As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the non-discretionary retail industry, including Grocery Outlet (NASDAQ: GO) and its peers.

Food is non-discretionary because it's essential for life (maybe not those Oreos?), so consumers naturally need a place to buy it. Selling food is a notoriously tough business, however, as the costs of procuring and transporting oftentimes perishable products and operating stores fit to sell those products can be high. Competition is also fierce because the alternatives are numerous. While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of the product. Still, we could be one startup or innovation away from a paradigm shift.

The 8 non-discretionary retail stocks we track reported a strong Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 37.4% above.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

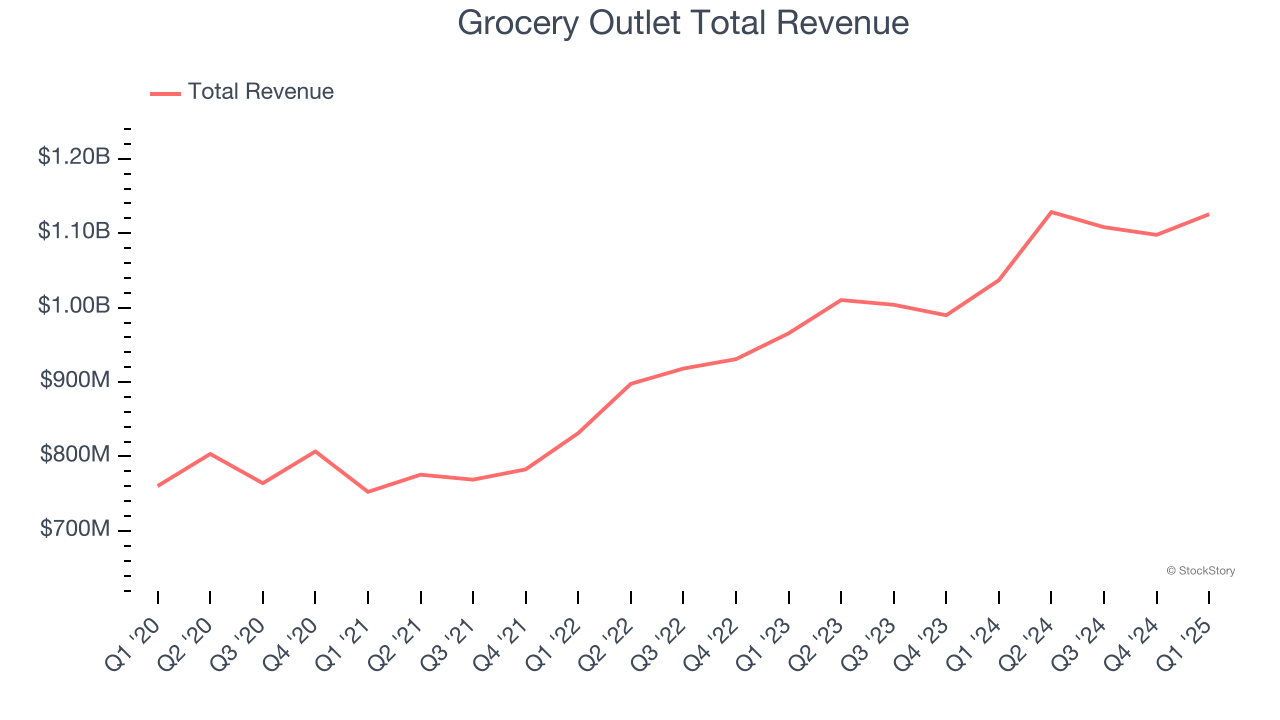

Grocery Outlet (NASDAQ: GO)

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ: GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

Grocery Outlet reported revenues of $1.13 billion, up 8.5% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS and EBITDA estimates.

“We delivered solid first quarter results, with comp-store sales and gross margins slightly ahead of our outlook, driven by traffic growth and tighter inventory management,” said Jason Potter, President and CEO of Grocery Outlet.

Grocery Outlet pulled off the highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 14.6% since reporting and currently trades at $13.92.

Is now the time to buy Grocery Outlet? Access our full analysis of the earnings results here, it’s free.

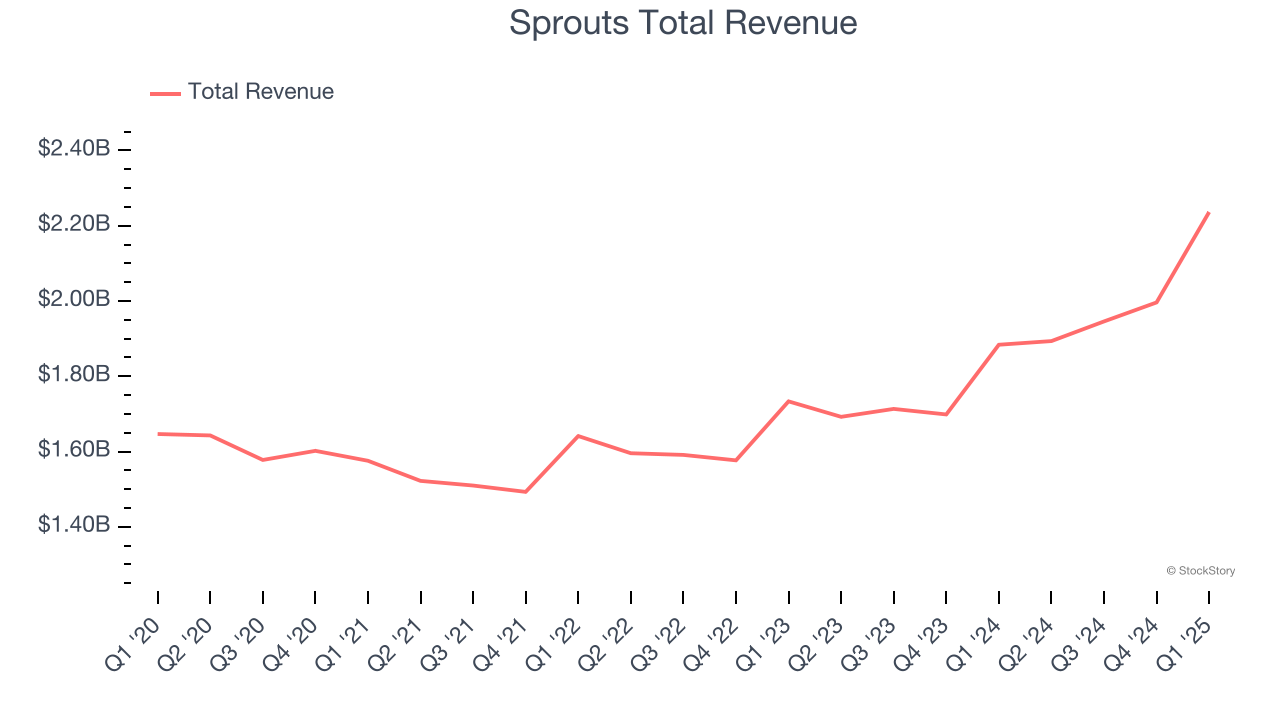

Best Q1: Sprouts (NASDAQ: SFM)

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ: SFM) is a grocery store chain emphasizing natural and organic products.

Sprouts reported revenues of $2.24 billion, up 18.7% year on year, outperforming analysts’ expectations by 1.4%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Sprouts delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.5% since reporting. It currently trades at $164.70.

Is now the time to buy Sprouts? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Target (NYSE: TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE: TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Target reported revenues of $23.85 billion, down 2.8% year on year, falling short of analysts’ expectations by 2%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

Target delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 6.8% since the results and currently trades at $104.90.

Read our full analysis of Target’s results here.

Dollar Tree (NASDAQ: DLTR)

A treasure hunt because there’s no guarantee of consistent product selection, Dollar Tree (NASDAQ: DLTR) is a discount retailer that sells general merchandise and select packaged food at extremely low prices.

Dollar Tree reported revenues of $4.64 billion, up 11.3% year on year. This number beat analysts’ expectations by 2.4%. It was a very strong quarter as it also logged revenue guidance for next quarter exceeding analysts’ expectations and full-year EPS guidance beating analysts’ expectations.

Dollar Tree delivered the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 12.1% since reporting and currently trades at $108.30.

Read our full, actionable report on Dollar Tree here, it’s free.

Dollar General (NYSE: DG)

Appealing to the budget-conscious consumer, Dollar General (NYSE: DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Dollar General reported revenues of $10.44 billion, up 5.3% year on year. This result surpassed analysts’ expectations by 1.7%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

The stock is up 16.1% since reporting and currently trades at $112.75.

Read our full, actionable report on Dollar General here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.