Over the last six months, Preferred Bank’s shares have sunk to $80.84, producing a disappointing 11.4% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy PFBC? Find out in our full research report, it’s free.

Why Does PFBC Stock Spark Debate?

Founded in 1991 with a focus on serving the Pacific Rim community in Southern California, Preferred Bank (NASDAQ: PFBC) is a commercial bank that provides banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, and high net worth individuals.

Two Positive Attributes:

1. Net Interest Income Drives Additional Growth Opportunities

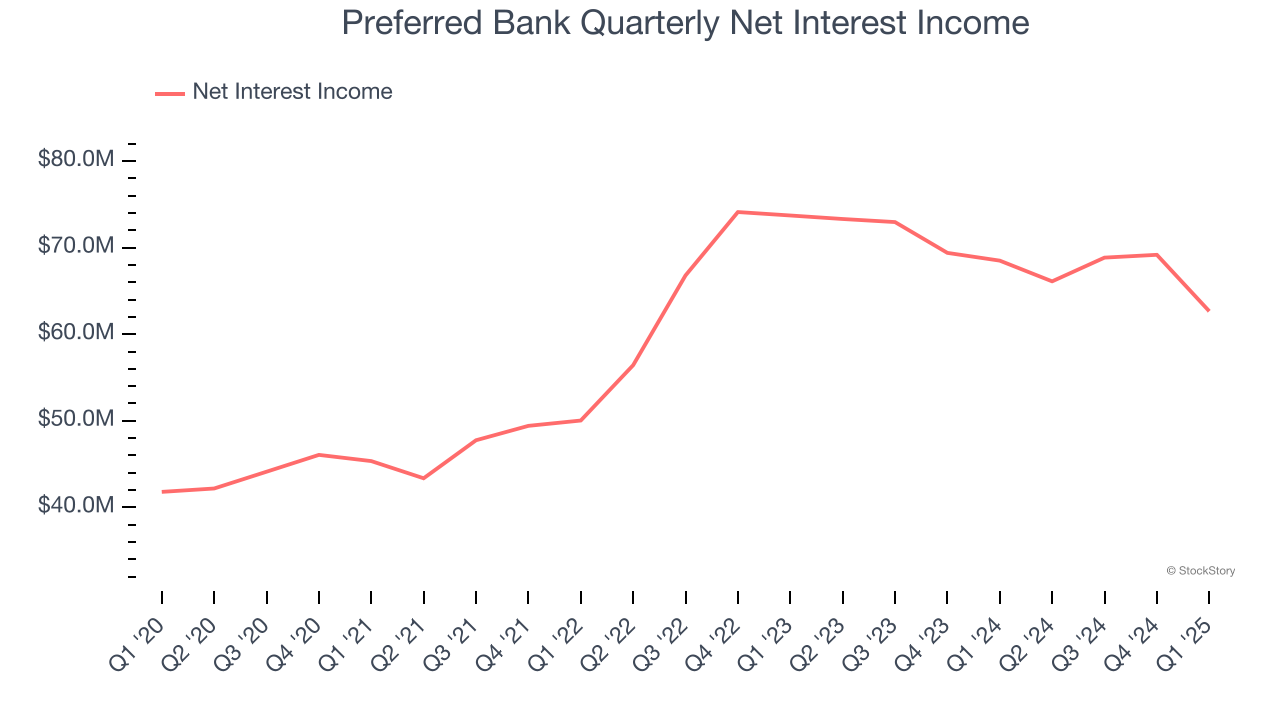

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Preferred Bank’s net interest income has grown at a 10.7% annualized rate over the last four years, a step above the broader bank industry.

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Preferred Bank’s EPS grew at an astounding 13.4% compounded annual growth rate over the last five years, higher than its 10.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Net Interest Margin Dropping

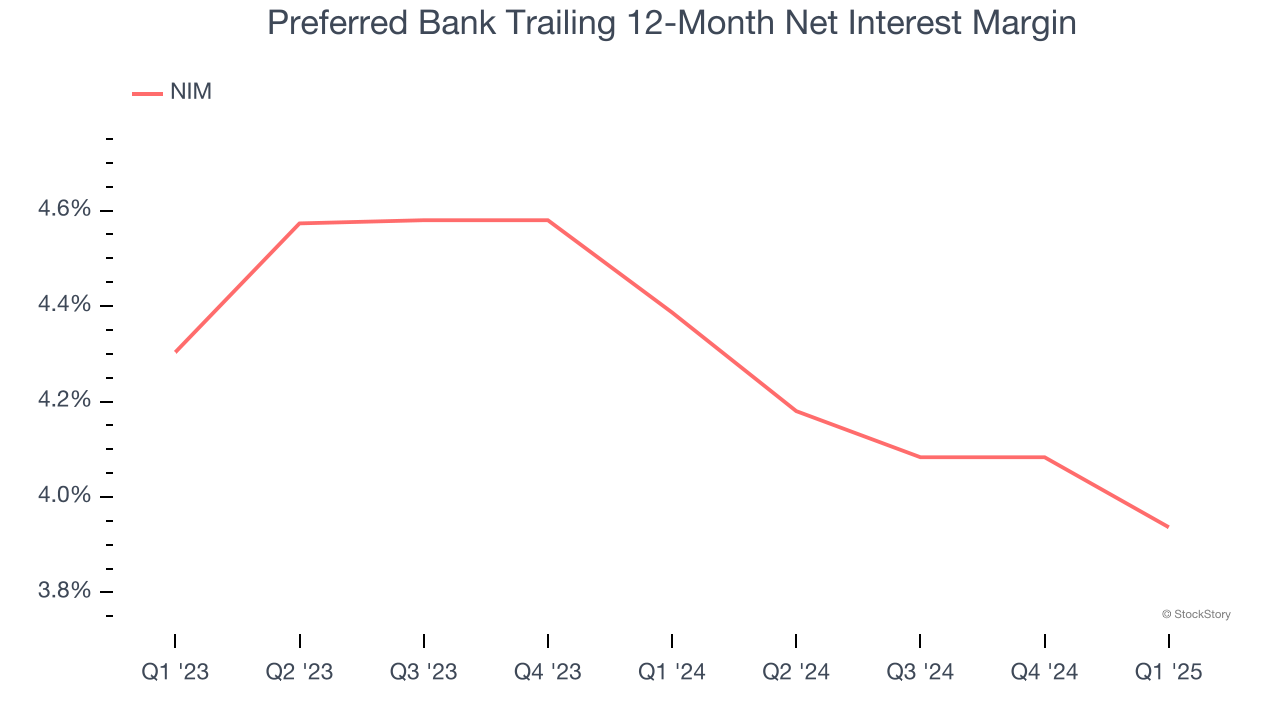

Net interest margin represents how much a bank earns in relation to its outstanding loans. It’s one of the most important metrics to track because it shows how a bank’s loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, Preferred Bank’s net interest margin averaged 4.2%. However, its margin contracted by 36.7 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean Preferred Bank either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition. One caveat is that net interest margins can also decrease to reflect lower default risk if banks begin making more conservative loans.

Final Judgment

Preferred Bank’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 1.3× forward P/B (or $80.84 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Preferred Bank

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.