The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how investment banking & brokerage stocks fared in Q3, starting with LPL Financial (NASDAQ: LPLA).

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

The 16 investment banking & brokerage stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.9% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.4% on average since the latest earnings results.

LPL Financial (NASDAQ: LPLA)

As the nation's largest independent broker-dealer with no proprietary products of its own, LPL Financial (NASDAQ: LPLA) provides technology, compliance, and business support services to independent financial advisors and institutions who manage investments for retail clients.

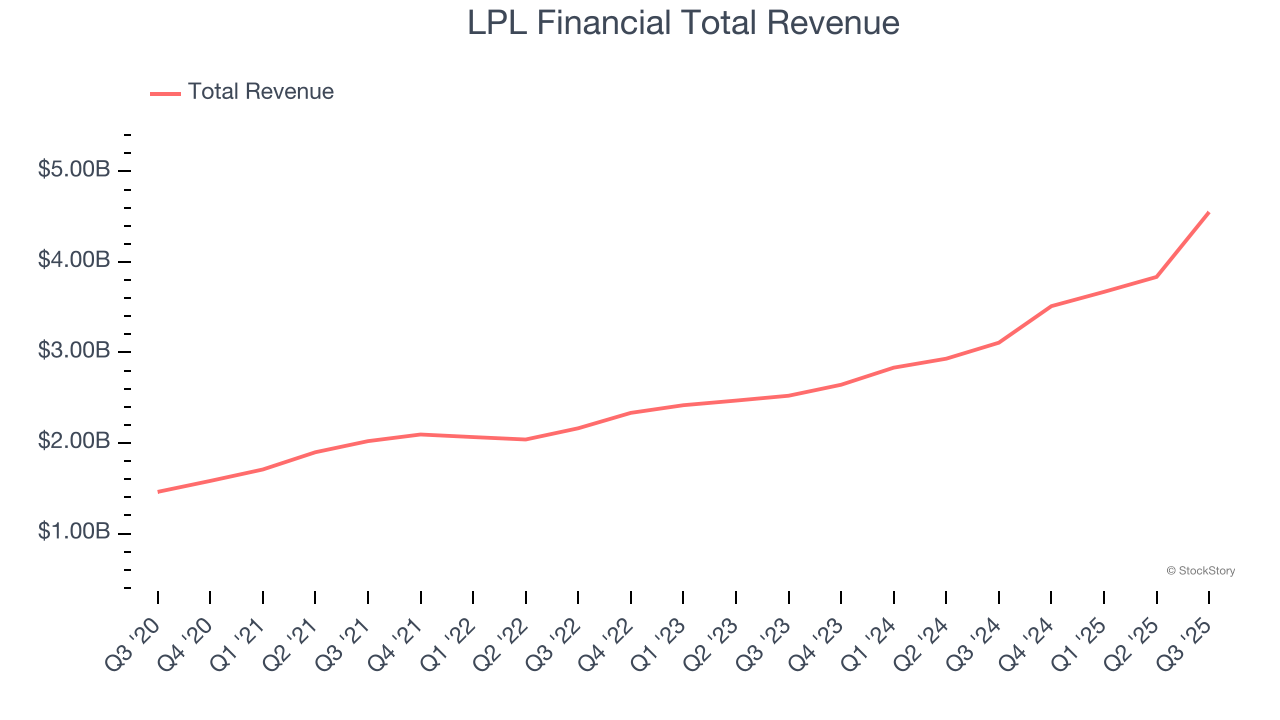

LPL Financial reported revenues of $4.55 billion, up 46.4% year on year. This print exceeded analysts’ expectations by 5%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ Advisory segment estimates and an impressive beat of analysts’ EBITDA estimates.

"Over the past quarter, we continued to make progress against our key priorities, while delivering strong business results and record adjusted earnings per share," said Rich Steinmeier, CEO.

LPL Financial scored the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 14% since reporting and currently trades at $387.09.

Best Q3: Morgan Stanley (NYSE: MS)

Founded in 1924 during the post-WWI economic boom by former JP Morgan partners, Morgan Stanley (NYSE: MS) is a global financial services firm that provides investment banking, wealth management, and investment management services to corporations, governments, institutions, and individuals.

Morgan Stanley reported revenues of $18.22 billion, up 18.5% year on year, outperforming analysts’ expectations by 9.2%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 14.8% since reporting. It currently trades at $180.29.

Is now the time to buy Morgan Stanley? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Perella Weinberg (NASDAQ: PWP)

Founded in 2006 by veteran investment bankers Joseph Perella and Peter Weinberg during a wave of boutique advisory firm launches, Perella Weinberg Partners (NASDAQ: PWP) is a global independent advisory firm that provides strategic and financial advice to corporations, financial sponsors, and government institutions.

Perella Weinberg reported revenues of $164.6 million, down 40.8% year on year, falling short of analysts’ expectations by 8.4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

Perella Weinberg delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 2.4% since the results and currently trades at $18.41.

Read our full analysis of Perella Weinberg’s results here.

Piper Sandler (NYSE: PIPR)

Tracing its roots back to 1895 and rebranded from Piper Jaffray in 2020, Piper Sandler (NYSE: PIPR) is an investment bank that provides advisory services, capital raising, institutional brokerage, and research for corporations, governments, and institutional investors.

Piper Sandler reported revenues of $455.3 million, up 29.4% year on year. This print beat analysts’ expectations by 7.5%. Overall, it was a stunning quarter as it also logged an impressive beat of analysts’ revenue estimates and an impressive beat of analysts’ Investment Banking segment estimates.

The stock is up 11.7% since reporting and currently trades at $365.44.

Read our full, actionable report on Piper Sandler here, it’s free for active Edge members.

Jefferies (NYSE: JEF)

Tracing its roots back to 1962 and rebranded from Leucadia National Corporation in 2018, Jefferies Financial Group (NYSE: JEF) is a global investment banking and capital markets firm that provides advisory services, securities trading, and asset management to corporations, institutions, and wealthy individuals.

Jefferies reported revenues of $2.05 billion, up 21.6% year on year. This result topped analysts’ expectations by 8.4%. It was an incredible quarter as it also produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The stock is down 6.8% since reporting and currently trades at $62.15.

Read our full, actionable report on Jefferies here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.