Security and Aerospace company Lockheed Martin (NYSE: LMT) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 9.1% year on year to $20.32 billion. The company’s full-year revenue guidance of $78.75 billion at the midpoint came in 1.2% above analysts’ estimates. Its GAAP profit of $5.80 per share was 0.9% above analysts’ consensus estimates.

Is now the time to buy Lockheed Martin? Find out by accessing our full research report, it’s free.

Lockheed Martin (LMT) Q4 CY2025 Highlights:

- Revenue: $20.32 billion vs analyst estimates of $19.84 billion (9.1% year-on-year growth, 2.4% beat)

- EPS (GAAP): $5.80 vs analyst estimates of $5.75 (0.9% beat)

- Adjusted EBITDA: $2.88 billion vs analyst estimates of $2.66 billion (14.2% margin, 8.2% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $29.80 at the midpoint, beating analyst estimates by 1.3%

- Operating Margin: 11.5%, up from 3.7% in the same quarter last year

- Free Cash Flow Margin: 15.8%, up from 2.4% in the same quarter last year

- Backlog: $193.6 billion at quarter end, up 10% year on year

- Market Capitalization: $138.2 billion

"With a record $194 billion backlog, 6% year-over-year sales growth, and free cash flow generation above our prior expectation, 2025 marked a year of unprecedented demand for Lockheed Martin capabilities. This escalating demand for our signature programs and systems has been driven by combat-proven performance over recent years that has already been again demonstrated in 2026. During the U.S. military's recent Operation Absolute Resolve, F-35 and F-22 fighter jets, RQ-170 stealth drones, and Sikorsky Black Hawk helicopters were decisive contributors to enable American soldier, sailors, marines, and airmen to successfully execute extremely difficult missions and return safely," said Lockheed Martin Chairman, President and CEO Jim Taiclet.

Company Overview

Headquartered in Maryland, Famous for the F-35 aircraft, Lockheed Martin (NYSE: LMT) specializes in defense, space, homeland security, and information technology products.

Revenue Growth

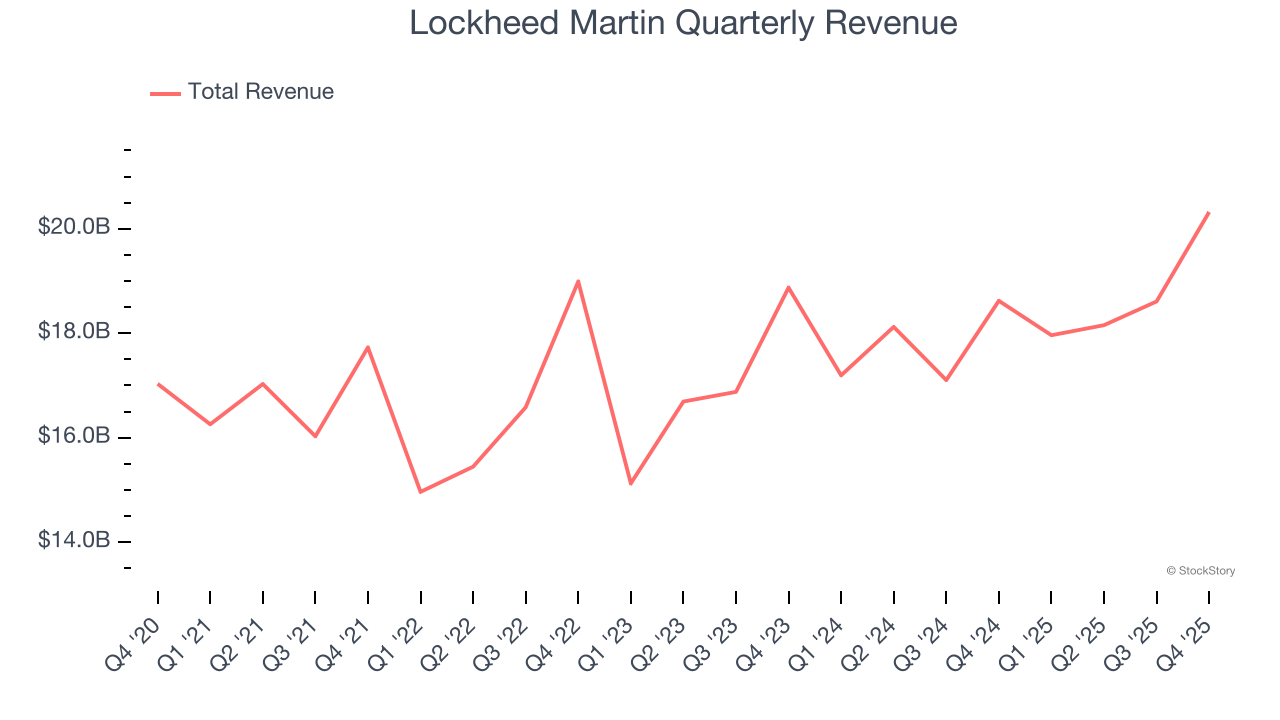

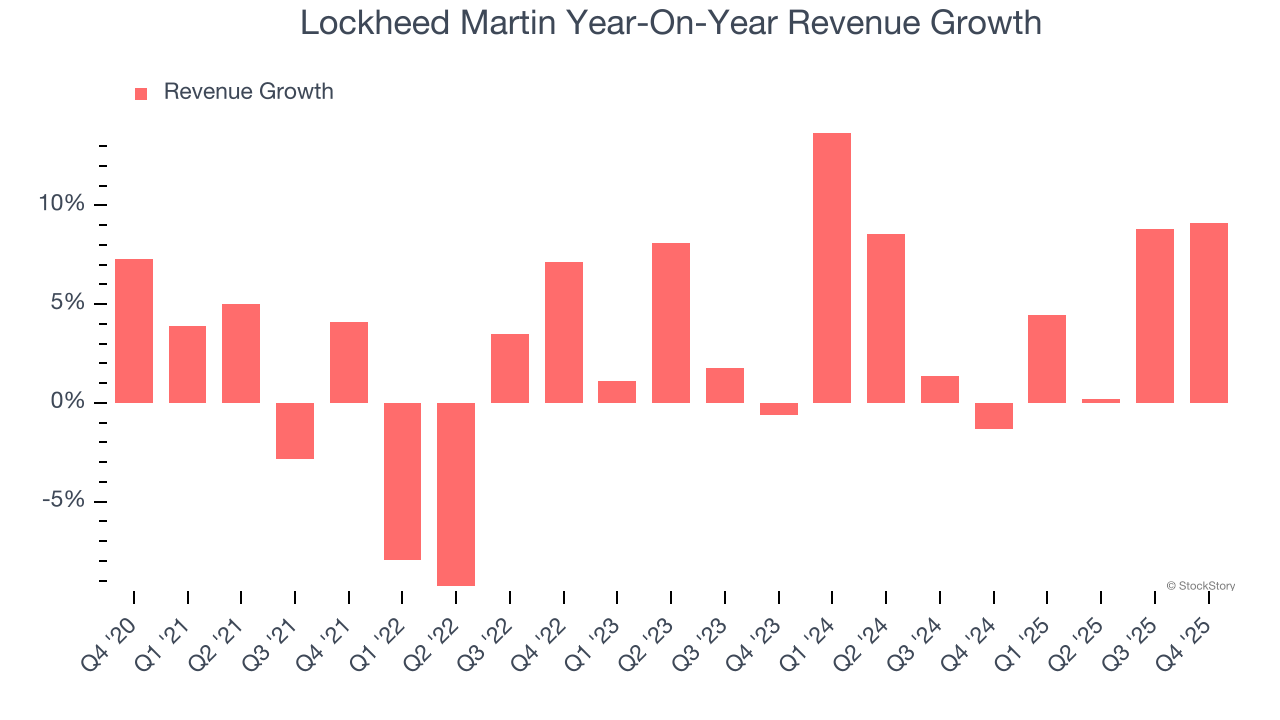

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Lockheed Martin’s sales grew at a sluggish 2.8% compounded annual growth rate over the last five years. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Lockheed Martin’s annualized revenue growth of 5.4% over the last two years is above its five-year trend, but we were still disappointed by the results.

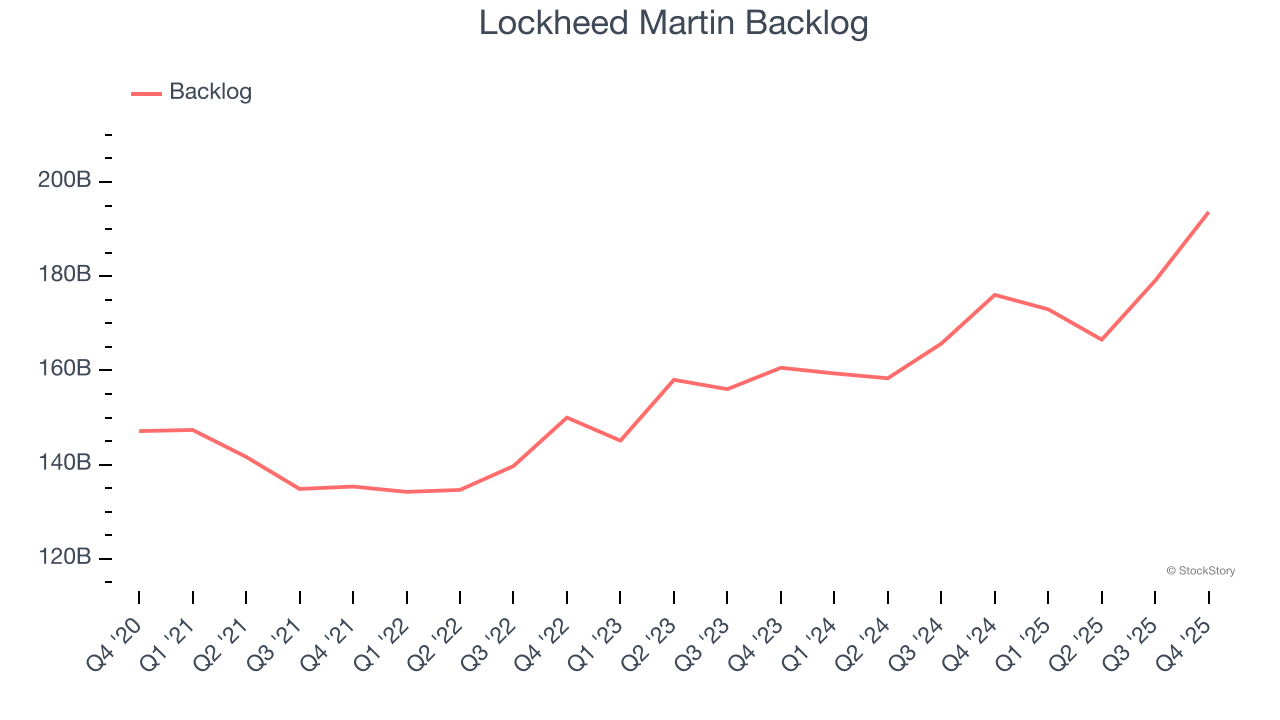

Lockheed Martin also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Lockheed Martin’s backlog reached $193.6 billion in the latest quarter and averaged 7.2% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Lockheed Martin’s products and services but raises concerns about capacity constraints.

This quarter, Lockheed Martin reported year-on-year revenue growth of 9.1%, and its $20.32 billion of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

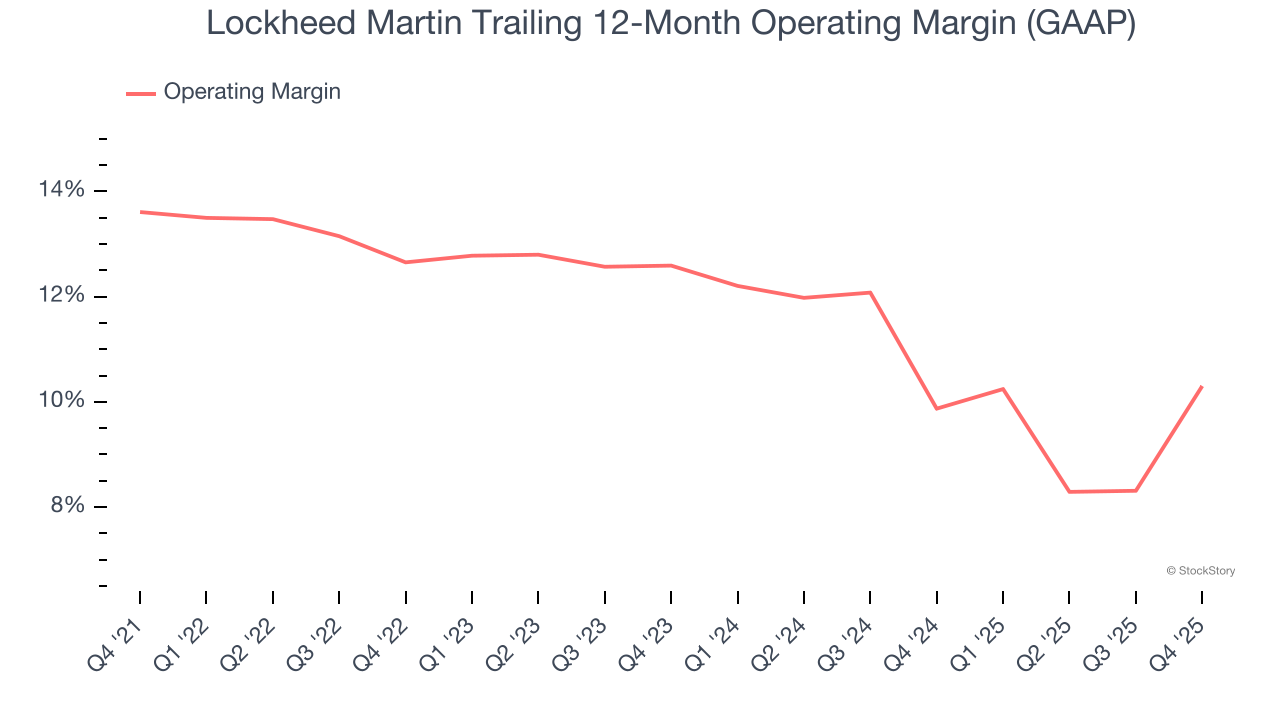

Lockheed Martin has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.7%.

Analyzing the trend in its profitability, Lockheed Martin’s operating margin decreased by 3.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Lockheed Martin generated an operating margin profit margin of 11.5%, up 7.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

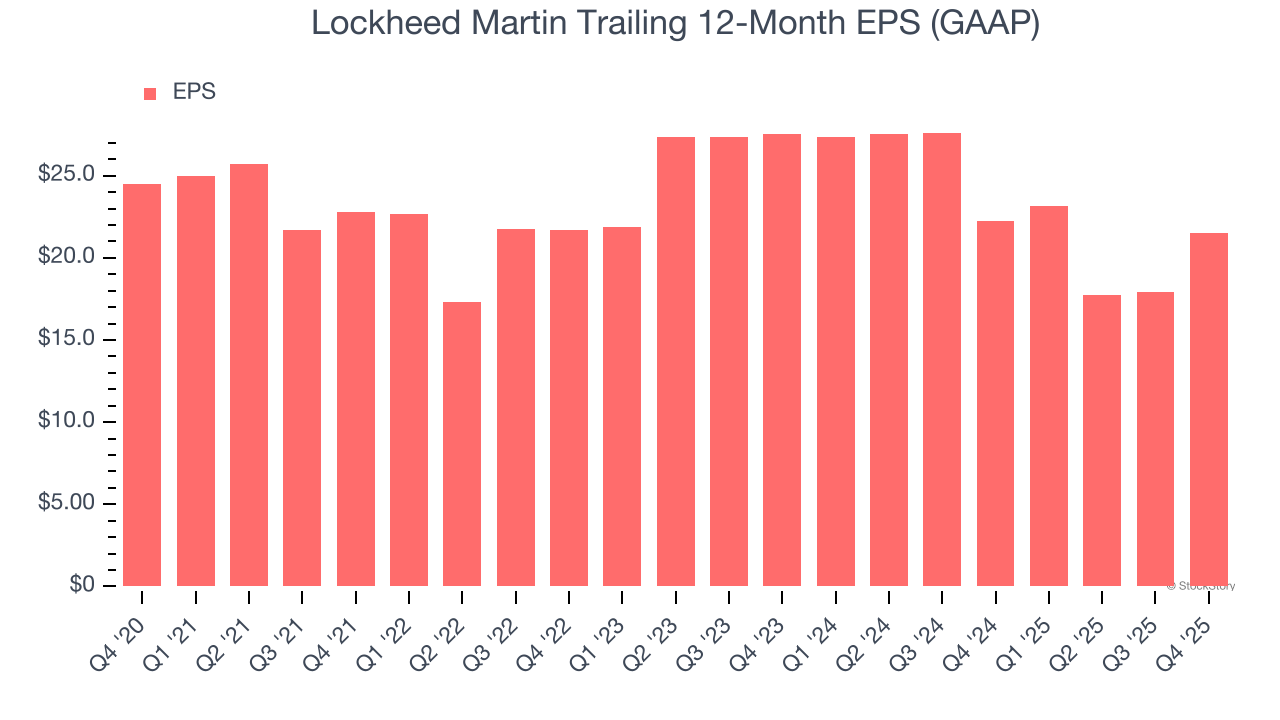

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Lockheed Martin, its EPS declined by 2.6% annually over the last five years while its revenue grew by 2.8%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Lockheed Martin’s earnings can give us a better understanding of its performance. As we mentioned earlier, Lockheed Martin’s operating margin expanded this quarter but declined by 3.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Lockheed Martin, its two-year annual EPS declines of 11.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Lockheed Martin reported EPS of $5.80, up from $2.22 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Lockheed Martin’s full-year EPS of $21.49 to grow 37.7%.

Key Takeaways from Lockheed Martin’s Q4 Results

We were impressed by how significantly Lockheed Martin blew past analysts’ backlog expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 2.8% to $614.00 immediately after reporting.

Indeed, Lockheed Martin had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).