Over the past six months, Himax’s shares (currently trading at $8.37) have posted a disappointing 7.5% loss, well below the S&P 500’s 9.6% gain. This might have investors contemplating their next move.

Is now the time to buy Himax, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Himax Will Underperform?

Even though the stock has become cheaper, we're swiping left on Himax for now. Here are three reasons you should be careful with HIMX and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

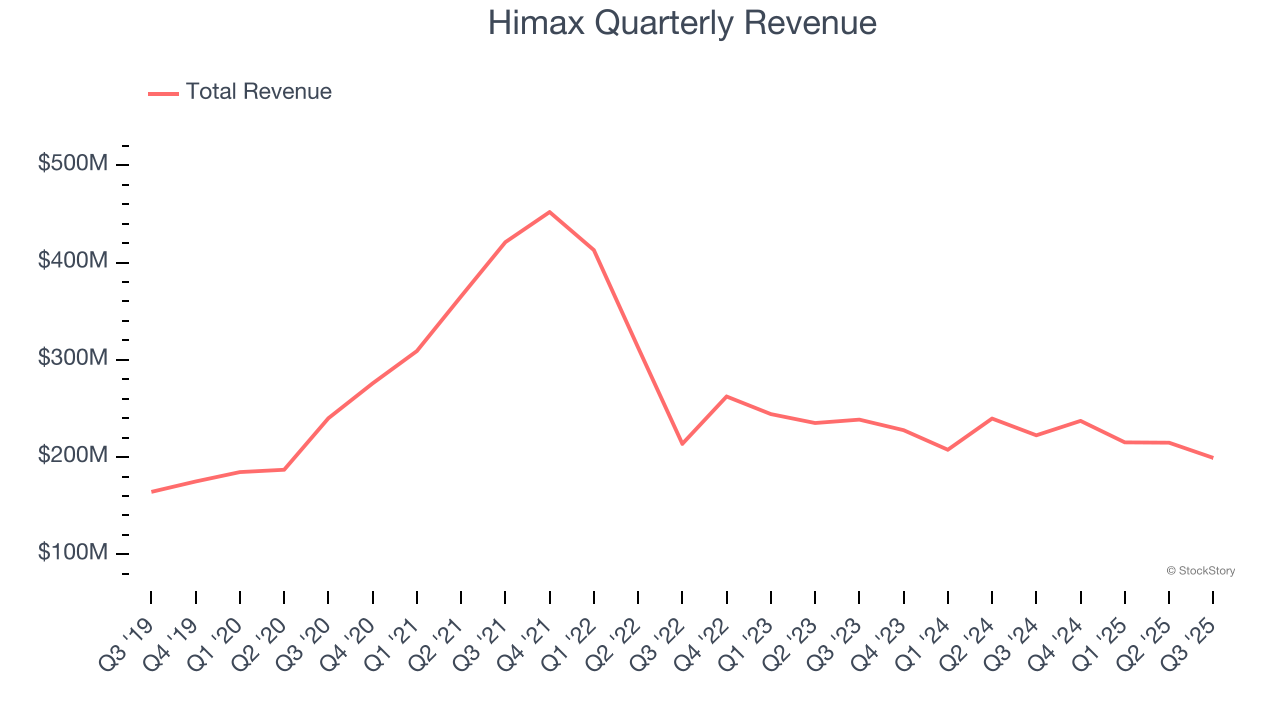

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Himax’s 2% annualized revenue growth over the last five years was tepid. This fell short of our benchmarks. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Himax’s revenue to drop by 4.4%. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

3. Shrinking Operating Margin

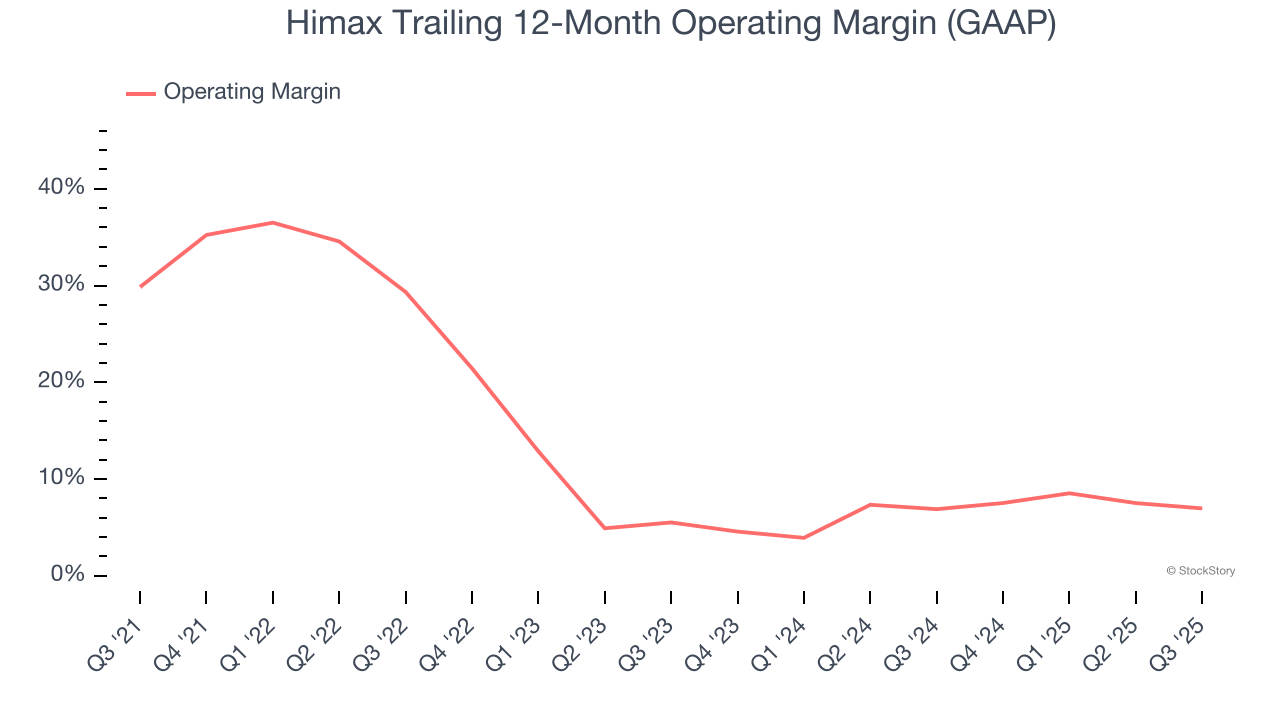

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Himax’s operating margin decreased by 22.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Himax’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 7%.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Himax, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 56.8× forward P/E (or $8.37 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than Himax

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.