Cruise vacation company Royal Caribbean (NYSE: RCL) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 10.4% year on year to $4.54 billion. Its non-GAAP profit of $4.38 per share was 7.4% above analysts’ consensus estimates.

Is now the time to buy Royal Caribbean? Find out by accessing our full research report, it’s free.

Royal Caribbean (RCL) Q2 CY2025 Highlights:

- Revenue: $4.54 billion vs analyst estimates of $4.55 billion (10.4% year-on-year growth, in line)

- Adjusted EPS: $4.38 vs analyst estimates of $4.08 (7.4% beat)

- Adjusted EBITDA: $1.85 billion vs analyst estimates of $1.75 billion (40.8% margin, 6% beat)

- Management raised its full-year Adjusted EPS guidance to $15.48 at the midpoint, a 2.9% increase

- Operating Margin: 29.3%, up from 26.7% in the same quarter last year

- Free Cash Flow was $910 million, up from -$567 million in the same quarter last year

- Passenger Cruise Days: 14.28 million, up 1.05 million year on year

- Market Capitalization: $95.59 billion

"Demand for our portfolio of brands and our industry-leading experiences continues to accelerate. Grounded in our mission to deliver the best vacations responsibly, we remain keenly focused on delivering exceptional value for our guests and shareholders - not just by executing today, but by staying ahead of where demand is going," said Royal Caribbean Group President and CEO Jason Liberty.

Company Overview

Established in 1968, Royal Caribbean Cruises (NYSE: RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

Revenue Growth

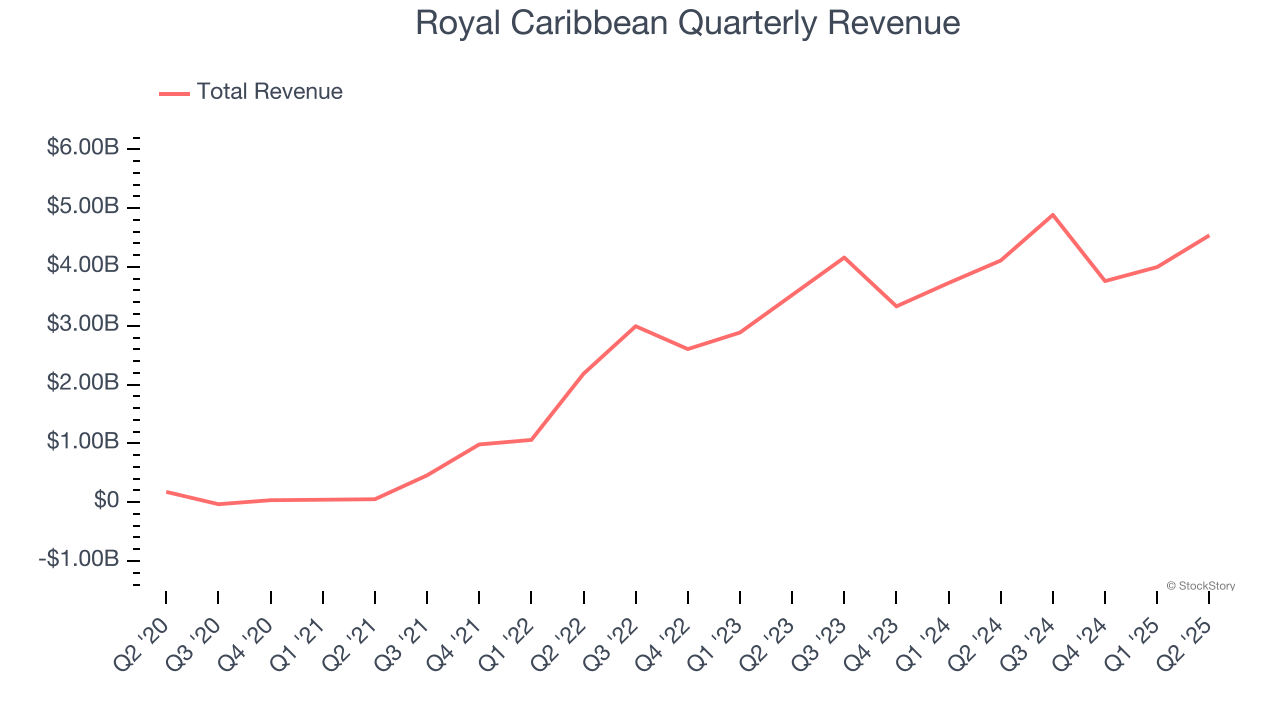

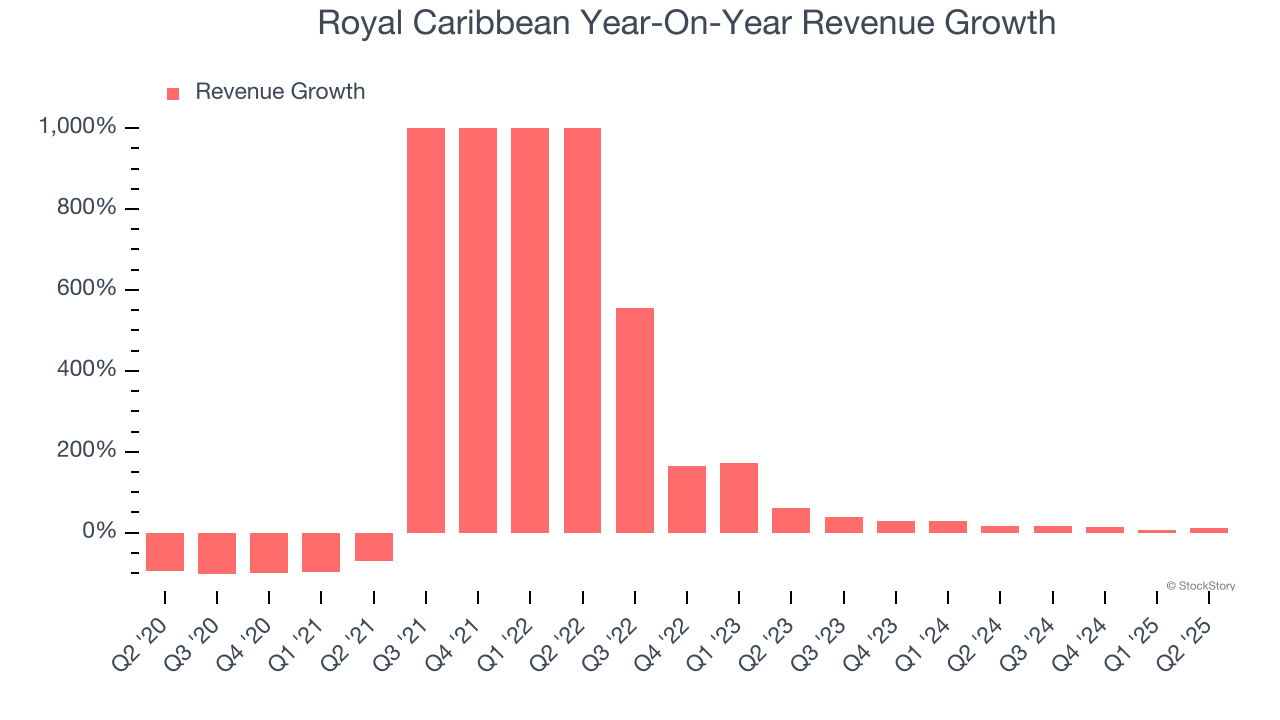

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Royal Caribbean’s sales grew at a decent 16.8% compounded annual growth rate over the last five years. Its growth was slightly above the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Royal Caribbean’s annualized revenue growth of 19.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Royal Caribbean’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

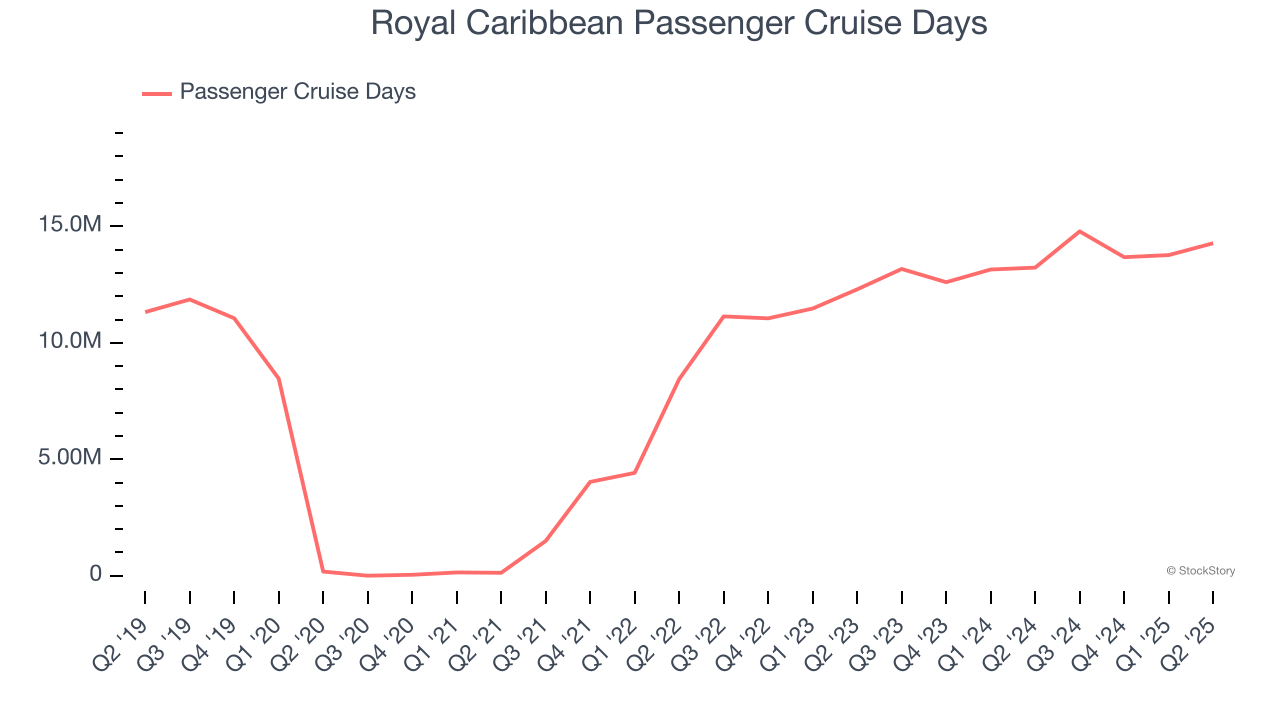

We can dig further into the company’s revenue dynamics by analyzing its number of passenger cruise days, which reached 14.28 million in the latest quarter. Over the last two years, Royal Caribbean’s passenger cruise days averaged 11% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Royal Caribbean’s year-on-year revenue growth was 10.4%, and its $4.54 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

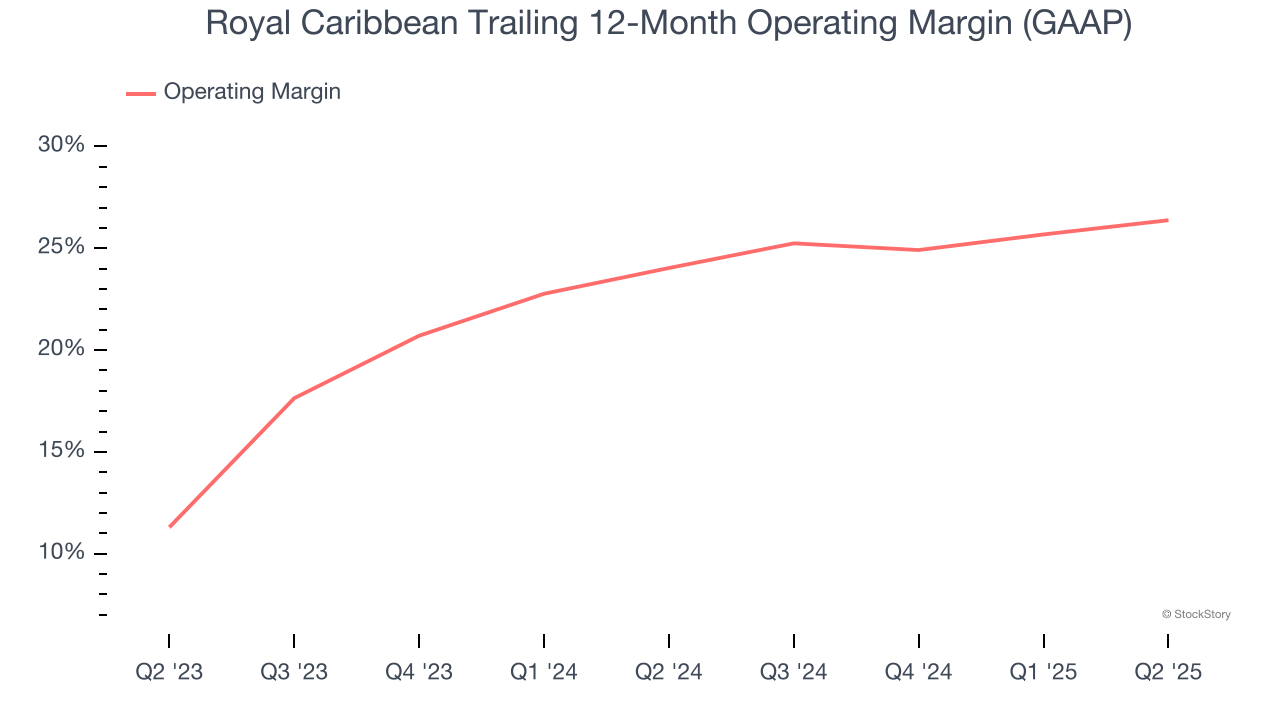

Royal Caribbean’s operating margin has risen over the last 12 months and averaged 25.3% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

This quarter, Royal Caribbean generated an operating margin profit margin of 29.3%, up 2.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

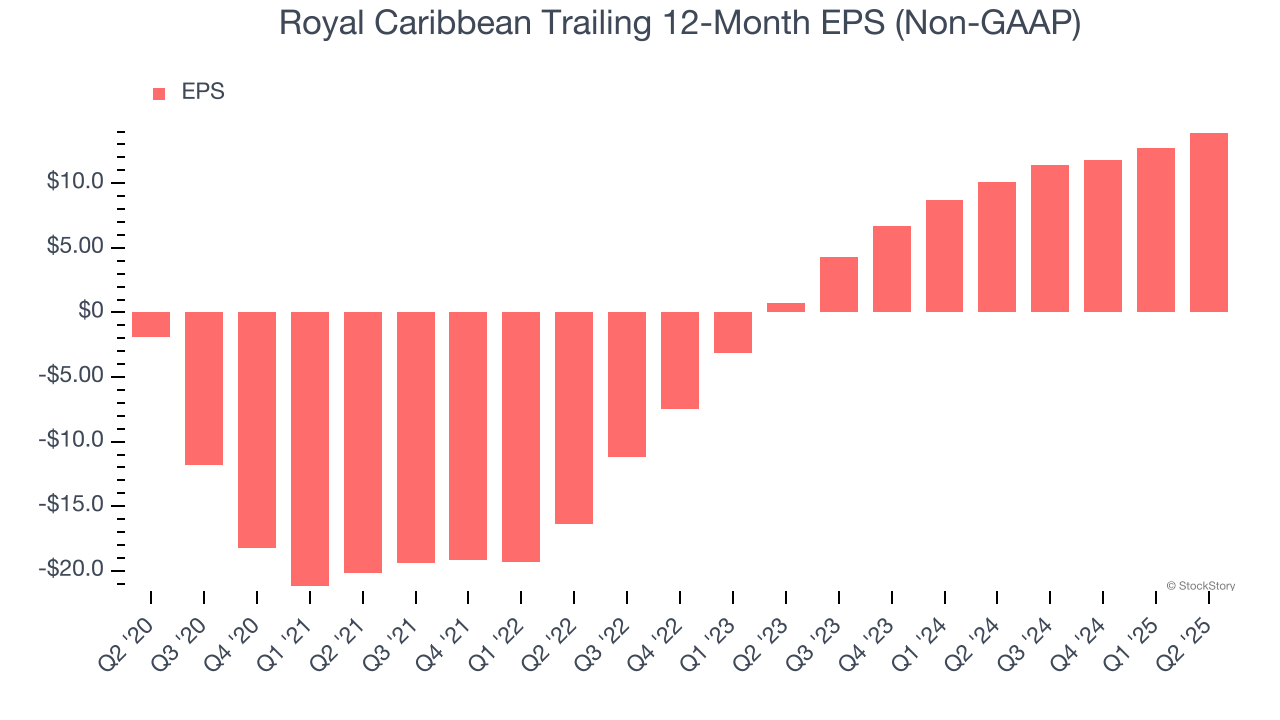

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Royal Caribbean’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q2, Royal Caribbean reported EPS at $4.38, up from $3.21 in the same quarter last year. This print beat analysts’ estimates by 7.4%. Over the next 12 months, Wall Street expects Royal Caribbean’s full-year EPS of $13.92 to grow 19.4%.

Key Takeaways from Royal Caribbean’s Q2 Results

It was encouraging to see Royal Caribbean beat analysts’ EPS and EBITDA expectations this quarter. We were also happy it raised its full-year EPS guidance. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 4.3% to $337 immediately after reporting.

Is Royal Caribbean an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.