Office furniture manufacturer Steelcase (NYSE: SCS) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 1.7% year on year to $788 million. The company expects next quarter’s revenue to be around $772.5 million, coming in 3.7% above analysts’ estimates. Its non-GAAP profit of $0.26 per share was 26.2% above analysts’ consensus estimates.

Is now the time to buy Steelcase? Find out by accessing our full research report, it’s free.

Steelcase (SCS) Q1 CY2025 Highlights:

- Revenue: $788 million vs analyst estimates of $790.9 million (1.7% year-on-year growth, in line)

- Adjusted EPS: $0.26 vs analyst estimates of $0.21 (26.2% beat)

- Adjusted EBITDA: $40.4 million vs analyst estimates of $53.17 million (5.1% margin, 24% miss)

- Revenue Guidance for Q2 CY2025 is $772.5 million at the midpoint, above analyst estimates of $745.3 million

- Adjusted EPS guidance for Q2 CY2025 is $0.15 at the midpoint, above analyst estimates of $0.12

- Operating Margin: 1.2%, down from 3.1% in the same quarter last year

- Market Capitalization: $1.20 billion

Company Overview

Founded in 1912 when metal office furniture was replacing wooden alternatives, Steelcase (NYSE: SCS) is a global office furniture manufacturer that designs and produces workplace solutions including desks, chairs, architectural products, and services.

Office & Commercial Furniture

The sector faces a tepid outlook as workplace dynamics continue to evolve. Hybrid work means that enterprise demand for office furniture is lower. Consumer demand for the same products likely will not offset the loss from enterprises, as individual workers tend to have less space and need for the sector's wares. The Trump administration also possesses a high willingness to impose tariffs on key partners, which could result in retaliatory actions, all of which could pressure those selling furniture that may feature components or labor from overseas. Lastly, the COVID-19 pandemic showed that there is always a risk that something disrupts supply chains, and companies need contingency plans for this.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.17 billion in revenue over the past 12 months, Steelcase is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

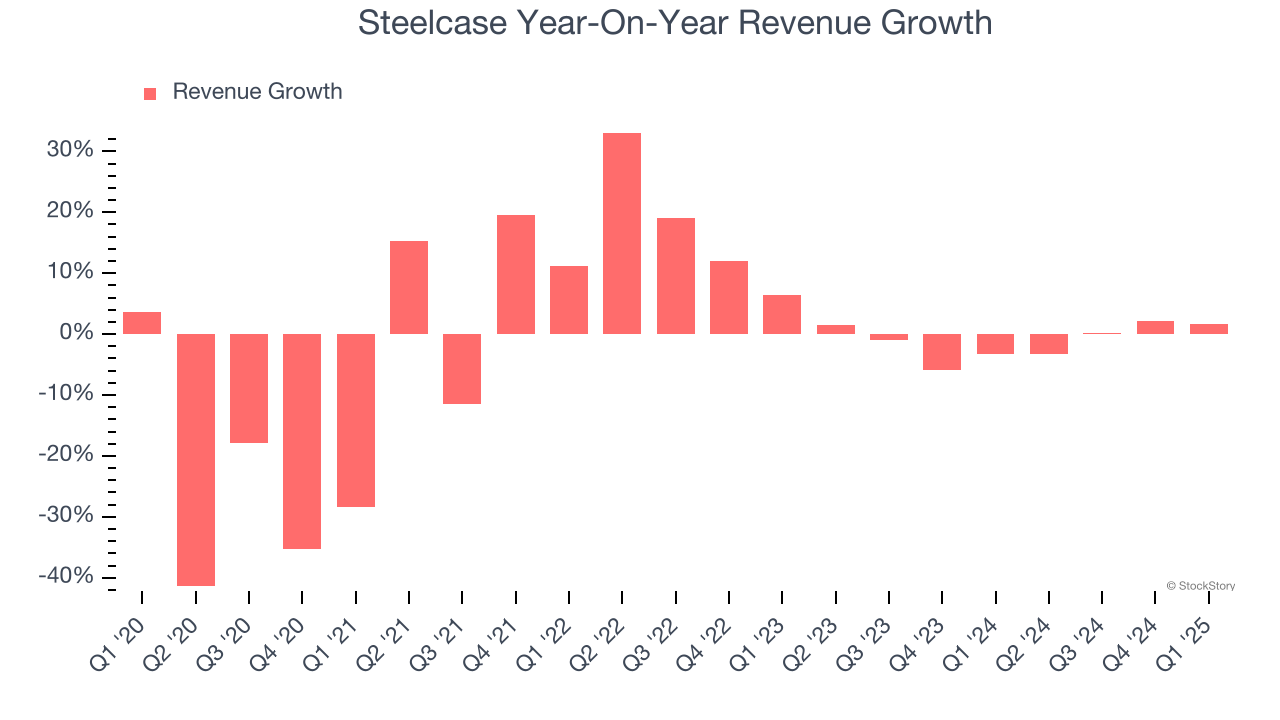

As you can see below, Steelcase’s revenue declined by 3.2% per year over the last five years, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Steelcase’s annualized revenue declines of 1% over the last two years suggest its demand continued shrinking.

This quarter, Steelcase grew its revenue by 1.7% year on year, and its $788 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 6.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

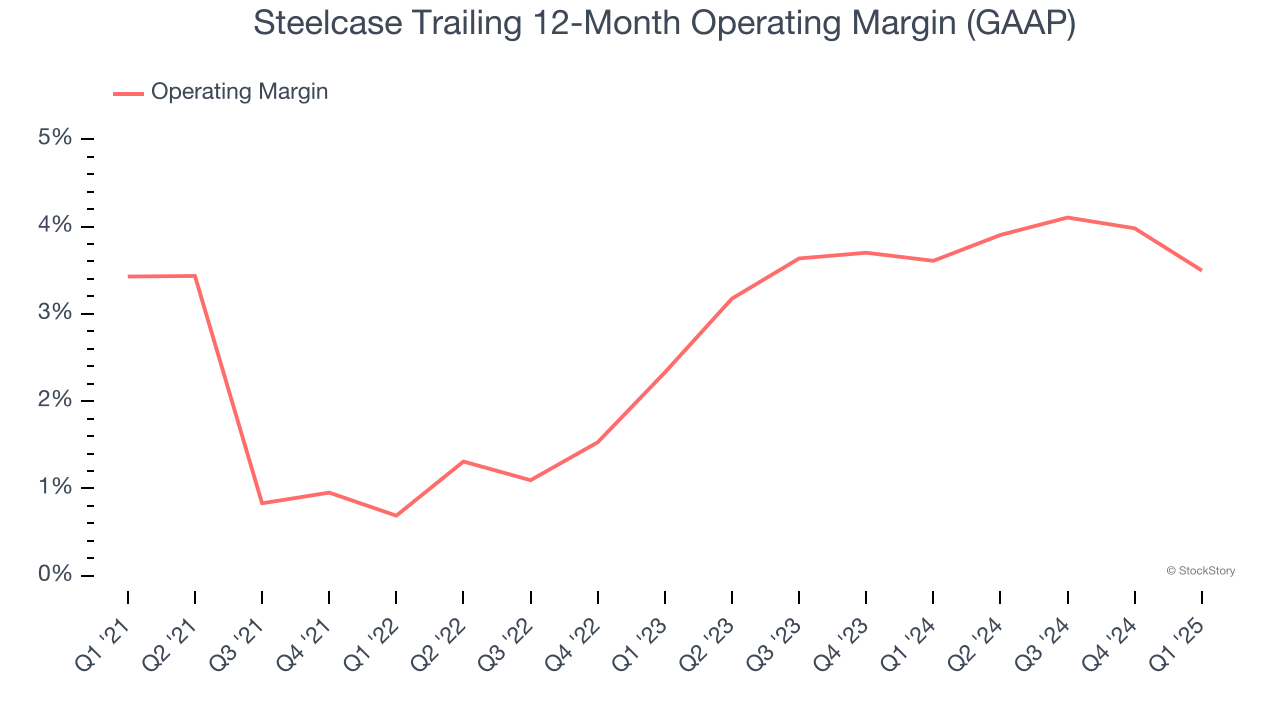

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Steelcase was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.7% was weak for a business services business.

Looking at the trend in its profitability, Steelcase’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, which doesn’t help its cause.

In Q1, Steelcase generated an operating profit margin of 1.2%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

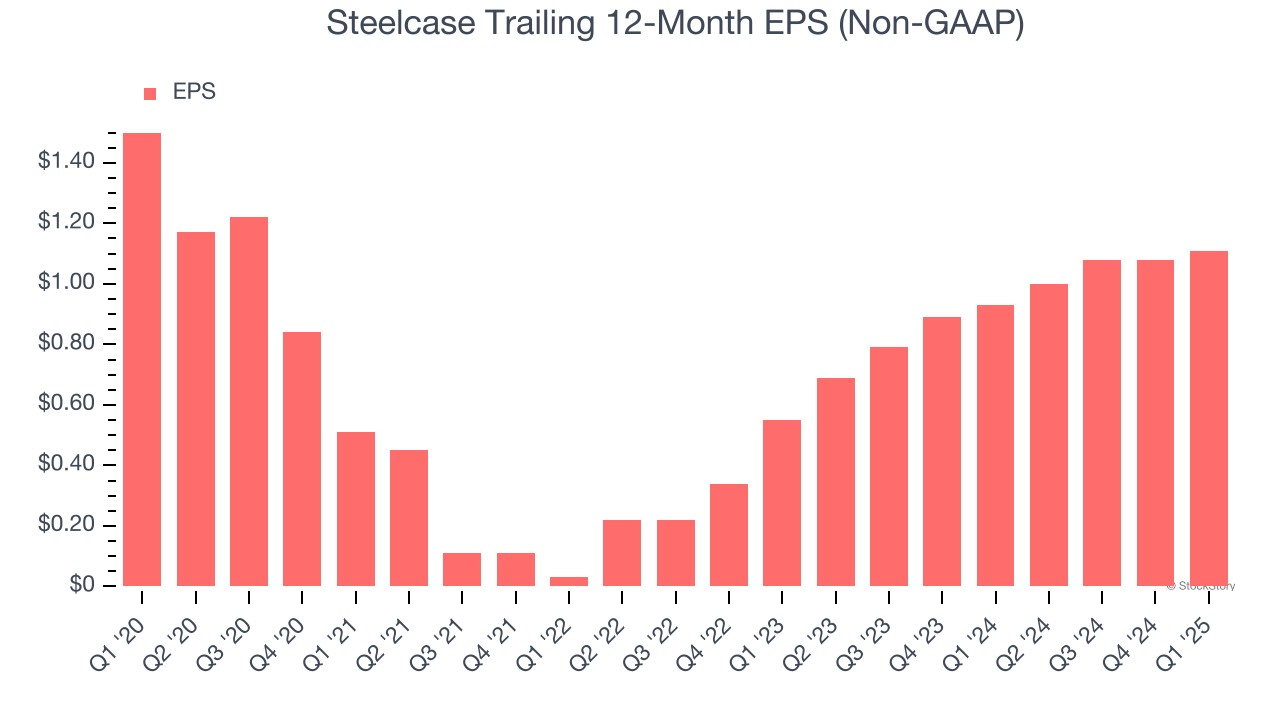

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Steelcase, its EPS declined by 5.8% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q1, Steelcase reported EPS at $0.26, up from $0.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Steelcase’s full-year EPS of $1.11 to shrink by 2%.

Key Takeaways from Steelcase’s Q1 Results

We were impressed by how significantly Steelcase blew past analysts’ EPS expectations this quarter. We were also excited its revenue and EPS guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 10.9% to $11.76 immediately following the results.

Indeed, Steelcase had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.