Looking back on leisure facilities stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including European Wax Center (NASDAQ: EWCZ) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.4% below.

In light of this news, share prices of the companies have held steady as they are up 2.6% on average since the latest earnings results.

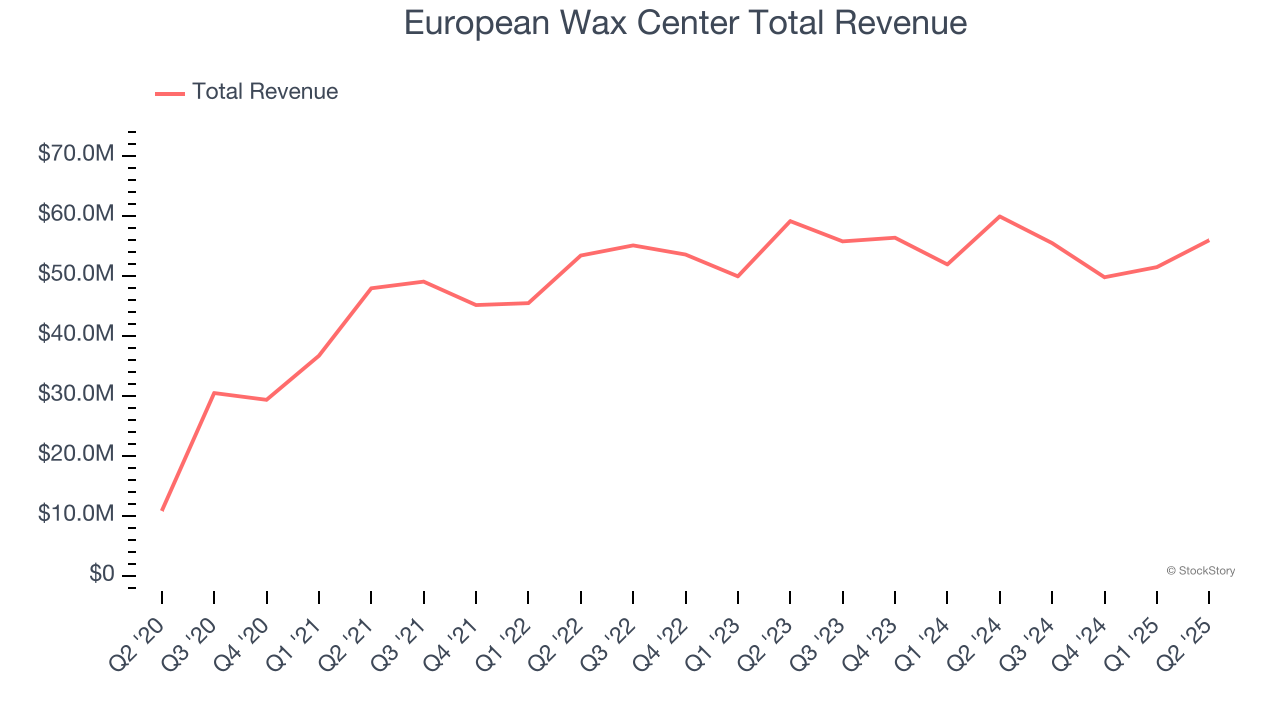

European Wax Center (NASDAQ: EWCZ)

Founded by two siblings, European Wax Center (NASDAQ: EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $55.91 million, down 6.6% year on year. This print fell short of analysts’ expectations by 1.7%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ adjusted operating income estimates but full-year revenue guidance missing analysts’ expectations.

Chris Morris, Chairman and CEO of European Wax Center, Inc., stated: “In the second quarter, we began to see encouraging early signs that our strategies are taking hold, reinforcing the stability of our core business and the resilience of the European Wax Center brand. This is a transitional year in which we are strengthening the foundation of the business through data-driven decision making, disciplined execution, and a clear focus on our three strategic priorities: driving traffic and sales growth, improving four-wall profitability for franchisees, and pursuing thoughtful, profitable expansion.”

European Wax Center delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 11.5% since reporting and currently trades at $3.91.

Read our full report on European Wax Center here, it’s free.

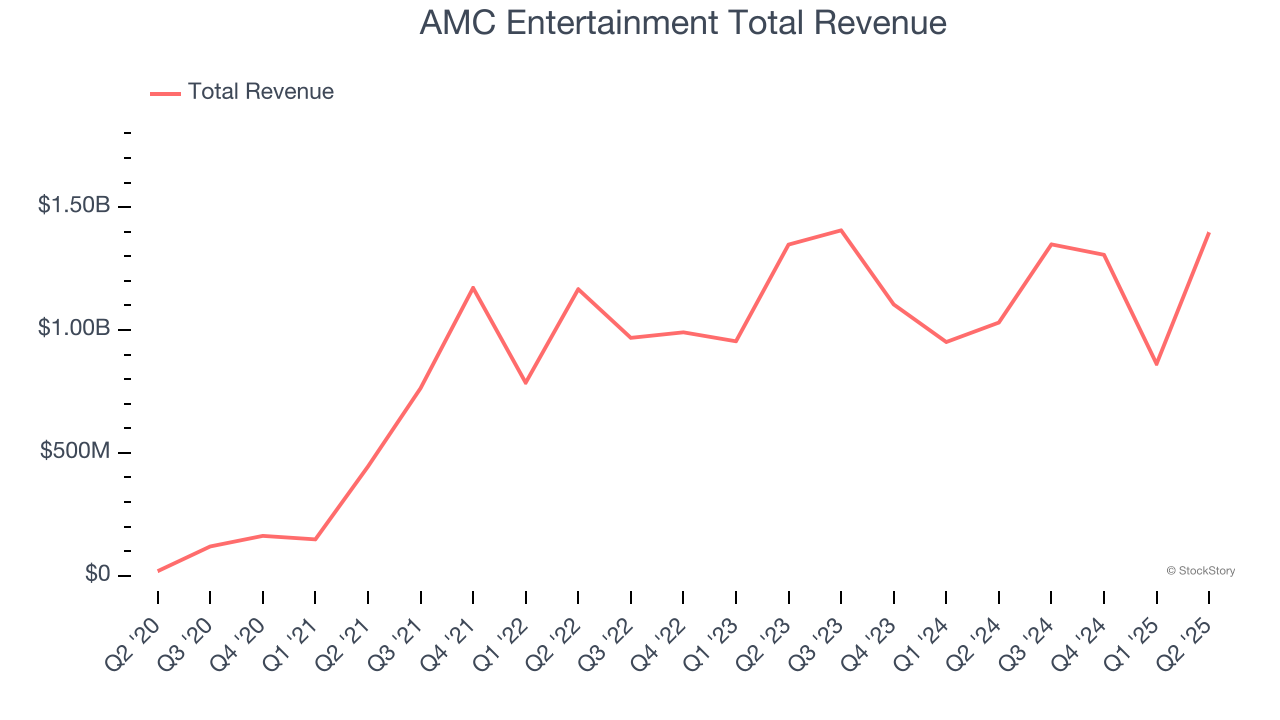

Best Q2: AMC Entertainment (NYSE: AMC)

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE: AMC) operates movie theaters primarily in the US and Europe.

AMC Entertainment reported revenues of $1.40 billion, up 35.6% year on year, outperforming analysts’ expectations by 3.1%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

AMC Entertainment achieved the fastest revenue growth among its peers. The market seems content with the results as the stock is up 1.5% since reporting. It currently trades at $2.98.

Is now the time to buy AMC Entertainment? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Dave & Buster's (NASDAQ: PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ: PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $557.4 million, flat year on year, falling short of analysts’ expectations by 0.9%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates and EPS estimates.

As expected, the stock is down 20.6% since the results and currently trades at $19.22.

Read our full analysis of Dave & Buster’s results here.

Xponential Fitness (NYSE: XPOF)

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE: XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Xponential Fitness reported revenues of $76.21 million, flat year on year. This number missed analysts’ expectations by 1.5%. Overall, it was a softer quarter as it also logged full-year revenue guidance missing analysts’ expectations.

Xponential Fitness had the weakest full-year guidance update among its peers. The stock is down 18.6% since reporting and currently trades at $7.83.

Read our full, actionable report on Xponential Fitness here, it’s free.

Sphere Entertainment (NYSE: SPHR)

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE: SPHR) hosts live entertainment events and distributes content across various media platforms.

Sphere Entertainment reported revenues of $282.7 million, up 3.4% year on year. This print came in 7.4% below analysts' expectations. It was a slower quarter as it also produced a significant miss of analysts’ EBITDA estimates.

Sphere Entertainment had the weakest performance against analyst estimates among its peers. The stock is up 55% since reporting and currently trades at $62.44.

Read our full, actionable report on Sphere Entertainment here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.