Athletic apparel retailer Lululemon (NASDAQ: LULU) announced better-than-expected revenue in Q4 CY2024, with sales up 12.7% year on year to $3.61 billion. On the other hand, next quarter’s revenue guidance of $2.35 billion was less impressive, coming in 2.1% below analysts’ estimates. Its GAAP profit of $6.14 per share was 4.6% above analysts’ consensus estimates.

Is now the time to buy Lululemon? Find out by accessing our full research report, it’s free.

Lululemon (LULU) Q4 CY2024 Highlights:

- Revenue: $3.61 billion vs analyst estimates of $3.58 billion (12.7% year-on-year growth, 0.8% beat)

- EPS (GAAP): $6.14 vs analyst estimates of $5.87 (4.6% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $11.23 billion at the midpoint, missing analyst estimates by 1% and implying 6% growth (vs 9.8% in FY2024)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $15.05 at the midpoint, missing analyst estimates by 2.3%

- Operating Margin: 28.9%, in line with the same quarter last year

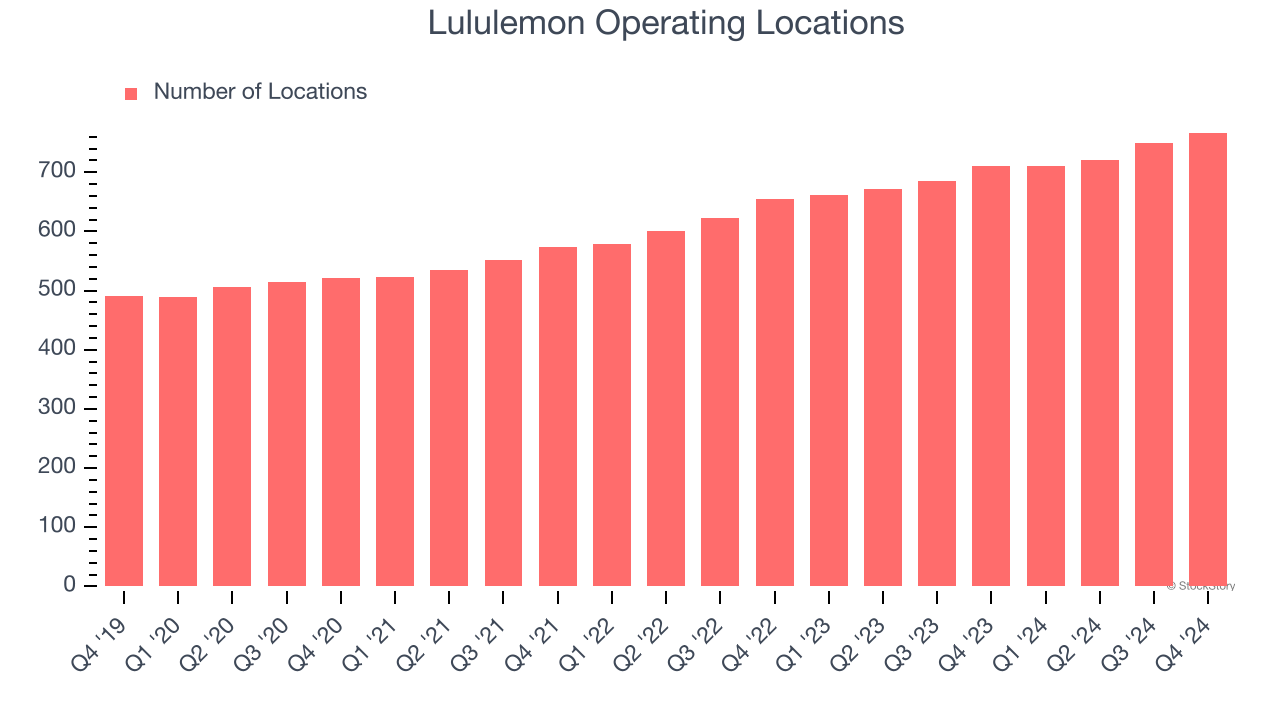

- Locations: 767 at quarter end, up from 711 in the same quarter last year

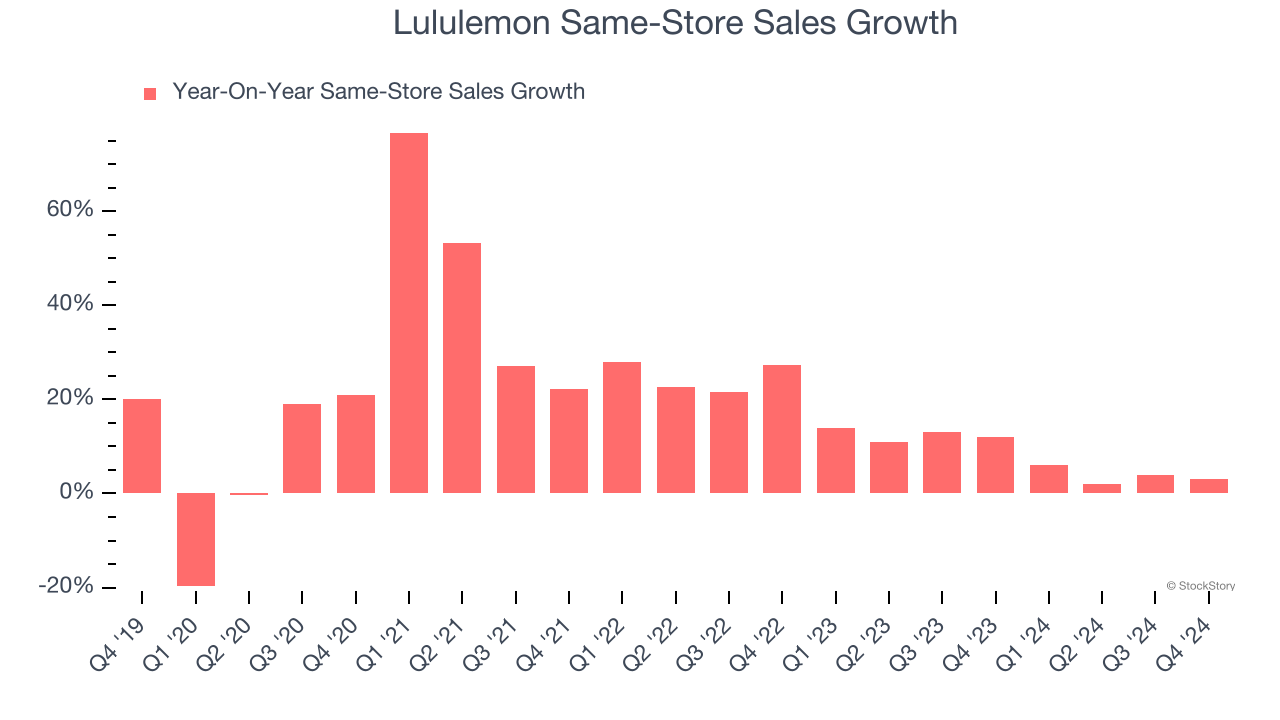

- Same-Store Sales rose 3% year on year (12% in the same quarter last year)

- Market Capitalization: $41.01 billion

Company Overview

Originally serving yogis and hockey players, Lululemon (NASDAQ: LULU) is a designer, distributor, and retailer of athletic apparel for men and women.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $10.59 billion in revenue over the past 12 months, Lululemon is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

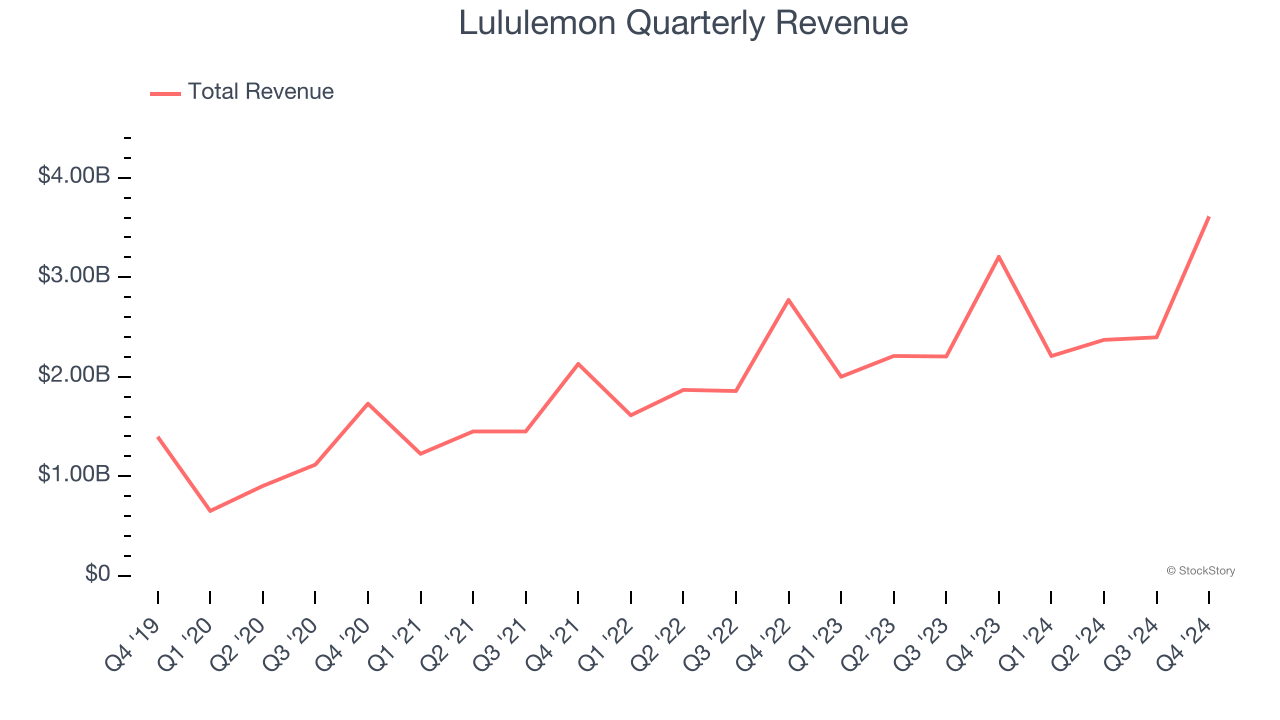

As you can see below, Lululemon’s sales grew at an exceptional 21.6% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, Lululemon reported year-on-year revenue growth of 12.7%, and its $3.61 billion of revenue exceeded Wall Street’s estimates by 0.8%. Company management is currently guiding for a 6.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is attractive given its scale and suggests the market sees success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

Lululemon operated 767 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 9.6% annual growth, much faster than the broader consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Lululemon has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 8.1%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Lululemon multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Lululemon’s same-store sales rose 3% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Lululemon can reaccelerate growth.

Key Takeaways from Lululemon’s Q4 Results

It was good to see Lululemon narrowly top analysts’ gross margin expectations this quarter. We were also happy its revenue and EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue and EPS guidance fell short, making this a weaker quarter. The stock traded down 6.8% to $318.35 immediately following the results.

Lululemon’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.