Off-Road and powersports vehicle corporation Polaris (NYSE: PII) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales fell by 6.7% year on year to $1.85 billion. Guidance for next quarter’s revenue was better than expected at $1.7 billion at the midpoint, 1.5% above analysts’ estimates. Its non-GAAP profit of $0.40 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Polaris? Find out by accessing our full research report, it’s free.

Polaris (PII) Q2 CY2025 Highlights:

- Revenue: $1.85 billion vs analyst estimates of $1.72 billion (6.7% year-on-year decline, 7.9% beat)

- Adjusted EPS: $0.40 vs analyst estimates of -$0.02 (significant beat)

- Adjusted EBITDA: $119 million vs analyst estimates of $106.2 million (6.4% margin, 12% beat)

- Revenue Guidance for Q3 CY2025 is $1.7 billion at the midpoint, above analyst estimates of $1.67 billion

- Operating Margin: -0.7%, down from 6% in the same quarter last year

- Free Cash Flow Margin: 15.1%, up from 4% in the same quarter last year

- Market Capitalization: $2.78 billion

Company Overview

Founded in 1954, Polaris (NYSE: PII) designs and manufactures high-performance off-road vehicles, snowmobiles, and motorcycles.

Revenue Growth

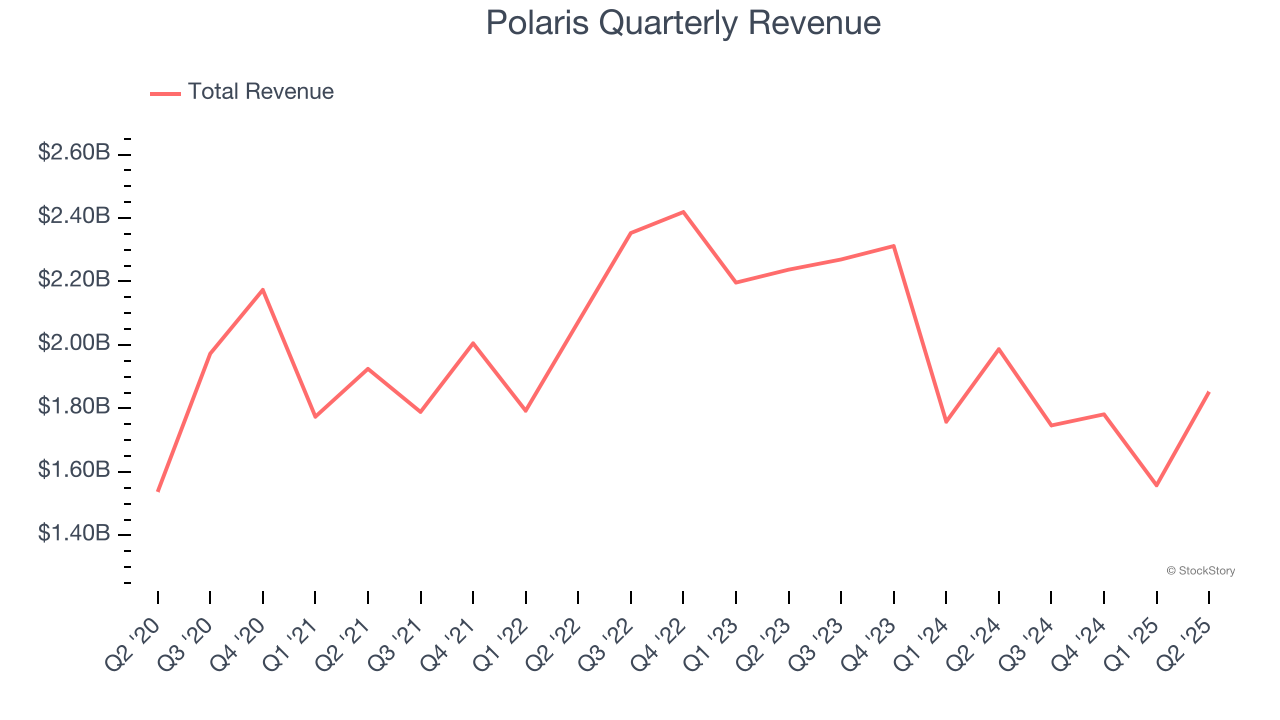

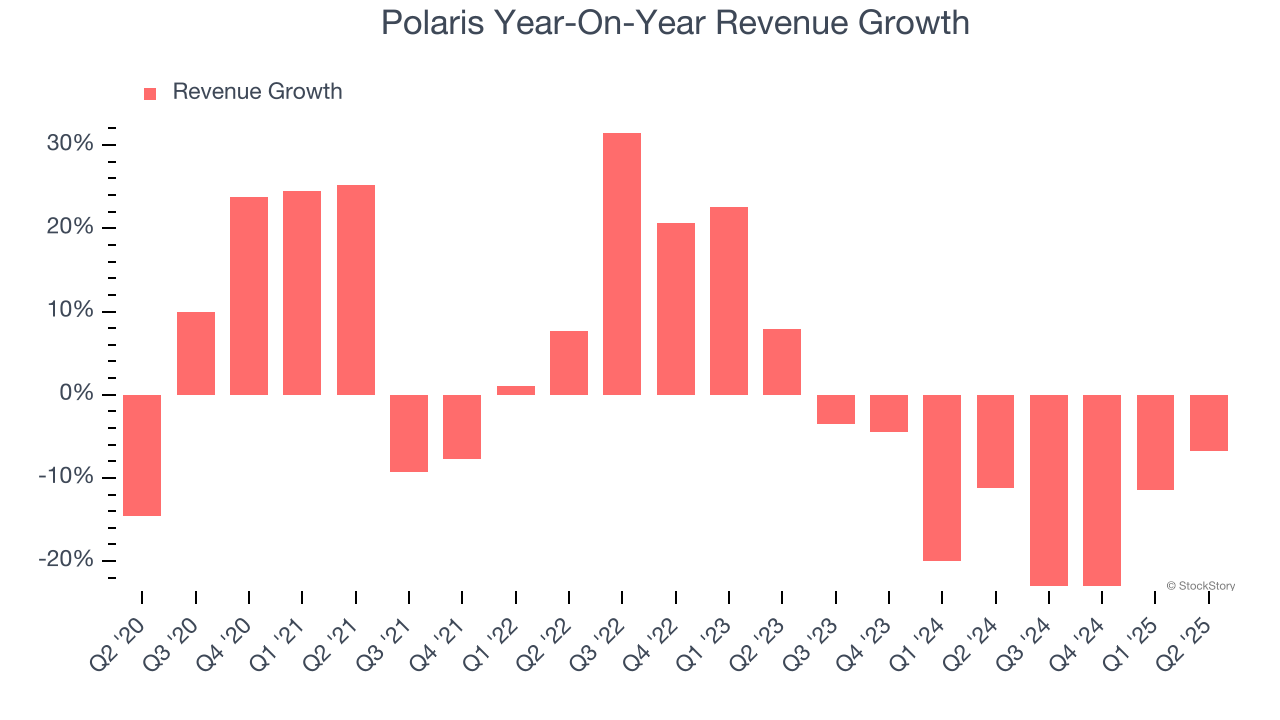

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Polaris’s sales grew at a weak 1.3% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Polaris’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 13.2% annually.

This quarter, Polaris’s revenue fell by 6.7% year on year to $1.85 billion but beat Wall Street’s estimates by 7.9%. Company management is currently guiding for a 2.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

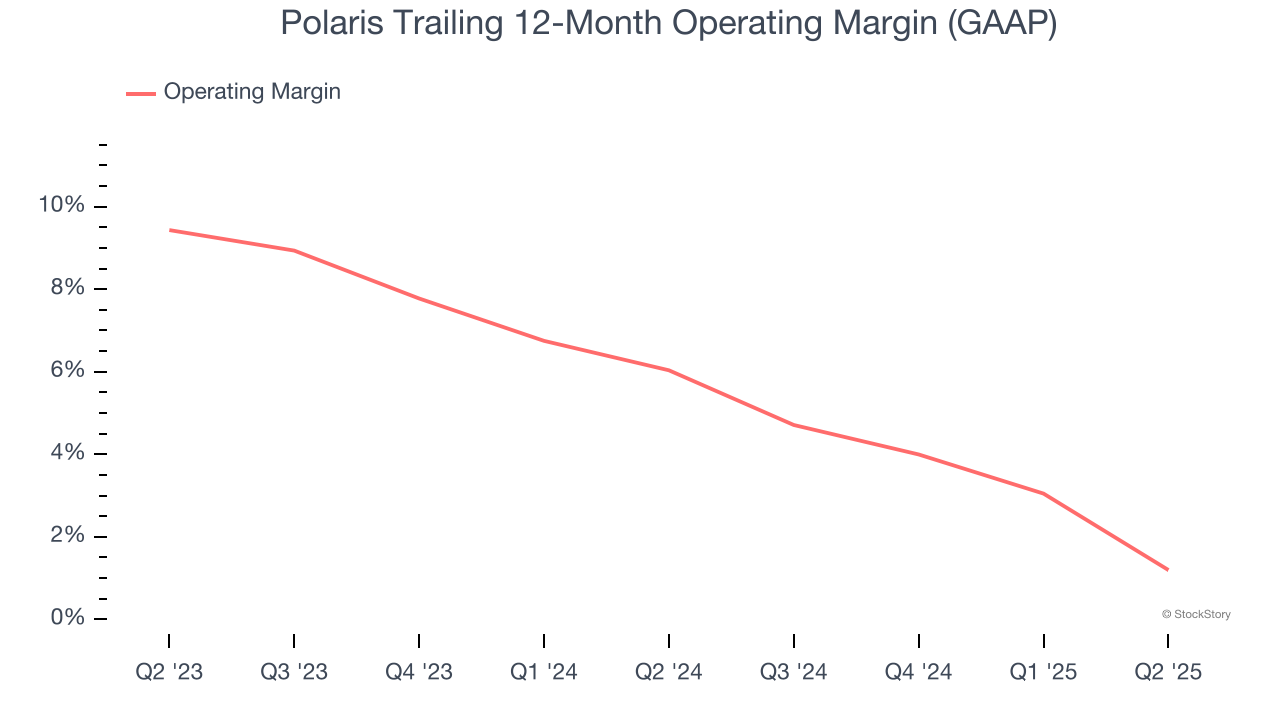

Polaris’s operating margin has shrunk over the last 12 months and averaged 3.8% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q2, Polaris’s breakeven margin was down 6.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

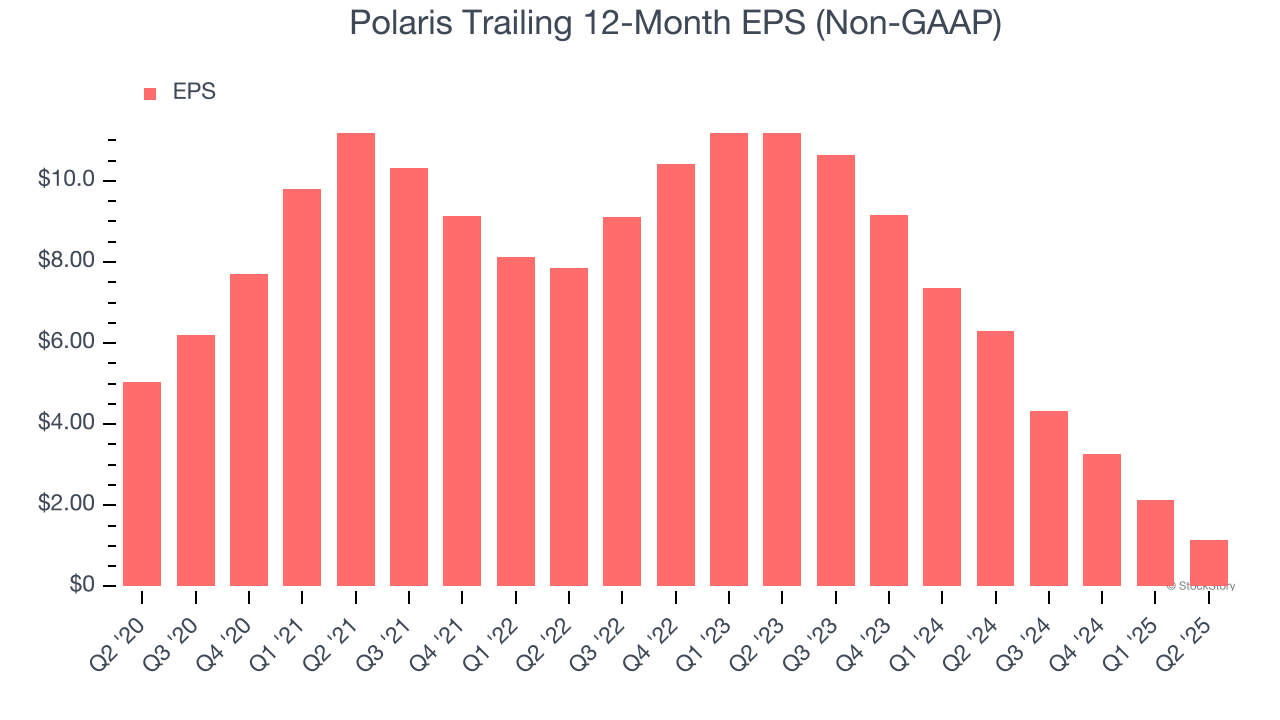

Sadly for Polaris, its EPS declined by 25.6% annually over the last five years while its revenue grew by 1.3%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q2, Polaris reported EPS at $0.40, down from $1.38 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Polaris to perform poorly. Analysts forecast its full-year EPS of $1.15 will invert to negative negative $0.57.

Key Takeaways from Polaris’s Q2 Results

We were impressed by how significantly Polaris blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 7.7% to $53.26 immediately following the results.

Polaris may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.