Over the past six months, Banc of California’s stock price fell to $13.65. Shareholders have lost 11.1% of their capital, which is disappointing considering the S&P 500 has climbed by 1.9%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Banc of California, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Banc of California Not Exciting?

Even though the stock has become cheaper, we're cautious about Banc of California. Here are three reasons why BANC doesn't excite us and a stock we'd rather own.

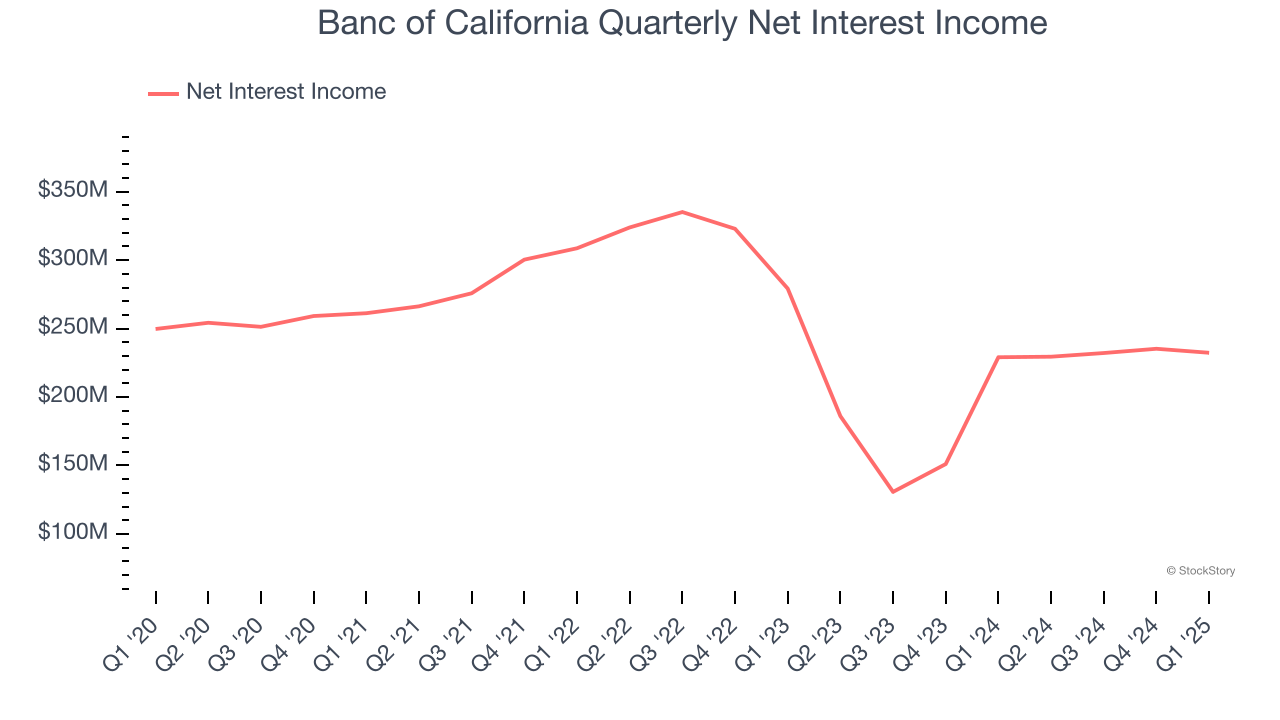

1. Declining Net Interest Income Reflects Weakness

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

Banc of California’s net interest income has declined by 2.4% annually over the last four years, much worse than the broader bank industry.

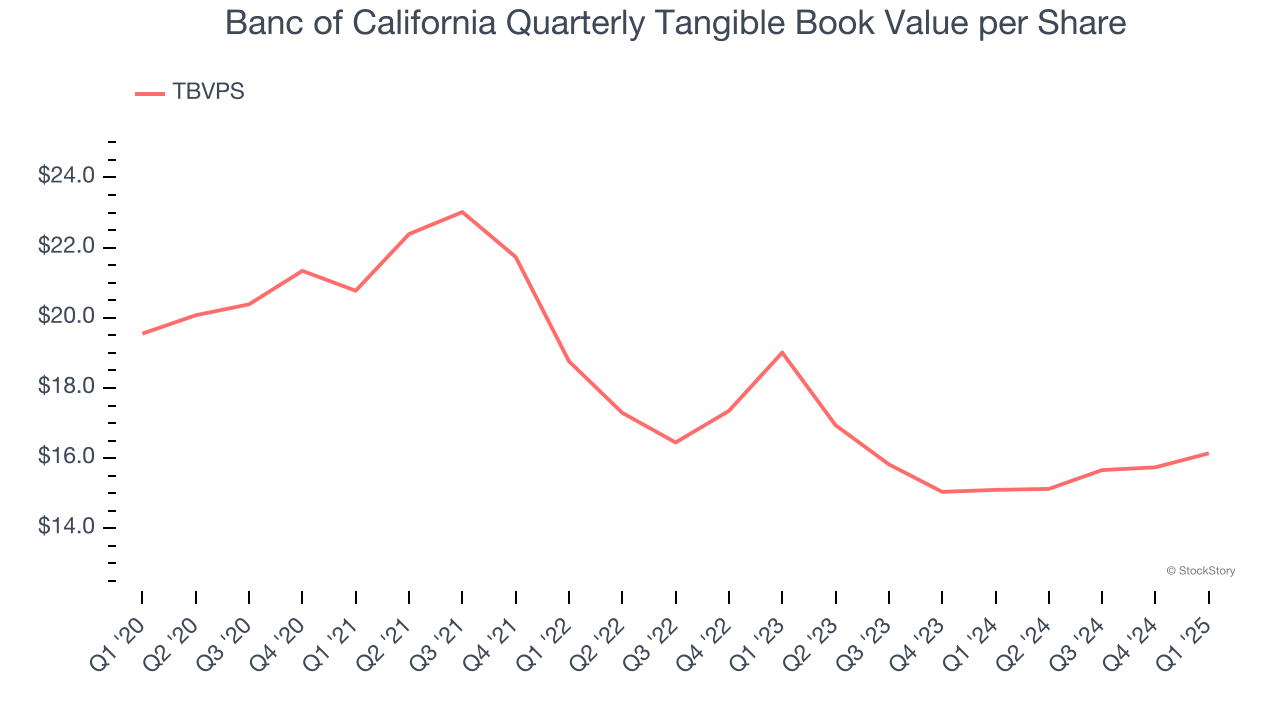

2. Declining TBVPS Reflects Erosion of Asset Value

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

Disappointingly for investors, Banc of California’s TBVPS continued freefalling over the past two years as TBVPS declined at a -7.9% annual clip (from $19.01 to $16.14 per share).

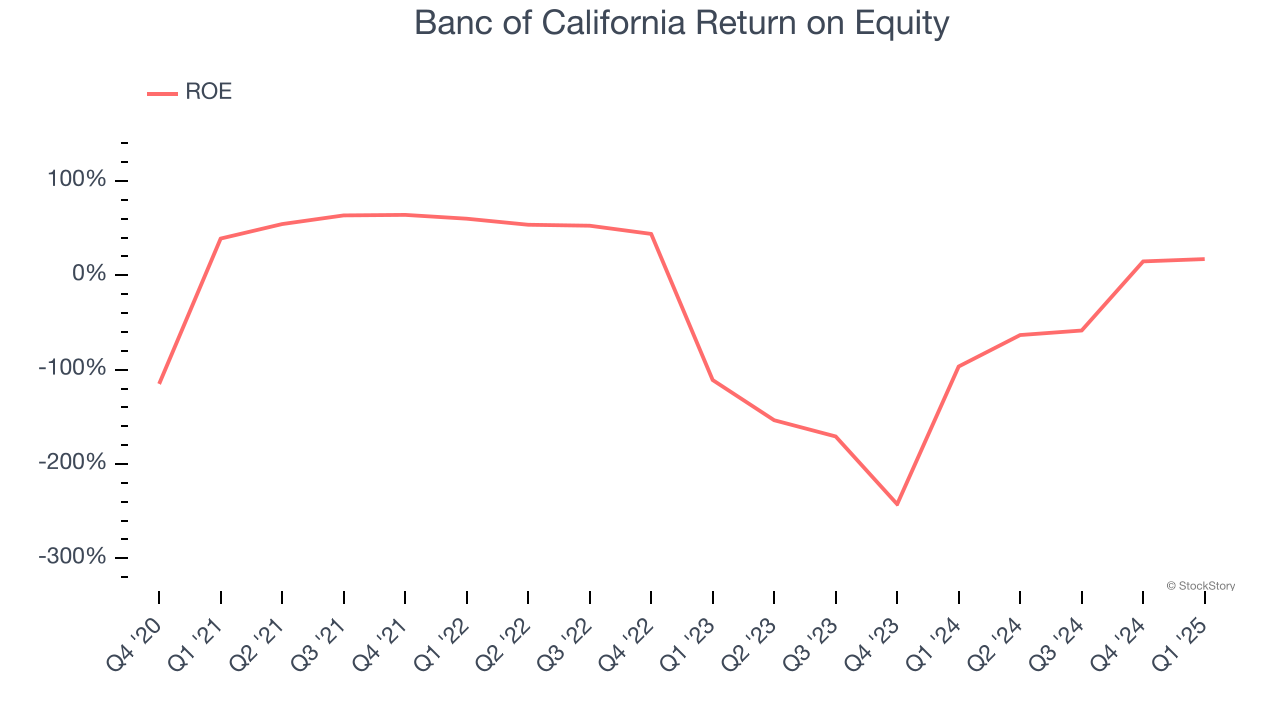

3. Previous Growth Initiatives Have Lost Money

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity — a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Banc of California has averaged an ROE of negative 4.6%, a bad result not only in absolute terms but also relative to the majority of banks putting up 7.5%+. It also shows that Banc of California has little to no competitive moat.

Final Judgment

Banc of California isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 0.7× forward P/B (or $13.65 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Banc of California

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.