Home security and automation software provider Alarm.com (NASDAQ: ALRM) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 7.1% year on year to $242.2 million. The company expects the full year’s revenue to be around $979.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.58 per share was 8.6% above analysts’ consensus estimates.

Is now the time to buy Alarm.com? Find out by accessing our full research report, it’s free.

Alarm.com (ALRM) Q4 CY2024 Highlights:

- Revenue: $242.2 million vs analyst estimates of $237.5 million (7.1% year-on-year growth, 2% beat)

- Adjusted EPS: $0.58 vs analyst estimates of $0.53 (8.6% beat)

- Adjusted EBITDA: $46.39 million vs analyst estimates of $45.33 million (19.1% margin, 2.3% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $979.5 million at the midpoint, in line with analyst expectations and implying 4.2% growth (vs 6.6% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $190 million at the midpoint, in line with analyst expectations

- Operating Margin: 12.7%, up from 11.4% in the same quarter last year

- Free Cash Flow Margin: 22.3%, down from 31% in the previous quarter

- Market Capitalization: $3.00 billion

“I want to thank our team and our service provider partners for their help in delivering another quarter and year of solid financial performance,” said Steve Trundle, CEO of Alarm.com.

Company Overview

Founded in 2000 as a business unit within MicroStrategy, Alarm.com (NASDAQ: ALRM) is a software-as-a-service platform that enables users to control their security systems and smart home appliances from a single app.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

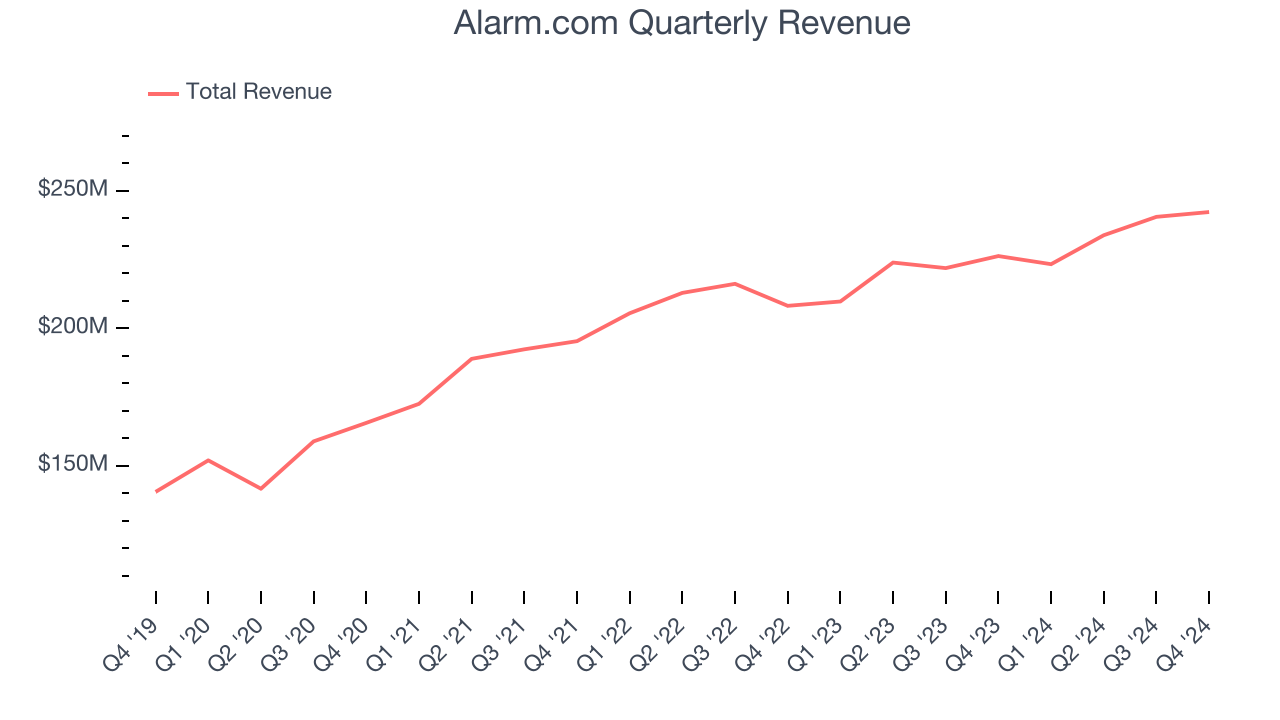

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Alarm.com grew its sales at a weak 7.9% compounded annual growth rate. This was below our standard for the software sector and is a tough starting point for our analysis.

This quarter, Alarm.com reported year-on-year revenue growth of 7.1%, and its $242.2 million of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Alarm.com is extremely efficient at acquiring new customers, and its CAC payback period checked in at 15.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Alarm.com’s Q4 Results

It was encouraging to see Alarm.com beat analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and its full-year EBITDA guidance was in line with Wall Street’s estimates. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $60.08 immediately following the results.

Is Alarm.com an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.