Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Sezzle (NASDAQ: SEZL) and the best and worst performers in the personal loan industry.

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

The 9 personal loan stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 4.9% while next quarter’s revenue guidance was 1.4% below.

Thankfully, share prices of the companies have been resilient as they are up 5.9% on average since the latest earnings results.

Sezzle (NASDAQ: SEZL)

Founded in 2016 as an alternative to traditional credit cards for younger shoppers, Sezzle (NASDAQ: SEZL) provides a payment platform that allows consumers to split purchases into four interest-free installments over six weeks at participating retailers.

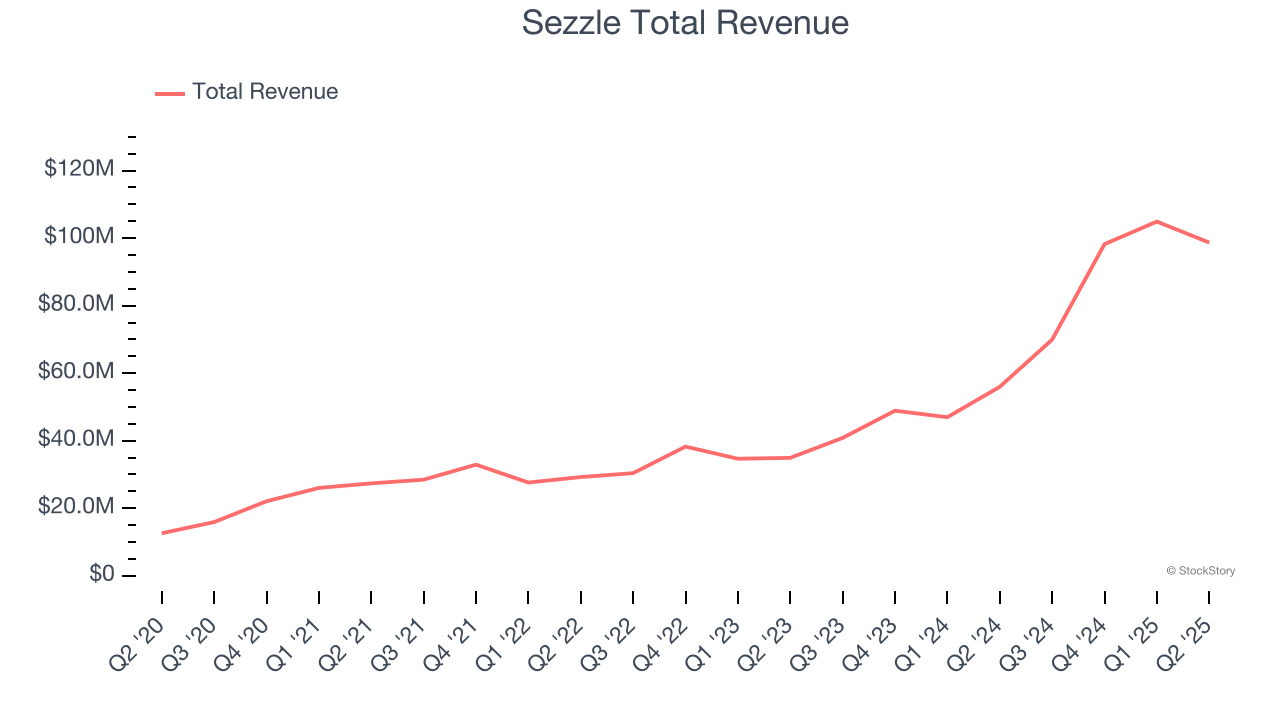

Sezzle reported revenues of $98.7 million, up 76.4% year on year. This print exceeded analysts’ expectations by 4%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates.

Sezzle achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 41.6% since reporting and currently trades at $81.50.

Is now the time to buy Sezzle? Access our full analysis of the earnings results here, it’s free.

Best Q2: LendingClub (NYSE: LC)

Pioneering peer-to-peer lending in the US before evolving into a digital bank, LendingClub (NYSE: LC) operates a marketplace that connects borrowers with lenders, offering personal loans, auto refinancing, and banking services.

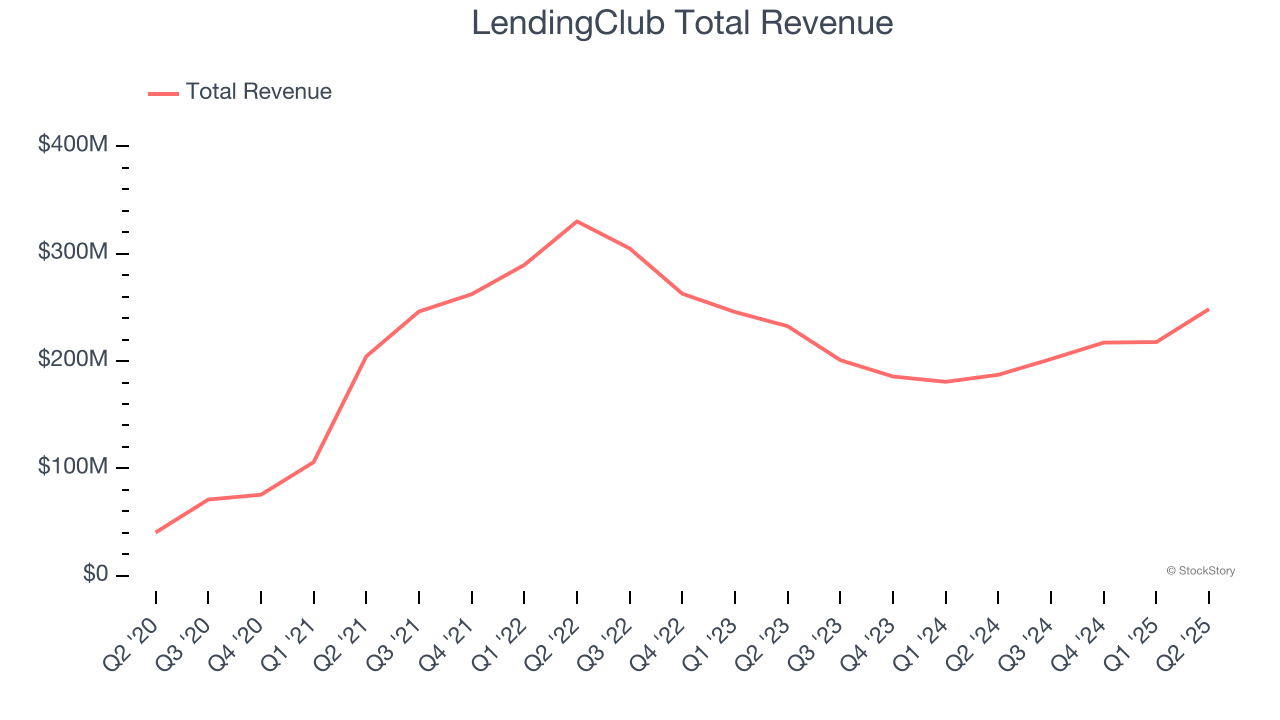

LendingClub reported revenues of $248.4 million, up 32.7% year on year, outperforming analysts’ expectations by 9.2%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 22.4% since reporting. It currently trades at $16.08.

Is now the time to buy LendingClub? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Nubank (NYSE: NU)

With nearly 94 million customers across Brazil, Mexico, and Colombia through its viral member-get-member referral program, Nubank (NYSE: NU) is a digital banking platform that offers financial services including spending, saving, investing, borrowing, and protection products to millions of customers across Latin America.

Nubank reported revenues of $2.64 billion, up 20.8% year on year, exceeding analysts’ expectations by 1.3%. It was a satisfactory quarter as it also posted EPS in line with analysts’ estimates.

Interestingly, the stock is up 32.9% since the results and currently trades at $15.95.

Read our full analysis of Nubank’s results here.

Enova (NYSE: ENVA)

Pioneering online lending since 2004 with a massive database of over 65 terabytes of customer behavior data, Enova International (NYSE: ENVA) provides online financial services including installment loans and lines of credit to non-prime consumers and small businesses in the United States and Brazil.

Enova reported revenues of $764 million, up 21.6% year on year. This result beat analysts’ expectations by 0.9%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA and EPS estimates.

Enova had the weakest performance against analyst estimates among its peers. The stock is up 9% since reporting and currently trades at $121.96.

Read our full, actionable report on Enova here, it’s free.

SoFi (NASDAQ: SOFI)

Starting as a student loan refinancing company founded by Stanford business school students in 2011, SoFi Technologies (NASDAQ: SOFI) operates a digital financial platform offering lending, banking, investing, and other financial services to help members borrow, save, spend, invest, and protect their money.

SoFi reported revenues of $854.9 million, up 42.8% year on year. This print surpassed analysts’ expectations by 5.7%. It was a stunning quarter as it also put up a beat of analysts’ EPS and transaction volumes estimates.

The company reported 11.75 million active customers, up 33.9% year on year. The stock is up 30.5% since reporting and currently trades at $27.45.

Read our full, actionable report on SoFi here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.