Over the last six months, Walker & Dunlop’s shares have sunk to $64.58, producing a disappointing 14.6% loss - a stark contrast to the S&P 500’s 9.6% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Walker & Dunlop, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Walker & Dunlop Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons we avoid WD and a stock we'd rather own.

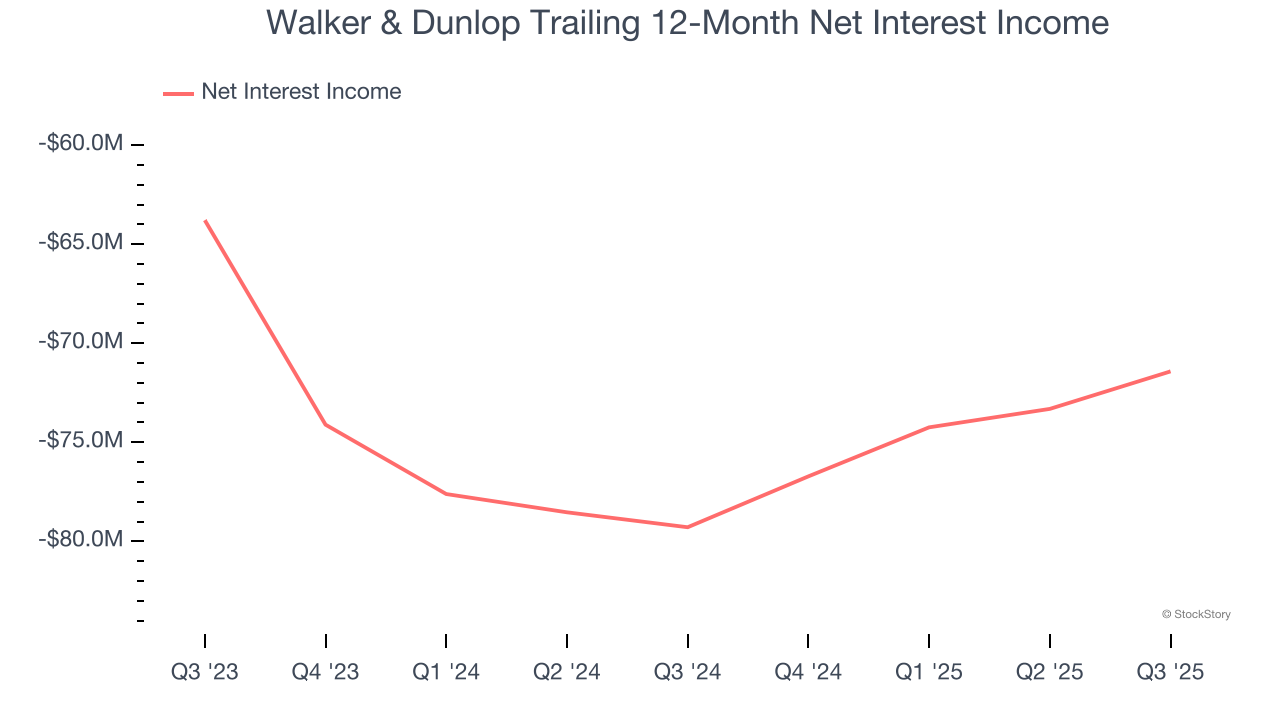

1. Declining Net Interest Income Reflects Weakness

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Walker & Dunlop’s net interest income has declined by 43.8% annually over the last five years, much worse than the broader banking industry. This shows that lending underperformed its other business lines.

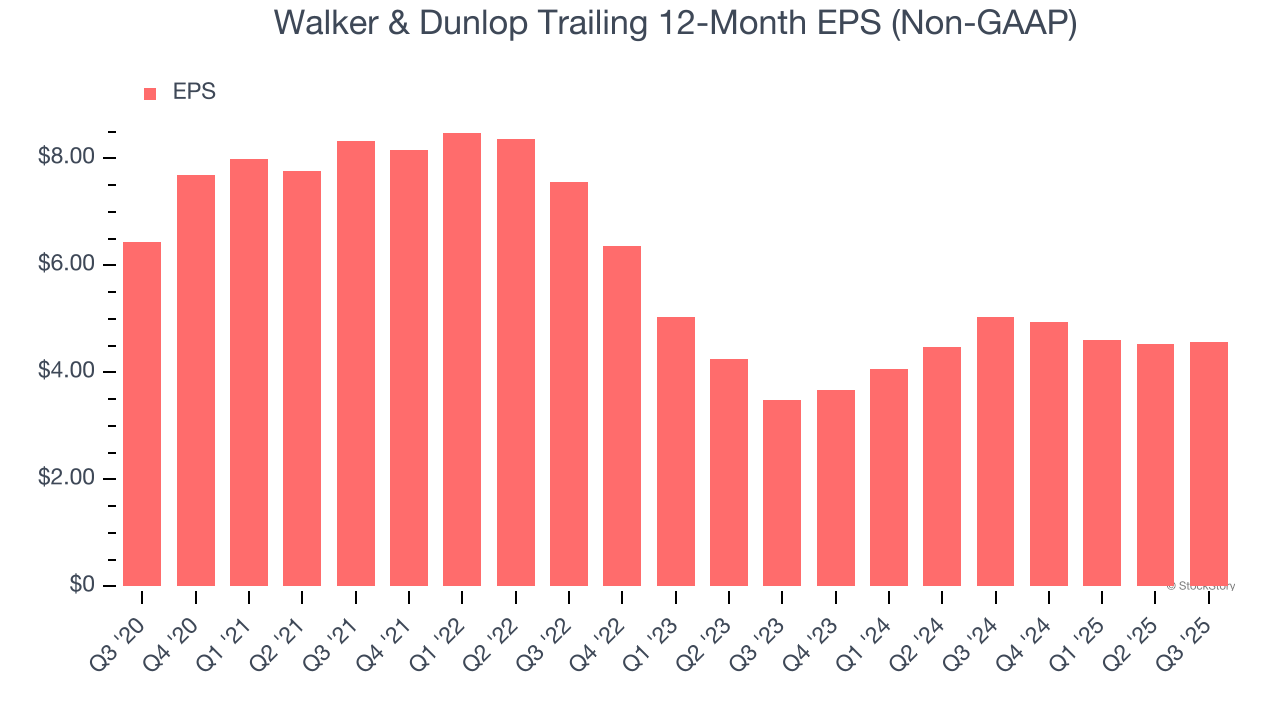

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Walker & Dunlop, its EPS declined by 6.7% annually over the last five years while its revenue grew by 5.4%. This tells us the company became less profitable on a per-share basis as it expanded.

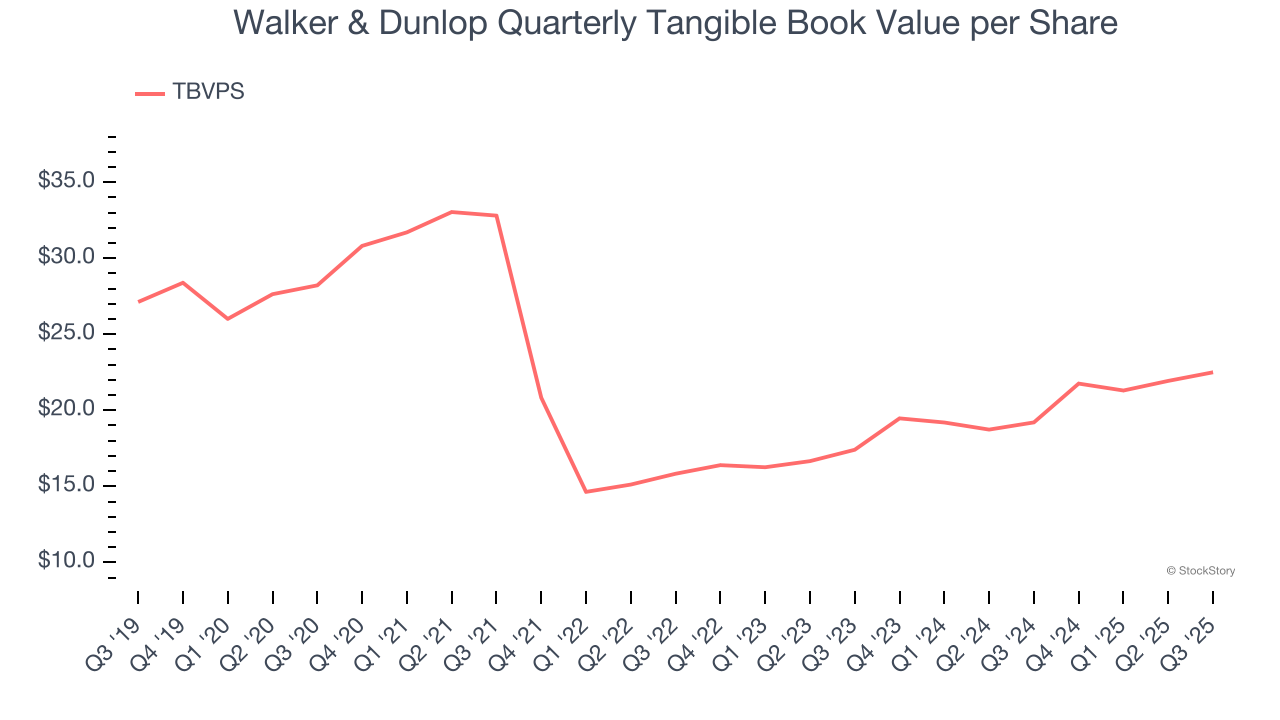

3. Steady Increase in TBVPS Highlights Solid Asset Growth

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

Although Walker & Dunlop’s TBVPS declined at a 4.4% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as TBVPS grew at a solid 13.7% annual clip (from $17.41 to $22.50 per share).

Final Judgment

Walker & Dunlop isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 1.2× forward P/B (or $64.58 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of our top digital advertising picks.

Stocks We Like More Than Walker & Dunlop

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.