multi-phase porphyry system with copper, silver, gold with more recent discoveries highlighting the potential for significant PGEs, rare earth minerals and tellurium. This large-scale mineralized system is associated with a 10 km2 strongly magnetic signature with intense hydrothermal alteration. Surrounding the central porphyry system is an associated high-grade silver and gold-rich epithermal system measuring at least 8 km by 2 km that hosts 56 identified vein, replacement, and breccia structures. Historical production from some of these high-grade structures included bonanza grades for silver and gold.

Exploration by Metallic Minerals and Allard Deposit NI 43-101 Resource Estimate

Metallic Minerals is conducting systematic exploration of the La Plata property since its acquisition in late 2019. This work has included drilling, underground sampling, mapping, geochemical soil sampling and 3-dimensional modeling. Comprehensive geophysical surveys have also been undertaken including airborne resistivity and magnetics, ground-based induced polarization surveys, and analysis of multi-spectral remote sensing data to establish mineralized anomalies and domains for the various styles of mineralization. This work has identified potential extensions of the main Allard deposit, as well as 16 untested potential porphyry signatures outside of the resource area, and has developed targets for high-grade epithermal silver, gold and tellurium.

Exploration in 2021 included 1,980 meters of diamond drilling, resampling of historical drill core, underground sampling from the Allard tunnel and mapping and sampling across the broader property. This work supported the development of an inaugural NI 43-101 resource in the Allard area. The April 2022 technical report defined the resource as 115.7 million tonnes at an average grade of 0.39% CuEq (0.35% Cu and 4.02 g/t Ag) using a 0.25% CuEq cut-off grade1.

The 1,730-meter 2022 La Plata drill program was designed to test extensions of porphyry style mineralization beyond the resource area to provide vectors toward higher-grade parts of the mineral system. Results from that drilling demonstrate that mineralization remains open to significant expansion. Modelling work for an updated resource estimate, incorporating the 2022 drilling, has been initiated by SGS and is anticipated to be complete by mid-2023.

Critical Minerals

The Allard deposit at La Plata is a significant potential source of copper and silver, both important industrial metals used for modern technologies broadly and particularly in renewable and clean energy applications. Recent and historical work has also demonstrated that the broader La Plata district is also a potential source of other Critical Minerals identified by the U.S. Government as requirements for economic and national security4. Drilling by Metallic Minerals in 2022 returned multi-gram intervals of platinum group elements with individual grades up to 5.0 g/t Pt and 5.4 g/t Pd, as well as critical minerals such as vanadium, and rare earth elements. Tellurium, another element on the critical mineral list, was a by-product of historic high-grade gold and silver production in the district. The potential for these critical minerals to add additional economic value to the La Plata project will be evaluated as part of ongoing exploration.

USGS Earth MRI Program

The U.S. Geological Survey ("USGS") is funding the Colorado Geological Survey for geological studies in the La Plata Mountains as part of the Earth Mapping Resources Initiative ("Earth MRI"). The work to be carried out by the Colorado Geological Survey includes geologic mapping as well as geochemical and mineralogical studies in the La Plata Mining District to generate a greater understanding of the area's potential to host critical minerals. See USGS news release dated January 25, 2023.

Forest Service Plan of Operations Authorization

The U.S. Forest Service ("USFS") has authorized Metallic Minerals' Plan of Operations for proposed 2023 exploration drilling on USFS lands. The authorization of these drill sites allows for expanded drill testing opportunities near the Allard Cu-Ag-Au-PGE resource and for the drilling of several of the additional porphyry-style targets as defined by the Company's geological team.

About Metallic Minerals

Metallic Minerals Corp. is a leading exploration and development stage company, The Company is focused on silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon, and copper, silver and other critical minerals in the La Plata mining district in Colorado. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada's Yukon Territory, directly adjacent to Hecla Mining's operations, with more than 300 million ounces of high-grade silver in past production and current M&I resources. Hecla Mining Company, the largest primary silver producer in the USA and third largest in the world, completed the acquisition of Alexco Resources and their Keno Hill operations in September 2022.

Metallic Minerals is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the hit television show Gold Rush on the Discovery Channel. At the Company's La Plata project in southwestern Colorado an inaugural NI 43-101 mineral resource estimate in April 2022 returned a significant porphyry copper-silver resource with results from the 2023 resource expansion pending.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Foot notes:

1) See Technical Report on the Inaugural Mineral Resource Estimate for the Allard Cu-Ag Porphyry Deposit, La Plata Project, Colorado, USA with an effective date of April 3, 2022. The Mineral Resource has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards - For Mineral Resources and Mineral Reserves (2014). The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% CuEq, based on metal prices of $3.60/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. (1) CuEq* calculations are based on 100% recovery of all metals using the same metal prices used for the resource calculation. All figures are rounded to reflect the relative accuracy of the estimate. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

2) Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949.

3) Bear Creek Mining (now Rio Tinto), Humble Oil (now Exxon) and Phelps Dodge (now Freeport-McMoRan) company reports.

4) The US Geological Survey has released a list of 50 critical minerals that the US economy requires for economic and national security. Earth Mapping Resources Initiative.

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals' mineral properties has been reviewed and approved by Jeff Cary, CPG, who is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Quality Assurance / Quality Control

All samples were prepared by Bureau Veritas Sparks, Nevada facility and analyzed at the Burnaby, B.C. facility. All samples were analyzed using the AQ-252 EXT procedure using a 30-gram multi-acid digestion with an ICP-ES/MS finish. Over-limit copper and silver samples were analyzed using the MA-401 procedure using a multi-acid digestion and atomic absorption spectrometry analysis. Select samples with elevated values of gold, platinum or palladium were re-analyzed using the FA330 procedure using a 30-gram fire assay fusion with an ICP-ES finish. All results have passed the QAQC screening by the lab and the company utilized a quality control and quality assurance program which included blank, duplicate, multiple standard reference samples and third-party umpire samples.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/741140/Metallic-Minerals-Intercepts-816-Meters-of-041-CuEq-Ending-in-353-CuEq-Over-Final-975-Meters-in-Newly-Discovered-High-Grade-Zone-at-its-La-Plata-Project-Colorado-USA