Home appliances manufacturer Whirlpool (NYSE: WHR) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 5.4% year on year to $3.77 billion. On the other hand, the company’s full-year revenue guidance of $15.8 billion at the midpoint came in 0.9% above analysts’ estimates. Its GAAP profit of $1.17 per share was 25.8% below analysts’ consensus estimates.

Is now the time to buy Whirlpool? Find out by accessing our full research report, it’s free.

Whirlpool (WHR) Q2 CY2025 Highlights:

- Revenue: $3.77 billion vs analyst estimates of $3.89 billion (5.4% year-on-year decline, 3% miss)

- EPS (GAAP): $1.17 vs analyst expectations of $1.58 (25.8% miss)

- Adjusted EBITDA: $284 million vs analyst estimates of $312.1 million (7.5% margin, 9% miss)

- The company reconfirmed its revenue guidance for the full year of $15.8 billion at the midpoint

- Operating Margin: 5.4%, up from 3.3% in the same quarter last year

- Free Cash Flow was -$63 million, down from $275 million in the same quarter last year

- Market Capitalization: $5.55 billion

"As expected, the second quarter continued to be impacted by competitors stockpiling Asian imports into the U.S. Despite this, we are well positioned in North America with a robust pipeline of new products, the industry's leading U.S. manufacturing footprint, and favorable housing demand fundamentals. We are confident in our long-term strategy and believe that evolving tariff policies will ultimately support domestic manufacturers."

Company Overview

Credited with introducing the first automatic washing machine, Whirlpool (NYSE: WHR) is a manufacturer of a variety of home appliances.

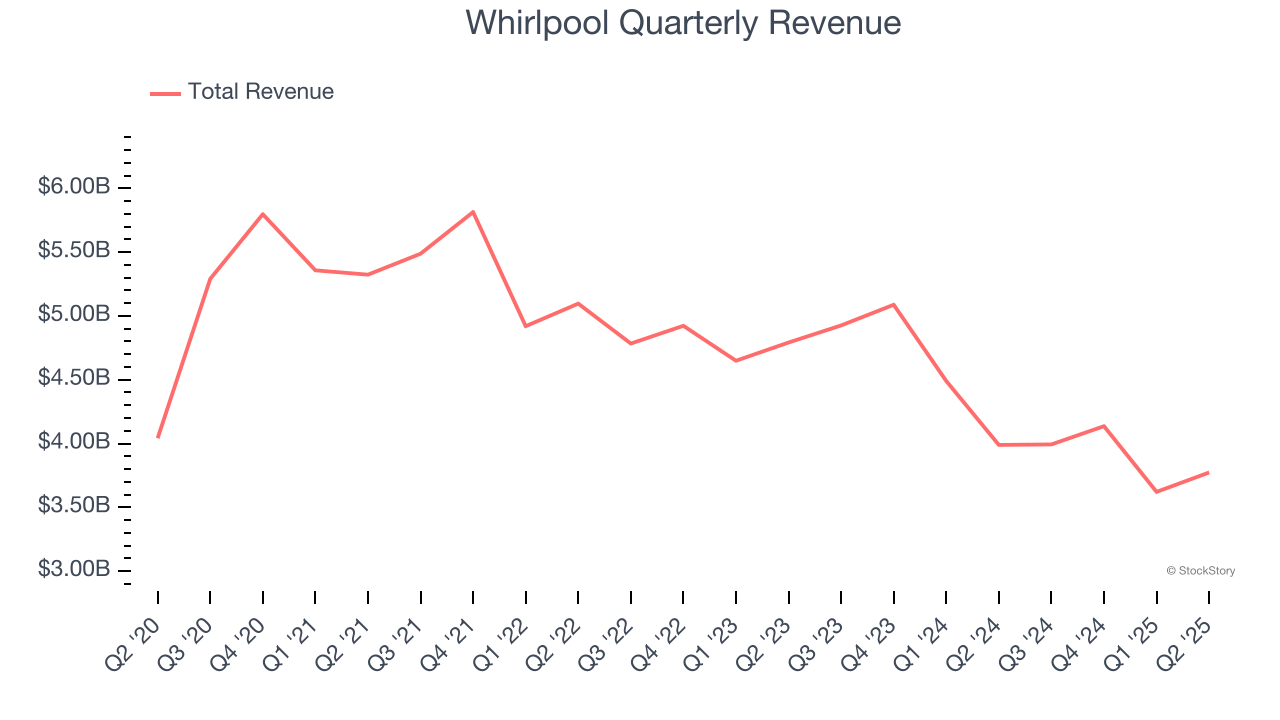

Revenue Growth

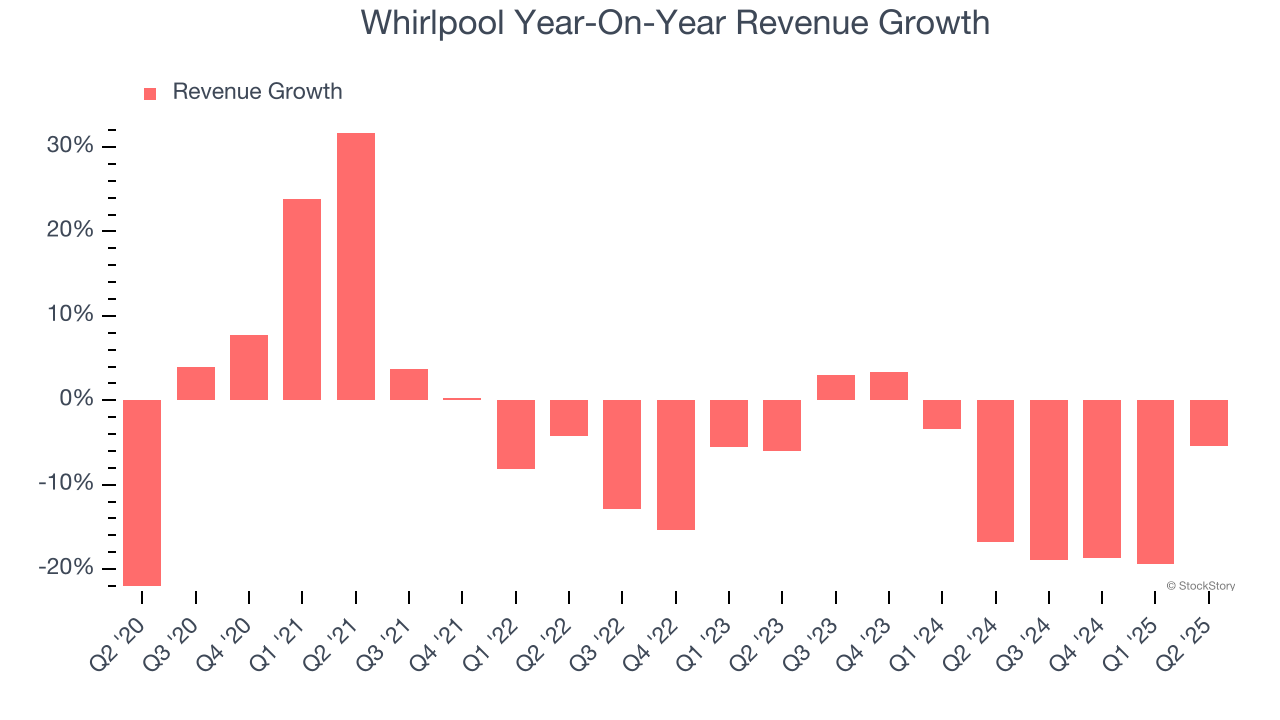

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Whirlpool’s demand was weak and its revenue declined by 3.8% per year. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Whirlpool’s recent performance shows its demand remained suppressed as its revenue has declined by 10% annually over the last two years. Whirlpool isn’t alone in its struggles as the Electrical Systems industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Whirlpool missed Wall Street’s estimates and reported a rather uninspiring 5.4% year-on-year revenue decline, generating $3.77 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

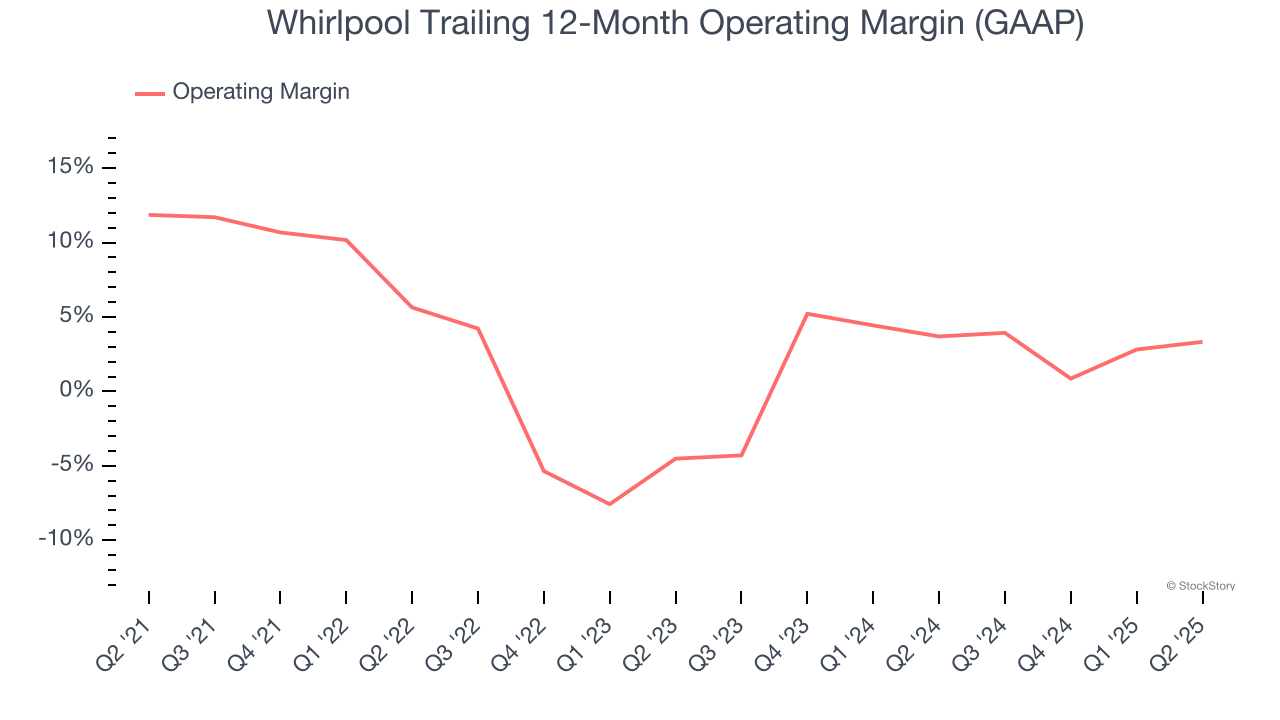

Operating Margin

Whirlpool was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Whirlpool’s operating margin decreased by 8.5 percentage points over the last five years. Whirlpool’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q2, Whirlpool generated an operating margin profit margin of 5.4%, up 2.1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

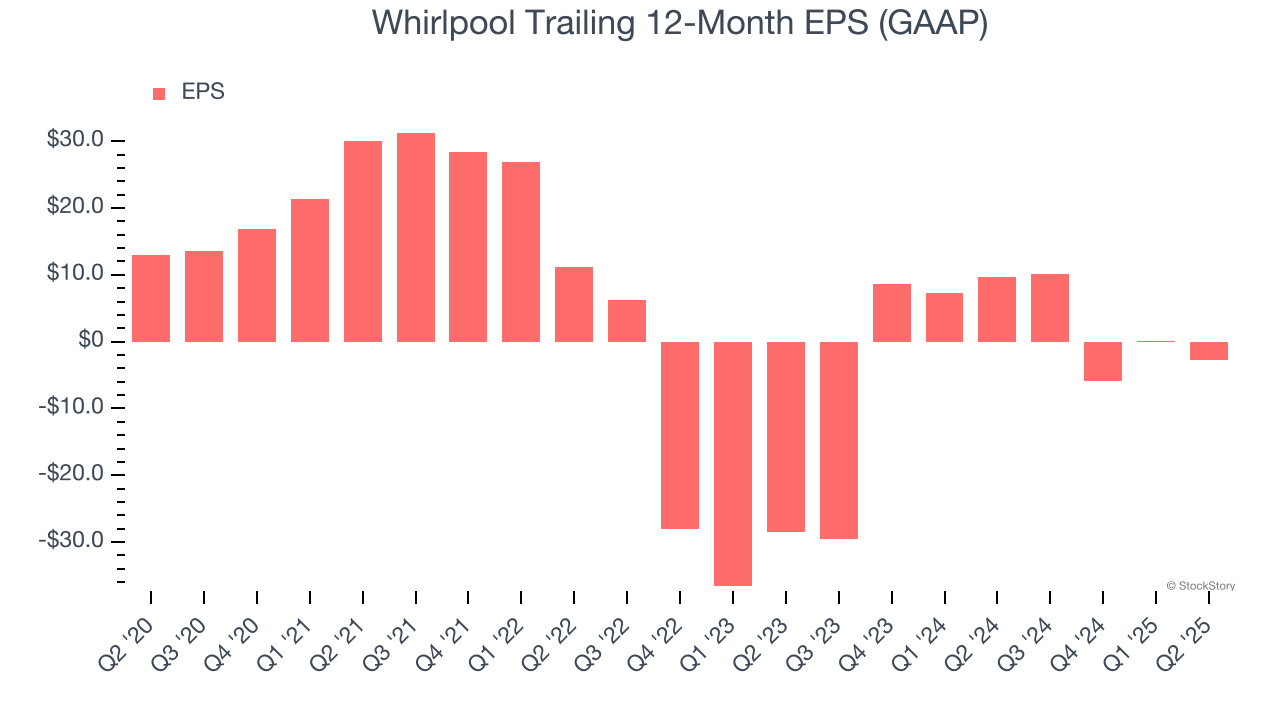

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Whirlpool, its EPS declined by 17.1% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

We can take a deeper look into Whirlpool’s earnings to better understand the drivers of its performance. As we mentioned earlier, Whirlpool’s operating margin expanded this quarter but declined by 8.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Whirlpool, its two-year annual EPS growth of 69.3% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q2, Whirlpool reported EPS at $1.17, down from $3.98 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Whirlpool’s full-year EPS of negative $2.68 will flip to positive $9.77.

Key Takeaways from Whirlpool’s Q2 Results

Whirlpool missed on revenue, EBITDA, and EPS this quarter. Overall, this was a very weak quarter. The stock traded down 12.8% to $85.31 immediately following the results.

Whirlpool underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.