Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at WillScot Mobile Mini (NASDAQ: WSC) and the best and worst performers in the construction and maintenance services industry.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 12 construction and maintenance services stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 5.9%.

Luckily, construction and maintenance services stocks have performed well with share prices up 19.4% on average since the latest earnings results.

WillScot Mobile Mini (NASDAQ: WSC)

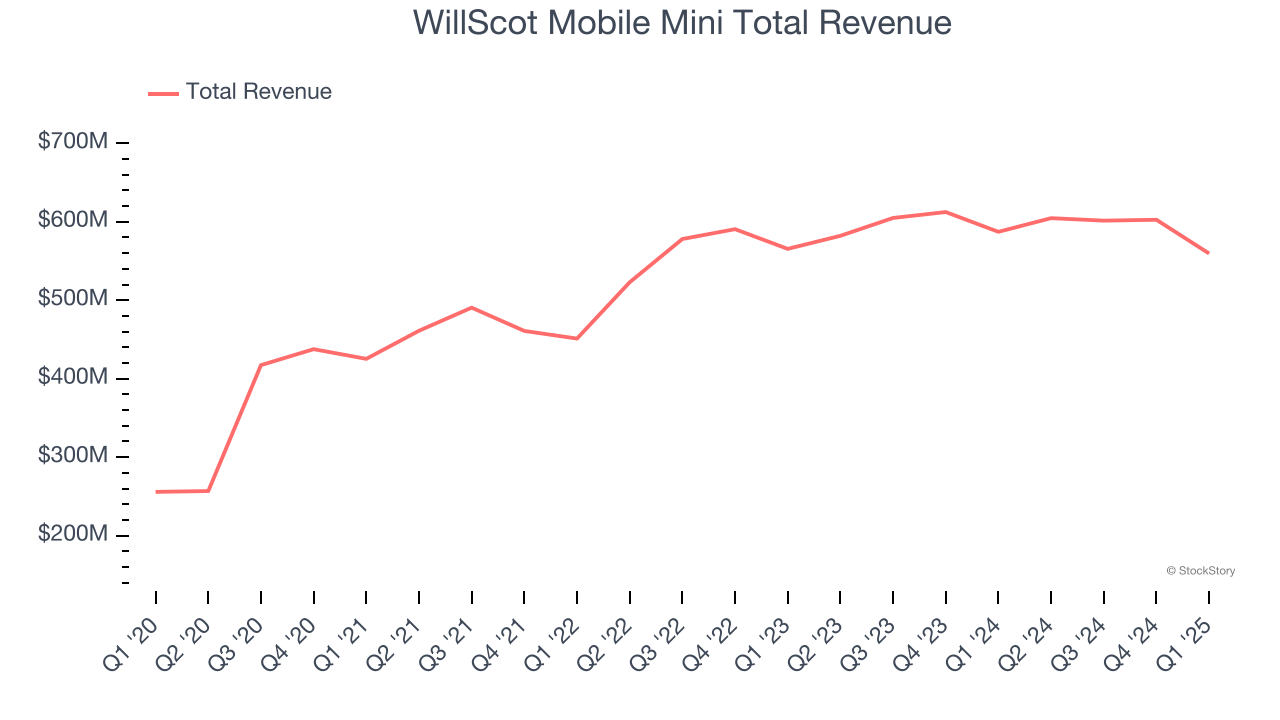

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ: WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

WillScot Mobile Mini reported revenues of $559.6 million, down 4.7% year on year. This print fell short of analysts’ expectations by 0.5%. Overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and a miss of analysts’ Leasing revenue estimates.

Brad Soultz, Chief Executive Officer of WillScot, commented, “Our first quarter financial results were consistent with our expectations and support reaffirming our previously issued full year 2025 outlook. We delivered $145 million of Adjusted Free Cash Flow at a 26% margin, returned $45 million to shareholders, and progressed our acquisition pipeline. In addition to our focus on day-to-day execution, we continued investing in the business to support our medium-to-longer term margin expansion and organic revenue growth plans discussed at our Investor Day on March 7, 2025."

WillScot Mobile Mini delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 16.1% since reporting and currently trades at $29.70.

Read our full report on WillScot Mobile Mini here, it’s free.

Best Q1: Great Lakes Dredge & Dock (NASDAQ: GLDD)

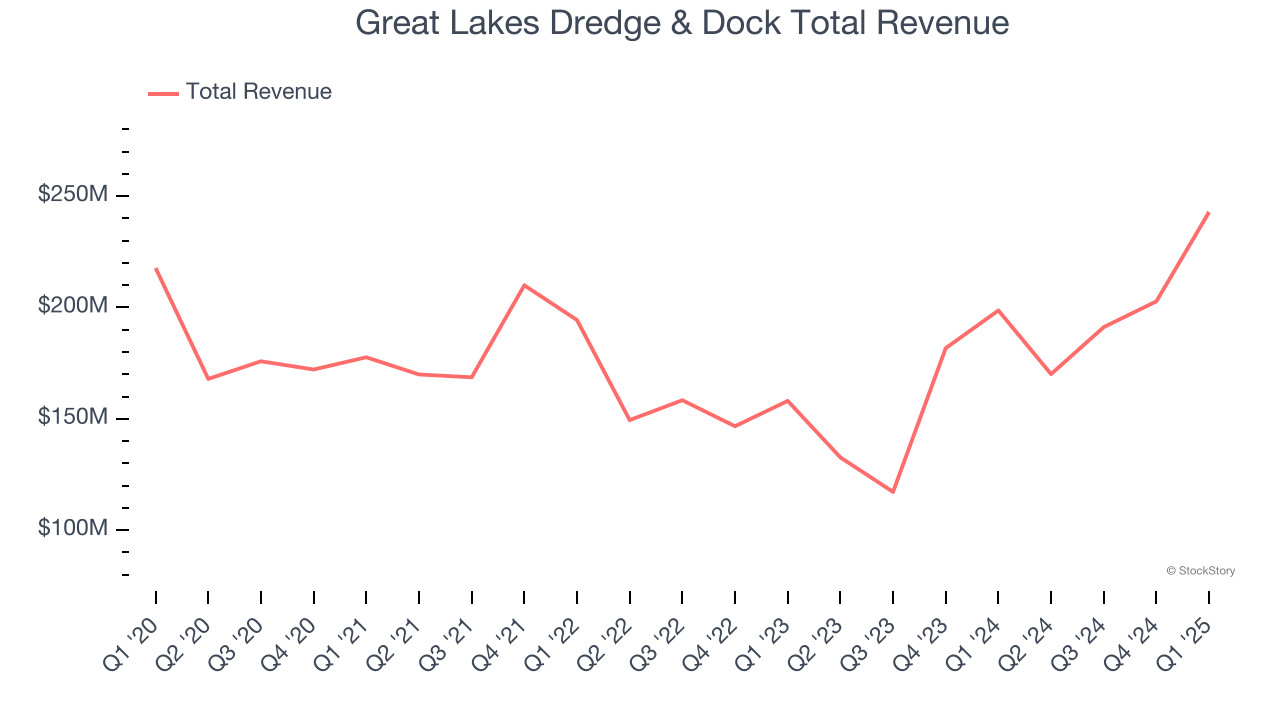

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ: GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Great Lakes Dredge & Dock reported revenues of $242.9 million, up 22.3% year on year, outperforming analysts’ expectations by 17.5%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Great Lakes Dredge & Dock achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 20.7% since reporting. It currently trades at $11.53.

Is now the time to buy Great Lakes Dredge & Dock? Access our full analysis of the earnings results here, it’s free.

Matrix Service (NASDAQ: MTRX)

Founded in Oklahoma, Matrix Service (NASDAQ: MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Matrix Service reported revenues of $200.2 million, up 20.6% year on year, falling short of analysts’ expectations by 6.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Matrix Service delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. Interestingly, the stock is up 3.3% since the results and currently trades at $12.64.

Read our full analysis of Matrix Service’s results here.

Primoris (NYSE: PRIM)

Listed on the NASDAQ in 2008, Primoris (NYSE: PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Primoris reported revenues of $1.65 billion, up 16.7% year on year. This number surpassed analysts’ expectations by 10.6%. It was a stunning quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 10.5% since reporting and currently trades at $74.05.

Read our full, actionable report on Primoris here, it’s free.

APi (NYSE: APG)

Started in 1926 as an insulation contractor, APi (NYSE: APG) provides life safety solutions and specialty services for buildings and infrastructure.

APi reported revenues of $1.72 billion, up 7.4% year on year. This result beat analysts’ expectations by 4.7%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ organic revenue estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The stock is up 20.1% since reporting and currently trades at $45.37.

Read our full, actionable report on APi here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.